Despite years of economic uncertainties and the lack of a proper legal framework to help promising startups obtain capital, Argentine entrepreneurs are building a vibrant entrepreneurial ecosystem.

The country is home to many of Latin America’s biggest startup success stories, and with the introduction of one new law, the pathway to success is about to get a whole lot easier. Last month, the Senate voted unanimously to approve legislation supporting entrepreneurial activity growth in Argentina.

Aimed at easing the bureaucratic burdens entrepreneurs must bear, and backed by the Association of Entrepreneurs in Argentina (ASEA) and Argentina Association of Private Equity, Venture and Seed Capital (ARCAP), the new legislation replaces the old application, approval and financing procedures that took up to one year for entrepreneurs to complete before they could legally launch their companies.

The passing of the Entrepreneurs’ Law (Ley de Emprendedores) comes at a pivotal time for Argentina. It is aligned with President Mauricio Macri’s push to open up Argentina’s economy and place the country once again in the global market. But, to fully understand the significance of the Entrepreneurs’ Law, it’s important to understand Argentina’s difficult, yet resilient, entrepreneurial past.

Early offices of Argentine giant Globant

Decades of peaks and valleys

Argentina’s startup story begins in the 1990s when, after facing years of high inflation, the government launched new initiatives to reopen the country. This period of time coincided with the 1990s’ dot-com bubble, and Buenos Aires became a launching pad for some of the most successful entrepreneurs in the country’s history.

During this time, it’s estimated that 70 percent of the venture capital available in Latin America was concentrated in Buenos Aires. It was also during this time that the country’s first major internet companies got their start.

A group of Argentine entrepreneurs founded MercadoLibre, Latin America’s equivalent of eBay, which launched its IPO in 2007, as well as OfficeNet, which was acquired by Staples in 2004. For many years to come, these companies gave aspiring entrepreneurs hope in a country where climbing the corporate ladder was often seen as the only way to advance or succeed.

Unfortunately, the 1990s ended poorly for Argentina, and the country entered a steep economic crisis, faced a severe currency devaluation and defaulted on its public debts in 2001. Since then, entrepreneurs have faced a difficult business environment, relying on patience and extreme determination to uncover funding for their ventures in a capital-scarce environment.

A few tech companies, like OLX, Argentina’s answer to Craigslist, and now publicly traded outsourcing giant Globant, were remarkably successful during the 2000s. However, in recent years, the growth of Argentina’s startup ecosystem has been somewhat stagnant and laced with far too many obstacles for today’s entrepreneurs to truly succeed.

It was during this time (in 2013) that neighboring Chile passed a similar “Law of Businesses in One Day,” which allowed Chilean entrepreneurs to start a business in just one day and complete all the necessary paperwork and registration requirements online. The Chilean Association of Entrepreneurs (Asech) helped pass the law just before the entirely government-funded initiative, Start-Up Chile, emerged to revitalize the country’s position as a global, innovative leader.

The program has since become one of the most successful acceleration programs the global startup community has ever seen. The Chilean startup ecosystem exploded and Santiago was even dubbed “Chilecon Valley.”

Start-Up Chile has helped more than 3,000 entrepreneurs to date, and more than 30 percent of the startups that have been through the program have gone on to raise additional capital. CORFO is another Chilean governmental initiative that invested heavily in innovation and entrepreneurship in the country early on and became a key player in transforming Chile into a global innovation and entrepreneurial hub.

For Argentina’s startup community, and organizations like ASEA and ARCAP, Chile has been a prime example of what is possible when entrepreneurs have the backing and support of the government. This is why the passing of the Entrepreneurs’ Law comes at such a crucial time. Argentine innovators have always stood out in the region, but with this new law, the country’s entrepreneurs can finally go beyond being just a regional success story and take a momentous leap forward as a leader in technology and innovation in the world.

For the last few years, emerging markets have been drawing inspiration for their entrepreneurial laws from another program that has been widely credited as a prime model of successful government intervention in venture capital: Yozma.

