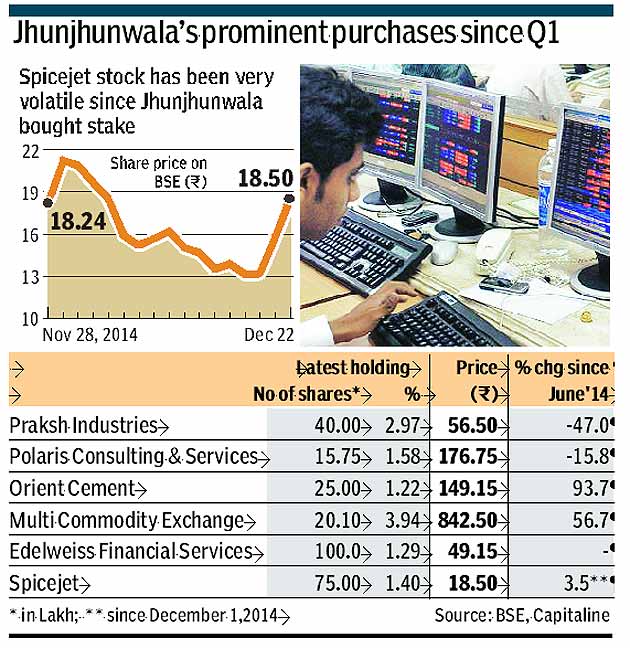

Even as his latest investment in the SpiceJet stock met with some volatility, Rakesh Jhunjhunwala’s portfolio picks on the Lok Sabha election euphoria have seen moderate returns.

Data compiled by FE show that some of the stocks — three of the five companies in which Jhunjhunwala raised his stake to more than 1% in the three months to June — have under-performed the benchmark index, which has rallied more than 14% in the last six months.

As the momentum in the equity market came off with the global factors and pace of actual reforms attaining the center stage, stocks that rode on the election-led euphoria have retreated in the recent past.

As a result, stocks of companies like Praksh Industires, Edelweiss Financial Services and Polaris consulting & Services, where Jhunjhunwala picked up substantial stakes between April and June have retreated.

In case of Praksh Industires, the stock price has corrected nearly 13% since Jhunjhunwala accumulated 2.97% stake (40 lakh shares) through multiple bulk deals at an average price of Rs 65 in April 2014. Even Edelweiss Financial services, the stock which traded with 125% gain in the calendar year till mid-June, has declined close to 11% after he purchased 1.29% (1 crore shares) on June 12, 2014.

On other hand, his bets on Orient Cement and Multi Commodity Exchange (MCX) have fetched handsome returns.

Exchange data show that after Jhunjhunwala bought 17.1 lakh shares or 68% of his holding in Orient Cement in May 2014, the stock has jumped three-fold. In case of commodity derivatives exchange, wherein he picked up 2% stake at Rs 664 per share and went on to increase his holding to close to 4%, the stock has rallied 27%.

Although his interest in Spicejet — he picked 1.4% equity on November 28, 2014 — caused a strong rally of more than 17% the next day, the stock saw a lot of volatility in the last two weeks due to concerns surrounding the carrier’s financial viability and its impact on operations.