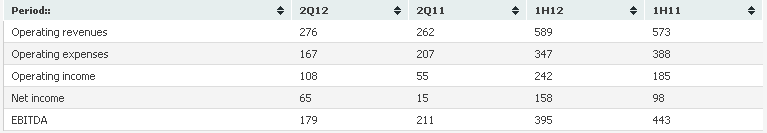

On July 30, 2012, Boardwalk Pipeline Partners, LP (BWP) reported results of operations for 2Q 2012. Revenues, operating income, net income and earnings before interest, depreciation & amortization and income tax expenses (EBITDA) were as follows:

On the revenue side, the period to period improvements in Table 1 primarily reflects the acquisition of HP Storage (referred to below). On the expense side, the improvements primarily reflect larger than normal expenses in 2011 (due, for example, to materials & supply impairment charges and charges related to a fire at a compressor station). EBITDA came in above consensus estimates at $0.92 per unit vs. $1.08 in 1Q 2012 and $0.65 in 2Q 2011. Second quarter distributions were held flat at $0.5325 per unit ($2.13 per annum). BWP’s definition of Distributable Cash Flow (“DCF”) and a comparison to definitions used by other master limited partnerships (“MLPs”) are described in a prior article. Using that definition, DCF for the trailing 12 months (“TTM”) period ending 6/30/12 was $449 million ($2.50 per unit), up from $413 million in the comparable prior year period ($2.43 per unit).

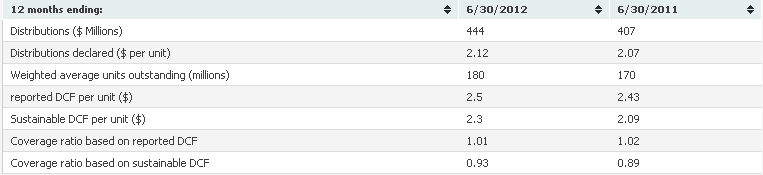

As always, I first attempt to assess how these DCF figures compare with what I call sustainable DCF for these periods and whether distributions were funded by additional debt or issuing additional units. Given quarterly fluctuations in revenues, working capital needs and other items, it makes sense to review TTM numbers rather than quarterly numbers for the purpose of analyzing changes in reported and sustainable distributable cash flows.

The generic reasons why DCF as reported by the MLP may differ from sustainable DCF are reviewed in an article titled Estimating Sustainable DCF-Why and How. Applying the method described there to BWP results through 2Q 2012 generates the comparison outlined in the table below:

The principal differences between reported and sustainable DCF in Table 2 is attributable to working capital used. I generally do not include working capital generated in the definition of sustainable DCF but I do deduct working capital used. Despite appearing to be inconsistent, this makes sense because in order to meet my definition of sustainability the MLP should generate enough capital to cover normal working capital needs. On the other hand, cash generated by the MLP through the liquidation or reduction of working capital is not a sustainable source and I therefore ignore it. Over reasonably lengthy measurement periods, working capital generated tends to be offset by needs to invest in working capital. I therefore do not add working capital used to net cash provided by operating activities in deriving sustainable DCF. The principal components of “other”, which I exclude from the sustainable category, are non-cash interest expense and proceeds from an insurance settlement received in 2Q 2012 relating to a fire that occurred in 1Q 2011 at one of the Partnership’s compressor stations near Carthage, Texas.

Coverage ratios for 2Q 2012 are indicated in the table below:

Coverage ratios are thin. However, on August 8, 2012, BWP’s distribution yield was ~8.04%, significantly higher than yields offered as of the same date by some of the other MLPs I have covered. For example: 4.80% for Magellan Midstream Partners (MMP); 4.79% for Enterprise Products Partners (EPD); 4.97% for Plains All American Pipeline (PAA); 6.23% for Williams Partners (WPZ); 6.40% for El Paso Pipeline Partners (EPB); and 6.60% for Targa Resources Partners (NGLS).

