The week of July 22 saw new all-time stock market highs, after two straight weeks of rallying. Many investors have reportedly exited some of their stock holdings and there are numerous unusual hurdles that many expected would be blocking the current bull market. One theme that keeps coming up is that investors still want to look for new value and make money.

24/7 Wall St. reviews dozens of analyst research reports each morning. This ends up being hundreds of analyst reports each week. Our goal is to find new investing and trading ideas. Some of these analyst reports cover stocks to buy, while other reports feature stocks to sell or avoid.

When it comes to stocks that analysts want you to buy, the projected upside in most Dow and S&P 500 stocks is generally in the range of 8% to 15% at this stage of the bull market. Then there are the speculative companies, or even the highly speculative companies. Analysts sometimes issue upside projections of 25%, 50% or even over 100% in these stocks. Many companies come with small cap or micro cap valuations, and many of their stocks trade under $10 per share.

Investors need to at least take some pause when they hear upside calls of this magnitude. Some serious issues can get in the way. Sometimes analysts get their views entirely wrong, and other times outside forces or unexpected events wreck the upside thesis. And sometimes management just falls short on their ability to deliver.

24/7 Wall St. warns its readers whenever possible that there is no free lunch when it comes to investing, even in asset classes outside of stocks, like bonds, commodities and other classes. It hardly seems fair when you make projections that come true and then the market refuses to value it with the same upside, but that happens frequently. Sometimes companies even go into zombie mode or implode and disappear.

Again, there are generally big risks when you see huge potential upside. That said, here are 10 stocks trading under $10 in which analysts gave massive upside calls during the week of July 22.

AU Optronics Corp. (NYSE: AUO) was raised to Buy from Neutral at Merrill Lynch on July 19. The call was based on a more favorable 2017 supply-demand outlook with improving bottom line. The firm thinks that AU Optronics will start delivering profits from the third quarter and that should sustain through the end of 2017.

Groupon Inc. (NASDAQ: GRPN) was raised to Overweight from Neutral at Piper Jaffray on July 18. The firm’s price target was raised to $6 from $4 in the call, up sharply from the prior $3.49 close beforehand. Groupon’s shares closed at $3.72 on Friday, but the new target still implies better than 50% upside. Groupon had a consensus analyst price target of $4.08, and its 52-week trading range is $2.15 to $5.28.

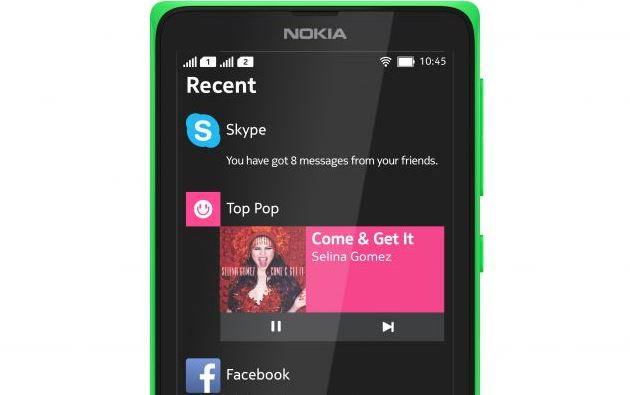

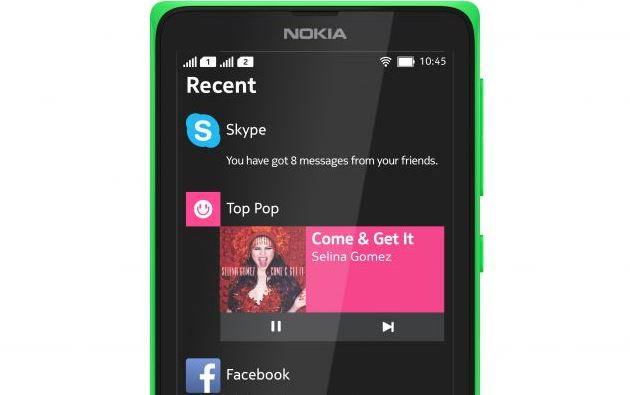

Nokia Corp. (NYSE: NOK) has now made the analyst stocks under $10 list two weeks in a row. This week it was Goldman Sachs, and while it was already rated as Buy, the firm added Nokia to the prized Conviction Buy list on July 21. The $7.20 price target compared to a previous closing price of $5.82 and the shares hardly budged on that news.

MGIC Investment Corp. (NYSE: MTG) was raised to Buy from Neutral with a $9 price target (versus a $6.81 prior close) at Compass Point on July 20. On the same day, FBR Capital Markets reiterated its Outperform rating and raised its price target to $9.00 from $7.50. The stock has a 52-week range of $5.36 to $11.34. After these calls were made, its consensus price target increased to $9.64 from $9.45.

Orion Energy Systems Inc. (NASDAQ: OESX) was started with a Buy rating at Rodman & Renshaw on July 18, and the firm’s $2.50 price target was more than 100% higher than the prior $1.20 close. The shares were up at $1.34 mid-week, removing the would-be “double your money” analyst call here, and shares were trading at $1.45 on Friday’s close. The 52-week range is $1.04 to $2.50, and the market cap is a mere $40 million.

Sonus Networks Inc. (NASDAQ: SONS) was started with a Buy rating and assigned a $12 price target at D.A. Davidson on July 20. Shares had closed at $8.92 ahead of the call, and the stock was trading at $9.32 shortly after the call was made. Its 52-week range is $5.15 to $9.66, and that high was hit just on Friday.

Star Bulk Carriers Corp. (NASDAQ: SBLK) was raised to Overweight from Neutral with a $6.50 price target at JPMorgan on July 19. Its prior closing price was $3.86, and its shares were at $4.13 a day after the call. Even after the bump, this implied more than 50%, if JPMorgan is right. The stock ended last week at $4.22, a more than 6% drop on the day.

TechTarget Inc. (NASDAQ: TTGT) was started with a Buy rating at Sidoti on July 20, and it was assigned a $12 price target. The closing price before the call was $8.74, and shares hit $9.00 mid-week after the call. Few details were seen here, but TechTarget’s shares were last seen trading at $9.02.

Vical Inc. (NASDAQ: VICL) was started with a Buy rating at H.C. Wainwright on July 19. The $12 price target stood out here, because Vical was trading at $4.36 before the call was made. However, shares were down around 9% at $3.98 on Friday’s close. The 52-week range is $2.80 to $6.80, and the market cap is $39 million.

Cellcom Israel Ltd. (NYSE: CEL) was started as Overweight at Barclays on July 18. No price target was represented, but the prior closing price was $7.14 for the New York-traded American depositary shares. Shares were at $6.84 late on Wednesday and closed trading at $6.77 on Friday. The 52-week range is $5.42 to $8.52.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.