Canadian ETFs Fall In Response To Interest Rate Cut

On Wednesday, the Bank of Canada cut its benchmark interest rate to 0.50 percent in what is the second move by fiscal regulatory to try to stimulate its flagging economy this year. The 25 basis point reduction is aimed to try to revive growth projections for the second half of 2015 and was immediately felt throughout Canadian markets.

iShares MSCI Canada

The iShares MSCI Canada Index (ETF) (NYSE: EWC) has over $2.2 billion dedicated to 94 large- and mid-cap stocks in Canada. This exchange-traded fund is down over 9 percent this year and fell over 1 percent intra-day, as the interest rate change was announced.

EWC is now trading near multi-year lows and has yet to shows signs of a convincing turnaround for international investors to become enthusiastic about. As a result of the weak performance, fund flow data shows that EWC has lost $196 million in outgoing assets so far this year.

The financial sector dominates the asset allocation of EWC, with more than 38 percent of the total portfolio weighting. Top holdings include Royal Bank of Canada (NYSE: RY) and Toronto-Dominion Bank (NYSE: TD). These banking institutions will likely feel the immediate effects of the rate cut, as they make adjustments to borrowing costs and investor savings rates.

Related Link: Statistics Canada Releases Consumer Price Index Info

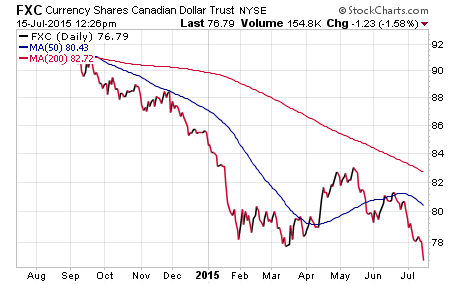

CurrencyShares Canadian Dollar

The Guggenheim CurrencyShares Canadian (NYSE: FXC) also fell significantly on Wednesday. This ETF is designed to track the daily price fluctuations of the Canadian dollar versus the U.S. dollar.

FXC fell to fresh 2015 lows and is now off more than 10 percent in 2015, as a flight to the U.S. dollar exacerbates this trend. The Canadian dollar makes up approximately 9 percent of the major currency benchmark PowerShares DB US Dollar Index Bullish (NYSE: UUP).

Next to financial stocks, the most important sector exposure in Canada is energy and materials companies. As a result, the continued deflationary trend in broad-based commodities such as the SPDR Gold Trust (ETF) (NYSE: GLD) and United States Oil Fund LP (ETF) (NYSE: USO) make for a significant economic drag.

The rebound in Canadian stocks may be stalled until the commodity sector can regain its footing to act as a tailwind for this struggling market.

Image Credit: Public Domain

See more from Benzinga

© 2015 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.