October Undervalued Opportunities – BT Group And More

BT Group and Virgin Money Holdings (UK) may be trading at prices below their likely values. This suggests that these stocks are undervalued, meaning we can benefit when the stock price moves to its true valuation. There’s a few ways you can value a company. The most popular methods include discounting the company’s cash flows it is expected to create in the future, or comparing its price to its peers or the value of its assets. Analysing the most recent financial data, I’ve created a list of companies that compare favourably in all criteria, making them potentially good investments.

BT Group plc (LSE:BT.A)

BT Group plc provides communications services worldwide. Started in 2001, and currently headed by CEO Gavin Patterson, the company employs 106,400 people and with the stock’s market cap sitting at GBP £25.90B, it comes under the large-cap stocks category.

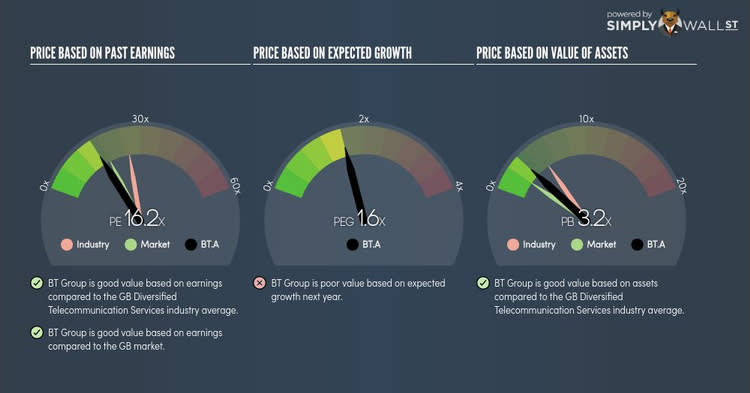

BT.A’s stock is currently trading at -40% below its value of £4.4, at the market price of £2.62, based on my discounted cash flow model. This mismatch indicates a chance to invest in BT.A at a discounted price. In addition to this, BT.A’s PE ratio stands at around 16.2x against its its diversified telecommunication services peer level of 25.9x, meaning that relative to its peers, you can buy BT.A’s shares at a cheaper price. BT.A also has a healthy balance sheet, as current assets can cover liabilities in the near term and over the long run. Finally, its debt relative to equity is 176%, which has been diminishing for the last couple of years signalling its capability to reduce its debt obligations year on year.

Virgin Money Holdings (UK) plc (LSE:VM.)

Virgin Money Holdings (UK) plc engages in the retail banking business primarily in the United Kingdom. Established in 1995, and headed by CEO Jayne-Anne Gadhia, the company now has 3,139 employees and with the market cap of GBP £1.30B, it falls under the small-cap category.

VM.’s shares are currently trading at -40% less than its true value of £4.83, at a price of £2.92, based on its expected future cash flows. This discrepancy gives us a chance to invest in VM. at a discount. Furthermore, VM.’s PE ratio stands at around 8.9x while its banks peer level trades at 17.3x, indicating that relative to its competitors, VM. can be bought at a cheaper price right now. VM. is also a financially healthy company, with short-term assets covering liabilities in the near future as well as in the long run. Finally, its debt relative to equity is 140%, which has over time, signalling VM.’s capability

North Midland Construction PLC (LSE:NMD)

North Midland Construction PLC engages in the civil, building and mechanical, and electrical engineering businesses in the United Kingdom. Started in 1946, and run by CEO John Homer, the company employs 1,280 people and with the company’s market cap sitting at GBP £34.26M, it falls under the small-cap stocks category.

NMD’s shares are now hovering at around -78% less than its intrinsic level of £14.75, at the market price of £3.3, according to my discounted cash flow model. signalling an opportunity to buy the stock at a low price. Additionally, NMD’s PE ratio is around 10.7x against its its construction and engineering peer level of 14.3x, meaning that relative to other stocks in the industry, we can invest in NMD at a lower price. NMD also has a healthy balance sheet, with short-term assets covering liabilities in the near future as well as in the long run. Finally, its debt relative to equity is 37%, which has over the past couple of years showing its capability

For more financially sound, undervalued companies to add to your portfolio, you can use our free platform to explore our interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.