With the euphoria for seemingly everything in the stock market these days, it's a bit surprising when you come across a stock that Wall Street doesn't like. Even more rare are the ones that Wall Street isn't keen on that actually look to have a decent future ahead of them.

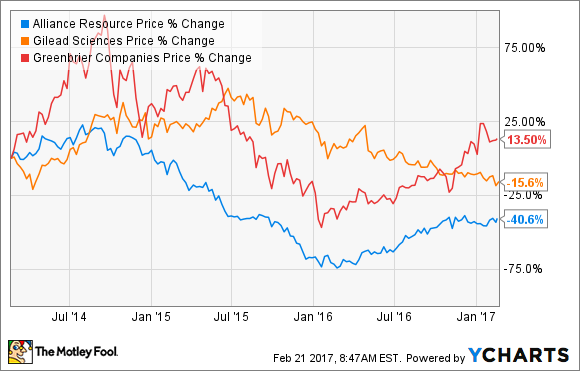

Three dividend stocks that have been cast aside by Wall Street lately include rail car manufacturer The Greenbrier Companies (GBX -0.08%), coal miner Alliance Resource Partners (ARLP 0.60%), and biotech Gilead Sciences (GILD -0.65%). Here's a quick rundown as to why these dividend stocks aren't well received by the market today but look to be bargain buys for long-term investors.

Image source: Getty Images.

Getting back on track

Greenbrier Companies has had a rough go of it over the past couple of years. Back in 2010, the company was staring down a large debt load and was a little product constrained with its offerings of tank cars and hoppers that have been popular for transporting frack sand during the shale boom. So the company underwent a major restructuring plan that focused on diversifying its product offerings, optimizing its operations to lower costs, and trimming its balance sheet. These initiatives came at just the right time as demand for frack sand hoppers was high and the company had a decent backlog of work to fund these changes.

Fast-forward to today, and you have a company that has a more diverse offering of rail cars and is taking market share with a growing business of leasing rail cars and other services. These higher-margin business lines are also helping to drive better bottom-line performance. Also, the company has lowered its net debt-to-EBITDA ratio from well north of 5.5 to a much more respectable 0.9. This is a pretty impressive transformation in a matter of less than a decade.

As with many other major industrial products, rail cars are a cyclical business, and right now we are in a bit of a lull. Coal shipments are declining, and the large build-out of frack sand hopper cars has yet to be fully absorbed by the oil and gas industry. As a result, Greenbrier expects 2017 to be a slower year than 2016. At the same time, the company is much better suited to handle a downturn with its much improved balance sheet and wider array of products to offer to the rail industry. With shares trading at an enterprise value-to-trailing-12-month-EBITDA ratio of just 3.89, the market isn't putting a lot of faith in Greenbrier's new business model. That looks like an opportunity to buy this 1.9%-dividend-yielding stock on the cheap.

Stories of coal's death are greatly exaggerated

That statement about declining coal volumes has been a real tough obstacle for coal companies to overcome as of late. Sure, coal prices are up slightly as coal inventories start to finally dwindle a little, but the overarching theme is that coal will slowly lose out to natural gas and renewables over time. That may very well be the case, but that doesn't mean there isn't some value left in Alliance Resource Partners' 7.2% distribution yield.

One thing that often gets overlooked is where coal comes from. The assumption is that with coal in decline, then all coal companies will suffer. That isn't necessarily the case. While legacy coal regions like Appalachia and the Powder River Basin are expected to see declines over the coming years, the Illinois Basin or Central Region -- where almost all of Alliance's coal mines are located -- is expected to see steady demand for several more years. There was even some evidence of this when Alliance recently released its quarterly results that showed an increase in volumes, sales, EBITDA, and net income.

The company is looking to continue that success by maintaining low operational costs, reducing its debt load, and adding modest production growth over the next several years. This is giving Alliance a strong financial foundation to pay its shareholders that large distribution with plenty of extra cash remaining.

Shares are trading at a bargain-basement valuation of 3.1 times EBITDA. It's pretty clear that coal's role in the U.S. energy mix is on the decline, but that decline isn't as pronounced as you might think for players like Alliance, and that makes it a pretty interesting dividend stock today.

A multipronged approach to today's troubles

Gilead Sciences' most recent quarterly results and management guidance didn't exactly ease the concern that the company's best days are behind it. Sales for its hepatitis C virus (HCV) treatments continue to decline, its HIV treatments are more or less treading water, and its other, smaller-market treatments simply aren't gaining enough traction to offset the declines in these two big market treatments. To make things worse, management is guiding for an even larger decline in HCV treatments for 2017.

Based on this information, I can certainly understand why investors would want to jump ship. What they may be overlooking, though, is the opportunities Gilead has in the pipeline to offset those declines. In 2016, total R&D spending bumped up to $1.2 billion as several of its 28 clinical studies went into late-stage trials. These late-stage trials are larger in scope and cost more money, so there seems to be a big push to the finish line with several of these treatments. The chances of all of these treatments completing the clinical trial phase and receiving approval aren't high, but not all of them have to pass to improve Gilead's bottom line. Also, based on management's comments, it appears that 2017 could be the year that Gilead uses its $32 billion cash horde to make an acquisition.

The outlook for Gilead isn't exactly rosy through and through, but there are enough rosy elements within it to suggest there are still some better days ahead. So with the stock trading at a very cheap valuation of 4.5 times EBITDA and a dividend yield just shy of 3%, it would seem as good of a time as any to pick up shares.

![TVTC-Wet-Track-Car[1]](https://g.foolcdn.com/image/?url=https%3A%2F%2Fg.foolcdn.com%2Feditorial%2Fimages%2F431257%2Ftvtc-wet-track-car1.jpg&op=resize&w=92&h=52)