Image source: AMD.

So you're interested in Advanced Micro Devices (AMD -5.78%). I hope you have a strong stomach, or a duffel bag full of antacids.

When the semiconductor designer reported fourth-quarter results on Tuesday evening, the report kicked off a rollicking roller-coaster ride. The stock opened Wednesday's trading session at two-year lows, but immediately bounced back in a big way. Just 40 minutes into the market session, the difference between Wednesday's highs and lows was more than 11%. By 3 p.m., AMD's stock was up some 5% from the previous day's close at $2.24.

Against that backdrop, it can be hard to tell whether AMD's fourth quarter was a big disappointment or a positive turning point. So let me walk you through what's going on here.

First, let's get the basic numbers out of the way.

Analysts were expecting AMD to report net earnings of $0.01 per share on sales of $1.24 billion. Revenues fell 22% year over year to land exactly at the analyst target, yielding breakeven earnings. So in terms of pure earnings figures, the quarter was a slight disappointment.

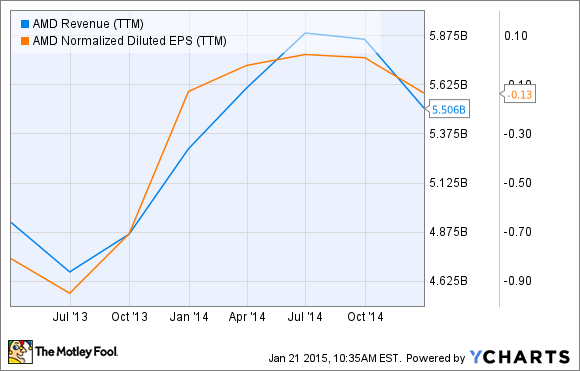

More to the point, AMD staged a bit of a business revival in 2013 and 2014, but this report took the edge off those gains:

AMD Revenue (TTM) data by YCharts

But if every trend is negative, how come the stock is rising again? Here's a novel idea: Investors may be looking beyond the current quarter for signs of a sustainable turnaround. And the numbers rarely tell the whole story.

AMD CEO Lisa Su. Source: AMD.

Recently appointed CEO Lisa Su certainly presented AMD's results in a positive light. "We made progress diversifying our business, ramping design wins and improving our balance sheet this past year despite challenges in our PC business," she said in prepared remarks. The business mix is shifting away from mass-market PC processors and graphics chips, and AMD is leaning more on semi-custom products for embedded systems and game consoles.

In fact, inventories of PC-style products such as CPUs and add-in graphics boards were painfully high at the start of the fourth quarter. AMD took steps to correct the oversupply by reducing manufacturing orders, which led to "short-term pressure in the business" but sets AMD up for a stronger 2015.

Here's where the good news starts.

Su knows that AMD is winning in the semi-custom market while losing badly to Intel (INTC -1.60%) in the traditional PC segment. Her solution is simple: apply the operating discipline and lessons learned in the custom chip sector to the ailing PC market.

"We clearly have more work to do to improve the overall revenue and financial performance of this segment," Su said. "We must think differently in 2015 about our market approach and investment priorities."

She's remixing this division to sell more high-end products and fewer of the truly mass-market chips on the lower end. That means leaving some easy but unprofitable sales on the table, but improving profit margins.

On a grander scale, AMD managed to grow full-year sales for the first time since 2011 while also delivering positive non-GAAP earnings.

So Su is not afraid to roll up her sleeves and get some serious work done. AMD's business approach is overdue for an update, and she's getting it done.

As an Intel shareholder, I'm not exactly shaking in my boots over the threat AMD poses right now. But Su's detailed tech insights may set AMD on a path that leads to becoming a serious Intel challenger once again. Right now, she's saddled with repairing the mess that predecessor Rory Read left behind. It's not easy work, and I wouldn't suggest loading your retirement nest egg into AMD stock today. But if she can pull it off, she'll spark an impressive turnaround in AMD's ailing stock as well.

So this one's for the gamblers, the speculators, and those with a bit of disposable funds to play around with. I'm tempted to buy a small ticket to the AMD lottery myself, if only to see what Su can do with it. In the meantime, I just gave AMD a thumbs-up rating in our Motley Fool CAPS system. You can click here to issue your own rating on Lisa Su's version of AMD.