Form 10-Q NCI BUILDING SYSTEMS For: Apr 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One) | |

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended April 30, 2017

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 1-14315

NCI BUILDING SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

Delaware | 76-0127701 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

10943 North Sam Houston Parkway West Houston, TX | 77064 |

(Address of principal executive offices) | (Zip Code) |

(281) 897-7788

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ý Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ý |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Emerging growth company | ¨ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes ý No

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Common Stock, $.01 par value - 70,899,742 shares as of June 1, 2017.

TABLE OF CONTENTS

PAGE | ||

Item 1. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 1. | ||

Item 1A. | ||

Item 2. | ||

Item 5. | ||

Item 6. | ||

i

PART I — FINANCIAL INFORMATION

Item 1. Unaudited Consolidated Financial Statements.

NCI BUILDING SYSTEMS, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except share data)

(Unaudited)

April 30, 2017 | October 30, 2016 | ||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 49,682 | $ | 65,403 | |||

Restricted cash | 70 | 310 | |||||

Accounts receivable, net | 168,625 | 182,258 | |||||

Inventories, net | 195,441 | 186,824 | |||||

Income taxes receivable | — | 982 | |||||

Deferred income taxes | 26,126 | 29,104 | |||||

Investments in debt and equity securities, at market | 6,469 | 5,748 | |||||

Prepaid expenses and other | 39,452 | 29,971 | |||||

Assets held for sale | 5,044 | 4,256 | |||||

Total current assets | 490,909 | 504,856 | |||||

Property, plant and equipment, net | 234,831 | 242,212 | |||||

Goodwill | 154,291 | 154,271 | |||||

Intangible assets, net | 141,958 | 146,769 | |||||

Other assets, net | 1,824 | 2,092 | |||||

Total assets | $ | 1,023,813 | $ | 1,050,200 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Current liabilities: | |||||||

Note payable | $ | 1,373 | $ | 460 | |||

Accounts payable | 121,177 | 142,913 | |||||

Accrued compensation and benefits | 55,760 | 72,612 | |||||

Accrued interest | 6,156 | 7,165 | |||||

Accrued income taxes | 1,119 | — | |||||

Other accrued expenses | 102,580 | 103,384 | |||||

Total current liabilities | 288,165 | 326,534 | |||||

Long-term debt, net of deferred financing costs of $7,341 and $8,096 on April 30, 2017 and October 30, 2016, respectively | 386,806 | 396,051 | |||||

Deferred income taxes | 24,701 | 24,804 | |||||

Other long-term liabilities | 21,267 | 21,494 | |||||

Total long-term liabilities | 432,774 | 442,349 | |||||

Stockholders’ equity: | |||||||

Common stock, $.01 par value, 100,000,000 shares authorized; 71,191,046 and 71,581,273 shares issued at April 30, 2017 and October 30, 2016, respectively; 70,899,918 and 70,806,202 shares outstanding at April 30, 2017 and October 30, 2016, respectively | 712 | 715 | |||||

Additional paid-in capital | 598,670 | 603,120 | |||||

Accumulated deficit | (283,757 | ) | (302,706 | ) | |||

Accumulated other comprehensive loss, net | (10,611 | ) | (10,553 | ) | |||

Treasury stock, at cost (291,128 and 775,071 shares at April 30, 2017 and October 30, 2016, respectively) | (2,140 | ) | (9,259 | ) | |||

Total stockholders’ equity | 302,874 | 281,317 | |||||

Total liabilities and stockholders’ equity | $ | 1,023,813 | $ | 1,050,200 | |||

See accompanying notes to consolidated financial statements.

1

NCI BUILDING SYSTEMS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

Fiscal Three Months Ended | Fiscal Six Months Ended | ||||||||||||||

April 30, 2017 | May 1, 2016 | April 30, 2017 | May 1, 2016 | ||||||||||||

Sales | $ | 420,464 | $ | 372,247 | $ | 812,167 | $ | 742,261 | |||||||

Cost of sales | 319,488 | 283,799 | 627,240 | 564,822 | |||||||||||

Loss (gain) on sale of assets and asset recovery | 137 | (927 | ) | 137 | (1,652 | ) | |||||||||

Gross profit | 100,839 | 89,375 | 184,790 | 179,091 | |||||||||||

Engineering, selling, general and administrative expenses | 75,124 | 74,648 | 144,164 | 144,498 | |||||||||||

Intangible asset amortization | 2,405 | 2,405 | 4,810 | 4,821 | |||||||||||

Strategic development and acquisition related costs | 124 | 579 | 481 | 1,260 | |||||||||||

Restructuring and impairment charges | 315 | 1,149 | 2,578 | 2,659 | |||||||||||

Gain on insurance recovery | (9,601 | ) | — | (9,601 | ) | — | |||||||||

Income from operations | 32,472 | 10,594 | 42,358 | 25,853 | |||||||||||

Interest income | 138 | 52 | 144 | 74 | |||||||||||

Interest expense | (7,479 | ) | (7,844 | ) | (14,365 | ) | (15,713 | ) | |||||||

Foreign exchange gain (loss) | 127 | 576 | 50 | (166 | ) | ||||||||||

Gain from bargain purchase | — | — | — | 1,864 | |||||||||||

Other income, net | 322 | 251 | 708 | 62 | |||||||||||

Income before income taxes | 25,580 | 3,629 | 28,895 | 11,974 | |||||||||||

Provision for income taxes | 8,606 | 1,209 | 9,882 | 3,662 | |||||||||||

Net income | $ | 16,974 | $ | 2,420 | $ | 19,013 | $ | 8,312 | |||||||

Net income allocated to participating securities | (115 | ) | (23 | ) | (131 | ) | (79 | ) | |||||||

Net income applicable to common shares | $ | 16,859 | $ | 2,397 | $ | 18,882 | $ | 8,233 | |||||||

Income per common share: | |||||||||||||||

Basic | $ | 0.24 | $ | 0.03 | $ | 0.27 | $ | 0.11 | |||||||

Diluted | $ | 0.24 | $ | 0.03 | $ | 0.27 | $ | 0.11 | |||||||

Weighted average number of common shares outstanding: | |||||||||||||||

Basic | 70,988 | 72,352 | 70,933 | 72,806 | |||||||||||

Diluted | 71,122 | 72,886 | 71,107 | 73,321 | |||||||||||

See accompanying notes to consolidated financial statements.

2

NCI BUILDING SYSTEMS, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(In thousands)

(Unaudited)

Fiscal Three Months Ended | Fiscal Six Months Ended | ||||||||||||||

April 30, 2017 | May 1, 2016 | April 30, 2017 | May 1, 2016 | ||||||||||||

Comprehensive income (loss): | |||||||||||||||

Net income | $ | 16,974 | $ | 2,420 | $ | 19,013 | $ | 8,312 | |||||||

Other comprehensive income (loss), net of tax: | |||||||||||||||

Foreign exchange translation gains (losses) and other(1) | (144 | ) | 492 | (58 | ) | 151 | |||||||||

Other comprehensive income (loss) | (144 | ) | 492 | (58 | ) | 151 | |||||||||

Comprehensive income | $ | 16,830 | $ | 2,912 | $ | 18,955 | $ | 8,463 | |||||||

(1) | Foreign exchange translation gains (losses) and other are presented net of taxes of $0 in both the three months ended April 30, 2017 and May 1, 2016, and $0 in both the six months ended April 30, 2017 and May 1, 2016. |

See accompanying notes to consolidated financial statements.

3

NCI BUILDING SYSTEMS, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In thousands, except share data)

(Unaudited)

Additional | Retained | Accumulated Other | |||||||||||||||||||||||||||

Common Stock | Paid-In | Earnings | Comprehensive | Treasury Stock | Stockholders’ | ||||||||||||||||||||||||

Shares | Amount | Capital | (Deficit) | (Loss) Income | Shares | Amount | Equity | ||||||||||||||||||||||

Balance, October 30, 2016 | 71,581,273 | $ | 715 | $ | 603,120 | $ | (302,706 | ) | $ | (10,553 | ) | (775,071 | ) | $ | (9,259 | ) | $ | 281,317 | |||||||||||

Treasury stock purchases | — | — | — | — | — | (402,825 | ) | (5,922 | ) | (5,922 | ) | ||||||||||||||||||

Retirement of treasury shares | (888,435 | ) | (8 | ) | (12,898 | ) | — | — | 888,435 | 12,906 | — | ||||||||||||||||||

Issuance of restricted stock | 362,946 | 4 | (4 | ) | — | — | (19,806 | ) | — | — | |||||||||||||||||||

Stock options exercised | 135,027 | 1 | 1,195 | — | — | — | — | 1,196 | |||||||||||||||||||||

Excess tax benefits from share-based compensation arrangements | — | — | 1,515 | — | — | — | — | 1,515 | |||||||||||||||||||||

Foreign exchange translation gain and other, net of taxes | — | — | 15 | (64 | ) | (58 | ) | — | — | (107 | ) | ||||||||||||||||||

Deferred compensation obligation | 235 | — | (135 | ) | — | — | 18,139 | 135 | — | ||||||||||||||||||||

Share-based compensation | — | — | 5,862 | — | — | — | — | 5,862 | |||||||||||||||||||||

Net income | — | — | — | 19,013 | — | — | — | 19,013 | |||||||||||||||||||||

Balance, April 30, 2017 | 71,191,046 | $ | 712 | $ | 598,670 | $ | (283,757 | ) | $ | (10,611 | ) | (291,128 | ) | $ | (2,140 | ) | $ | 302,874 | |||||||||||

See accompanying notes to consolidated financial statements.

4

NCI BUILDING SYSTEMS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Fiscal Six Months Ended | |||||||

April 30, 2017 | May 1, 2016 | ||||||

Cash flows from operating activities: | |||||||

Net income | $ | 19,013 | $ | 8,312 | |||

Adjustments to reconcile net income to net cash from operating activities: | |||||||

Depreciation and amortization | 20,378 | 21,512 | |||||

Amortization of deferred financing costs | 954 | 954 | |||||

Share-based compensation expense | 5,862 | 5,050 | |||||

Gain on insurance recovery | (9,601 | ) | — | ||||

Losses (gains) on assets, net | 262 | (3,516 | ) | ||||

Provision for doubtful accounts | 1,406 | 1,898 | |||||

Provision for deferred income taxes | (113 | ) | 1,668 | ||||

Excess tax (benefits) shortfalls from share-based compensation arrangements | (1,515 | ) | 390 | ||||

Changes in operating assets and liabilities, net of effect of acquisitions: | |||||||

Accounts receivable | 12,232 | 25,299 | |||||

Inventories | (8,617 | ) | 6,555 | ||||

Income taxes receivable | 982 | (4,140 | ) | ||||

Prepaid expenses and other | (1,875 | ) | 3,699 | ||||

Accounts payable | (21,737 | ) | (24,633 | ) | |||

Accrued expenses | (11,068 | ) | (22,976 | ) | |||

Other, net | (189 | ) | (59 | ) | |||

Net cash provided by operating activities | 6,374 | 20,013 | |||||

Cash flows from investing activities: | |||||||

Acquisitions, net of cash acquired | — | (4,343 | ) | ||||

Capital expenditures | (11,556 | ) | (10,280 | ) | |||

Proceeds from sale of property, plant and equipment | 2,533 | 4,663 | |||||

Proceeds from insurance | 420 | — | |||||

Net cash used in investing activities | (8,603 | ) | (9,960 | ) | |||

Cash flows from financing activities: | |||||||

Refund (deposit) of restricted cash | 240 | (49 | ) | ||||

Proceeds from stock options exercised | 1,196 | 1,401 | |||||

Excess tax benefits (shortfalls) from share-based compensation arrangements | 1,515 | (390 | ) | ||||

Proceeds from Amended ABL facility | 35,000 | — | |||||

Payments on Amended ABL facility | (35,000 | ) | — | ||||

Payments on term loan | (10,000 | ) | (20,000 | ) | |||

Payments on note payable | (458 | ) | (531 | ) | |||

Purchases of treasury stock | (5,922 | ) | (12,381 | ) | |||

Net cash used in financing activities | (13,429 | ) | (31,950 | ) | |||

Effect of exchange rate changes on cash and cash equivalents | (63 | ) | 151 | ||||

Net decrease in cash and cash equivalents | (15,721 | ) | (21,746 | ) | |||

Cash and cash equivalents at beginning of period | 65,403 | 99,662 | |||||

Cash and cash equivalents at end of period | $ | 49,682 | $ | 77,916 | |||

See accompanying notes to consolidated financial statements.

5

NCI BUILDING SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

April 30, 2017

(Unaudited)

NOTE 1 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

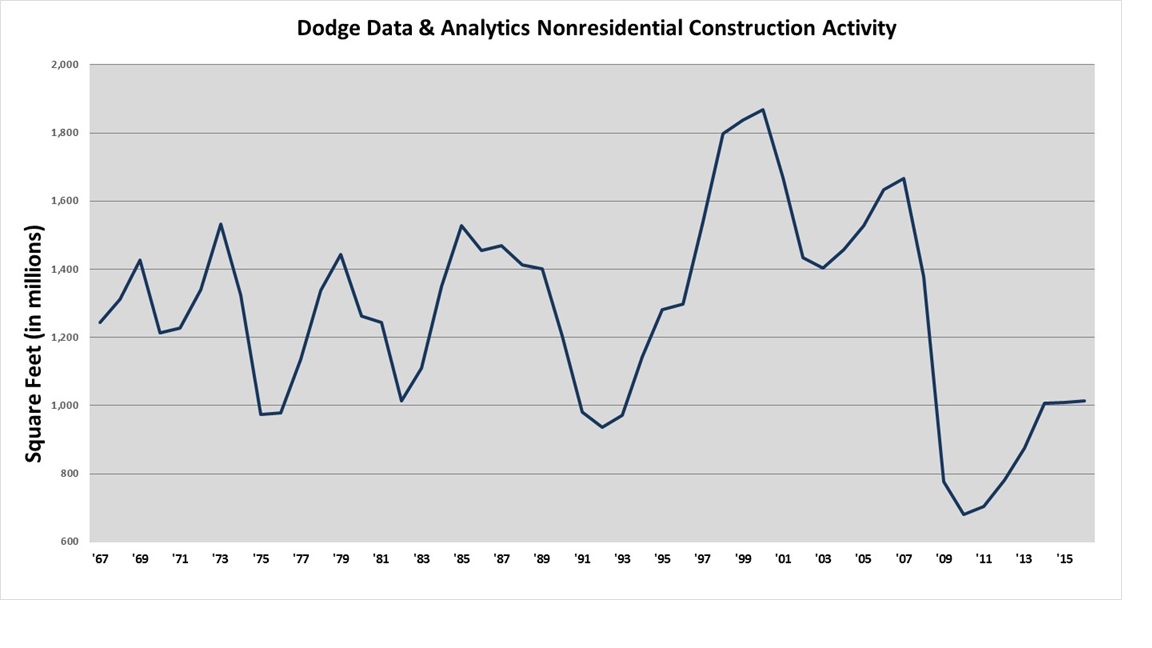

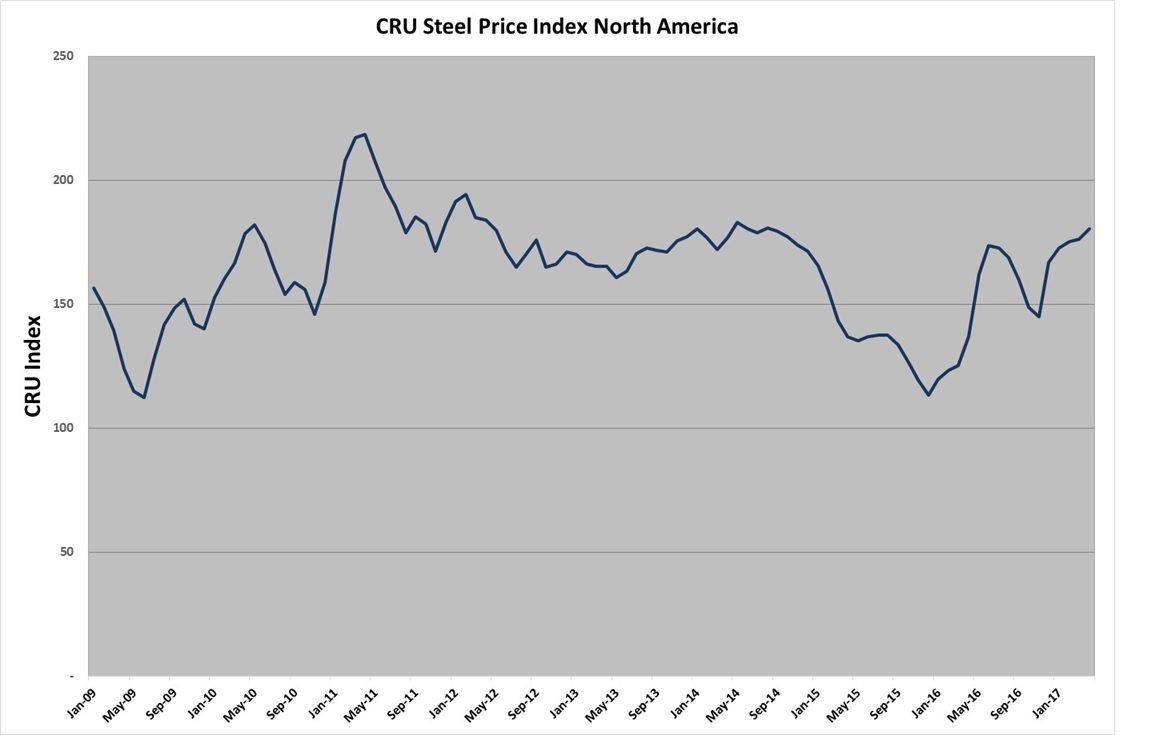

The accompanying unaudited consolidated financial statements for NCI Building Systems, Inc. (together with its subsidiaries, unless otherwise indicated, the “Company,” “NCI,” “we,” “us” or “our”) have been prepared in accordance with generally accepted accounting principles for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. In the opinion of management, the unaudited consolidated financial statements included herein contain all adjustments, which consist of normal recurring adjustments, necessary to fairly present our financial position, results of operations and cash flows for the periods indicated. Operating results for the fiscal three and six month periods ended April 30, 2017 are not necessarily indicative of the results that may be expected for the fiscal year ending October 29, 2017. Our sales and earnings are subject to both seasonal and cyclical trends and are influenced by general economic conditions, interest rates, the price of steel relative to other building materials, the level of nonresidential construction activity, roof repair and retrofit demand and the availability and cost of financing for construction projects.

