Some mining stocks look compelling now. Image Source: Getty Images.

After getting squashed in recent years, metal and mining stocks are back on investors' radar, as prices of key commodities have been recovering in recent months, and analysts have been calling this the bottom for mining. Donald Trump's victory has further fueled optimism, as mining investors are betting on greater infrastructure spending and protectionism to boost commodity markets.

If you're considering getting in on mining, too, our contributors have identified three mining stocks that look promising today: Alliance Resource Partners, L.P. (ARLP -0.05%), Albemarle Corporation (ALB 0.93%), and Royal Gold (RGLD 0.43%). Read on to learn why.

Outside the outside of the box

Reuben Gregg Brewer (Alliance Resource Partners, L.P.): If you're a contrarian investor, or just like to understand views that don't go with the mainstream, then you have to look at coal-focused Alliance Holdings GP, L.P. The big story is that renewable energy and natural gas are taking market share in the utility space, squeezing coal out of the mix. While this is an undisputable fact, there's a deeper story to look at, too.

Coal from different parts of the country have different qualities, and thus have different demand profiles. Alliance Holdings, which is the general partner for Alliance Resource Partners, L.P., is focused on the Illinois Basin region.

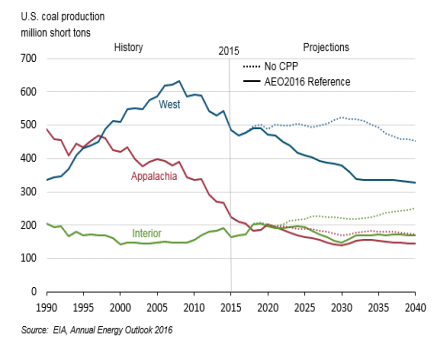

Illinois Basin coal has been stealing market share from other regions for years. And according to the U.S. Energy Information Administration (EIA), the region is projected to see increased demand out to 2040 -- even in the worst-case scenario. (The Illinois Basin is included in the "Interior Region" noted below in the graph.)

EIA coal projections out to 2040. The Interior Region, which includes the Illinois Basin, is actually set to see demand grow. Image Source: U.S. Energy Information Administration.

That should support production growth for Alliance Resource Partners, which should lead to distribution increases. And since Alliance Holdings is the general partner of Alliance Resource Partners, it will benefit in three ways.

First, it gets paid to run Alliance Resource Partners. Second, it receives distributions from 'Partners' because it owns units in the limited partnership (LP) that it runs. And third, it gets incentive payments when the distribution gets increased. In other words, Alliance Holdings is leveraged to the success of Alliance Resource Partners.

Here's the best part: Alliance Resource Partners has remained profitable throughout the coal market's downturn, unlike so many of its peers -- including some that have taken a trip through bankruptcy court. And while it cut its distribution not too long ago, it still pays $1.75 per unit a year, for a distribution yield of approximately 7%. Alliance Holdings, which also trimmed its distribution, pays $2.20 per unit a year, for a yield of around 7.25%.

Generally, general partners yield less than the LPs they run because they're leveraged to improvements at the LP -- which means that now could be a unique opportunity to get in on Alliance Holdings at a relatively cheap price -- if you can look past the big-picture narrative about coal.

Supplying the world's "new oil"

Beth McKenna (Albemarle Corporation): Albemarle probably isn't a stock many investors would think of when hearing the term "mining stock." That's because it mines lithium, not gold or silver. In fact, the Charlotte, N.C.-based specialty-chemicals company became the largest lithium supplier in the world when it acquired Rockwood Holdings in 2015. It's not a pure play, however, as lithium sales currently account for about a quarter of Albemarle's total revenue.

Demand for lithium has significantly increased in recent years due to the popularity of smartphones and other electronic gadgets that are powered by rechargeable lithium-ion batteries. Demand is expected to rev up further for what's being called the "world's new oil," as electric vehicles become increasingly popular.

Albemarle obtains some of its lithium by open-pit mining of ore containing the lithium-bearing mineral spodumene at its joint venture in Australia. Its primary method of obtaining lithium, however, involves extracting it from reservoirs of mineral-containing brine located underneath dried lake beds at the Salar de Atacama, Chile, and at its Nevada location.

Brine in evaporation pond at Salar de Atacama, Chile. Image source: Albemarle.

In the third quarter, Albemarle's year-over-year lithium sales -- which accounted for 25% of total sales -- jumped nearly 30%, while this business line's EBITDA (earnings before interest, taxes, depreciation, and amortization) shot up nearly 32%.

The stock has returned a scorching 65% in the last year, through Nov. 21. While I don't think it's too late to get in on lithium stocks, investors must tread carefully. Many smaller -- and very speculative companies -- have hopped on the lithium bandwagon. Most investors should go with the established leaders in the industry, like Albemarle. Even then, you should limit your investment accordingly, as mining stocks, in general, can be quite volatile.

The stock is trading at a forward price-to-earnings ratio of 23.8, which is somewhat pricey for a company that analysts expect will grow earnings by 17.1% in 2016, but only at an average annual rate of 9.3% over the next five years. However, market is likely pricing in the certainty of that future growth -- the world is highly likely to need lots more lithium in the future. Moreover, the stock pays a modest dividend, currently yielding 1.5%. All in all, shares are a strong bet.

A unique low-risk mining stock that also pays a dividend

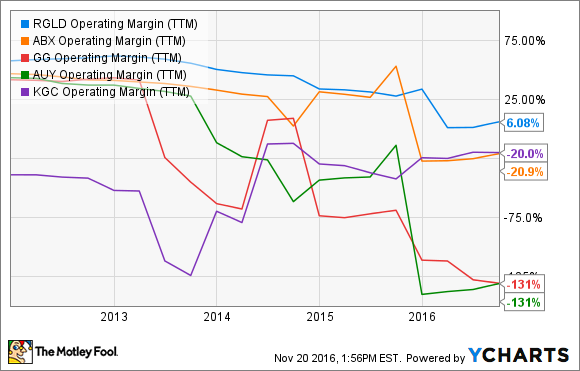

Neha Chamaria (Royal Gold): Unlike its name, Royal Gold isn't a gold miner. Heck, it isn't a miner at all! But owning Royal Gold stock will still give you as much exposure to gold as investing in a traditional miner. The only difference -- and it's a big one -- is that Royal Gold is much safer than any other precious-metal miner stock, thanks to its unique business model.

Royal Gold doesn't own any mines, but buys bullion from miners to sell in the market. In return, it finances the miners upfront to help them carry out capital-intensive operations or projects. Such a business model benefits Royal Gold in two ways: low fixed costs, as it doesn't have to incur any mine exploration or operation costs, and high margins, as it buys metals from miners at substantially reduced rates.

To give you an example, Royal Gold paid $610 million cash to Barrick Gold (GOLD -1.02%)last year in exchange for the right to buy gold and silver from Barrick at 30% of spot prices up to a certain threshold, and then at 60% of spot. So at any point in time, Royal Gold will secure bullion under this deal at least 40% below market price.

You can imagine how profitable such a business model must be, especially when precious metals are in demand. That explains why Royal Gold has the best margins in the industry.

RGLD Operating Margin (TTM) data by YCharts.

You could even call Royal Gold's business among the most stable in the industry: The company has increased its dividend for 15 years in a row despite the wild fluctuations in prices of gold and silver during the period. Forget hikes -- it's hard to find a dividend-paying miner. If you want to bet on mining without taking on too much risk, Royal Gold is a great choice today, especially when you take into account the stock's near-16% drop in the past three months.