STOCK MARKET NEWS: Stocks mixed, Musk denies affair, gas, oil prices lower

U.S. markets unable to gain traction, oil traders fear Fed hike. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

U.S. stocks ended Monday's trading session mixed, as investors a slew of corporate earnings and the next move by the Federal Reserve on interest rates.

The Dow Jones Industrial Average climbed 90.75 points, or 0.28%, and the S&P 500 was little changed. The Nasdaq Composite finished in the red, down 0.43%.

TrendMacro chief investment officer Donald Luskin gives his take on the consequences of rate hikes from the Federal Reserve on 'Making Money.'

Veriten Energy market strategy partner Michael Bradley discusses U.S. energy prices as heat wave impacts millions, arguing the country needs to start drilling.

Former AOL CEO Tim Armstrong assesses Elon Musk's shattered Twitter deal and shares his outlook for the Big Tech industry.

Iris Independent Research's Dr. Rebecca Grant discusses the impact of Russia striking Odesa port after signing deal to allow Ukrainian grain exports on markets and global food supply.

Google confounder Sergey Brin is poised to make an estimated $100 million or more in sales of Tesla stock, as he is believed to be selling off his interests in the company after a report that Tesla CEO Elon Musk had an affair with Brin's wife.

U.S. stocks were little changed on Monday as investors await a busy week of corporate earnings and the next move by the Federal Reserve on interest rates.

Cryptocurrency prices for Bitcoin, Ethereum and Dogecoin were trending lower early Monday morning.

At approximately 4 a.m. ET, Bitcoin was trading at nearly $22,000 (-2.86%), or lower by almost $650.

For the week, Bitcoin was trading higher by nearly 8.7%. For the month, the cryptocurrency was also higher by nearly 6%.

Ethereum was trading at approximately $1,525 (-4.9%), or lower by nearly $79.

For the week, Ethereum was trading higher by about 19%. For the month, it was trading higher by almost 30%. Dogecoin was trading at 0.06518 (-3.83%), or lower by approximately $0.002596.

For the week, Dogecoin was higher by more than 7.05%. For the month, the crypto was higher by nearly 0.25%.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TSLA | $816.73 | +1.61 | +0.20% |

| GOOGL | $107.90 | -6.44 | -5.63% |

Telsa founder Elon Musk denied an alleged affair with the wife of Google co-founder Sergey Brin, which was reported as the reason for the couple’s divorce earlier this year.

In a tweet late Sunday evening, Musk said a recent Wall Street Journal report alleging he was the cause of the divorce is "total bs" and that he and Sergey "are friends."

"This is total bs. Sergey and I are friends and were at a party together last night!" Musk tweeted.

The report identified Musk as the reason Brin filed for divorce from his wife, Nicole Shanahan, in January after learning that she had an affair with Musk in December.

The WSJ reported the alleged affair between Musk and Shanahan occurred during the Art Basel event in Miami, Florida.

The alleged affair continued for a short while after the event, while Brin and Shanahan were separated but still living together.

"I’ve only seen Nicole twice in three years, both times with many other people around," Musk continued in the tweet. "Nothing romantic," he added.

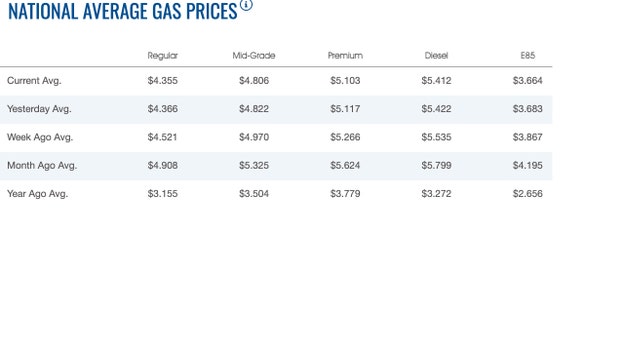

The average price of a gallon of gasoline slipped on Monday to $4.355, according to AAA.

Gas prices nationwide were $4.366 on Sunday and $4.382 on Saturday. Prices have been on the decline since hitting a high of $5.016 on June 14, nearly seven weeks ago.

One week ago, the average price of a gallon of gasoline was $4.521. One month ago, that same gallon of gasoline was $4.908. One year ago, a gallon of gasoline was $3.155, according to AAA.

