E&P | NGI All News Access | NGI The Weekly Gas Market Report

Schlumberger Expecting NAM Land Activity to Plunge 10%

Schlumberger Ltd., the No. 1 oilfield services (OFS) operator in the world, is forecasting a sharp pullback in U.S. and Canadian onshore activity this year, while domestic offshore and overseas activity are on an upward trajectory.

CEO Paal Kibsgaard, who is retiring effective Aug. 1, led his final conference call on Friday, offering a sobering forecast for North American (NAM) land through the remainder of the year. Exploration and production (E&P) operators have slowed their onshore activity in part to appease shareholders and improve cash flow.

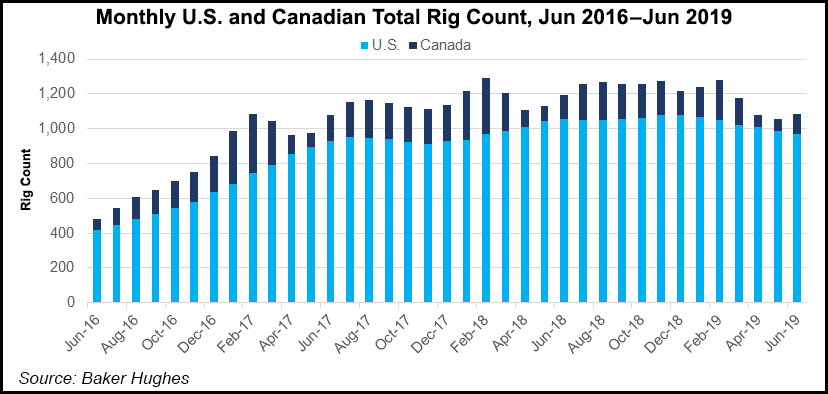

The downturn in Lower 48 activity began to rear its head early this year, and in 2Q2019 revenue in the region increased by only 1% sequentially. In the first half of the year, NAM land revenue fell 12%, in contrast to mainly U.S. offshore activity, where revenue jumped 10%.

Activity within OneStim, the pressure pumping business, was only slightly higher between April and June, offset by “weak hydraulic fracturing pricing and a general decrease in drilling activity,” Kibsgaard said.

The reset points to global markets that are rebalancing. The latest results reflected the “normalization” in global E&P spend “in response to the accelerating decline in the mature production base,” he said, while NAM land investments are falling “due to E&P operator cash flow constraints.”

From a macro perspective, “we expect oil market sentiments to remain balanced. The oil demand forecast for 2019 has been reduced slightly on trade war fears and current global geopolitical tensions, but we do not anticipate a change in the structural demand outlook for the mid-term.”

On the supply side of the equation, U.S. unconventional oil growth is the “only near- to medium-term source of global production growth, albeit at a slowing growth rate, as E&P operators continue to transition from an emphasis on growth to a focus on cash and returns, with consequent restraining effects on investment levels.”

Combined with a decision by the Organization of the Petroleum Exporting Countries and allies to extend production cuts through 1Q2020, oil prices should remain “rangebound around present levels,” Kibsgaard said.

Global oil and gas markets “are well supplied from production added by projects that were sanctioned before 2015,” but “this added supply will begin to fall in 2020 and create risk for the future as the decline rates in many mature production basins become an increasingly significant challenge.”

While several oil and gas projects are set to be sanctioned this year, “their size and number account for supply additions far below the required global annual production replacement rates. We therefore maintain our view that international E&P investment will grow 7-8% in 2019, further supported by the increase in international rig count.

“In contrast, spending in North America land is tracking our expectations of a 10% decline this year.”

By business segment, sequential growth was led by a 7% uptick in revenue within the Reservoir Characterization unit, followed by a 6% jump in production from higher international activity.

NAM consolidated revenue of $2.8 billion was 2% higher sequentially. OneStim revenue was up 3% on improved fracturing fleet utilization from increased market demand, but it was partially offset by “continued pricing weakness.”

Still, Schlumberger’s production unit revenue overall “was strengthened by increasing deployment of new fracturing technologies in North America land that improved completions performance and increased wellsite efficiency through automation.

“In addition, international contract awards and the deployment of innovative artificial lift and completions technologies helped maximize production in horizontal wells and improve recovery in low-productivity zones.”

On the technology front, Schlumberger highlighted OneStim’s deployment in the Eagle Ford Shale of the WellWatcher Stim stimulation monitoring service and BroadBand Shield fracture-geometry control service for Freedom Oil & Gas to avoid parent-child well interference effects. The Kinetix reservoir-centric stimulation-to-production software also was used for the far field diverter design to optimize the completions schedule.

Schlumberger said the StimCommander Pump technology for NAM land activity “has now been used in all major shale plays, totaling more than 29,000 stages and 51,000 pumping hours.”

Meanwhile, 22-year veteran Kibsgaard, who has helmed the Paris-based operator for eight years, said Olivier Le Peuch will take over as CEO in August. Board director Mark G. Papa is to be nonexecutive chair.

Le Peuch, who has worked for Schlumberger for 32 years, currently is executive vice president, Reservoir & Infrastructure. He also has served as president of the Cameron product lines, president of Schlumberger Completions and vice president of Engineering, Manufacturing and Sustaining.

“Olivier possesses the company’s values, an in-depth knowledge of our business, and a proven industry track record — all together, he is ideally suited to lead Schlumberger into the next chapter of our history,” Kibsgaard said.

Peter Currie, who will continue to serve as the board’s lead independent director, said Kibsgaard had “navigated the company through the worst downturn in the history of the industry and set us on the right course to win in a different landscape. The board owes Paal a debt of gratitude for his excellent leadership in modernizing and transforming the company to ensure its continued future success.”

Papa, who helmed EOG Resources Inc. for 13 years, now chairs Centennial Resource Development Inc., a Permian Basin pure-play. He said the board was “highly confident that Schlumberger will continue to grow and prosper” under Le Peuch’s leadership.

Net earnings in 2Q2019 totaled $492 million (35 cents/share), versus year-ago profits of $430 million (31 cents). Capital expenditure guidance for 2019 remains unchanged at $1.5-1.7 billion. Schlumberger spent $404 million in the second quarter. Free cash flow was $459 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |