If FluoroPharma (FPMI) successfully won FDA approval for its Phase 2 imaging agent, BFPET, but never commercialized the product, and sought to sell it once patent protection lapsed in 2025, Lantheus Medical's acquisition of Cardiolite suggests FPMI is worth at least $2. This compares to a recent market quote of $0.34 per FPMI share.

However, if BFPET, and the closely-related CardioPET - both of which have demonstrated superior qualities to the 'gold standard' Cardiolite - are commercialized, even marginal penetration of the projected $16B market by 2025 would value FPMI shares at $4.69 per share. This is compelling in view of aggressive acquisition activity in pharma/healthcare for novel products addressing multi-billion dollar unmet needs (discussed, below). Further, it is believed that BFPET and CardioPET could actually cut billions in unnecessary expenditure, which is absolutely imperative for the future of the U.S. healthcare system. Lastly, even with aggressive discounting and use of a large margin of safety, FPMI is still one of the most compelling risk-adjusted opportunities in the healthcare sector today. In our view, the upside could be greater than 13X current price by year’s end, as two major de-risking events create a catalyst for shares.

If Lantheus Medical Paid $525 Million for Cardiolite, Then FPMI Must Be Worth At Least the Same

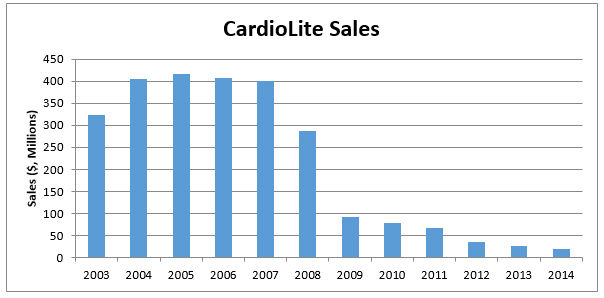

In the early 2000s, Cardiolite enjoyed patent protection and saw peak sales at upwards of $400M/ annum (as shown in Figure 1, below). Cardiolite is the current gold standard scan to see how much blood is reaching different parts of the heart, a diagnostic tool that helps physicians make decisions related to diagnosis of coronary artery disease.

Figure 1: CardioLite Sales Diminishing After Patent Expiration

The problem, however, is that Cardiolite’s SPECT imaging has a ~75% diagnostic accuracy due to its subpar image quality. Therefore, about ¼ patients are incorrectly diagnosed, which results in added costs to the healthcare system as these patients would need to be re-evaluated using invasive and costly procedures.

If FPMI’s Products Are Superior to Cardiolite, Then FPMI Must Be Worth >$525M

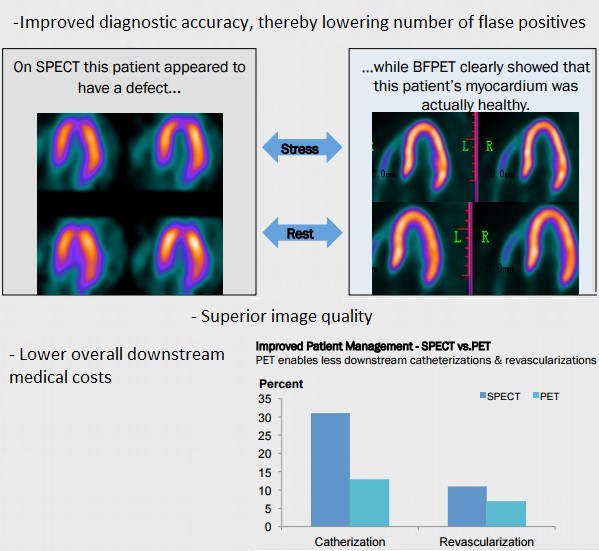

FPMI is developing two next-generation imaging agents for diagnosing coronary artery disease (CAD) using Positron emission tomography (PET). PET has distinct advantages over Single-photon emission computed tomography (SPECT) that include improved diagnostic accuracy, superior image quality and lower costs to the medical system in the long-run (shown Figure 2, below).

