Get ready for a busy Friday.

Here are the five things you need to know before the opening bell rings in New York:

1. Premarket movers -- Amazon, Visa, Starbucks: Amazon (AMZN) shares bolted up by about 18% in extended trading after it released better-than-expected earnings on Thursday.

If the shares hold onto those gains at the open, Amazon's market capitalization could trounce Wal-Mart's (WMT), making it the biggest retailer by value in the world.

Shares in Visa (V) look set for a 5% pop at the open after its earnings beat analyst forecasts. And Starbucks (SBUX) shares are up about 4% premarket after reporting earning Thursday afternoon.

But disappointing results from TripAdvisor (TRIP) sent its stock tumbling, down about 9% in extended trading.

In London, Pearson (PSO) shares are rising by about 3% after the publishing company reported half-year results. The company is also selling its Financial Times Group, which owns the eponymous business newspaper.

2. M&A movers: Anthem (ANTX) has announced it is acquiring Cigna (CI) for $54.2 billion.

The health insurance sector is going through a shake up as Obamacare pressures company profits.

Just three weeks ago, Aetna (AET) reached a $34 billion deal to buy Humana (HUM).

3. More earnings and economic data: Quarterly earnings are expected from companies including American Airlines (AAL), Spirit Airlines (SAVE) and Xerox (XRX) before the market opens.

On the economic side, the U.S. Census Bureau will report new home sales data for June at 10 a.m. ET. Numbers from May showed home sales were at their highest level since 2008.

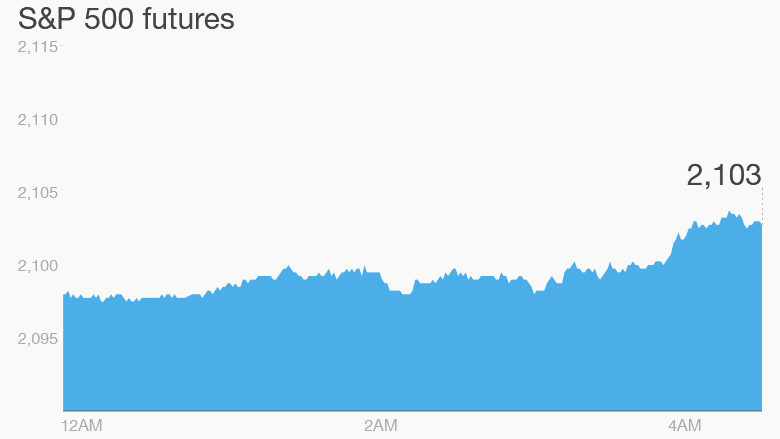

4. Global stock market overview: U.S. stock futures are edging up a bit and European markets are broadly in positive territory in early trading

However, Asian markets ended the week with losses as investors react to some disappointing economic data.

An early reading of China's manufacturing activity for the month of July came in below analyst expectations. At 48.2, the flash reading was the lowest in 15 months, and indicates that factories in the world's second-largest economy are losing momentum.

5. Market recap: Thursday was a negative day in the U.S. markets. The Dow Jones industrial average sank 0.7%, the S&P 500 dipped 0.6% and the Nasdaq declined by 0.5%.