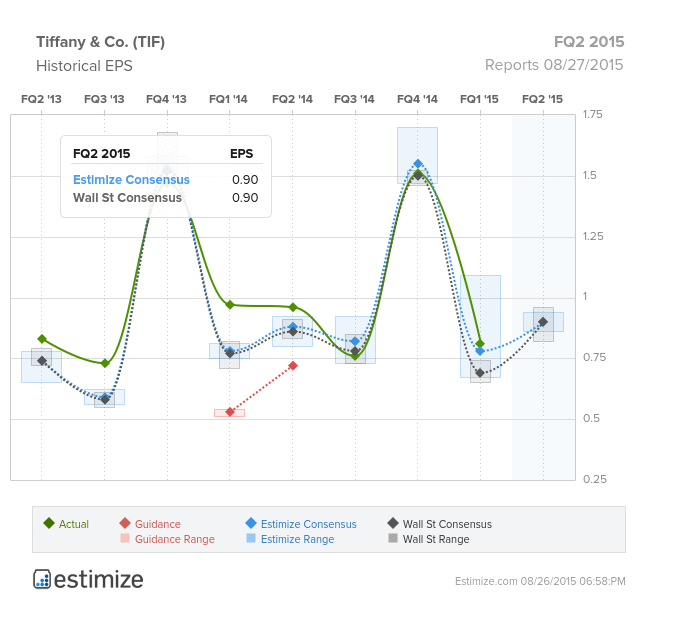

A diamond is forever. But can the same be said for Tiffany & Co (NYSE:TIF).? Following Monday’s dramatic fall in equity prices, the world-renowned jeweller saw its stock price drop from $85.91 to $82.64 pre-market trading with concerns about a slowing Chinese economy. Currently, Estimize EPS estimates are in line with Wall St. estimates at $0.90 while the Estimize consensus for revenue is a little lower at $998.57M compared to Wall St. consensus at $1,006M. Although Tiffany’s reported a decline in net worldwide sales by 5% last quarter, it was able to beat investors’ expectations by a long shot. The company reported a $0.81 EPS, compared to the $0.69 Wall St. consensus and $0.78 Estimize consensus. Scheduled to report on its Q2 earnings tomorrow before the opening bell, the market is anticipating whether or not Tiffany’s can continue to surpass expectations.

Tiffany’s started as a luxury goods brand for the American aristocracy but over the past 175 years has expanded into one of the world’s most recognizable luxury good brands, with 40% of its business conducted overseas and close to 300 stores worldwide. However, its multinational footprint may prove troublesome in the volatile global currency environment. Many investors speculate that the strong dollar will not only hurt global sales but also negatively affect the buying power of tourists who come to the U.S. Tiffany’s slowed growth in its top 2 geographical locations, Americas and Japan, has caused some serious concern. With nearly 9% of Tiffany’s sales coming from its flagship store in Manhattan, and nearly 3% coming from its Tokyo Ginza store, it will be crucial to see if Tiffany’s can maintain its same store sales.

In an effort to combat the slowing demand for high-end luxury products, Tiffany’s started increasing their presence in the affordable luxury segment. Their lower priced Atlas collection has gained increasing visibility, and nearly half of Tiffany’s jewellery sales now come from products with prices under $1,000. However, this has caused great debate within the community. Some investors criticize Tiffany’s for diluting their prestigious image by expanding and are concerned that affluent customers will leave as a result of the lack of exclusivity while others believe that Tiffany’s little blue box will be able to maintain its iconic allure. Investor concerns are not without reason. Michael Kors Holdings Limited (NYSE:KORS), for example, has more than doubled its retail space devoted to discounted products and is now considered overexposed. Their stock price has also fallen more than 60% to $40 a share compared to its peak of around $100 per share in February of 2014.

Tiffany’s definitely has a difficult task ahead of itself but it appears that the large jeweller still has room to grow. While Japan is most likely a saturated market, the rest of Asia, namely China and India seem to have a growing appetite as more and more people begin to accept the concept of Western diamonds and jewellery. For now, investors are sitting on edge for Tiffany’s results tomorrow which will give clues as to what’s in store for the future of the company.