Figure 2: Superiority of FPMI’s Scans VS Market Standards

For instance, most scans in oncology rely on PET imaging but the transition from SPECT to PET in cardiology has been limited by imaging agents that were either inefficient or prohibitively expensive. FPMI’s CardioPET and BFPET could potentially alter this landscape and make PET imaging the standard in diagnosing CAD – which is a leading cause of death and costs the US healthcare system upwards of $100 Billion per year.

BPFET is potentially superior to Cardiolite – which holds title of best-selling imaging agent ever launched despite only a 75% diagnostic accuracy. This means that false positive scans refer patients to unnecessary and invasive procedures like angioplasty, which involves passing a balloon over wire within blood vessels to inflate balloon, expand blood vessels and improve flow. According to FluoroPharma, $25 Billion is wasted on unnecessary procedures. If diagnostic accuracy is improved from the standard 75%, which is likely with BFPET given the higher image quality, billions could potentially be saved by the US healthcare system. More importantly, this is likely to mean that BFPET could command pricing power, as the implied ‘gold standard'.

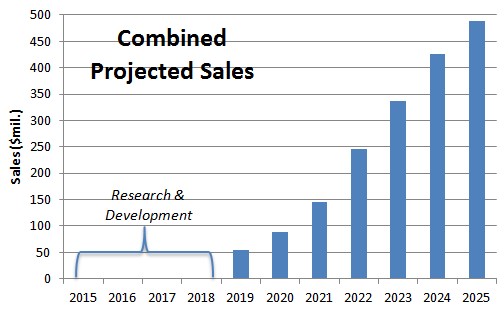

CardioPET addresses an unmet need in detecting regions of fatty acid uptake for metabolism. This is a projected $4.8B opportunity by 2025 that is COMPLETELY unmet and could yield FPMI peak sales of $144M based on our estimate of 3% penetration. If we also assume BFPET peaks at $345M in annual sales, or captures 3% of the market by 2025, the present value of these future sales could be worth $4.69 per share to FPMI’s shareholder today (discussed in greater detail, below).

Figure 3: BFPET & CardioPET Sales Could Hit Half Billion Dollars By 2025

The basis for BPFET being worth at least as much as what Cardiolite was acquired for is rooted in the assumption that data remains in line with what we’ve seen in previous studies and that BFPET is approved by the FDA in 2019.

FPMI Trades At 93% Discount to Fair Value for Reasons We Believe Won’t Exist In 6-12 Months

We believe FPMI trades at a deep discount to fair value of $4.69/share. But if the opportunity really is 13X in potential upside for investors today, why isn’t everyone jumping on the FPMI bandwagon? Historically, FPMI hasn’t been able to raise a substantial amount of capital – likely a function of the poor-quality underwriter in their public listing and lack of trading volume. These remain hurdles for the Company and create financing risk – a risk that the Company might not raise all or any of the capital that it needs or that it isn’t able to raise money at favorable terms. However, intrinsically, BFPET is at least as valuable as Cardiolite was to Bristol-Myers Squibb (BMS) when it enjoyed patent protection. This is also exactly what BFPET is worth in a base-case scenario to an acquirer. For shareholders this is all that should matter. And if the P2 data expected later this year is a major de-risking event, we believe sophisticated investors will view BFPET the same way and value the product in-line with Cardiolite at its peak, discounted of course for time value of money.

We believe smart money will narrow or completely eliminate the gap between current market price for FPMI shares and fair value of $4.69 by year-end, when BFPET P2 data is revealed. This is why we believe that pervasive risks that have limited FPMI’s valuation for the greater part of its existence as a publicly-traded company will not exist in 6-12 months - and perhaps sooner.

Patent Cliff Causes Pharma Giants to Compete For Promising Therapeutics, Often Sparking Bidding War

$44 Billion – that’s the total U.S. sales of top-selling branded drugs at risk of going off-patent and facing generic competition in 2015, which explains why pharmaceutical giants are willing to pay hand over fist to acquire novel drugs that address large, unmet needs. Figure 4 (below) shows select acquisitions in biotech/pharma, including size of deal (in $ billions) and premium paid to where the acquired company’s shares traded the day of the announcement. As might be expected, run-up in share price ahead of a rumored or widely anticipated acquisition was not adjusted for or included in the premium column.

