The State Bank of Pakistan (SBP) has laid the foundation to eliminate exchange companies from the currency business by allowing banks and their entire branches to buy and sell foreign currencies with public across the country.

The SBP issued revised chapters of Foreign Exchange (FE) Manual providing details about the currency business while assigning the role of exchange companies to banks.

Earlier, the banks were not allowed to sell or buy foreign currencies directly from public except for those having their own exchange companies.

The SBP did not say anything regarding the existence or future role of exchange companies but feel threatened with the latest development.

Under the headline of purchase of foreign currency notes from the public, the SBP said that all incoming persons whether Pakistani or foreign national can bring with them without any limit foreign currencies and other instruments against the submission of a declaration to the customs authorities on amount exceeding $10,000 or equivalent.

“Such currencies or instruments may be freely purchased by the Authorised Dealers (banks) against payment in PKR. Authorised dealers may also purchase foreign currencies withdrawn by the account holders from their foreign currency accounts and from the walk-in-customers against payment in PKR subject to fulfilment of applicable AML/CFT regulations,” said the SBP. Banks were also told to ensure availability of foreign currencies to sell it to the public.

It is the responsibility of authorised dealers to ensure adequate foreign currency is available with their authorised branches at all times for meeting the requirements of their customers, read the manual.

Under the headline of ‘Sale of foreign currency notes to the public’, the SBP said the dealers may sell foreign currency notes to persons proceeding abroad within the amount of foreign exchange allowed through special permission by the SBP or under the authority delegated to them. Currency dealers said allowing banks to conduct day-to-day currency business with the general public means there is no need for exchange companies.

“I personally know that some high officials in the government are willing to close down the exchange companies as they hold them responsible for financial indiscipline,” said Secretary General Exchange Companies Association of Pakistan Zafar Paracha. He said that amendments in the manual are clear indications that exchange companies are not required in this country.

“But I must say that general public will suffer since they easily buy foreign currencies from exchange companies and sell them without hurdles. Banks are unable to take care of millions of people for buying and selling of foreign currencies,” Paracha said, adding that banks will charge higher margins as they do currently.

He said banks are paid Rs12-14 per remittance from abroad while exchange companies provide this service without this cost. “We annually provide $10 to $11bn to the country which includes import of dollars against other foreign currencies,” he said.

“If exchange companies are closed about 25,000 direct employees lose their jobs and up to 60 thousand indirectly attached with this business would lose jobs.”

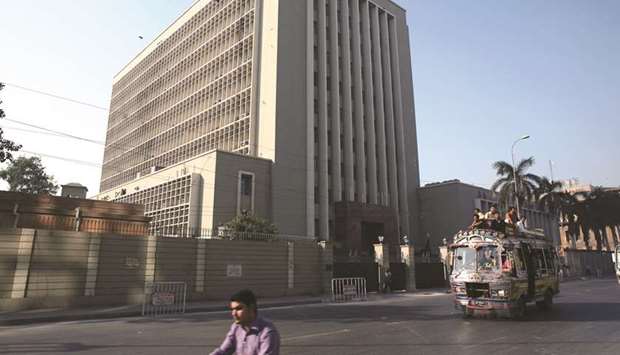

The State Bank of Pakistan building in Karachi. The SBP has laid the foundation to eliminate exchange companies from the currency business by allowing banks and their entire branches to buy and sell foreign currencies with public across the country.