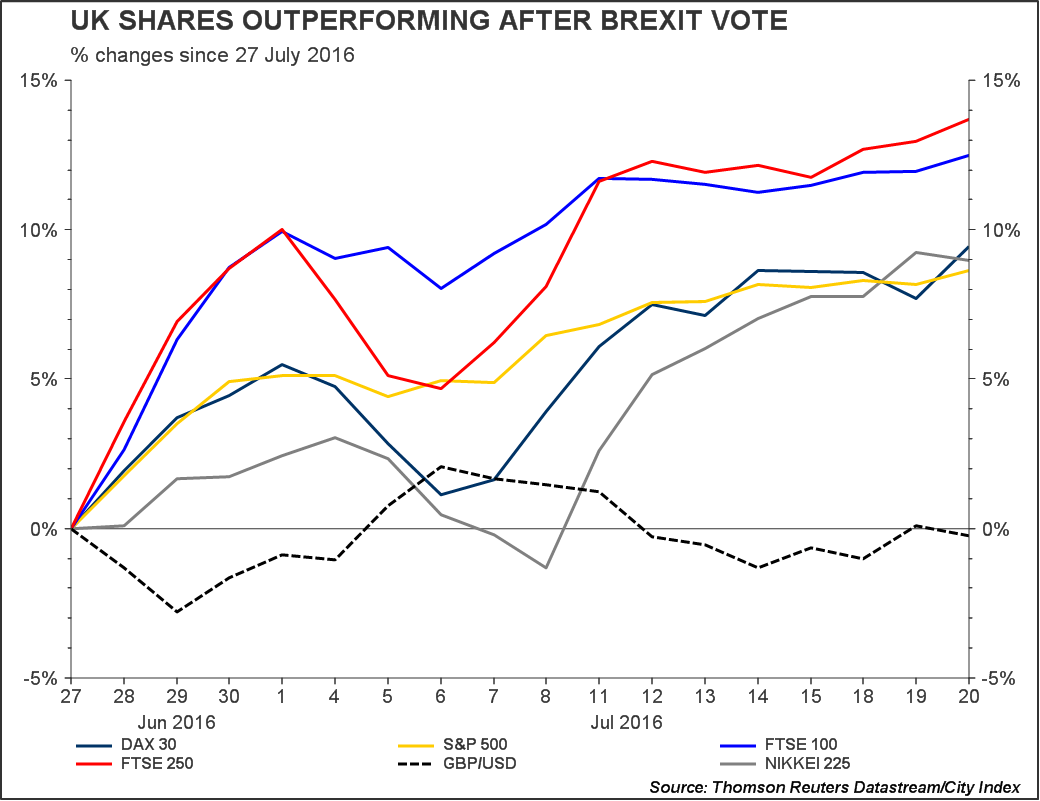

The FTSE 250 index has recouped almost all Brexit vote losses as the pound rises off 30-year lows, though if the pound relapses, some middleweight shares will hold on to gains better than others.

For now, FTSE 250 mid-caps are having their best run since a 14% two-day fall in the wake of the Brexit vote.

Sterling’s bounce is the most obvious reason for the broad rally. Almost 60% of FTSE 250 company sales were in sterling last year vs. 22% of FTSE 100 sales, according to BlackRock.

So, sterling’s 3% rise against the dollar from thirty year lows earlier this month, recharged last week by the Bank of England’s (BoE) decision not to ease, has helped the mid-cap index recoup almost all of its post Brexit loss.

It has even begun to slightly outpace the dollar-fuelled FTSE 100.

As for the pound, it has strengthened on a string of better-than-expected economic readings, though most were from before the referendum. Resilient US economic data have helped propel the dollar well above early-July lows too, making the pound’s recovery less than streamlined.

The BoE’s next meeting looming just a fortnight away is also cautionary. The Bank said last week it was likely to deliver stimulus, possibly as a "package of measures".

We think the higher probability of BoE easing will reinstate investors’ recent bias for companies with most costs in sterling and sales largely in foreign currencies. The preference partly explains why the FTSE 100 outperformed all major stock indices in the fortnight following 27th June.

FTSE 250 companies with more regionally diverse sales should outperform too, though there’s a risk they will again be caught up in an indiscriminate sell-off of mid-sized shares like last month’s, if the Bank starts easing.

More positively, sterling’s weak condition is an opportunity to pick up stocks with better chances of outperforming, due to loose ties to sterling.

Not all are large caps.

Smaller miners and oil companies are the most obvious, as all do business in dollars, though risk-averse investors will run for the hills from many of these.

Most that survived commodity price routs are highly indebted and unprofitable and have scrapped dividends.

Ironically the risk-reward balance in Acacia, Centamin, Fresnilo, platinum producer Lonmin, and Petra Diamonds is now less attractive after surges of 35%-190% in 2016.

Shares which are accelerating but which have not yet to recovered last year’s losses—Anglo, Glencore, Lonmin—may attract the brave.

Either way, these groups will still preserve price gains better than sterling-focused stocks so long as the dollar remains at multi-year highs against the pound.

Remaining SME mining stock opportunities will be found among those that have rallied least, though laggards trail the sector for sound reason. Like exposure to metals with less than sparkling price recoveries, or too-slow debt reduction.

(See copper miner Kaz Minerals whose net debt is 14 times forecast core earnings).

There are even fewer choices among mid-sized oil groups. Excluding the majors leaves only Tullow and Cairn. The rest are in more perilous FTSE SmallCap and AIM waters.

Almost all are running cash deficits and negative operating margins too.

Oil services firms Amec Foster Wheeler and John Wood Group are rare dividend payers. Premier Oil and Tullow are among the more solid explorers. Premier is saving millions of dollars whilst bringing new North Sea fields on stream in sterling.

Tullow is expecting a $500m insurance payout and its large TEN fields project, offshore Ghana, starts production within weeks.

A handful of FTSE 250 shares outside of the energy sector, have significant dollar exposure that’s less easy to spot.

Transport group Stagecoach and Tate & Lyle are the household names among these.

Stagecoach’s US business contributed $552m of sales in its last financial year; Tate’s US arm generated 78% of revenue worth around $2.4bn.

Engineer Meggitt, business publisher UBM and packaging group DS Smith also come out top among FTSE 250 shares, on dividends, cash in the bank, and debt.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.