If you were a business banker, how would you like access to a digital rolodex stuffed with business leads? Want to talk to business owners at companies who have at least 200 employees within 50 miles of your headquarters? Are your best prospects VPs of Finance in the medical industry? Or maybe you want to connect with the head of accounts payable at large manufacturing firms.

You want lists by title? By company size? By industry? By geographic location? All the above?

With LinkedIn Sales Navigator you can do that, and more. Like saving your searches, and getting automatic push notifications anytime LinkedIn finds someone new who matches your criteria.

LinkedIn launched its version of Sales Navigator for commercial banking in January 2013. The premium subscription is provided on an enterprise basis to bankers, relationship managers and their senior management teams that lets them leverage LinkedIn to find and engage with business owners, C-Level executives and high net-worth individuals in their local communities.

LinkedIn Sales Navigator combines LinkedIn’s network data, relevant news sources, information from your team’s accounts, leads, and preferences to produce customized recommendations and insights — specifically more prospects and potential contacts. In other words, Sales Navigator gets smarter based on everything you do within the system, making it easier as time goes by to zero-in on the right people at the right kind of companies.

Key Features of LinkedIn Sales Navigator:

- Prospecting, lead generation and recommendations – save up to 3,000 leads

- Notifications – job changes, common connections, etc.

- CRM integration with Salesforce and Microsoft Dynamics

- Unlock profiles from your search results to gain visibility into sales prospects beyond third degree connections

- Full list of who’s viewed your profile over the last 90 days

- TeamLink – an intradepartmental networking tool for your salesforce

- Up to 25 free InMail messages every month

- News mentions of key companies and contacts

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

How Does the LinkedIn Tool Work?

It’s really simple. First of all, you need to identify how many bankers, relationship managers and sales people are at your bank. This is the group that will be using Sales Navigator. For a nominal fee (starting at roughly $1,200 per person per year, not much more than a cup of coffee), LinkedIn will provide these people with an annual license each to LinkedIn Sales Navigator. Then LinkedIn will train your bank’s team.

“We will teach your revenue producers how to find high quality prospects in your local community on LinkedIn,” says Dan Swift, Director of Financial Services for LinkedIn Sales Solutions. “We’ll then teach your bankers how to relate quickly to these prospects with insights that prospects share on LinkedIn. And finally, we’ll coach your revenue producers on how to engage with your prospects through common connections or your company network on LinkedIn to find new business opportunities or cross-selling opportunities.”

LinkedIn’s educational curriculum includes a “profile makeover,” showing business bankers how they can amplify the bank’s brand, humanize their profile, and position themselves as a thought leader.

LinkedIn Sales Navigator Onboarding Process

Step 1 – Training

Step 2 – Profile Makeover

Step 3 – Network Building

Step 4 – Prospecting & Lead Generation

Step 5 – Advanced Techniques

As if the value of the Sales Navigator tool and training weren’t enough, LinkedIn provides every corporate customer with a relationship manager who’s there specifically “to ensure the success of banks using LinkedIn.”

Sales Navigator is also available as a mobile app. The app allows users to save new leads, see profiles and connections, send messages (to prospects or fellow team members), and provides a variety of real-time updates.

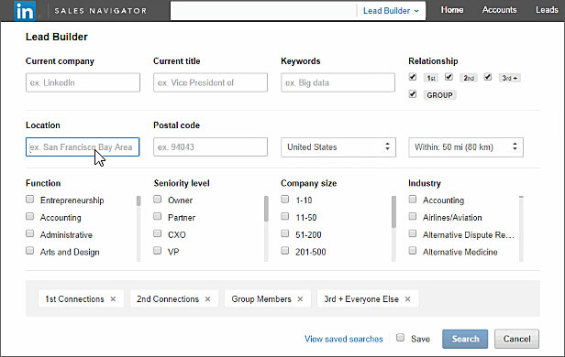

The “Lead Builder” tool within LinkedIn Sales Navigator. You can specify specific companies, titles, keywords, geographic location/proximity, industry and more. Each search can be saved for future reference. Automatic email alerts can be created for saved searches.

Warm Introductions

Let’s say one of your business bankers wanted to speak with someone in the finance department at the Acme Manufacturing Company. And let’s say Acme is a big company, with thousands of employees. Using Sales Navigator, your salesperson can work through their network, the networks of their fellow salespeople, and all the connections within those networks to track down someone who can arrange a “warm introduction.”

With Sales Navigator, you can see who knows who knows who — what LinkedIn refers to as “third degree connections.” Typically users don’t have access to any meaningful or useful profile information from third degree connections. This makes is much easier — and more likely — that a user will be able to locate someone who can facilitate an introduction. All you have to do is shoot them a short, private message in LinkedIn: “Hey Bob, I see you know Chris Smith at Acme Manufacturing. Just curious how you know him, and if you’d be willing to arrange an introduction. Thanks.”

Swift with LinkedIn says this method of networking is more efficient and effective than traditional modes.

“Why continue to cold call and spend countless hours at networking events in return for a couple of possible warm leads?” Swift wonders aloud.

The networking potential LinkedIn represents is indeed massive. According to LinkedIn, 22.1 million of its 313 million members are VP-level decision makers or higher — that’s nearly 10% of the people on LinkedIn. Another 39 million members are in positions that influence decision makers. And two more people join LinkedIn every second.

Helping Sales People Do What They Do Best

Salespeople often resist technology-based solutions; they are, after all focused on interpersonal relationships… in real life. Salespeople don’t want new lead tracking tools, they want new lead generation tools.

And that’s the beauty of Sales Navigator; it complements existing sales systems, rather than replace or compete with them. Salespeople know how to make initial contact, forge relationships, and cultivate them over time. All they need is more leads. Give them the leads, and they know what to say.

