Trustpilot rates Wall Street banks to deliver £800m London float

The ratings platform has hired JP Morgan and Morgan Stanley to lead a London IPO next year, Sky News learns.

Thursday 29 October 2020 19:48, UK

The online ratings platform Trustpilot is lining up two of Wall Street's biggest banks to deliver a London flotation that could value it at about £800m.

Sky News has learnt that Trustpilot has appointed JP Morgan and Morgan Stanley to act as global co-ordinators of an initial public offering (IPO) that is likely to take place in the first half of next year - subject to market conditions.

The listing, if it goes ahead, would swell the ranks of technology companies floating in London at a time when the government and stock exchange executives are trying to make the City a more attractive destination for high-growth companies.

The cybersecurity company Darktrace, food delivery app Deliveroo and the "recommerce" platform musicMagpie are all drawing up plans for IPOs in London.

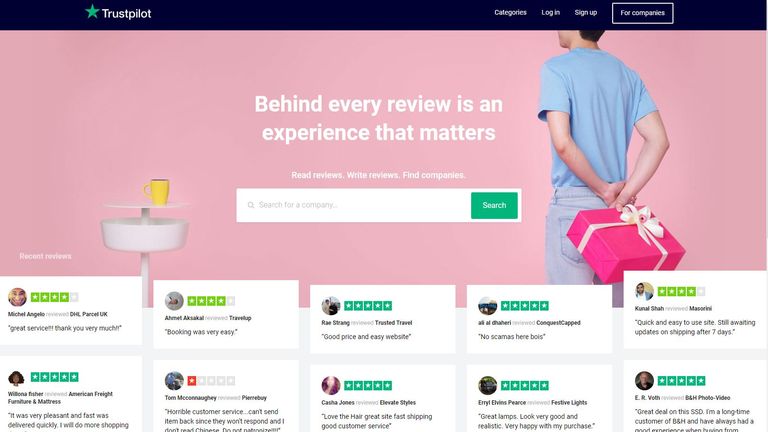

Trustpilot, which is headquartered in Copenhagen, is one of the world's leading online business review platforms.

Founded in 2007 by Peter Muhlmann, a Danish entrepreneur, it boasts hundreds of thousands of merchants on its platform, and is viewed billions of times every month.

Most of its revenue is generated from companies which subscribe to its services.

Trustpilot now records more than $100m in annual sales, meaning a $1bn (£774m) valuation at IPO - which would make it the latest European tech company to achieve "unicorn" status - is far from unrealistic.

The company has offices as far afield as Melbourne, New York and Berlin, and employs more than 700 people globally.

It last raised $55m from investors in a Series E round in March last year.

Among the funds which participated in the round were Draper Esprit, the London-listed venture capital group, and Sunley House Capital Management, a fund affiliated to the private equity group Advent International.

The online reviews site is chaired by Tim Weller, the British serial entrepreneur who has steered a number of successful tech and media companies through public listings.

Last year, it appointed Angela Seymour-Jackson, a director at public companies including the insurer Esure and asset manager Janus Henderson, to its board.

Like other review sites, Trustpilot has at times attracted scepticism over its ability to weed out fake reviews.

To improve users' trust in content posted on the site, it has introduced features such as one which allows consumers to see how many complaints have been deleted.

"There has never been a greater need for trust online and in the world which is why we keep pushing the boundaries of what's possible in the review space," Mr Muhlmann said at the time of its last fundraising.

In August, it announced further measures aimed at strengthening consumers' faith in reviews posted on its platform.

Trustpilot said: "We maintain regular contact with various potential investors and advisors. We've consistently said IPO is one of various potential options down the line."