We have been talking a lot about China, emerging markets, and commodities price declines over the past few months. In short, we see a slowdown for some economies and an attendant decline in share prices for firms like Caterpillar (NYSE:CAT)--makers of mining and construction equipment, other materials firms, and perhaps biggest of all, energy firms involved in oil and gas.

Of course, the carnage in the oil market has been linked to more than just lower demand in China. Here we have a host of theories: massive increases in supply driven by the fracking boom in the US, a postulated Saudi ploy to flood the market and undercut US frackers, the end of sanctions in Iran bringing still more crude to market, etc.

While lower energy prices may have killed the latest boom in Texas, Oklahoma, Pennsylvania, and Ohio, they have been a boon to US consumers still tied to their automobiles, the trucking industry, auto manufacturers, airlines, and other companies sensitive to the price of refined crude.

Regardless of the benefits for US-based consumers and businesses, declining prices have certainly beat up the share prices of some oil industry players. Now, some analysts believe that the trend may be coming to an end and that it is time to consider buying oil stocks once again. This call is not based on fundamental data or driven by news, but rather found in technical analysis of major industry players and some surprising price action so far this week.

Basically, the chart readers argue that for many oil companies, the technicals show an extremely oversold market with potential double bottoms achieved. The word "capitulation" is being tossed around, and that is a good thing for buyers looking to pick up bargains.

Of course, market timing is always difficult, and many find that technical analysis is more akin to palm reading than a valid means of research. But, the power of TA lies in the fact that many practitioners exist and they believe it and time their purchases accordingly.

Here we do not focus on technicals for our research, but we do use it as yet another factor when looking out for bargains. Obviously, if you are looking to buy low, it helps to see a bottom formation pattern on a chart. So, again, if you're looking for cheap energy/oil stocks, you have more supporting evidence for the call now than you would have just a few months ago.

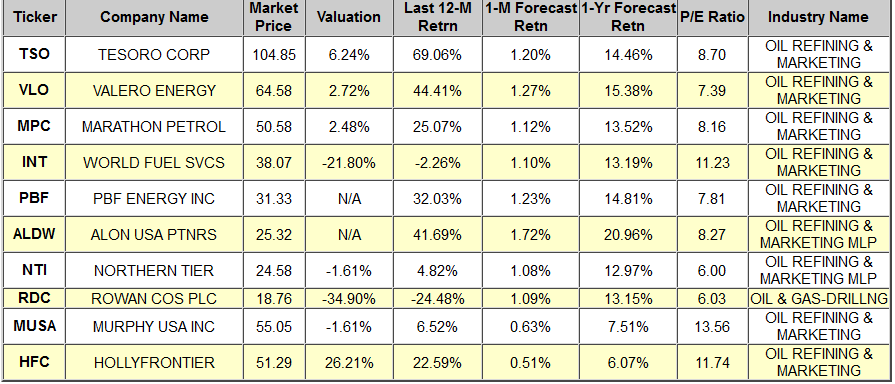

When we query our systems for the various oil-related industries in the Energy Sector today, we find the following companies ranked at the top. Alon USA Partners (NYSE:ALDW) is the leader of this list.

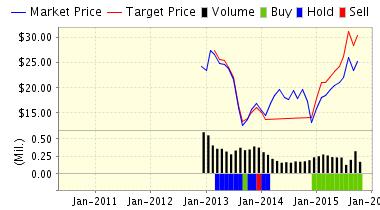

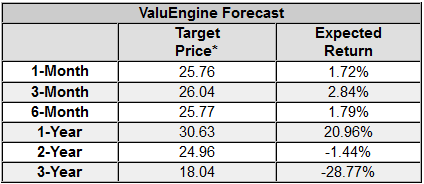

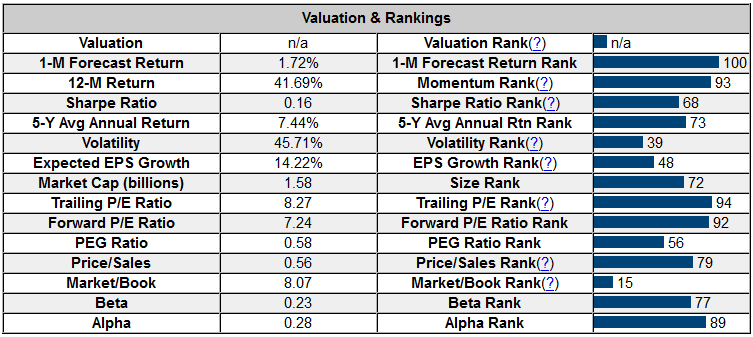

Below is today's data on ALDW:

Alon USA Partners, LP (ALDW) owns and operates refining and petroleum products marketing business. The Company's integrated downstream business operates primarily in the South Central and Southwestern regions of the United States. It refines crude oil into finished products, which it market primarily in West Texas, Central Texas, Oklahoma, New Mexico and Arizona. Alon USA Partners, LP is based in Texas.

VALUENGINE RECOMMENDATION: ValuEngine continues its STRONG BUY recommendation on ALON USA PTNRS for 2015-10-05. Based on the information we have gathered and our resulting research, we feel that ALON USA PTNRS has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE P/E Ratio and Momentum.

You can download a free copy of detailed report on ALDW from ValueEngine's site.

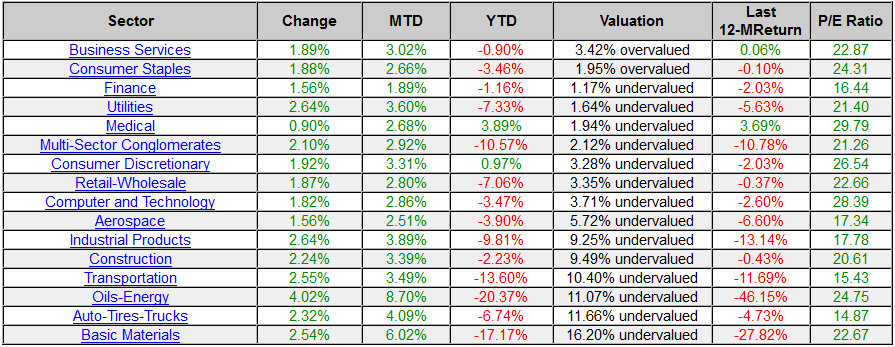

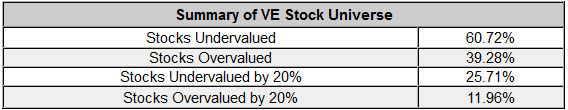

ValuEngine Market Overview

ValuEngine Sector Overview