Is Citigroup Inc. (NYSE:C) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments. More recently the top 30 mid-cap stocks (market caps between $1 billion and $10 billion) among hedge funds delivered an average return of 18% during the last four quarters (S&P 500 Index funds returned only 7.6% during the same period).

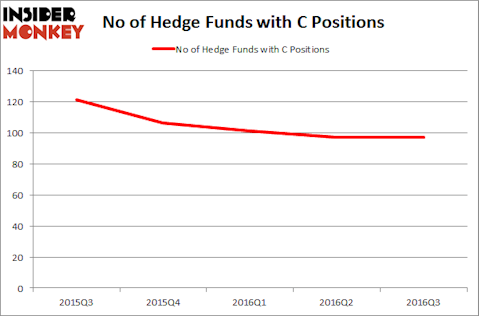

Overall, Citigroup Inc. (NYSE:C) shares haven’t seen a lot of action during the fourth quarter as the hedge fund sentiment was unchanged during the third quarter and the stock was included in the portfolios of 97 funds tracked by us at the end of September. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as PetroChina Company Limited (ADR) (NYSE:PTR), HSBC Holdings plc (ADR) (NYSE:HSBC), and Bristol Myers Squibb Co. (NYSE:BMY) to gather more data points.

Follow Citigroup Inc (NYSE:C)

Follow Citigroup Inc (NYSE:C)

In the eyes of most stock holders, hedge funds are perceived as worthless, outdated financial tools of yesteryear. While there are greater than 8000 funds with their doors open at the moment, We hone in on the bigwigs of this club, approximately 700 funds. These hedge fund managers handle the lion’s share of the smart money’s total asset base, and by keeping track of their top stock picks, Insider Monkey has spotted several investment strategies that have historically beaten the S&P 500 index. Insider Monkey’s small-cap hedge fund strategy exceeded the S&P 500 index by 12 percentage points a year for a decade in their back tests.

Kiev.Victor / Shutterstock.com

Keeping this in mind, we’re going to take a peek at the new action regarding Citigroup Inc. (NYSE:C).

How have hedgies been trading Citigroup Inc. (NYSE:C)?

Heading into the fourth quarter of 2016, a total of 97 of the hedge funds tracked by Insider Monkey were long this stock. With the smart money’s sentiment swirling, there exists a select group of key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Eagle Capital Management, managed by Boykin Curry, holds the most valuable position in Citigroup Inc. (NYSE:C). Eagle Capital Management has a $1.27 billion position in the stock, comprising 5.5% of its 13F portfolio. On Eagle Capital Management’s heels is Robert Rodriguez and Steven Romick’s First Pacific Advisors LLC, with a $653.7 million position; 5.4% of its 13F portfolio is allocated to the stock. Other peers that are bullish encompass Edgar Wachenheim’s Greenhaven Associates, Ric Dillon’s Diamond Hill Capital and Richard S. Pzena’s Pzena Investment Management.