Sweden-based startup Truecaller made its name as a nifty mobile app that helps people filter out unwanted phone calls and messaging, but now it is making a move to become a platform.

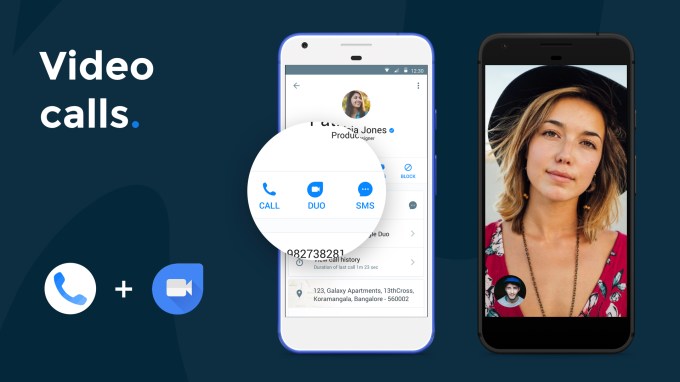

At a press event in India, Truecaller’s largest market based on its 150 million users, the company announced a series of partnerships, including a tie-in with Google which will see the U.S. firm’s Duo newly launched video calling feature integrated into the Truecaller app.

The Truecaller app, which is dedicated to battling annoying calls, is about to become much more than that. In addition to the Duo tie-in, Truecaller is boosting the app by integrating Truemessenger, its two-year-old service for making messaging smarter and managing spam.

Now, in India, Truecaller for Android will go from being a dialing app alternative to a service that can handle calls and also manage SMS and make video calls.

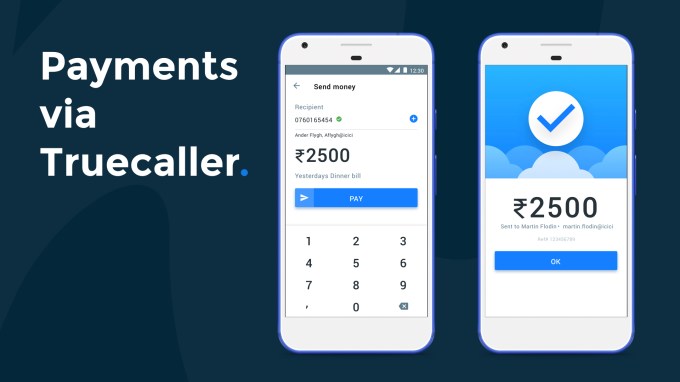

But that’s not quite all, Truecaller is also introducing payments.

The company has partnered with ICICI Bank to enable peer-to-peer payments between Truecaller users. ICICI Bank is providing the technology behind the service, Truecaller confirmed. Beyond holding the requisite licenses for the service, the bank is using India’s UPI payment system to enable it. Truecaller Pay will open to users of any bank in India, both parties said.

“India has played an important role for the innovation we bring to our users. As our product has matured, so has India as a market which made it more organic than ever to build more meaningful services on top of Truecaller,” Alan Mamedi, Truecaller CEO and co-founder said in a statement in TechCrunch

So, video calls, text messages and payments — that sounds like the basis of a mobile platform in line with services like WeChat in China, Line in Japan and Kakao in Korea.

A Truecaller representative explained to TechCrunch that the company isn’t making its service open to third parties at this point, but it is open to integrating other services where it sees a match. Likewise, the company is initially introducing these features in India but it isn’t discounting the potential to introduce similar offerings in other parts of the world.

“If we are able to find success with these kinda of services [in India], then we could replicate a similar model in other markets,” Kim Fai Kok, director of communications at Truecaller, told TechCrunch. “There are big opportunities in markets like Kenya and Nigeria, [but] we need to focus and make sure we get the first rollout right.”

Truecaller is far from the only company attacking the opportunity around mobile platforms in India, which is a key growth market for tech. The country’s online population is tipped to reach 450 million-465 million people by June 2017, according to a recent report co-authored by the Internet and Mobile Association of India, widening the audience of potential e-commerce customers. China and the U.S. currently dominate in terms of e-commerce spending, but the value of online sales in India is predicted to reach $48 billion by 2020, analyst firm Forrester claimed.

The country’s is WhatsApp’s largest single market worldwide with 200 million active users. That popularity has made it central to the service’s much-anticipated monetization plans, which may be tested in India first. On a recent visit in India, WhatsApp co-founder Brian Acton said the Facebook-owned company would look at opportunities around “commercial messaging” and digitals payments when the time comes.

WhatsApp aside, there is also Hike, the home-grown company recently valued at $1 billion after it raised a $175 million funding round led by WeChat maker Tencent. Hike is following WhatsApp with a focus on messaging. While it has been more aggressive expanding into connected services like games, news and stickers, Hike hasn’t revealed its active user base in India. That’s fueled speculation that the numbers aren’t particularly impressive.

That raises an interesting point about Truecaller’s move to become a platform. The company isn’t competing head-on with WhatsApp. That’s an unenviable task in India. Instead, it is offering a different first proposition — filtering pesky spam calls and messages — which could give it a leg up as it aims to find engagement with these new features. Nonetheless, with an abundance of payment options already in the market, it’ll be interesting to see how the new Truecaller service fares against the incumbents.

More wider, an alliance with Truecaller is a tacit admission from Google that it is struggling to find an audience for its latest messaging apps, Duo and Allo. Despite product quality, Google is years late to the messaging and calling app space, which WhatsApp dominates in India and many other emerging markets. Piggybacking with Truecaller is a logical move for both, but again it remains to be seen if the combination can break the network effect that has made WhatsApp, which added voice calls in 2015 and video calls last year, the world’s most successful messaging service with more than one billion active users.