For further information, refer to the consolidated financial statements and footnotes thereto included in our Annual Report on Form 10-K for the fiscal year ended October 30, 2016 filed with the Securities and Exchange Commission (the “SEC”) on January 9, 2017.

Reporting Periods

We use a four-four-five week calendar each quarter with our fiscal year end being on the Sunday closest to October 31. The year end for fiscal 2017 is October 29, 2017.

Gain on Insurance Recovery

In June 2016, the Company experienced a fire at a facility in the metal components segment. During the second quarter of fiscal 2017, the Company settled the property damage claims with the insurers for actual cash value of $18.0 million. Of this amount, the Company received proceeds of $10.0 million from our insurers during the fourth quarter of fiscal 2016. The remaining $8.0 million was recorded as an insurance receivable on the consolidated balance sheet as of April 30, 2017 in prepaid and other assets. We subsequently received proceeds from the insurers in May 2017 in full satisfaction of the insurance receivable.

Approximately $8.8 million was previously recognized to offset the loss on involuntary conversion and other amounts incurred related to the incident. The remaining $9.2 million was recognized as a gain on insurance recovery in the consolidated statement of operations at April 30, 2017 as the associated contingency was resolved.

The Company’s property insurance policy is a replacement cost policy such that the Company will be reimbursed an additional amount of up to $4.7 million for the difference between the actual cash value and the replacement cost if and when the property is replaced and/or new assets are acquired. Such amount will only be recognized in the Company’s financial statements upon resolution of the associated contingency. Additionally, the Company anticipates additional insurance recoveries may be received for business interruption claims related to the fire.

The Company also settled an outstanding claim with insurers for hail damage sustained at a facility within the metal components segment. The Company received proceeds of $0.4 million, which was recognized as a gain on insurance recovery in the consolidated statement of operations during the three month period ended April 30, 2017.

NOTE 2 — ACQUISITION

Fiscal 2016 acquisition

On November 3, 2015, we acquired manufacturing operations in Hamilton, Ontario, Canada for cash consideration of $2.2 million, net of post-closing working capital adjustments. This business allows us to service customers more competitively within the Canadian and Northeastern United States insulated metal panel (“IMP”) markets. Because the business was acquired from a seller in connection with a divestment required by a regulatory authority, the fair value of net assets acquired exceeded the purchase consideration by $1.9 million, which was recorded as a non-taxable gain from bargain purchase in the unaudited consolidated statements of operations during the first quarter of fiscal 2016.

6

The fair values of the assets acquired and liabilities assumed as part of this acquisition as of November 3, 2015, as determined in accordance with ASC Topic 805, were as follows (in thousands):

November 3, 2015 | ||||

Current assets | $ | 307 | ||

Property, plant and equipment | 4,810 | |||

Assets acquired | 5,117 | |||

Current liabilities assumed | 380 | |||

Fair value of net assets acquired | 4,737 | |||

Total cash consideration transferred | 2,201 | |||

Deferred tax liabilities | 672 | |||

Gain from bargain purchase | $ | (1,864 | ) | |

The results of operations for this business are included in our metal components segment. Pro forma financial information and other disclosures for this acquisition have not been presented as it is not material to the Company’s financial position or operating results.

NOTE 3 — ACCOUNTING PRONOUNCEMENTS

Adopted Accounting Pronouncements

In June 2014, the FASB issued ASU 2014-12, Accounting for Share-Based Payments When the Terms of an Award Provide That a Performance Target Could Be Achieved after the Requisite Service Period. ASU 2014-12 requires that a performance target that affects vesting and could be achieved after the requisite service period be treated as a performance condition. A reporting entity should apply existing guidance in ASC Topic 718, Compensation - Stock Compensation, as it relates to such awards. We adopted this guidance in our first quarter in fiscal 2017 on a prospective basis. The adoption of this guidance did not have any impact on our financial position or results of operations.

In January 2015, the FASB issued ASU 2015-01, Income Statement — Extraordinary and Unusual Items (Subtopic 225-20): Simplifying Income Statement Presentation by Eliminating the Concept of Extraordinary Items. ASU 2015-01 eliminates from U.S. GAAP the concept of extraordinary items. We adopted ASU 2015-01 prospectively in our first quarter in fiscal 2017. The adoption of this guidance did not have any impact on our financial position or results of operations.

In April 2015, the FASB issued ASU 2015-04, Practical Expedient for the Measurement Date of an Employer’s Defined Benefit Obligation and Plan Assets. This ASU provides a practical expedient option to entities that have defined benefit plans and have a fiscal year end that does not coincide with a calendar month end. This ASU allows an entity to elect to measure defined benefit plan assets and obligations using the calendar month-end that is closest to its fiscal year end. We adopted ASU 2015-04 prospectively in our first quarter in fiscal 2017. The adoption of this standard did not have any impact on our consolidated financial statements as presented; however, the future impact of ASU 2015-04 will be dependent upon the nature of future significant events, if any, impacting the Company’s pension plans.

In April 2015, the FASB issued ASU 2015-05, Intangibles — Goodwill and Other — Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Fees Paid in a Cloud Computing Arrangement. ASU 2015-05 provides guidance to customers about whether a cloud computing arrangement includes a software license. If a cloud computing arrangement includes a software license, the guidance specifies that the customer should account for the software license element of the arrangement consistent with the acquisition of other software licenses. ASU 2015-05 further specifies that the customer should account for a cloud computing arrangement as a service contract if the arrangement does not include a software license. We adopted ASU 2015-05 in our first quarter in fiscal 2017 on a prospective basis and, accordingly, the adoption of this guidance did not have a material impact on our consolidated financial statements.

In April 2015, the FASB issued ASU 2015-03, Interest - Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs. ASU 2015-03 requires debt issuance costs related to a recognized debt liability be presented on the balance sheet as a direct deduction from the carrying amount of the related debt liability instead of being presented as a separate asset. The retrospective adoption of this guidance in the first quarter of our fiscal 2017 resulted in a reclassification of approximately $8.1 million in deferred financing costs as of October 30, 2016 associated with our Notes and Credit Agreement (as defined in Note 11—Long-Term Debt and Note Payable) from other assets to long-term debt on our consolidated balance sheets.

In August 2015, FASB issued ASU 2015-15, Interest - Imputation of Interest (Subtopic 835-30) - Presentation and Subsequent Measurement of Debt Issuance Costs Associated with Line-of-Credit Arrangements (Amendments to SEC Paragraphs Pursuant to Staff Announcement at June 18, 2015 EITF Meeting), to provide further clarification to ASU 2015-03 as it relates to the

7

presentation and subsequent measurement of debt issuance costs associated with line of credit arrangements. Under this guidance, these costs may be presented as an asset and amortized ratably over the term of the line-of-credit arrangement, regardless of whether there are outstanding borrowings on the arrangement. We adopted this guidance in our first quarter in fiscal 2017 on a retrospective basis. The adoption of this guidance did not have any impact on our financial position as the deferred financing costs associated with our Amended ABL Facility remain classified in other assets on the consolidated balance sheets.

Recent Accounting Pronouncements

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606). ASU 2014-09 supersedes the revenue recognition requirements in ASC Topic 605, Revenue Recognition, and most industry-specific guidance. The core principle of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. During 2016, the FASB also issued ASU 2016-08, Revenue from Contracts with Customers: Principal versus Agent Considerations (Reporting Revenue Gross versus Net); ASU 2016-10, Revenue from Contracts with Customers: Identifying Performance Obligations and Licensing; ASU 2016-11, Rescission of SEC Guidance Because of Accounting Standards Updates 2014-09 and 2014-16 Pursuant to Staff Announcements at the March 3, 2016 EITF Meeting; and ASU 2016-12, Revenue from Contracts with Customers: Narrow-Scope Improvements and Practical Expedients; and ASU 2016-20, Technical Corrections and Improvements to Topic 606, Revenue from Contracts with Customers, all of which were issued to improve and clarify the guidance in ASU 2014-09. These ASUs are effective for our fiscal year ending November 3, 2019, including interim periods within that fiscal year, and will be adopted using either a full or modified retrospective approach. We are currently assessing the potential effects of these changes to our consolidated financial statements.

