Courtesy of Holly Energy Partners

Even the tollbooth-like business model of some midstream MLPs aren't completely immune from the ravages of the worst oil crash in a generation. Yet Holly Energy Partners (HEP) just reported strong results, along with wonderful news for dividend lovers. Here are the three most important takeaways from this past quarter and, more importantly, what they probably mean for its future security and growth prospects.

Slow and steady growth

| Metric | Q3 2015 | Q3 2014 | YoY Change |

| Operating Profit | $44.3 million | $38.9 million | 13.9% |

| EBITDA | $60 million | $53.8 million | 11.5% |

| Distributable cash flow (DCF) | $50.3 million | $45.6 million | 10.3% |

| Quarterly distribution | $0.555 | $0.523 | 6.1% |

| Distribution coverage ratio | 1.55 | 1.49 | 4% |

Source: Holly Energy Partners earnings release.

Holly Energy Partners' slow and steady growth won't be making headlines, but in the face of falling energy prices it's rather impressive. The steady growth in EBITDA and DCF were courtesy of the acquisition of a 50% interest in the Frontier Pipeline, and the completion of a prior drop down of a naphtha fractionation and hydrogen generation unit from sponsor and general partner HollyFrontier Corp. (HFC).

Both of these acquisitions are supported by long-term fixed-fee contracts and have zero exposure to commodity prices. In fact, all of HollyFrontier's dropdowns to Holly Energy Partners are secured by such 100% fee-based contracts.

Vault like distribution security

What makes Holly Energy Partners' distribution profile so appealing is not just that the distribution of 6.8% is so well covered by DCF. The MLP's nine month coverage ratio of 1.49 combined with Holly Energy's complete insensitivity to energy prices means that investors should be able to rely on this payout no matter how low oil prices decline.

Another thing to love about Holly Energy Partners' distribution is that management has been both highly predictable and conservative in how it grows the payout. For example, since 2006 it has grown the distribution at 6% CAGR.In fact, this quarter's 6.1% bump marks Holly Energy Partners' 44th consecutive quarterly increase. That 11-year period includes two of the worst oil crashes of the past few decades, which shows the resilience of Holly Energy's tollbooth-like business model.

Source: Holly Energy Partners investor presentation.

Its strong coverage ratio makes it highly likely that Holly Energy Partners can continue to grow its payout at its historical rate even if oil prices fail to recover for years. Better still, the excess DCF the MLP generates also serves as a strong competitive advantage, because it can be used to finance organic growth projects and further dropdowns from HollyFrontier Corp. without having to further tap debt or equity markets.

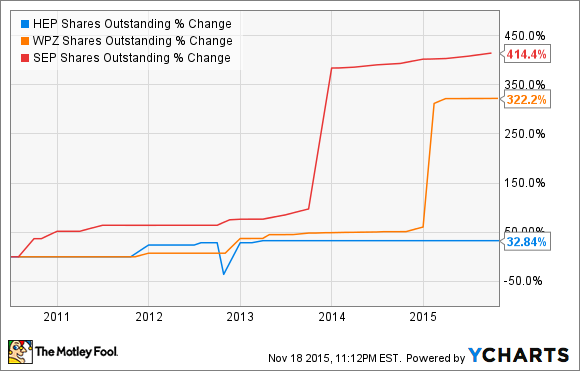

In fact, Holly Energy Partners has an excellent track record of keeping equity sales to a minimum, especially compared with some of its larger midstream peers, such as Williams Partners (NYSE: WPZ) or Spectra Energy Partners (SEP).

HEP Shares Outstanding data by YCharts

The ability to internally fund its growth has also allowed Holly Energy Partners to maintain a stronger balance sheet than many midstream MLPs.

| MLP | Total Debt/TTM EBITDA | TTM EBITDA/Interest |

| Holly Energy Partners | 4.1 | 6.5 |

| Williams Partners | 18.0 | 2.7 |

| Spectra Energy Partners | 3.5 | 7.6 |

Sources: earnings releases, Morningstar

In fact, Holly Energy's balance sheet and business model are strong enough that its creditors recently increased its borrowing base by $200 million. That means Holly Energy Partners has access to $207 million in liquidity to finance its growth. Better yet, its excess DCF is adding around $94 million in additional growth funding power each year.

Solid growth prospects

Holly Energy Partners is a relatively small midstream MLP, and its growth project backlog may not be seem that impressive. For example management has targeted $400 million to $450 million in growth capital expenditure through the end of 2017.

While that pales in comparison to Williams Partners and Spectra Energy Partners, both whom have approximately $30 billion in growth projects planned over the next few years, that small size also makes achieving consistent growth much easier. In fact Holly Energy Partners' organic growth pipeline is expected to increase annual EBITDA by 42% compared to 2014.

Funding those projects shouldn't prove difficult since Holly Energy's existing credit revolver alone is enough to fund nearly half its planned capital investment. The other half is likely to be paid for through the MLP's rapidly rising excess DCF.

Bottom line: A strong relationship with its sponsor and conservative management bode well for long-term payout growth

Thanks to Holly Energy Partners' tollbooth business model and its long-term focus on maintaining a rock-solid distribution, the MLP now finds itself with a strong balance sheet, and impressive excess DCF-generating capacity. Combined with management's current growth plans, this should not only make moderate, sustainable distribution growth possible but also mean future growth investment might be easier to fund; no matter what oil prices do in the coming years.