Low-risk, diversified healthcare play

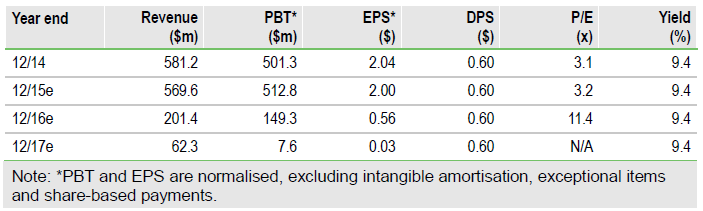

PDL BioPharma Inc (NASDAQ:PDLI) is reinventing itself as a healthcare-focused finance company through a two-pronged strategy, investing in royalty streams and providing high-yield financing life science companies with near-term product launches. This strategy allows investors to gain exposure in healthcare through a relatively low-risk, diversified vehicle. We currently value PDL at $6.84 per basic share.

Several royalty streams

For the next year, PDL will still be receiving royalties from its Queen et al patents, which enabled some of biotechnology’s most successful monoclonal antibodies (eg Avastin, Herceptin, etc). PDL will also be receiving royalties on Glumetza, Janumet XR and other medications into the next decade, which should provide some income, albeit not at the level of the Queen et al patents.

High-yield debt financing business has potential

PDL has funded several companies through high-yield notes with interest ranging from 12-15%, providing a healthy return given the current low interest rate environment and PDL’s ability to raise funds with low single-digit rate interest.

Lower-risk play on solanezumab

Solanezumab is a Phase III antibody, which PDL has the right to receive a 2% royalty, being developed by Lilly for Alzheimer’s disease. After missing the primary endpoints in the EXPEDITION 1 & 2 trials in mild to moderate Alzheimer’s patients, Lilly has focused the EXPEDITION 3 trial on mild patients, where it saw efficacy and tightened up the entry criteria to ensure that participants are truly Alzheimer’s patients with β amyloid plaques.

To Read the Entire Report Please Click on the pdf File Below