In July 2015, the FASB issues ASU 2015-11, Inventory (Topic 330): Simplifying the Measurement of Inventory. ASU 2015-11 requires that inventory that has historically been measured using first-in, first-out (FIFO) or average cost method should now be measured at the lower of cost and net realizable value. The update requires prospective application and is effective for our fiscal year ending October 28, 2018, including interim periods within that fiscal year. We do not expect that the adoption of this guidance will have a material impact on our consolidated financial statements.

In November 2015, the FASB issued ASU 2015-17, Balance Sheet Classification of Deferred Taxes. ASU 2015-17 requires all deferred tax assets and liabilities to be presented on the balance sheet as noncurrent. ASU 2015-17 is effective for our fiscal year ending October 28, 2018, including interim periods within that fiscal year. Upon adoption, we will present the net deferred tax assets as noncurrent and reclassify any current deferred tax assets and liabilities in our consolidated financial position on a retrospective basis.

In February 2016, the FASB issued ASU 2016-02, Leases, which will require lessees to record most leases on the balance sheet and modifies the classification criteria and accounting for sales-type leases and direct financing leases for lessors. ASU 2016-02 is effective for our fiscal year ending November 1, 2020, including interim periods within that fiscal year. The guidance requires entities to use a modified retrospective approach for leases that exist or are entered into after the beginning of the earliest comparative period in the financial statements. We are evaluating the impact that the adoption of this guidance will have on our consolidated financial statements.

In March 2016, the FASB issued ASU 2016-09, Improvements to Employee Share-Based Payment Accounting, which is intended to simplify certain aspects of the accounting for share-based payment award transactions, including income tax effects when awards vest or settle, repurchase of employees’ shares to satisfy statutory tax withholding obligations, an option to account for forfeitures as they occur, and classification of certain amounts on the statement of cash flows. ASU 2016-09 is effective for our fiscal year ending October 28, 2018, including interim periods within that fiscal year. We are evaluating the impact that the adoption of this ASU will have on our consolidated financial statements.

In June 2016, the FASB issued ASU 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. This ASU requires an entity to measure all expected credit losses for financial assets, including trade receivables, held at the reporting date based on historical experience, current conditions, and reasonable and supportable forecasts. Entities will now incorporate forward-looking information based on expected losses to estimate credit losses. ASU 2016-13 is effective for our fiscal year ending October 31, 2021, including interim periods within that fiscal year. We are evaluating the impact that the adoption of this ASU will have on our consolidated financial position, result of operations and cash flows.

In August 2016, the FASB issued ASU No. 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments, which provides guidance on eight cash flow classification issues with the objective of reducing differences in practice. We will be required to adopt the amendments in this ASU in annual and interim periods for our fiscal year ending November 3, 2019, with early adoption permitted. Adoption is required to be on a retrospective basis, unless impracticable for any of the amendments, in which case a prospective application is permitted. We are evaluating the impact that ASU 2016-15 will have on our consolidated financial statements.

8

In October 2016, the FASB issued ASU 2016-16, Income Taxes (Topic 740): Intra-Entity Transfers of Assets Other than Inventory, which eliminates the exception that prohibits the recognition of current and deferred income tax effects for intra-entity transfers of assets other than inventory until the asset has been sold to an outside party. We will be required to adopt the amendments in this ASU in the annual and interim periods for our fiscal year ending November 3, 2019, with early adoption permitted. The application of the amendments will require the use of a modified retrospective basis through a cumulative-effect adjustment to retained earnings as of the beginning of the period of adoption. We are evaluating the standard and the impact it will have on our consolidated financial statements.

In November 2016, the FASB issued ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash (a consensus of the FASB Emerging Issues Task Force), which clarifies how entities should present restricted cash and restricted cash equivalents in the statement of cash flows. Entities will no longer present transfers between cash and cash equivalents and restricted cash and restricted cash equivalents in the statement of cash flows. An entity with a material balance of restricted cash and restricted cash equivalents must disclose information about the nature of the restrictions. We will be required to adopt this guidance on a retrospective basis in the annual and interim periods for our fiscal year ending November 3, 2019, with early adoption permitted. We are evaluating the impact ASU 2016-18 will have on our consolidated financial statements.

In January 2017, the FASB issued ASU 2017-01, Business Combinations (Topic 805): Clarifying the Definition of a Business. This ASU adds guidance to assist entities with evaluating whether transactions should be accounted for as acquisitions (or disposals) of assets or businesses. Under the new guidance, if a single asset or group of similar identifiable assets comprise substantially all of the fair value of the gross assets acquired (or disposed of) in a transaction, the assets and related activities are not a business. Also, a minimum of an input process and a substantive process must be present and significantly contribute to the ability to create outputs in order to be considered a business. We will be required to adopt this guidance on a prospective basis in the annual and interim periods for our fiscal year ending November 3, 2019, with early adoption permitted. We are evaluating the impact ASU 2017-01 will have on our consolidated financial statements.

In January 2017, the FASB issued ASU 2017-04, Intangibles—Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment. This ASU eliminates Step 2 from the goodwill impairment test and requires an entity to perform its goodwill impairment test by comparing the fair value of a reporting unit with its carrying amount. Under this guidance, an entity should recognize an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value. We will be required to adopt the amendments in this ASU on a prospective basis in the annual and interim periods for our fiscal year ending October 31, 2021, with early adoption permitted. We are evaluating the impact ASU 2017-04 will have on our consolidated financial statements.

In February 2017, the FASB issued ASU 2017-05, Other Income—Gains and Losses from the Derecognition of Nonfinancial Assets (Subtopic 610-20): Clarifying the Scope of Asset Derecognition Guidance and Accounting for Partial Sales of Nonfinancial Assets, which clarifies the scope of guidance on nonfinancial asset derecognition in Accounting Standards Codification 610-20 and the accounting for partial sales of nonfinancial assets. The new guidance also conforms the derecognition guidance for nonfinancial assets with the model in the new revenue standard (ASU 2014-09). We will be required to adopt this guidance on a prospective basis in the annual and interim periods for our fiscal year ending November 3, 2019, and the Company is required to apply the amendments at the same time that it applies the amendments in ASU 2014-09. We are evaluating the impact of adopting this guidance.

In March 2017, the FASB issued ASU 2017-07, Compensation—Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost, which amends the requirements related to the income statement presentation of the components of net periodic benefit cost for employer sponsored defined benefit pension and other postretirement benefit plans. Under the new guidance, an entity must disaggregate and present the service cost component of net periodic benefit cost in the same income statement line items as other employee compensation costs arising from services rendered during the period, and only the service cost component will be eligible for capitalization. Other components of net periodic benefit cost will be presented separately from the line items that include the service cost. We will be required to adopt this guidance on a prospective basis in the annual and interim periods for our fiscal year ending November 3, 2019, with early adoption permitted. Entities must use a retrospective transition method to adopt the requirement for separate presentation of the income statement service cost and other components, and a prospective transition method to adopt the requirement to limit the capitalization of benefit cost to the service component. We are evaluating the impact of adopting this guidance.

In May 2017, the FASB issued ASU 2017-09, Compensation—Stock Compensation (Topic 718): Scope of Modification Accounting, which provides clarity on the accounting for modifications of stock-based awards. We will be required to adopt this guidance on a prospective basis in the annual and interim periods for our fiscal year ending November 3, 2019 for share-based payment awards modified on or after the adoption date. We are evaluating the impact ASU 2017-09 will have on our consolidated financial statements.

9

NOTE 4 —RESTRUCTURING AND ASSET IMPAIRMENTS

As part of the plans developed in the fourth quarter of fiscal 2015 primarily to improve ESG&A and manufacturing cost efficiency and to optimize our combined manufacturing footprint given the Company’s acquisitions and restructuring efforts, we incurred restructuring charges, primarily consisting of severance related costs of $0.3 million, including $0.2 million and $0.1 million in the engineered building systems segment and metal components segment, respectively, during the three months ended April 30, 2017. During the three months ended May 1, 2016, we incurred restructuring charges, primarily consisting of severance related costs of $1.1 million, including $0.1 million and $0.6 million in the engineered building systems segment and metal components segment, respectively, and $0.4 million at corporate.

For the six months ended April 30, 2017, we incurred restructuring charges, primarily consisting of severance related costs of $2.6 million, including approximately $2.1 million and $0.5 million in the engineered building systems segment and metal components segment, respectively. For the six months ended May 1, 2016, we incurred restructuring charges, primarily consisting of severance related costs of $2.7 million, including $0.6 million and $0.9 million in the engineered building systems segment and metal components segment, respectively, and $1.2 million at corporate.

