Funds hunt for cracks in most-prized US shopping malls

Simply sign up to the Property sector myFT Digest -- delivered directly to your inbox.

A defining feature of the financial crisis was a group of hedge funds making vast sums by wagering against supposedly AAA-rated mortgage debt well before markets imploded in 2008.

Now some believe a similar story will play out for US shopping malls — that the most risky investments will end up being those that investors now believe to be the safest. Central to their premise is the idea that too much faith may be being placed in a classification system used for shopping malls that is little known outside of the real estate sector.

So as well as number crunching at their desks, investors are also actively leaving the office and conducting field research.

In April researchers from a large US hedge fund travelled to the outer boroughs of New York to a shopping mall that is home to Apple and Armani among other retailers.

The mall was ranked by real estate consultants as an “A mall”, meaning it was a low-risk premium property that generated over $600-per-square-foot of sales a year. To their surprise the researchers quickly came across a pop-up shop selling cheaply manufactured stuffed teddy bears and plastic toys. Two months later the store had disappeared.

“We were very surprised,” one person at the fund says. “These sorts of crappy stores are not meant to exist in prime malls in America — there is simply no way a store selling stuffed toys can generate the level of sales needed to pay prime rents. We travelled to a dozen other supposedly ‘prime’ malls in other towns and we kept seeing these weird temporary tenants.”

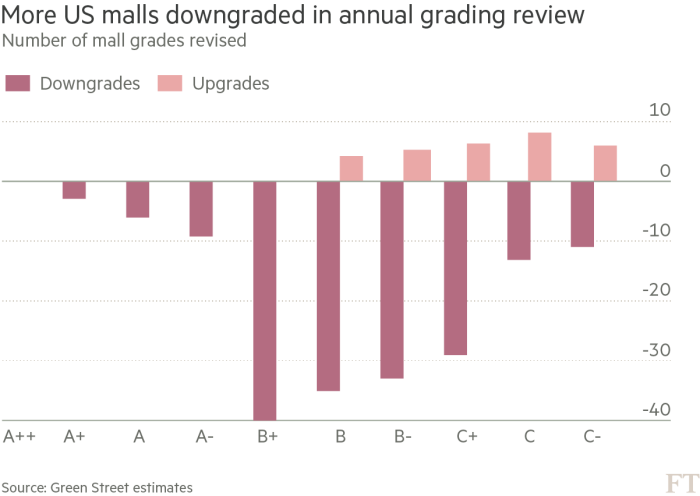

Malls are given ratings by a small group of property consultants generally ranging from A++ to C based on factors that include their sales per square foot and location. While there is no universally accepted system for ranking the malls, with each consultant having slightly different methodologies, banks and investors tend to rely on these ratings to make decisions over how secure each mall is as a creditor or investment.

“Lenders look at mall ratings from the point of view of risk,” says Hemant Kotak, a managing director at Green Street Advisors, one of the largest consultants that rates malls for clients. “It is inherently less risky to lend against A-quality malls as landlords generally spend the money to keep assets in good physical condition and protect capital values. It gives lenders comfort to lend to these operators at more attractive rates.”

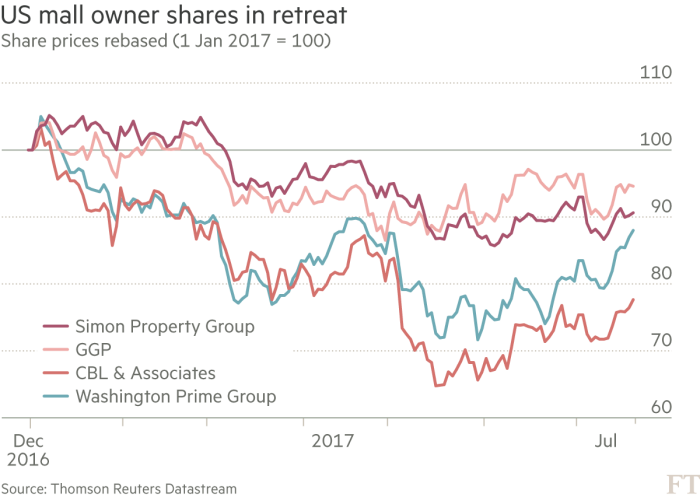

The stock market has until recently appeared to believe that prime “A” malls are largely insulated from the pain being felt across a US retail sector being shaken by e-commerce.

Shares in Washington Prime, an operator of lower quality B and C classed malls, are down by half since the start of 2015. However, until recently shares in “prime” mall operators Simon Property Group and GGP had held up, underpinned by the belief that their A-quality malls in prime locations were safe from the challenge of online shopping.

Yet there is growing evidence to suggest that these prime malls, which have been treated by investors and lenders alike as rock solid bets in the face of the internet headwinds, are not as protected as once thought.

Shares in Simon Property, the largest Reit in America with a market value of $50bn, are down by almost 30 per cent over the past 12 months, having held up strongly to the middle of 2016. Short interest in Simon, which tracks the amount of shares hedge funds have borrowed to bet that its value will fall, rose to the highest level since the financial crisis last month, with bets worth more than $1bn.

The hedge funds wagering against the highest quality malls believe that the wider market will come to believe these A-quality malls are far more similar to lesser ranked ones. “This idea that there are these magic malls in America that are immune to secular change is a myth,” the US-based hedge fund manager says.

Some argue that the market underappreciates that A class mall operators and B and C class mall operators all have very similar tenant bases, in spite of being in different locations. L Brands, the owner of lingerie chain Victoria’s Secret, is the largest single tenant for prime operator GGP, according to company filings.

However, it is also the biggest tenant for the lesser ranked CBL and second largest for Washington Prime. CBL shares are down more than 22 per cent this year, while GGP is only down 5 per cent. L Brands itself has posted consecutive quarters of slowing sales, pushing its shares down by a third for the year.

Russell Clark of Horseman Capital notes the vulnerability malls have to the loss of single big brands, known as anchor tenants, with their departure often triggering a wave of rent loss with other tenants.

“Many tenants have a clause in their lease to reduce rents should an anchor close a store. Thus, even though the loss of rent due to an anchor closing is minimal, the knock-on effect of reduced rents from the remaining tenants is a serious concern,” he noted.

Now some are on the hunt for opportunities to bet against quality malls outside the US. The share prices of Intu Properties and Hammerson, the UK’s largest publicly listed shopping centre operators, have not yet followed the falls seen in the shares of their largest tenants.

Intu shares are largely flat since the start of the year while the value of Debenhams, Dixons and Next — three of its five largest tenants making up a combined 8 per cent of its secured rent — are all down more than 20 per cent.

“US-listed mall Reits are already trading at large discounts to their net asset values, with their share prices showing clear signs of suffering in line with their tenants,” says Mr Kotak of Greenstreet. “In Europe this is not yet the case.”

Comments