Figure 4: Big Pharma Competing to Own the Next Blockbuster Drug

For example, before Celgene announced that it had acquired Receptos - developer of late-stage Relapsing Multiple Sclerosis (RMS) drug - it was reported that Receptos had rejected takeover bids from AstraZeneca PLC (AZN), Teva (TEVA) and Gilead (GILD). In the month leading up to Receptos’ announced acquisition, shares jumped 40%, presumably because of the bidding war between biotech heavyweights for the smaller biotech company’s Phase III RMS drug.

Since Cardiolite went off-patent in 2008, the lion’s share of $400M in annual [Cardiolite] revenue was forfeited to generic manufacturers. If the market for PET scans is expected to be $16B by 2025 (by our estimates, explained below), what would an acquirer pay to own the rights to BPFET, a PET-imaging agent with superior image quality, sensitivity and specificity to the ‘gold standard’ Cardiolite? Our view is that as the US population ages, CAD scans will become increasingly more commonplace – already every 3 seconds a cardiac perfusion scan is performed, according to FluoroPharma.

Why BioPharma Would Want to Own FPMI’s Pipeline

One might argue that even if FPMI were to commercialize its PET-based imaging agent(s), capturing a large share of the market would still be far from guaranteed. But for a pharmaceutical company with an existing salesforce and large infrastructure, a superior imaging agent could prove an easy sale. Importantly, this is why pharma companies usually acquire promising drugs in a disease area that they’ve been successful in – the existing salesforce makes plugging a new and improved version of a drug the acquirer already understands, seamless. For CardioPET and BFPET, natural targets would include SPECT imaging agent manufacturers like Lantheus, General Electric, Mallinckrodt or even RB-82 maker Bracco Diagnostics. In this space, consolidation explains why there are few independent medical imaging companies.

For an acquirer it’s all about perceived risk. We see Phase 2 data in BFPET, therefore, as an important de-risking event not just for FPMI investors, but for a potential acquirer too. An acquirer can make a relatively accurate forecast of 5-year sales of a product that’s well understood and supports the transition that is inevitable from SPECT to PET scans. Calculating the risk of successful Phase 1 to Phase 2 transition, followed by a registration study and regulatory decision might prove harder. Either way, with Lantheus hitting a snag in their Phase 3 study of Definity – a PET tracer – FPMI could again prove the front-runner in enabling (at a reasonable price; with a reliable supply; and by providing meaningful improvement in diagnostic accuracy versus Cardiolite et al.) PET scans for diagnosis of Coronary Artery Disease.

It’s worth pointing out that FPMI’s CEO, Thijs Spoor, and VP of Marketing, Edward Lyons Jr., are tenured in working with General Electric’s contrast imaging agents, with Spoor having managed their portfolio of nuclear cardiology products and later led new product opportunities in PET; Lyons having held position of global marketing director for nuclear medicine for GE. This gives FPMI’s top insiders a real insider perspective on what FPMI needs to do to get acquired.

For a company of FPMI’s size, the estimates of potential peak sales that management prepared in their corporate presentation [see PDF] suggest not only strong belief in their product portfolio but equally strong belief in the weak competitive landscape for a next-generation PET imaging agent that could compete with one of their own.

Step By Step Look At Why FPMI Shares Are Potentially Worth 13X Current Price to an Acquirer – And $4.69/Share to Shareholders

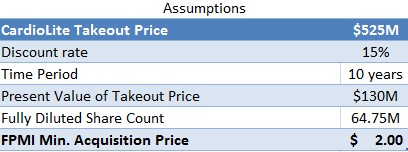

Upon patent expiration in 2025, FPMI should be worth $525M at the very least, which is what Lantheus acquired CardioLite rights for. To account for the 10 year time lapse and the risk associated with development, we assumed a 15% discount rate and used a fully diluted share count of 64.75M (as shown in Figure 5, below). The results are that at present, even if FPMI were sold for salvage when patents expire in 10 years, it would still be worth $2/share right now.