The following table summarizes the costs and charges associated with the restructuring plans during the three and six months ended April 30, 2017, which are recorded in restructuring and impairment charges in the Company’s consolidated statements of operations (in thousands):

Fiscal Three Months Ended | Fiscal Six Months Ended | ||||||||||

April 30, 2017 | April 30, 2017 | Cost Incurred To Date (since inception) | |||||||||

General severance | $ | 155 | $ | 1,043 | $ | 8,387 | |||||

Plant closing severance | 90 | 1,330 | 3,070 | ||||||||

Asset impairments | — | 125 | 5,969 | ||||||||

Other restructuring costs | 70 | 80 | 711 | ||||||||

Total restructuring costs | $ | 315 | $ | 2,578 | $ | 18,137 | |||||

We expect to fully execute our plans in phases over the next 24 months and estimate that we will incur future additional restructuring charges associated with these plans. We are unable at this time to make a good faith determination of cost estimates, or ranges of cost estimates, associated with future phases of these plans.

The following table summarizes our severance liability and cash payments made pursuant to the restructuring plans from inception through April 30, 2017 (in thousands):

General Severance | Plant Closing Severance | Total | |||||||||

Balance at November 2, 2014 | $ | — | $ | — | $ | — | |||||

Costs incurred | 3,887 | 1,575 | 5,462 | ||||||||

Cash payments | (2,941 | ) | (1,575 | ) | (4,516 | ) | |||||

Accrued severance(1) | 739 | — | 739 | ||||||||

Balance at November 1, 2015 | $ | 1,685 | $ | — | $ | 1,685 | |||||

Costs incurred(1) | 2,725 | 165 | 2,890 | ||||||||

Cash payments | (3,928 | ) | (165 | ) | (4,093 | ) | |||||

Balance at October 30, 2016 | $ | 482 | $ | — | $ | 482 | |||||

Costs incurred and other | 1,043 | 1,330 | 2,373 | ||||||||

Cash payments | (1,317 | ) | (1,330 | ) | (2,647 | ) | |||||

Balance at April 30, 2017 | $ | 208 | $ | — | $ | 208 | |||||

(1) | During the second and fourth quarters of fiscal 2015, we entered into transition and separation agreements with certain executive officers. Each terminated executive officer was entitled to severance benefit payments issuable in two installments. The termination benefits were measured initially at the separation dates based on the fair value of the liability as of the termination date and were recognized ratably over the future service period. Costs incurred during fiscal 2016 exclude $0.7 million of amortization expense associated with these termination benefits. |

10

NOTE 5 — INVENTORIES

The components of inventory are as follows (in thousands):

April 30, 2017 | October 30, 2016 | ||||||

Raw materials | $ | 148,555 | $ | 145,060 | |||

Work in process and finished goods | 46,886 | 41,764 | |||||

$ | 195,441 | $ | 186,824 | ||||

NOTE 6 — ASSETS HELD FOR SALE

We record assets held for sale at the lower of the carrying value or fair value less costs to sell. The following criteria are used to determine if property is held for sale: (i) management has the authority and commits to a plan to sell the property; (ii) the property is available for immediate sale in its present condition; (iii) there is an active program to locate a buyer and the plan to sell the property has been initiated; (iv) the sale of the property is probable within one year; (v) the property is being actively marketed at a reasonable sale price relative to its current fair value; and (vi) it is unlikely that the plan to sell will be withdrawn or that significant changes to the plan will be made.

In determining the fair value of the assets less cost to sell, we consider factors including current sales prices for comparable assets in the area, recent market analysis studies, appraisals and any recent legitimate offers. If the estimated fair value less cost to sell of an asset is less than its current carrying value, the asset is written down to its estimated fair value less cost to sell. During the three months ended April 30, 2017, we reclassified $3.4 million from property, plant and equipment to assets held for sale for idled facilities in our engineered building systems segment of $2.9 million and our metal components segment of $0.5 million that met the held for sale criteria. The total carrying value of assets held for sale (primarily representing idled facilities in our engineered building systems segment) was $5.0 million and $4.3 million as of April 30, 2017 and October 30, 2016, respectively. All of these assets continued to be actively marketed for sale or are under contract at April 30, 2017.

During the three months ended April 30, 2017, we completed the sale of an idle facility in the engineered building systems segment, along with related equipment, which had previously been classified in assets held for sale. In connection with the sale of these assets, we received net cash proceeds of $2.5 million, and recognized a net loss of $0.1 million, which is included in loss (gain) on sale of assets and asset recovery in the consolidated statements of operations.

Due to uncertainties in the estimation process, it is reasonably possible that actual results could differ from the estimates used in our historical analysis. Our assumptions about property sales prices require significant judgment because the current market is highly sensitive to changes in economic conditions. We determined the estimated fair values of assets held for sale based on current market conditions and assumptions made by management, which may differ from actual results and may result in impairments if market conditions deteriorate.

NOTE 7 — SHARE-BASED COMPENSATION

Our 2003 Long-Term Stock Incentive Plan (“Incentive Plan”) is an equity-based compensation plan that allows us to grant a variety of types of awards, including stock options, restricted stock, restricted stock units, stock appreciation rights, performance share units (“PSUs”), phantom stock awards, long-term incentive awards with performance conditions (“Performance Share Awards”) and cash awards. Awards are generally granted once per year, with the amounts and types of awards determined by the Compensation Committee of our Board of Directors (the “Committee”). As a general rule, option awards terminate on the earlier of (i) 10 years from the date of grant, (ii) 30 days after termination of employment or service for a reason other than death, disability or retirement, (iii) one year after death or (iv) one year for incentive stock options or five years for other awards after disability or retirement. Awards are non-transferable except by disposition on death or to certain family members, trusts and other family entities as the Committee may approve. Awards may be paid in cash, shares of our Common Stock or a combination, in lump sum or installments and currently or by deferred payment, all as determined by the Committee.

As of April 30, 2017, and for all periods presented, our share-based awards under this plan have consisted of restricted stock grants, PSUs and stock option grants, none of which can be settled through cash payments, and Performance Share Awards. Both our stock options and restricted stock awards are subject only to vesting requirements based on continued employment at the end of a specified time period and typically vest in annual increments over three to four years or earlier upon death, disability or a change of control. However, our annual restricted stock awards issued prior to December 15, 2013 also vest upon attainment of age 65 and, only in the case of certain special one-time restricted stock awards, a portion vest on termination without cause or for good reason, as defined by the agreements governing such awards. Restricted stock awards issued after December 15, 2013 do not vest upon attainment of age 65, as provided by the agreements governing such awards. The vesting of our Performance Share Awards is described below.

11

Our time-based restricted stock awards are typically subject to graded vesting over a service period, which is typically three or four years. Our performance-based and market-based restricted stock awards are typically subject to cliff vesting at the end of the service period, which is typically three years. We recognize compensation cost for these awards on a straight-line basis over the requisite service period for each annual award grant. In the case of performance-based awards, expense is recognized based upon management’s assessment of the probability that such performance conditions will be achieved. Certain of our awards provide for accelerated vesting upon qualified retirement, after a change of control or upon termination without cause or for good reason. We recognize compensation cost for such awards over the period from grant date to the date the employee first becomes eligible for retirement.

Stock option awards

During the six month periods ended April 30, 2017 and May 1, 2016, we granted 10,424 and 28,535 stock options, respectively. The grant date fair value of options granted during the six month periods ended April 30, 2017 and May 1, 2016 was $6.59 and $5.38, respectively. There were 0.1 million options with an intrinsic value of $1.1 million exercised during the six months ended April 30, 2017, respectively. Cash received from the option exercises was $1.2 million.

Restricted stock and performance awards

Long-term incentive awards granted to our senior executives generally have a three-year performance period. Long-term incentive awards include restricted stock units and PSUs representing 40% and 60% of the total value, respectively. The restricted stock units vest upon continued employment. Vesting of the PSUs is contingent upon continued employment and the achievement of targets with respect to the following metrics, as defined by management: (1) cumulative free cash flow (weighted 40%); (2) cumulative earnings per share (weighted 40%); and (3) total shareholder return (weighted 20%), in each case during the performance period. At the end of the performance period, the number of actual shares to be awarded varies between 0% and 200% of target amounts. The PSUs vest pro rata if an executive’s employment terminates prior to the end of the performance period due to death, disability, or termination by the Company without cause or by the executive for good reason. If an executive’s employment terminates for any other reason prior to the end of the performance period, all outstanding unvested PSUs, whether earned or unearned, will be forfeited and cancelled. If a change in control occurs prior to the end of the performance period, the PSU payout will be calculated and paid assuming that the maximum benefit had been achieved. If an executive’s employment terminates due to death or disability while any of the restricted stock is unvested, then all of the unvested restricted stock will become vested. If an executive’s employment is terminated by the Company without cause or after reaching normal retirement age, the unvested restricted stock will be forfeited. If a change in control occurs prior to the end of the performance period, the restricted stock will fully vest. The fair value of the awards is based on the Company’s stock price as of the date of grant. During the six month periods ended April 30, 2017 and May 1, 2016, we granted PSUs with a total fair value of approximately $4.6 million and $5.2 million, respectively, to the Company’s senior executives.