In that regard, Sales Navigator should be a comfortable solution to integrate into the sales cycle. Sure, a few new processes and procedures might be necessary, but they in the Sales Navigator environment, they feel a lot more intuitive than learning the features available in many other sales tools.

When salespeople see firsthand what kind of prospecting power LinkedIn Sales Navigator delivers, even the crustiest, most conservative among them will likely be willing to bite the proverbial tech bullet.

Keeping Tabs on Leads

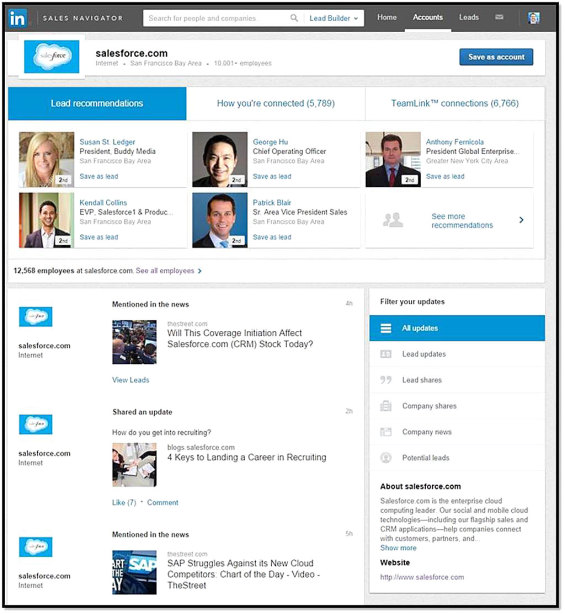

As your salespeople built their LinkedIn prospect pool, they can use Sales Navigator to keep up tabs on leads — both companies and individuals. Each salesperson can create “Saved Accounts,” allowing them to quickly access any new updates and information about their prospects.

Let’s return to our Acme Manufacturing example. One of your salespeople wants to get his foot in the door there. He’s got some connections with a few employees there, but he hasn’t contacted anyone yet. He’s just added them to his network on LinkedIn. Before he reaches out to anyone, he wants to know more about the company — current events, new products, recent additions to the C-suite, etc.

Sales Navigator makes it easy. The salesperson can create turn Acme Manufacturing into a “Saved Account,” then access a dashboard with updates about the company whenever they feel like it. The dashboard provides a summary of recent posts on LinkedIn from the company and its employees. It lists any new articles connected to Acme. And it suggests potential leads — people outside the salesperson’s existing network that they might want to connect with.

Using Sales Navigator’s “Saved Accounts,” business banking sales teams can quickly access any new updates and information about their prospects from a single, central dashboard.

Case Studies: Banks Ahead of the Curve

Some of you might still be thinking to yourself: “Oh, our bankers will never use LinkedIn!” But that’s not the case. LinkedIn already has a number of financial institutions actively using Sales Navigator.

One great example is Lynn Sigfred, VP Commercial Lending at First Business Bank ($1.1 billion) in Madison, Wisconsin. After the LinkedIn team provided training on profile optimization and how to build their network of connections, their bankers handed LinkedIn Sales Navigator.Their bankers now use the Lead Builder functionality and have discovered target accounts that they never had access to (or even knew existed) through traditional lead lists. When leveraging teammates’ connections to set up a meeting, the average success rate is at least 80% higher than without Sales Navigator. Bankers that use the TeamLink functionality get warm introductions from their peers to valuable contacts, shortening the sales process and increasing the likelihood of getting in the door.

“I called on companies for two years without getting a meeting, and within three months of using Sales Navigator, I was able to get in the door,” Sigfred says. “We haven’t found a better source for getting to the proper contact as quickly as we can with LinkedIn Sales Navigator.”

National Bank of Canada has also deployed LinkedIn Sales Navigator. Rather than use the tool to identify business banking and business lending prospects, National Bank of Canada uses Sales Navigator in its wealth management division to find wholesalers looking for financial advisors. According to LinkedIn, top sales reps using Sales Navigator are 5.2 times more likely to be successful than their peers. At National Bank of Canada, top performers are connected to twice as many people as their peers, do 4.3 times more searches for prospects on LinkedIn, and view 2.1 times as many pages/profiles as others.

Other financial institutions that have deployed Sales Navigator include heavy hitters like GE Capital, Bain Capital and Guardian. But Sales Navigator scales down to smaller institutions as neatly as it scales up. Community banks and even credit unions involved in business lending should definitely feel that Sales Navigator is within reach, particularly at the price point LinkedIn offers it. If you only have one or two salespeople, you won’t be paying tens of thousands of dollars for an “enterprise level solution” intended for bigger institutions.

Convincing the C-Suite

Swift at LinkedIn believes more bankers can be convinced to embrace social media prospecting. He says they are merely reluctant to try something new that they don’t fully understand, and they use compliance issues as an excuse.

“Heads of lending and marketing shared their reluctance to jump into social, citing compliance as a principal reason,” Swift explains. “When challenged on what specific components of compliance, I get blank stares.”

Swift says you shouldn’t be discouraged if you hear the word “no.”

“Be more curious when you are told no,” Swift advises. “If you don’t understand why you can’t do something that you believe will drive revenue and build deeper relationships with the community, be curious. Find out why. ‘No’ is often the answer when senior leadership does not understand.”

Swift’s team of banking experts conduct executive education briefings with the senior leadership to explain how and why they should be leveraging LinkedIn.

“We show them the specific opportunity for their bank, how many warm introduction opportunities could be leveraged, and even stats like how many LinkedIn members visited a bank’s employee profiles the previous month,” Swift explains. “This ties back to the importance of providing training to a bank’s employees to ensure they are putting their best foot forward in terms personal and bank brand.”