Anheuser-Busch InBev’s attempted £65bn takeover of SABMiller is a story of beer, billions and blue blood. Behind the two brewers sit three private shareholder groups worth more than $100bn (£65bn) between them.

AB InBev was formed in 2004 by an unlikely alliance between three Brazilian dealmakers, led by a former national tennis champion, and the Belgian brewing dynasties that controlled Stella Artois.

Now they are trying to force SABMiller, which makes Peroni and Grolsch, to sell out and form a brewing mammoth that would produce one-third of the world’s beer.

Blocking their path, at least for now, is the young and dashing head of Colombia’s Santo Domingo brewing family, who is about to marry into the highest echelons of the British aristocracy.

This airport novel of a tale will reach its denouement on Wednesday when AB InBev’s aggressive dealmakers have to make a firm bid or walk away. Here are the multibillionaire players involved.

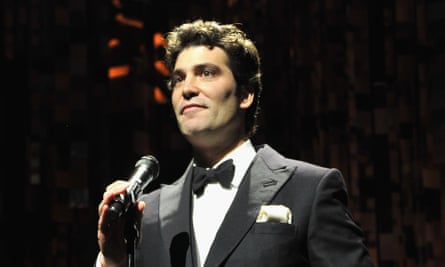

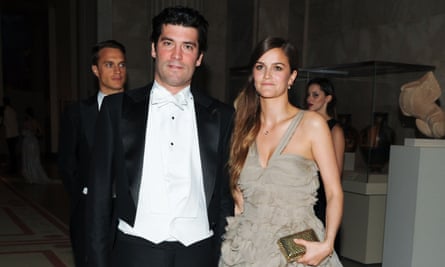

The Colombian eligible bachelor

The Santo Domingo family, Colombia’s richest, owns a 14% stake in SABMiller and is standing in the way of a deal being done. The brewing dynasty, which was founded by Julio Mario Santo Domingo, who died in 2011, is led by 38-year-old Alejandro Santo Domingo.

Regularly listed as one of the world’s most eligible and best-dressed men, he became engaged to Lady Charlotte Wellesley, the Duke of Wellington’s daughter, in July. Now he has emerged as the ultimate kingmaker in the bid talks, as the family he represents engages in brinkmanship designed to extract the highest possible offer.

The SAB Miller shareholder register comprises two large blocks, with the remainder of the shareholder base consisting of smallish institutional holdings. The largest block is owned by Altria, the tobacco group that owns the Marlboro and Benson & Hedges brands, which owns 27% of the group and supports a takeover. However, the Santo Domingos, who have two representatives on the board, have the power to thwart a deal because the bidder doesn’t appear to want to go hostile.

For decades, the family has controlled a web of businesses, including a television channel, a newspaper and radio station. Its interest in SABMiller stems from the merger of Bavaria Brewery, in which it held a majority stake, and SABMiller in 2005. The family’s holdings are now said to be valued at $14.8bn, according to the Bloomberg billionaires index. The Santo Domingo family was represented in the boardroom discussions earlier in the week that ended in a rejection of the latest offer.

A close follower of the negotiations said on Friday: “It is notable that people who are as well-informed about the brewing industry as they are felt the revised terms weren’t full enough to accept.” Those who know the family say they have a knack for holding out for the best possible price, with experience of keeping an interest in a business, as they did with SABMiller. The family is not believed to be hostile to the industrial logic of a deal but does think the current terms need sweetening.

The boys from Brazil

With the chief executive, Carlos Brito, running the show, the men behind the rampaging growth of AB InBev are three Brazilian financiers worth more than $45bn between them.

Jorge Paulo Lemann, Carlos Alberto Sicupira and Marcel Telles, who own almost 23% of the brewer, have been doing deals together for more than 40 years, first by advising investment banking clients on acquisitions and then by building an empire run through 3G Capital, the private equity firm they established in 2004, which also controls Burger King and Heinz.

Their leader is Lemann, Brazil’s richest person with a fortune of $23bn, according to Forbes. Lemann, 75, was Brazil’s national tennis champion five times and played at Wimbledon but after juggling tennis and investment banking during the 1960s he realised he was not going to become a global star on court and concentrated on business.

In 1971, Lemann bought a small stockbroker, Banco Garantia, and hired Sicupira, whom he met on a fishing trip, and Telles to turn it into Brazil’s version of Goldman Sachs. They sold Garantia to Credit Suisse in 1998 for $675m. By this time the three men had started buying non-financial businesses, including the Brazilian brewer Brahma, acquired in 1989 for $50m.

Brahma bought Brazilian rival Antartica in 1999 to form AmBev, giving it 70% of the country’s beer market. It expanded in Argentina before combining in 2004 with Interbrew, the Belgian maker of Stella Artois and Beck’s, to form the world’s biggest brewer. The deal was structured as a takeover by Interbrew but Lemann and co remained the driving force. They installed Brito, Lemann’s protege, as chief executive of the new company, InBev, which in 2008 bought Anheuser-Busch, the US maker of Budweiser, to form AB InBev.

AB InBev is the main component of the trio’s fortunes – Sicupira is worth $10.4bn and Telles has $11.9bn – but it is only part of their empire. Through 3G they own Burger King, whose $11bn purchase of Canadian coffee chain Tim Hortons was criticised as a tax-avoidance ploy. Their most spectacular deal was the 2013 purchase of Heinz, financed by Warren Buffett, who became an admirer of Lemann when they were on the board of Gillette in the late 1990s. In a further piece of joint dealmaking, Lemann and Buffett combined Heinz with Kraft Foods last year.

Lemann dislikes publicity. He moved his family from Brazil to Switzerland after a failed kidnap attempt on his three children in 1999. To his colleagues, Lemann’s lateness to the office that day was the only sign that something was amiss. He retains the lean build of a tennis player but a relentless fitness and business regime took its toll in 1994 when he suffered a heart attack. Nevertheless, the deals have kept coming.

The Belgian brewing clans

The other big shareholders in AB InBev are three Belgian brewing dynasties. With a combined fortune estimated at about €42bn (£31bn) they are jointly ranked as the richest families in Belgium. The de Spoelberch, Van Damme and de Mevius clans hold a combined 28.6% of the giant beermaker after Interbrew, the company they controlled, bought AmBev.

Like Lemann, the aristocratic clans like to keep a low profile and have taken a back seat at the company since joining forces with the Brazilians. The de Spoelberchs merged their Artois operation with the Van Damme family’s Piedboeuf brewery in 1987 to form Interbrew, which then went on its own acquisition spree by buying Labatts in Canada, Bass in the UK and Germany’s Beck’s. In 2002, the families appeared to use their majority stake in Interbrew to veto a mooted bid for South African Breweries, now SABMiller, that failed to materialise.

The de Spoelberchs are represented on the AB InBev board by Gregoire de Spoelberch, the nephew of the family’s patriarch Philippe. The family has the biggest shareholding in AB InBev of the Belgian clans but its interests are spread far beyond brewing. Alexandre Van Damme, who spent many years working in the family business, including as strategy head of Interbrew, has a powerful voice and is closer to the Brazilians, sitting on the board of Restaurant Brands, which is the parent of Burger King and Tim Hortons. Reports have suggested that the families disagreed over InBev’s aggressive pursuit of family-led Anheuser-Busch, with Van Damme siding with the Brazilians to force the US brewer into a deal.

Comments (…)

Sign in or create your Guardian account to join the discussion