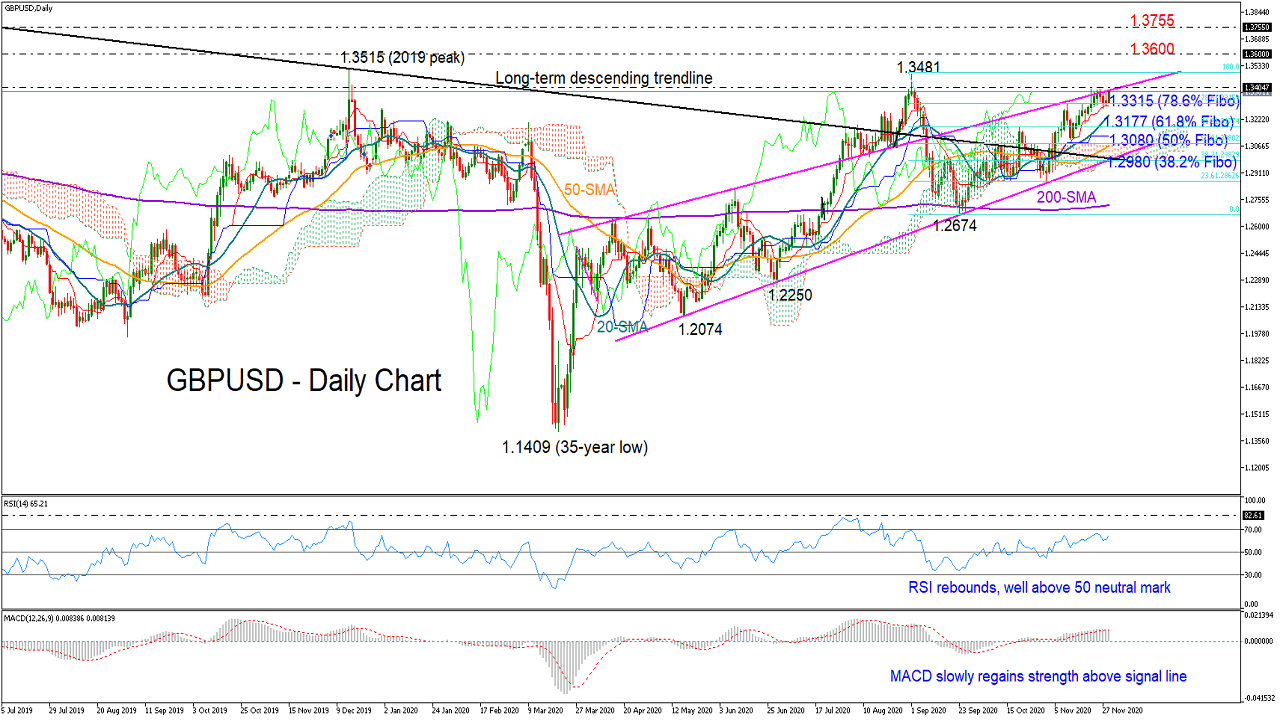

GBPUSD has been struggling to claim the 1.3400 level and the familiar upper ascending line over the past week, which once again managed to resist bullish forces.

Encouragingly, the red Tenkan-sen line and the 78.6% Fibonacci of the short 1.3481 – 1.2674 downleg came immediately to the rescue around 1.3315, providing another opportunity to the bulls. The recent rebound in the RSI and the soft bounce in the MACD, which is currently pushing efforts to return above its red signal line, keep the short-term bias on the positive side.

Should the resistance line give way, the rally may stretch towards the 1.3480 – 1.3515 key region formed by the September peak and the 2019 top. Breaching that border, the door would open for the 1.3600 number – a tough barrier to upside movements during the 2017-2018 period - while higher the next obstacle could commence around the 1.3755 hurdle.

In the case the price retreats below 1.3315, the 61.8% Fibonacci of 1.3177 may add some footing ahead of the 50% Fibonacci of 1.3080. Then, if sellers persist below the latter, all attention will turn to the 1.2980 mark, where the supportive upward-sloping trendline, a long-term descending trendline from 2015, and the 38.2% Fibonacci all intersect.

Meanwhile in the medium-term picture, the pair is set to switch its neutral profile to a positive one above 1.3400.

In brief, GBPUSD seems to have some extra bullish power in store, though only a decisive close above the ascending line could release it.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.