In 1993, the Israeli government created Yozma, a $100 million fund of funds, that spawned 10 venture capital funds in just three years. The program had three key features that contributed to its success. It supported many small funds, it did not try to select winners and, lastly, it helped foster relationships between Israeli and international venture capitalists.

In Mexico, INADEM and NAFIN teamed up to replicate the Yozma model, as spreading money across as many funds as possible has its advantages. For one, the number of companies funded by venture capital is what matters in job creation and GDP growth, rather than the actual amount invested in each company. More venture capital flowing means more investors are provided with the opportunity to learn the trade.

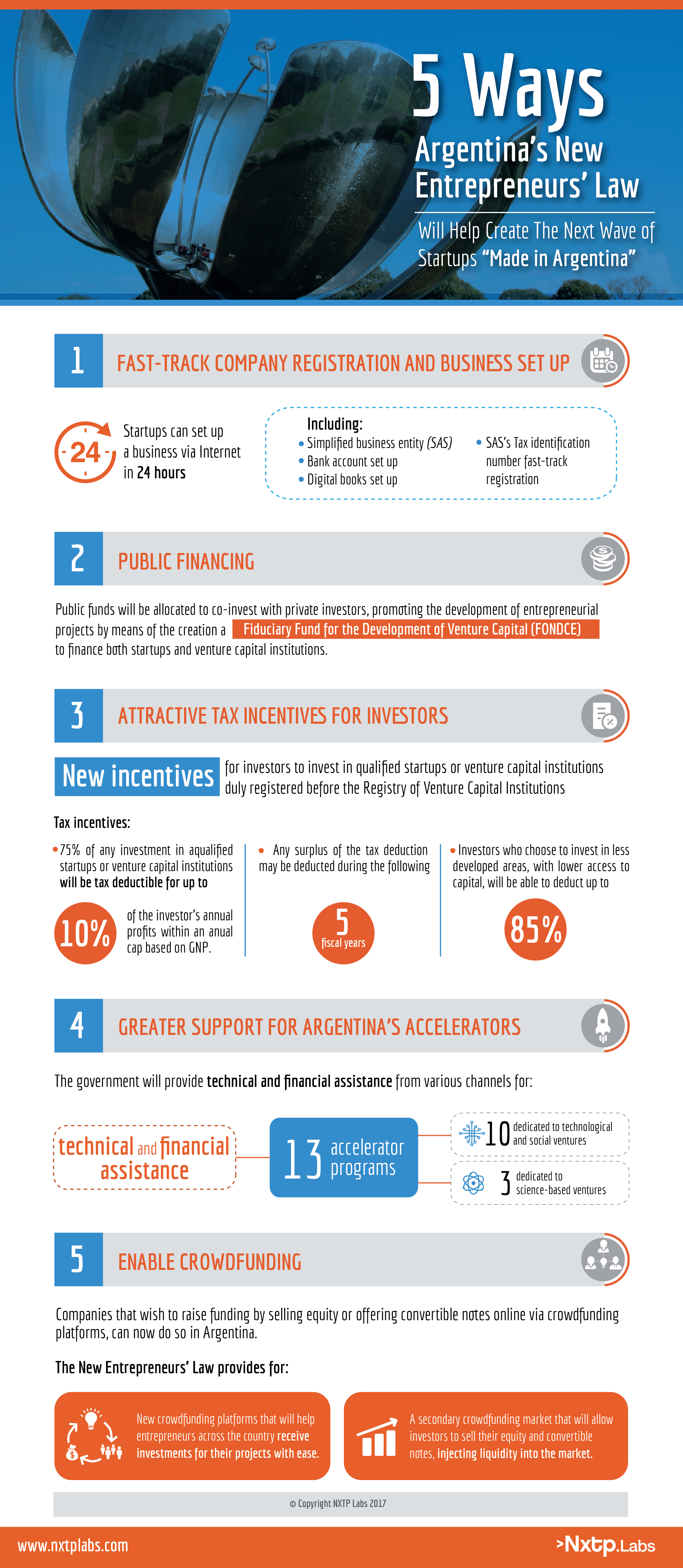

The new Entrepreneurs’ Law in Argentina consists of a number of measures aimed at increasing entrepreneurial and investment activity in the country by improving the ease of doing business, providing new channels of financing and, perhaps most importantly, providing attractive new tax breaks and incentives for those interested in investing in Argentine startups and venture capital funds.