Figure 5: FPMI’s Salvage Value In 10 years still worth $2 today

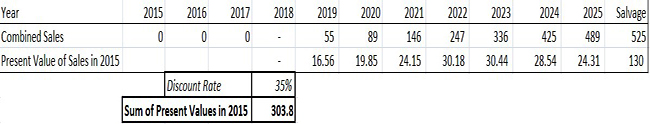

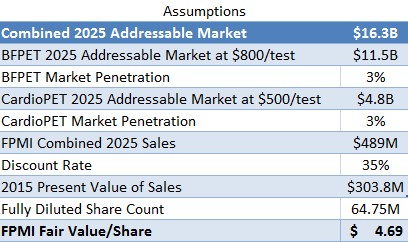

Next, we looked at the present value of future sales from CardioPET and BFPET, assuming regulatory approval and successful commercialization. Combined, the total addressable market for FPMI is projected to reach $16.3B by 2025. We assume both BFPET & CardioPET are able to penetrate 3% of the addressable market and generate sales of $489M. To account for the 10 year time lapse and the risk associated with regulatory approval, commercialization and competitive environment risk, we assume a discount rate of 35%, much higher than the salvage value discount rate used above (which, while it would involve development risk, involves none of the commercialization risk). With a fully diluted share count of 64.75M (explained below), we arrive at a present fair value for FPMI shares of $4.69, or roughly 13X recent market prices (as shown in Figure 6, below).

Figure 6: Computing $4.69/share Fair Value

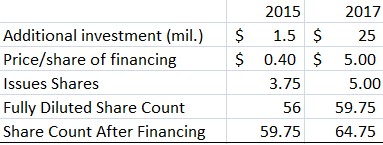

Lastly, to complete the BFPET Phase II trials and fund operations for the next 12 months, we assume FluoroPharma will need to raise $1.5M in equity financing and does so at a price of $0.40 per share. This is in line with the company’s projected Phase II cost of $1.7M. By the time FPMI initiates Phase III studies for both BFPET & CardioPET, which we assume will be 2017, we expect the company will need an additional $25M (based on Lantheus’ Phase III costs for Definity). By this time, we project the market will have priced FPMI stock at a fair value of $5/share, thereby ending the year with a fully diluted share count of 64.75M (as shown in Figure 7, below).

Figure 7: Capital Structure Changes Necessary to Fund Clinical Trials

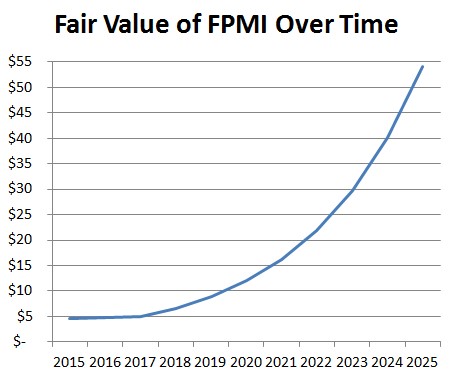

Finally, we arrive at a point in 2019, assuming regulatory approval and a steady growth rate in the number of PET procedures where FPMI is fully-funded and shares outstanding remain constant. As a result, growth in the PET tracer market begins to create an exponential-like benefit for the fair value of FPMI shares over time. At that point we view FPMI as being a no-brainer acquisition - because to an acquirer with an existing salesforce in nuclear cardiology, eg. General Electric, the transaction becomes seamless. However, we discount the upside heavily to arrive at a present value of $4.69 a share, which, even then gives us an incredible case for owning FPMI, particularly ahead of BFPET Phase 2 data expected later this year.

Figure 8: FPMI’s Exponential Upside to 2025

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal

Disclaimer: This research note has been prepared by One Equity Research LLC on

behalf of FluoroPharma Medical ("FluoroPharma" or the

"Company"), as part of research coverage services. One Equity

Research expects to receive ten thousand dollars for coverage of FluoroPharma

as of the date of this note. This research note is not an offer or solicitation

to buy or sell the securities of the Company. The report is for information

purposes only, and is not intended to (and is provided explicitly on the

condition that it not) be used as the sole basis to make any investment

decision. Investors should make their own determinations whether an investment

in any particular security is consistent with their investment objectives, risk

tolerance, and financial situation. Please read our full disclaimer at http://www.oneequityresearch.com/terms/

Please

also note that an affiliate of One Equity Research entered into a promissory

note with the Company in July, the details of which are described in an 8-k

filing with the Securities & Exchange Commission at http://www.sec.gov/Archives/edgar/data/1402785/000141588915002355/fpmi8k_july22015.htm