Diesel prices dropped as well early Monday with the national average for a gallon of diesel at $5.412. A gallon of diesel was $5.422 on Sunday and $5.432 on Saturday. A week ago, a gallon of diesel sold for $5.535. A month ago, that same gallon of diesel sold for $5.799. One year ago, a gallon of diesel cost $3.272, AAA reported.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $31,899.29 | -137.61 | -0.43% |

| SP500 | $3,961.63 | -37.32 | -0.93% |

| I:COMP | $11,834.11 | -225.50 | -1.87% |

U.S. stocks were whipsawing heading into the first day of the workweek as investors braced for the busiest week of second-quarter earnings reports led by mega-cap consumer/tech titans like Alphabet and Microsoft on Tuesday, Meta Platforms on Wednesday, and Apple and Amazon on Thursday.

Other names to watch include General Motors, GE, Ford, Comcast, Northrop Grumman, Charter Communications, and Exxon Mobil as 12 Dow members as well as 170 companies in the S&P 500 – or just over one-third of the benchmark index – will release earnings for the April-June period.

U.S. stocks slumped Friday, snapping a three-day winning streak, as some surprisingly weak quarterly updates from companies spooked investors.

The S&P 500 fell 37.32 points, or 0.9%, to 3961.63 a day after the broad benchmark index jumped 1%. The Dow Jones Industrial Average edged down 137.61 points, or 0.4%, to 31899.29, and the Nasdaq Composite declined 225.50 points, or 1.9%, to 11834.11.

Despite Friday's losses, all three indexes posted weekly gains. With a 2.5% rise for the week, the S&P 500 capped its best week in a month. Nonetheless, few investors are willing to call a bottom to a selloff that has dragged the S&P 500 down 17% this year.

Persistently high inflation, the possibility of a recession and the war in Ukraine remain at the forefront of investors' minds. Next week's meeting of the Federal Reserve, as well as coming gross domestic product data, could inject more volatility in the markets.

Asian shares tumbled Monday after a retreat on Wall Street spurred by disappointing economic data and corporate earnings.

Investors are awaiting the next move by the U.S. Federal Reserve, which is expected to raise its key interest rate again on Wednesday as it strives to beat back inflation. The Fed will likely announce its second 0.75% point increase in its short-term rate in a row, a hefty increase that it hasn’t otherwise implemented since 1994. That will put the Fed’s benchmark rate in a range of 2.25% to 2.5%, the highest level since 2018.

On Monday in Asia, Tokyo's Nikkei 225 shed 0.9% to 27,676.97 and the Kospi in Seoul slipped 0.6% to 2,406.98. Hong Kong's Hang Seng declined 1.2% to 20,365.99, while the Shanghai Composite index gave up 0.8% to 3,245.19. In Australia, the S&P/ASX 200 edged 0.2% lower to 6,781.60.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $74.53 | -0.96 | -1.27% |

| CVX | $144.19 | -1.21 | -0.83% |

| XOM | $87.08 | -0.67 | -0.76% |

Oil prices dropped on Monday, extending a recent losing streak on concerns that an expected rise in U.S. interest rates would weaken fuel demand.

Brent crude futures for September settlement fell $1.19, or 1.2%, to $102.01 a barrel by 0645 GMT, down for a fourth day.

U.S. West Texas Intermediate (WTI) crude futures for September delivery slid $1.33, or 1.4%, to $93.37 a barrel, also down for a fourth day. Both gave up early gains.

"Oil prices have been under pressure due to growing worries that aggressive rate rises by the U.S. Federal Reserve will slow the global economy and reduce fuel demand," said Tetsu Emori, chief executive of Emori Fund Management Inc. "Slack recovery in the Chinese economy is also weighing on market sentiment," he said.

Oil futures have been volatile in recent weeks as traders have tried to reconcile the possibilities of further interest rate hikes, which could limit economic activity and thus cut fuel demand growth, against tight supply from disruptions in trading of Russian barrels because of Western sanctions amid the Ukraine conflict.

Officials at the Fed have indicated that the central bank would likely raise rates by 75 basis points at its July 26-27 meeting.

China, the world's second-biggest economy, narrowly missed a contraction in the second quarter, growing just 0.4% year-on-year, weighed down by COVID-19 lockdowns, a weak property sector and cautious consumer sentiment.

The European Union said last week that it would allow Russian state-owned companies to ship oil to third countries under an adjustment of sanctions agreed by member states last week aimed at limiting the risks to global energy security.

However, Russian Central Bank Governor Elvira Nabiullina said on Friday that Russia would not supply oil to countries that decided to impose a price cap on its oil.

Live Coverage begins here