America's Car-Mart reported a loss just shy of $500,000, and its shares dropped 14 percent Friday after the company released second-quarter earnings results that missed an average of analysts' estimates by more than 70 cents a share.

On a conference call Friday morning, company executives said a $3 million noncash, after-tax charge from an increase in the allowance for credit losses pulled down results for the quarter. Bentonville-based Car-Mart released its earnings results after markets closed Thursday and held the call Friday.

Shares fell $5.37, or 14 percent, to close at $32.55 Friday on the Nasdaq exchange. Shares have traded as high as $57.55 and as low as $25.37 over the past year.

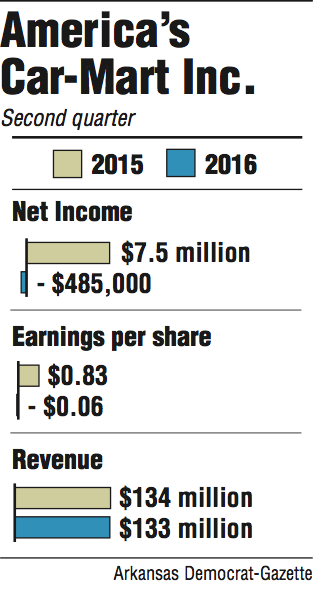

The buy-here, pay-here used-car dealer reported a loss of $485,000, or 6 cents per share, for the second quarter ending Oct. 31 of the company's fiscal 2016, compared with profits of $7.5 million, or 83 cents per share, for the year ago period. The average estimate of six analysts predicted earnings of 70 cents for the quarter.

Without the pretax charge, Car-Mart would have booked profits of 29 cents per share.

Revenue stood at $133 million for the second quarter, down slightly from $134 million for the same period in fiscal 2015. The average of three analysts predicted revenue of $151.8 million.

CEO Hank Henderson said the results reflected increased competition for Car-Mart's top-tier car buyers as well as rivals' offers of longer financing terms exerting more pressure on the company's less affluent core customers. Often the company's customers have low or nonexistent credit scores.

Other factors hurting profits were self-imposed, Henderson said, including the wholesale sale of some inventory that didn't meet the company's quality standards.

He called the company's recent actions -- including pouring resources into its infrastructure and operations by adding GPS-tracking technology, overhauling collection practices, additional training for staff and adding new software -- painful in the short term but vital for long-term growth.

Jeff Williams, chief financial officer, said the company added nine new dealerships over the past year and bought back $4 million of stock shares since April.

Henderson said the company's expansion plans would slow during the next two quarters while it focuses on supporting some of the company's older dealerships, where sales have been declining. He added the company was expecting an inspection early next year by the Consumer Financial Protection Bureau, a federal agency, to assess the company's compliance.

"We feel good about this," Henderson told analysts on the call, noting improvement and focus on the company's compliance management systems have been a part of Car-Mart's operation improvements over recent years.

Car-Mart sold 10,881 vehicles during the quarter compared with 12,084 for the second quarter of 2015, a 10 percent decline. Productivity was also lower, with 25.3 vehicles sold per store per month during the second quarter, compared with 29.6 for the year earlier period.

Sale prices per vehicle were up $757 to $10,247 for the quarter, or 8 percent, compared with the second quarter of fiscal 2015.

Henderson said the company is doing the right things and hopes to produce better results in the future.

"We have our sights set toward top-tier growth, " he said.

Business on 11/21/2015