Performance Share Awards granted to our key employees are paid 50% in cash and 50% in stock. Vesting of Performance Share Awards is contingent upon continued employment and the achievement of free cash flow and earnings per share targets, as defined by management, over a three-year performance period. At the end of the performance period, the number of actual shares to be awarded varies between 0% and 150% of target amounts. However, a minimum of 50% of the awards will vest upon continued employment over the three-year period if the minimum targets are not met. The Performance Share Awards vest earlier upon death, disability or a change of control. A portion of the awards also vests upon termination without cause or after reaching normal retirement age prior to the vesting date, as defined by the agreements governing such awards. The fair value of Performance Share Awards is based on the Company’s stock price as of the date of grant. During the six months ended April 30, 2017 and May 1, 2016, we granted awards to key employees with equity fair values of $2.0 million and $2.4 million and cash values of $2.0 million and $2.1 million, respectively.

On December 15, 2016, the performance period ended for certain PSUs granted to senior executives in December 2014 and the Performance Share Awards granted to key employees in December 2013. The PSUs vested at 149.3%, and resulted in the issuance of 0.1 million shares, net of shares withheld for taxes. The Performance Share Awards vested at 50.0%, and resulted in the issuance of less than 0.1 million shares, net of shares withheld for taxes.

For the restricted stock units granted in December 2016 and 2015 to our senior executives, one-third vests annually. The restricted stock units granted in December 2014 to our senior executives vested two-thirds on December 15, 2016 and the remaining one-third vests on December 15, 2017. The PSUs granted in December 2016 and 2015 to our senior executives cliff vest at the end of the respective three-year performance period. The PSUs granted in December 2014 to our senior executives vested one-half on December 15, 2016 and the remaining one-half vests on December 15, 2017. During the six months ended April 30, 2017 and May 1, 2016, we granted time-based restricted stock units with a fair value of $4.0 million, representing 0.3 million shares, and $3.9 million, representing 0.3 million shares, respectively.

During the six month periods ended April 30, 2017 and May 1, 2016, we recorded share-based compensation expense for all awards of $5.9 million and $5.1 million, respectively.

12

Deferred Compensation

In accordance with the Company’s Deferred Compensation Plan, amounts deferred into the Company Stock Fund must remain invested in the Company Stock Fund until distribution. The deferred compensation obligation related to the Company’s stock may only be settled by the delivery of a fixed number of the Company’s common shares held on the participant’s behalf. As a result, we have a deferred compensation obligation of $1.2 million related to the Company Stock Fund that is recorded within equity in additional paid-in capital on the consolidated balance sheet as of April 30, 2017. Subsequent changes in the fair value of the deferred compensation obligation classified within equity are not recognized. Additionally, the Company currently holds 164,663 shares in treasury shares, relating to deferred, vested PSU awards, until participants are eligible to receive benefits under the terms of the Deferred Compensation Plan.

NOTE 8 — EARNINGS PER COMMON SHARE

Basic earnings per common share is computed by dividing net income allocated to common shares by the weighted average number of common shares outstanding. Diluted earnings per common share, if applicable, considers the dilutive effect of common stock equivalents. The reconciliation of the numerator and denominator used for the computation of basic and diluted earnings per common share is as follows (in thousands, except per share data):

Fiscal Three Months Ended | Fiscal Six Months Ended | ||||||||||||||

April 30, 2017 | May 1, 2016 | April 30, 2017 | May 1, 2016 | ||||||||||||

Numerator for Basic and Diluted Earnings Per Common Share: | |||||||||||||||

Net income applicable to common shares | $ | 16,859 | $ | 2,397 | $ | 18,882 | $ | 8,233 | |||||||

Denominator for Basic and Diluted Earnings Per Common Share: | |||||||||||||||

Weighted average basic number of common shares outstanding | 70,988 | 72,352 | 70,933 | 72,806 | |||||||||||

Common stock equivalents: | |||||||||||||||

Employee stock options | 134 | 534 | 138 | 515 | |||||||||||

PSUs and Performance Share Awards | — | — | 36 | — | |||||||||||

Weighted average diluted number of common shares outstanding | 71,122 | 72,886 | 71,107 | 73,321 | |||||||||||

Basic earnings per common share | $ | 0.24 | $ | 0.03 | $ | 0.27 | $ | 0.11 | |||||||

Diluted earnings per common share | $ | 0.24 | $ | 0.03 | $ | 0.27 | $ | 0.11 | |||||||

Incentive Plan securities excluded from dilution(1) | 2 | 24 | 2 | 6 | |||||||||||

(1) | Represents securities not included in the computation of diluted earnings per common share because their effect would have been anti-dilutive. |

We calculate earnings per share using the “two-class” method, whereby unvested share-based payment awards that contain nonforfeitable rights to dividends or dividend equivalents are “participating securities” and, therefore, these participating securities are treated as a separate class in computing earnings per share. The calculation of earnings per share presented here excludes the income attributable to unvested restricted stock units related to our Incentive Plan from the numerator and excludes the dilutive impact of those shares from the denominator. Awards subject to the achievement of performance conditions or market conditions for which such conditions had been met at the end of any of the fiscal periods presented are included in the computation of diluted earnings per common share if their effect was dilutive.

NOTE 9 — WARRANTY

We sell weathertightness warranties to our customers for protection from leaks in our roofing systems related to weather. These warranties generally range from 2 years to 20 years. We sell two types of warranties, standard and Single Source™, and three grades of coverage for each. The type and grade of coverage determines the price to the customer. For standard warranties, our responsibility for leaks in a roofing system begins after 24 consecutive leak-free months. For Single Source™ warranties, the roofing system must pass our inspection before warranty coverage will be issued. Inspections are typically performed at three stages of the roofing project: (i) at the project start-up; (ii) at the project mid-point; and (iii) at the project completion. These inspections are included in the cost of the warranty. If the project requires or the customer requests additional inspections, those

13

inspections are billed to the customer. Upon the sale of a warranty, we record the resulting revenue as deferred revenue, which is included in other accrued expenses on our consolidated balance sheets.

The following table represents the rollforward of our accrued warranty obligation and deferred warranty revenue activity for each of the fiscal six months ended (in thousands):

Fiscal Six Months Ended | |||||||

April 30, 2017 | May 1, 2016 | ||||||

Beginning balance | $ | 27,200 | $ | 25,669 | |||

Warranties sold | 1,234 | 1,217 | |||||

Revenue recognized | (1,512 | ) | (1,421 | ) | |||

Ending balance | $ | 26,922 | $ | 25,465 | |||

NOTE 10 — DEFINED BENEFIT PLANS

RCC Pension Plan — With the acquisition of Robertson-Ceco II Corporation (“RCC”) on April 7, 2006, we assumed a defined benefit plan (the “RCC Pension Plan”). Benefits under the RCC Pension Plan are primarily based on years of service and the employee’s compensation. The RCC Pension Plan is frozen and, therefore, employees do not accrue additional service benefits. Plan assets of the RCC Pension Plan are invested in broadly diversified portfolios of government obligations, mutual funds, stocks, bonds, fixed income securities and master limited partnerships.

CENTRIA Benefit Plans — As a result of the CENTRIA Acquisition on January 16, 2015, we assumed noncontributory defined benefit plans covering certain hourly employees (the “CENTRIA Benefit Plans”) and are closed to new participants. Benefits under the CENTRIA Benefit Plans are calculated based on fixed amounts for each year of service rendered, although benefits accruals for one of the plans previously ceased. Plan assets of the CENTRIA Benefit Plans are invested in broadly diversified portfolios of domestic and international equity mutual funds, bonds, mortgages and other funds. CENTRIA also sponsors postretirement medical and life insurance plans that cover certain of its employees and their spouses (the “OPEB Plans”).

In addition to the CENTRIA Benefit Plans, CENTRIA contributes to a multi-employer plan, Steelworkers Pension Trust. The minimum required annual contribution to this plan is $0.3 million. The current contract expires on June 1, 2019. If we were to withdraw our participation from this multi-employer plan, CENTRIA may be required to pay a withdrawal liability representing an amount based on the underfunded status of the plan. The plan is not significant to the Company’s consolidated financial statements.

We refer to the RCC Pension Plan and the CENTRIA Benefit Plans collectively as the “Defined Benefit Plans” in this Note.