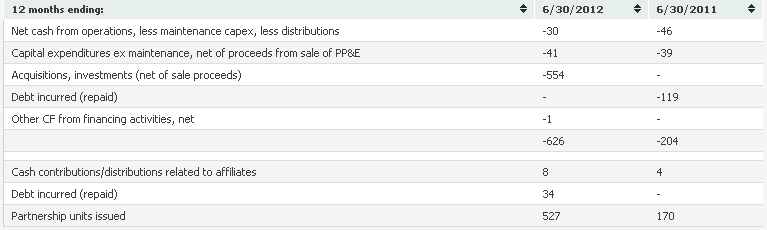

The simplified cash flow statement in Table 4 below nets certain items (e.g., debt incurred vs. repaid), separates cash generation from cash consumption, and gives a clear picture of how distributions have been funded in the last two years.

Simplified Sources and Uses of Funds

Net cash from operations less maintenance capital expenditures did not cover distributions in both TTM periods (the shortfall decreased to $30 million in the TTM ending 6/30/12 from $46 million in the prior year period). Table 3 therefore shows that distributions in both TTM periods were partially financed by issuing equity and, to a lesser extent, debt.

Note that ~ $282 million of the $527 million of equity issuance in the TTM ended 6/30/12 is an adjustment to partners’ capital. In February 2012, BWP acquired from Loews Corporation (L), the parent of BWP’s general partner, the remaining 80% equity interest in Boardwalk HP Storage Company, LLC for $285 million. This drop-down acquisition was accounted for as a transaction between entities under common control. Therefore, the assets and liabilities of HP Storage were recognized at their carrying amounts at the date of transfer and $281.8 million (the carrying amount of the net assets acquired) was treated as an adjustment to partners’ capital. Also, BWP includes HP Storage’s results for the 6 months period ended 6/30/12, as if the acquisition had occurred on 1/1/2012. Boardwalk HP Storage operates seven high deliverability salt dome natural gas storage caverns in Forrest County, Mississippi, having approximately 29 billion cubic feet (“Bcf”) of total storage capacity, of which approximately 19 Bcf is working gas capacity. It also owns undeveloped land suitable for up to six additional storage caverns.

In an article dated 6/4/12, I said I would not be surprised to see additional partnership units being issued later this year. Indeed, on 8/2/12 BWP priced at $27.80 per unit an offering of 10.5 million units which, together with another 1.575 million units likely to be sold pursuant to the underwriters’ overallotment option, will generate proceeds of ~$333 million. A portion of that will be used to fund the 2Q 2012 distribution estimated to total ~$105 million.

BWP is required to maintain a ratio of consolidated debt to EBITDA of no more than 5:1. Excluding the $100 million of affiliated debt, BWP’s total long-term debt stood at $3.4 billion as of 6/30/12. This equates to a multiple of 5.04x EBITDA for the TTM ending 6/30/12. Granted, EBITDA may be defined somewhat differently in the credit agreement (otherwise I do not see how management could have explicitly stated that BWP was in full compliance as of 6/30/12), but at this level (putting aside the $785 million availability via the revolving credit facility), it is probably not possible for BWP to use long-term debt to finance the remaining 2012 capital expenditures. The recent equity financing will, among other things, be used for that purpose.

There has been minimal distribution growth over the TTM ending 6/30/12 (0.5% to be precise). Given uncertainty regarding customer contract renewals (although renewal prices so far this year have not dropped) and its assessment of current market conditions, management decided it would not be prudent to increase distributions. I believe this is a sound decision. But even at their current level, distributions are being funded, in part, by issuing equity. Adding the thin coverage ratio and high leverage to this concern, I conclude that investors willing to add to their positions should consider other MLPs.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Closer Look at Boardwalk Pipeline Partners’ Distributable Cash Flow

Published 08/13/2012, 03:25 AM

Updated 07/09/2023, 06:31 AM

A Closer Look at Boardwalk Pipeline Partners’ Distributable Cash Flow

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.