India’s largest residential market, the national capital region, is in a state of correction as builders are staring at piling up of unsold homes and dipping sales. For long, investors have formed a major chunk of the housing market, but today the stagnation in prices and slowdown in real estate investment conversions have filtered out the speculators leaving builders at the hands of end users who refuse to buy until prices become affordable.

Currently, sellers are refusing to lower their prices, and buyers are refusing to meet the asking prices for property. As a result, transactions are not happening. To break this deadlock, one of the following has to happen. Either the government has to take some steps to boost buyer confidence, or sellers have to give in and reduce the prices of the property.

Since neither of the two have occurred, Delhi’s residential real estate market is staring at a free fall with new launches dropping by a whopping 68 percent in the first half of 2015 and sales down 50 percent in the same period. The NCR market saw only 11,360 housing units launched in the first half of 2015 compared to 35,500 units launched in the same period last year, according to data provided by real estate consultancy firm Knight Frank.

There were also no new launches in the premium category, priced above Rs 3 crore. Demand for properties prices above Rs 3 crore each have dropped from 918 units in the first half of 2013 to 215 in the first half of 2015, indicative of overall market sentiment, the report said.

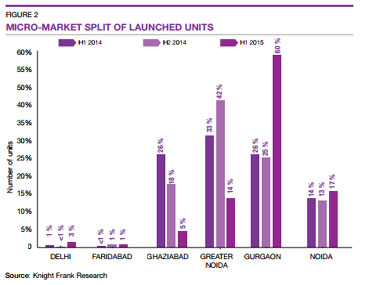

The table below clearly shows that new launches in NCR have hit an all-time low. Most of the launches this year have been in Gurgaon and 43 percent os such launches were fuelled by units launched under the Haryana government’s Affordable Housing Policy 2013. Most of these houses were priced at less than Rs 25 lakh.

The slump in sales and launches clearly indicates that the residential market is facing a strong price resistance against unattractive and unaffordable prices. At this current pace of sales, the unsold inventory of 1.8 lakh homes in NCR will take over five years to sell. In comparison, the Mumbai Metropolitan Region had unsold inventory of 1.9 lakh units, which will take over three years to exhaust. At the country level, the total unsold inventory stood at seven lakh units, which will take over three years to sell.

Barring Pune, no other market witnessed a year-on-year growth in sales numbers. While Bangalore showed signs of improvement in unit sales in 2014, it has also come under pressure now.

“This indicates that with weak demand, developers are looking to exhaust the current inventory instead of blocking capital in high ticket-size projects,” the report said.

The underlying message here is that the recovery will be a long drawn process, and things may, in fact, get worse before they get better.

Delays in projects have further made buyers wary of defaulting developers and it appears the tables have turned. NCR is no longer an investor’s market which had previously allowed builders to artificially hike prices. With investors preferring other modes of investment such as debt and equity, builders are now restricting new launches, while buyers carefully select clean projects. The existing investors that are looking for ways to cash out are entering into a ‘distressed resale’ mode, as they are now offering to exit at a 15 percent to 20 percent discount than the primary market price.

The majority of under-construction inventory is in Greater Noida, Noida and Gurgaon and a significant 30 percent of the under-construction inventory was actually launched in 2009-10.

“Stakeholders (developers, financial institutions and other supply-side stakeholders) believe that the current market scenario is worse compared to six months ago. Delayed reforms seem to have affected sentiment. Another factor that has had a negative impact on the current score is the under-performance of the residential market. A majority of respondents are of the view that residential launches, sales, and price appreciation are at a much lower level than six months ago,” says Samanthak Das, Chief Economist & National Director, Research, Knight Frank India.

This brings us back to the most important question: When will the bubble burst?

So far the bubble has survived because investors wanted to get in. But now that they are scrambling to get out, we may have to brace ourselves for that big popping sound.

)

)

)

)

)

)

)

)

)