The following table sets forth the components of the net periodic benefit cost, before tax, and funding contributions, for the periods indicated (in thousands):

Fiscal Three Months Ended April 30, 2017 | Fiscal Three Months Ended May 1, 2016 | ||||||||||||||||||||||

Defined Benefit Plans | OPEB Plans | Total | Defined Benefit Plans | OPEB Plans | Total | ||||||||||||||||||

Service cost | $ | 24 | $ | 9 | $ | 33 | $ | 34 | $ | 8 | $ | 42 | |||||||||||

Interest cost | 513 | 64 | 577 | 589 | 65 | 654 | |||||||||||||||||

Expected return on assets | (700 | ) | — | (700 | ) | (745 | ) | — | (745 | ) | |||||||||||||

Amortization of prior service credit | (2 | ) | — | (2 | ) | (2 | ) | — | (2 | ) | |||||||||||||

Amortization of net actuarial loss | 344 | — | 344 | 292 | — | 292 | |||||||||||||||||

Net periodic benefit cost | $ | 179 | $ | 73 | $ | 252 | $ | 168 | $ | 73 | $ | 241 | |||||||||||

Funding contributions | $ | 591 | $ | — | $ | 591 | $ | 394 | $ | — | $ | 394 | |||||||||||

14

Fiscal Six Months Ended April 30, 2017 | Fiscal Six Months Ended May 1, 2016 | ||||||||||||||||||||||

Defined Benefit Plans | OPEB Plans | Total | Defined Benefit Plans | OPEB Plans | Total | ||||||||||||||||||

Service cost | $ | 49 | $ | 18 | $ | 67 | $ | 68 | $ | 17 | $ | 85 | |||||||||||

Interest cost | 1,027 | 129 | 1,156 | 1,178 | 131 | 1,309 | |||||||||||||||||

Expected return on assets | (1,399 | ) | — | (1,399 | ) | (1,489 | ) | — | (1,489 | ) | |||||||||||||

Amortization of prior service credit | (5 | ) | — | (5 | ) | (5 | ) | — | (5 | ) | |||||||||||||

Amortization of net actuarial loss | 687 | — | 687 | 585 | — | 585 | |||||||||||||||||

Net periodic benefit cost | $ | 359 | $ | 147 | $ | 506 | $ | 337 | $ | 148 | $ | 485 | |||||||||||

Funding contributions | $ | 825 | $ | — | $ | 825 | $ | 765 | $ | — | $ | 765 | |||||||||||

We expect to contribute an additional $1.1 million to the Defined Benefit Plans for the remainder of fiscal 2017. Our policy is to fund the CENTRIA Benefit Plans as required by minimum funding standards of the Internal Revenue Code. The contributions to the OPEB Plans by retirees vary from none to 25% of the total premiums paid.

NOTE 11 — LONG-TERM DEBT AND NOTE PAYABLE

Debt is comprised of the following (in thousands):

April 30, 2017 | October 30, 2016 | ||||||

Credit Agreement, due June 2019 (variable interest, at 4.25% on April 30, 2017 and on October 30, 2016) | $ | 144,147 | $ | 154,147 | |||

8.25% senior notes, due January 2023 | 250,000 | 250,000 | |||||

Amended Asset-Based lending facility, due June 2019 (variable interest, at our option as described below) | — | — | |||||

Less: unamortized deferred financing costs(1) | 7,341 | 8,096 | |||||

Total long-term debt, net of deferred financing costs | $ | 386,806 | $ | 396,051 | |||

(1) | Includes the unamortized deferred financing costs associated with the Notes and Credit Agreement. The unamortized deferred financing costs associated with the Amended ABL Facility of $0.9 million and $1.1 million as of April 30, 2017 and October 30, 2016, respectively, are classified in other assets on the consolidated balance sheets. |

8.25% Senior Notes Due January 2023

The Company’s $250.0 million in aggregate principal amount of 8.25% senior notes due 2023 (the “Notes”) bear interest at 8.25% per annum and will mature on January 15, 2023. Interest is payable semi-annually in arrears on January 15 and July 15 of each year.

The Company may redeem the Notes at any time prior to January 15, 2018, at a price equal to 100% of the principal amount thereof, plus accrued and unpaid interest, if any, to the redemption date, plus the applicable make-whole premium. On or after January 15, 2018, the Company may redeem all or a part of the Notes at redemption prices (expressed as percentages of principal amount thereof) set forth below, plus accrued and unpaid interest, if any, to the applicable redemption date of the Notes, if redeemed during the 12-month period beginning on January 15 of the year as follows:

Year | Percentage | |

2018 | 106.188% | |

2019 | 104.125% | |

2020 | 102.063% | |

2021 and thereafter | 100.000% | |

In addition, prior to January 15, 2018, the Company may redeem the Notes in an aggregate principal amount of up to 40.0% of the original aggregate principal amount of the Notes with funds in an equal aggregate amount not exceeding the aggregate proceeds of one or more equity offerings, at a redemption price of 108.250%, plus accrued and unpaid interest, if any, to the applicable redemption date of the Notes.

15

Credit Agreement

The Company’s Credit Agreement provided for a term loan credit facility (“Term Loan”) in an original aggregate principal amount of $250.0 million. The Credit Agreement will mature on June 24, 2019. The Term Loan amortizes in nominal quarterly installments equal to one percent of the aggregate initial principal amount thereof per annum. The Term Loan bears interest at a floating rate measured by reference to, at the Company’s option, either (i) an adjusted LIBOR not less than 1.00% plus a borrowing margin of 3.25% per annum or (ii) an alternate base rate plus a borrowing margin of 2.25% per annum. At both April 30, 2017 and October 30, 2016, the interest rate on the Term Loan was 4.25%.

During the six month periods ended April 30, 2017 and May 1, 2016, the Company made voluntary prepayments of $10.0 million and $20.0 million, respectively, on the outstanding principal amount of the Term Loan.

On May 2, 2017, the Company entered into Amendment No. 2 (the “Amendment”) to the Credit Agreement. For additional information on the Amendment, see Note 18 — Subsequent Events.

Amended ABL Facility

The Company’s Asset-Based Lending Facility (“Amended ABL Facility”) provides for revolving loans of up to $150.0 million (subject to a borrowing base) and letters of credit of up to $30.0 million. Borrowing availability under the Amended ABL Facility is determined by a monthly borrowing base collateral calculation that is based on specified percentages of the value of qualified cash, eligible inventory and eligible accounts receivable, less certain reserves and subject to certain other adjustments. At April 30, 2017 and October 30, 2016, the Company’s excess availability under the Amended ABL Facility was $139.9 million and $140.9 million, respectively. At both April 30, 2017 and October 30, 2016, the Company had no revolving loans outstanding under the Amended ABL Facility. In addition, at April 30, 2017 and October 30, 2016, standby letters of credit related to certain insurance policies totaling approximately $10.0 million and $9.1 million, respectively, were outstanding but undrawn under the Amended ABL Facility. The Amended ABL Facility will mature on June 24, 2019.

The Amended ABL Facility includes a minimum fixed charge coverage ratio of 1.00:1.00, which will apply if we fail to maintain a specified minimum borrowing capacity. The minimum level of borrowing capacity as of April 30, 2017 and October 30, 2016 was $21.0 million and $21.1 million, respectively. Although the Amended ABL Facility did not require any financial covenant compliance, at April 30, 2017 and October 30, 2016, NCI’s fixed charge coverage ratio, which is calculated on a trailing twelve month basis, was 3.43:1.00 and 2.86:1.00, respectively.

Loans under the Amended ABL Facility bear interest, at NCI’s option, as follows:

(1) | Base Rate loans at the Base Rate plus a margin. The margin ranges from 0.75% to 1.25% depending on the quarterly average excess availability under such facility, and |

(2) | LIBOR loans at LIBOR plus a margin. The margin ranges from 1.75% to 2.25% depending on the quarterly average excess availability under such facility. |

An unused commitment fee is paid monthly on the Amended ABL Facility at an annual rate of 0.50% based on the amount by which the maximum credit exceeds the average daily principal balance of outstanding loans and letter of credit obligations. Additional customary fees in connection with the Amended ABL Facility also apply.

For additional information on the Notes, Credit Agreement and the Amended ABL Facility, including guarantees and security, see our Annual Report on Form 10-K for the fiscal year ended October 30, 2016.

Debt Covenants

The Company’s outstanding debt agreements contain a number of covenants that, among other things, limit or restrict the ability of the Company and its subsidiaries to dispose of assets, make acquisitions and engage in mergers. As of April 30, 2017, the Company was in compliance with all covenants that were in effect on such date.

Insurance Note Payable

As of April 30, 2017 and October 30, 2016, the Company had an outstanding note payable in the amount of $1.4 million and $0.5 million, respectively, related to financed insurance premiums. Insurance premium financings are generally secured by the unearned premiums under such policies.

16

NOTE 12 — CD&R FUNDS

On August 14, 2009, the Company entered into an Investment Agreement (as amended, the “Investment Agreement”), by and between the Company and Clayton, Dubilier & Rice Fund VIII, L.P. (“CD&R Fund VIII”). In connection with the Investment Agreement and the Stockholders Agreement dated October 20, 2009 (the “Stockholders Agreement”), the CD&R Fund VIII and the Clayton, Dubilier & Rice Friends & Family Fund VIII, L.P. (collectively, the “CD&R Funds”) purchased convertible preferred stock, which was converted into shares of our common stock on May 14, 2013. Among other provisions, the Stockholders Agreement entitles the CD&R Funds to certain nomination or designation rights with respect to our board of directors; subscription rights with respect to future issuances of common stock by us; corporate governance rights; and consent rights with respect to certain types of transactions we may enter into in the future.

