A Spotlight On The Tata Power Company Limited’s (NSE:TATAPOWER) Fundamentals

Attractive stocks have exceptional fundamentals. In the case of The Tata Power Company Limited (NSE:TATAPOWER), there’s is a highly-regarded dividend-paying company with a a strong history of performance, trading at a discount. Below is a brief commentary on these key aspects. For those interested in digger a bit deeper into my commentary, read the full report on Tata Power here.

Established dividend payer and good value

TATAPOWER delivered a triple-digit bottom-line expansion over the past couple of years, with its most recent earnings level surpassing its average level over the last five years. Not only did TATAPOWER outperformed its past performance, its growth also surpassed the Electric Utilities industry expansion, which generated a 39% earnings growth. This is an notable feat for the company. TATAPOWER’s shares are now trading at a price below its true value based on its discounted cash flows, indicating a relatively pessimistic market sentiment. This mispricing gives investors the opportunity to buy into the stock at a cheap price compared to the value they will be receiving, should analysts’ consensus forecast growth be correct. Compared to the rest of the electric utilities industry, TATAPOWER is also trading below its peers, relative to earnings generated. This further reaffirms that TATAPOWER is potentially undervalued.

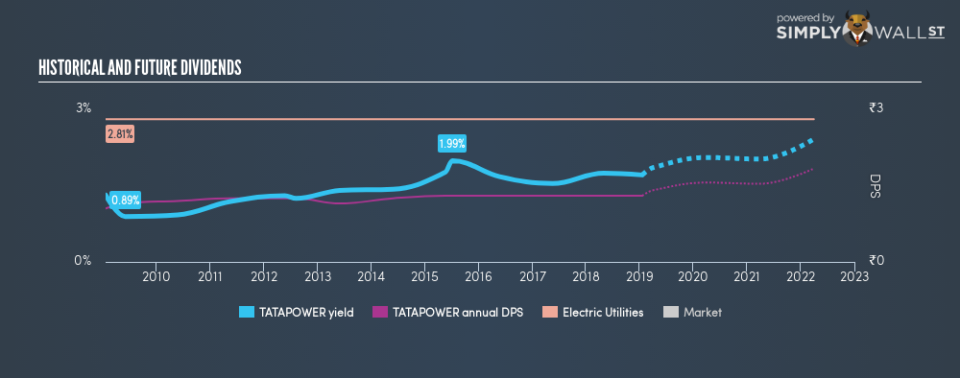

For those seeking income streams from their portfolio, TATAPOWER is a robust dividend payer as well. Over the past decade, the company has consistently increased its dividend payout, reaching a yield of 1.7%.

Next Steps:

For Tata Power, there are three important factors you should further examine:

Future Outlook: What are well-informed industry analysts predicting for TATAPOWER’s future growth? Take a look at our free research report of analyst consensus for TATAPOWER’s outlook.

Financial Health: Are TATAPOWER’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of TATAPOWER? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.