Here’s an overview of how each of these measures will play a significant role in launching the next wave of startups “Made in Argentina.”

Fast-track for company registration

The Entrepreneurs’ Law will facilitate the establishment, promotion and potential growth of new companies by allowing them to set up their businesses via the internet in 24 hours with a simplified business entity (SAS) model. This includes the opening of a bank account, digital books and setting up a CUIT (identification number). Another interesting advantage of the Company by Simplified Shares (SAS) model is that even though it allows Argentine companies to have just one owner, if a founder wishes to add a partner, there is no need to modify the type of partnership.

Currently, the entire process to set up a business in Argentina can take anywhere from six months to one year. This setup time is now significantly reduced, even providing companies with a temporary address. Founders will then have between six and 12 months to change to a permanent address.

New channels of financing

For the first time, Argentina will allocate public funds to co-invest with private investors in order to promote the development of entrepreneurial projects. The Entrepreneurs’ Law will create the Fiduciary Fund for the Development of Venture Capital (FONDCE), which will work to finance ventures and venture capital institutions. Over the next year, the fund will contribute up to 40 percent (of the total capital committed) to three venture capital funds, so long as the institutions also provide a counterpart.

A formal registry of venture capital institutions will also be created and serve as a place for Argentina’s various institutions and investors to register and share information. Fund managers, private investors, as well as funds and trusts, regardless of whether they are public or private, will all be able to register. This will make it much easier to track VC activity in the country.

Attractive tax incentives for investors

Argentine startups constantly face a short supply of financing opportunities from the private sector. As a result, they’ve had to rely on a very few angel investors, VC funds and, of course, more traditional FFF sources of capital (friends, family and fools.)

With the new Entrepreneurs’ Law, investors now have more incentive to invest in qualified startups or venture capital funds. Seventy-five percent of any investment in an SAS company or SAS accredited investment fund will be tax-deductible for up to 10 percent of the investor’s annual profits. Investors who choose to invest in less developed areas, with lower access to capital, will be able to deduct up to 85 percent.

Greater support for accelerators, crowdfunding platforms

The government plans to provide technical and financial assistance to 13 accelerator programs — 10 dedicated to technological and social ventures and three to science-based ventures — with the creation of a new seed fund program.

Financial assistance will come from various channels, including soft loans, non-reimbursable contributions and the FONDCE. Over the next year, the government also plans to co-create with the private sector 10 new accelerators, making it an exciting time for programs that help Argentine entrepreneurs drive their companies forward.

Finally, companies that wish to raise funding by selling equity, or offering convertible notes online via crowdfunding platforms, can now do so. The Entrepreneurs’ Law enables crowdfunding platforms to register their services and help entrepreneurs across the country receive investments for their projects with ease. An interesting component to point out is that the law also grants a secondary crowdfunding market to be implemented, allowing investors to sell their equity and convertible notes, and, therefore, injecting liquidity into the market.

A new wave of startups coming to life

Despite years of political and economic uncertainties, Argentina has managed to produce some of Latin America’s biggest startup success stories. The country is home to four out of the region’s nine most valuable “unicorn” technology companies. But it’s time for VCs to start paying attention to today’s entrepreneurs.

Even though Argentina is still in the early stages of this new government-startup collaboration, it will be exciting to witness firsthand all of the incredible things Argentine entrepreneurs can accomplish when they have the support of the government and friendlier conditions to operate.

With a boost in investments, a new wave of companies will also be able to generate jobs that will have a real social, environmental and economic impact on the country. The struggles Argentine entrepreneurs once faced will be mitigated with the Entrepreneurs’ Law; however, eliminating these hurdles completely will require even more guidance and support from the startup community. But there is hope that local investors will now be able to provide them with just that.