At April 30, 2017 and October 30, 2016, the CD&R Funds owned approximately 42.3% and 42.3%, respectively, of the outstanding shares of our common stock.

NOTE 13 — STOCK REPURCHASE PROGRAM

On September 8, 2016, the Company’s Board of Directors authorized a stock repurchase program for the repurchase of up to an aggregate of $50.0 million of the Company’s outstanding common stock. Under this repurchase program, the Company is authorized to repurchase shares, if at all, at times and in amounts that it deems appropriate in accordance with all applicable securities laws and regulations. Shares repurchased are usually retired. There is no time limit on the duration of the program.

During the six months ended April 30, 2017, the Company repurchased approximately 0.2 million shares for $3.5 million under the stock repurchase program. At April 30, 2017, approximately $39.9 million remained available for stock repurchases under the program. The timing and method of any repurchases, which will depend on a variety of factors, including market conditions, are subject to results of operations, financial conditions, cash requirements and other factors, and may be suspended or discontinued at any time.

In addition to the common stock repurchased during the six months ended April 30, 2017, the Company also withheld shares of stock to satisfy minimum tax withholding obligations arising in connection with the vesting of stock awards, which are included in treasury stock purchases in the consolidated statements of stockholders’ equity.

NOTE 14 — FAIR VALUE OF FINANCIAL INSTRUMENTS AND FAIR VALUE MEASUREMENTS

Fair Value of Financial Instruments

The carrying amounts of cash and cash equivalents, restricted cash, trade accounts receivable, accounts payable and notes payable approximate fair value as of April 30, 2017 and October 30, 2016 because of their relatively short maturities. The fair values of the remaining financial instruments not currently recognized at fair value on our consolidated balance sheets at the respective fiscal period ends were (in thousands):

April 30, 2017 | October 30, 2016 | ||||||||||||||

Carrying Amount | Fair Value | Carrying Amount | Fair Value | ||||||||||||

Credit Agreement, due June 2019 | $ | 144,147 | $ | 144,507 | $ | 154,147 | $ | 154,147 | |||||||

8.25% senior notes, due January 2023 | 250,000 | 270,625 | 250,000 | 272,500 | |||||||||||

The fair values of the Credit Agreement and the Notes were based on recent trading activities of comparable market instruments, which are level 2 inputs.

Fair Value Measurements

ASC Subtopic 820-10, Fair Value Measurements and Disclosures, requires us to use valuation techniques to measure fair value that maximize the use of observable inputs and minimize the use of unobservable inputs. These inputs are prioritized as follows:

Level 1: Observable inputs such as quoted prices for identical assets or liabilities in active markets.

Level 2: Other inputs that are observable directly or indirectly, such as quoted prices for similar assets or liabilities or market-corroborated inputs.

Level 3: Unobservable inputs for which there is little or no market data and which require us to develop our own assumptions about how market participants would price the assets or liabilities.

The following is a description of the valuation methodologies used for assets and liabilities measured at fair value. There have been no changes in the methodologies used at April 30, 2017 and October 30, 2016.

17

Money market: Money market funds have original maturities of three months or less. The original cost of these assets approximates fair value due to their short-term maturity.

Mutual funds: Mutual funds are valued at the closing price reported in the active market in which the mutual fund is traded.

Assets held for sale: Assets held for sale are valued based on current market conditions, prices of similar assets in similar condition and expected proceeds from the sale of the assets, representative of Level 3 inputs.

Deferred compensation plan liability: Deferred compensation plan liability is comprised of phantom investments in the deferred compensation plan and is valued at the closing price reported in the active markets in which the money market and mutual funds are traded.

The following tables summarize information regarding our financial assets and liabilities that are measured at fair value on a recurring basis as of April 30, 2017 and October 30, 2016, segregated by the level of the valuation inputs within the fair value hierarchy utilized to measure fair value (in thousands):

April 30, 2017 | |||||||||||||||

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Assets: | |||||||||||||||

Short-term investments in deferred compensation plan:(1) | |||||||||||||||

Money market | $ | 1,489 | $ | — | $ | — | $ | 1,489 | |||||||

Mutual funds – Growth | 873 | — | — | 873 | |||||||||||

Mutual funds – Blend | 1,782 | — | — | 1,782 | |||||||||||

Mutual funds – Foreign blend | 803 | — | — | 803 | |||||||||||

Mutual funds – Fixed income | — | 1,522 | — | 1,522 | |||||||||||

Total short-term investments in deferred compensation plan | 4,947 | 1,522 | — | 6,469 | |||||||||||

Total assets | $ | 4,947 | $ | 1,522 | $ | — | $ | 6,469 | |||||||

Liabilities: | |||||||||||||||

Deferred compensation plan liability | $ | — | $ | 4,490 | $ | — | $ | 4,490 | |||||||

Total liabilities | $ | — | $ | 4,490 | $ | — | $ | 4,490 | |||||||

October 30, 2016 | |||||||||||||||

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Assets: | |||||||||||||||

Short-term investments in deferred compensation plan:(1) | |||||||||||||||

Money market | $ | 422 | $ | — | $ | — | $ | 422 | |||||||

Mutual funds – Growth | 773 | — | — | 773 | |||||||||||

Mutual funds – Blend | 3,118 | — | — | 3,118 | |||||||||||

Mutual funds – Foreign blend | 730 | — | — | 730 | |||||||||||

Mutual funds – Fixed income | — | 705 | — | 705 | |||||||||||

Total short-term investments in deferred compensation plan | 5,043 | 705 | — | 5,748 | |||||||||||

Total assets | $ | 5,043 | $ | 705 | $ | — | $ | 5,748 | |||||||

Liabilities: | |||||||||||||||

Deferred compensation plan liability | $ | — | $ | 3,847 | $ | — | $ | 3,847 | |||||||

Total liabilities | $ | — | $ | 3,847 | $ | — | $ | 3,847 | |||||||

(1) | Unrealized holding gain (loss) for the three months ended April 30, 2017 and May 1, 2016 was $0.2 million and $0.3 million, respectively. Unrealized holding gain (loss) for the six months ended April 30, 2017 and May 1, 2016 was $(0.3) million and $(0.1) million, respectively. The net unrealized holding gain was insignificant for the fiscal year ended October 30, 2016. These unrealized holding gains (losses) were substantially offset by changes in the deferred compensation plan liability. |

18

The following table summarizes information regarding our financial assets that are measured at fair value on a nonrecurring basis as of April 30, 2017, segregated by level of the valuation inputs within the fair value hierarchy utilized to measure fair value (in thousands):

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Assets: | |||||||||||||||

Assets held for sale(2) | $ | — | $ | — | $ | 499 | $ | 499 | |||||||

Total assets | $ | — | $ | — | $ | 499 | $ | 499 | |||||||

(2) | Certain assets held for sale are valued at fair value and are measured at fair value on a nonrecurring basis. Assets held for sale are reported at fair value, if, on an individual basis, the fair value of the asset is less than cost. The fair value of assets held for sale is estimated using Level 3 inputs, such as broker quotes for like-kind assets or other market indications of a potential selling value that approximates fair value. |

NOTE 15 — INCOME TAXES

The effective tax rate for the six months ended April 30, 2017 was 34.2%, compared to 30.6% for the same period in the prior year. The change in the effective tax rate was primarily driven by a one-time adjustment in the first quarter of fiscal 2016 related to the research and development credit for fiscal 2015 that was permanently extended in the Protecting Americans from Tax Hikes Act of 2015 and was signed into law in fiscal 2016 as well as the nontaxable gain on bargain purchase from the Hamilton acquisition. There were no corresponding items in the six months ended April 30, 2017.

NOTE 16 — OPERATING SEGMENTS

Operating segments are defined as components of an enterprise that engage in business activities and by which discrete financial information is available that is evaluated on a regular basis by the chief operating decision maker to make decisions about how to allocate resources to the segment and assess the performance of the segment. We have three operating segments: engineered building systems; metal components; and metal coil coating. All operating segments operate primarily in the nonresidential construction market. Sales and earnings are influenced by general economic conditions, the level of nonresidential construction activity, metal roof repair and retrofit demand and the availability and terms of financing available for construction. Products of our operating segments use similar basic raw materials. The metal coil coating segment consists of cleaning, treating, painting and slitting continuous steel coils before the steel is fabricated for use by construction and industrial users. The metal components segment products include metal roof and wall panels, doors, metal partitions, metal trim, insulated panels and other related accessories. The engineered building systems segment includes the manufacturing of main frames, Long Bay® Systems and value-added engineering and drafting, which are typically not part of metal components or metal coil coating products or services. The operating segments follow the same accounting policies used for our consolidated financial statements.