Chinese ETFs: All Things Considered

This article is part of a regular series of thought leadership pieces from some of the more influential ETF strategists in the money management industry. Today's article is by Linda Zhang, co-founder of Women In ETFs, and former head of research and portfolio manager at Boston-based Windhaven Investment Management. Read part 2 in this series: "China's ETF Industry: Short History With Rapid Growth."

China has risen to the second-largest economy and the second-largest capital market after the U.S. for some time. How much can U.S.-based investors participate in the economic and capital market growth via China-related ETFs?

We set out to examine many aspects of the Chinese ETFs in the marketplace. How many Chinese ETFs do U.S. investors have access to in the U.S.? What kind of investment exposures do they provide? Who are the major players as issuers? What are the trends for fund flows this year? What is the state of fixed-income Chinese ETFs?

Key Players' Domination & Product Proliferation

There are currently 44 U.S.-listed ETFs tracking exclusively Chinese equities, with a total of close to $9 billion in AUM. BlackRock's iShares dominates the Chinese equity ETFs space, with the two largest products: the iShares China Large-Cap ETF (FXI), which tracks the FTSE China 50 index; and the iShares MSCI China ETF (MCHI), which tracks the MSCI China Index.

These two products count for a little over two-thirds of the asset category. SSGA's SPDR S&P China ETF (GXC) is a distant third, with over $800 million in AUM. Deutsche Bank came late to the game, however. It was among the first issuers to introduce the China local A-shares-based ETFs to U.S.-based investors. The Deutsche X-trackers Harvest CSI 300 China A-Shares ETF (ASHR), tracking the broad CSI 300 A Share Index, is on its way to break $500 million, making it the fourth-largest China only ETF.

Because of the operation and legal complexity, very few companies issue A-shares-based products. The majority of ETF products are tracking companies listed in Hong Kong (H shares), the U.S. (N shares) and other overseas markets, for ease of trading and settlements.

Dominance Of Top ETFs

Source: Bloomberg 10/11/2016

Although iShares and SSGA have dominated the Chinese ETF space, there is no lack of effort by other issuers to try and crack this market.

KraneShares is a firm that specializes only in China thematic ETFs. For example, it has met with success in an ETF tracking the Chinese internet companies listed overseas. The KraneShares CSI China Internet ETF (KWEB) is now becoming the fifth-largest Chinese equity ETF. Other notable players include Global X issuing its suite of Chinese sector ETFs, and Guggenheim issuing thematic ETFs. Direxion, PowerShares, VanEck Shares and Wisdom Tree have also entered the space.

It is worth noting that CSOP is the only Chinese asset manager that issues ETFs directly in the U.S. market. However, it has faced huge challenges in raising assets, partially due to lack of name recognition.

Market-Cap Indexes Dominate

The majority of indexes for these ETFs follow the market-cap-weighting scheme.

However, two of the 44 Chinese ETFs are based on smart-beta thematic weighting methodology. For example, the WisdomTree China ex-State-Owned Enterprises Fund (CXSE) followed the firm's signature methodology, dividend payments. The First Trust China AlphaDEX Fund (FCA) uses fundamental factor weighting.

Different Exposures, Different Returns

Due to the performance divergence between A-shares and overseas-listed shares this year, ETFs tracking A-shares have lagged in performance significantly year-to-date. We also see the so-called new economy (tech and consumer) outperforming the old economy (financial and industrial). For example, the China technology fund Guggenheim China Technology ETF (CQQQ) has produced returns of 15% this year (as of 10/11/2016).

Sector Exposure & Concentration

The largest ETFs track broad indexes. They tend to have substantial exposure to the financial sector, due to the dominance of state-owned banks and insurance companies. For example, nearly half of FXI is exposed to financials. These top ETFs also have larger exposure to tech and telecom sectors.

The two largest sector funds also correspond to the so-called new economy, i.e., KWEB and the Global X China Consumer ETF (CHIQ).

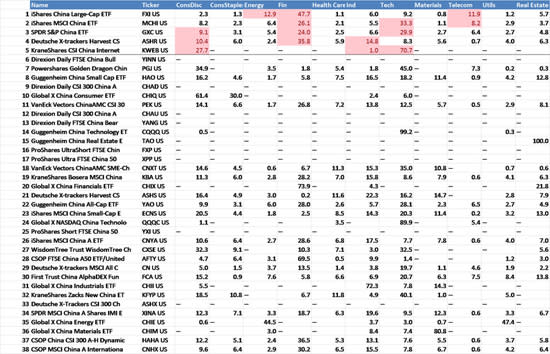

Chinese ETF Sector Exposure

For a larger view, please click on the image above.

2016 Flow Trends: Broad Index Losing Appeal

This year, the largest Chinese equity ETFs, the broad index-based ETFs, have all incurred net outflows. Yet A-share-based ETFs, such as ASHR, have attracted net inflow. The new economy sector ETFs, such as those focusing on technology and real estate, also attracted net inflows.

Expense Ratio

The expense ratio of these ETFs is within the range of 0.53% to 0.95%, with the vast majority of the products charging between 0.60-0.70%. Some of the largest ETFs are based on highly liquid H-shares and N-shares. It is probably just a matter of time before they bring the cost down for investors.

Fixed-Income ETFs: Just Starting

China has a large Treasury market, a growing muni and credit market, yet there are only three U.S.-listed Chinese fixed-income ETF products. The PowerShares Chinese Yuan Dim Sum Bond Portfolio (DSUM) is the largest, with only $50 million in assets under management. The KraneShares E Fund China Commercial Paper ETF (KCNY) invests in investment-grade commercial papers in domestic market. VanEck sought AMC as its partner in managing the VanEck Vectors ChinaAMC China Bond ETF (CBON), investing in RMB-denominated bonds.

Appendix I. US-Listed Chinese Equity ETFs

Source: Bloomberg 10/11/2016

The demand for Chinese fixed-income ETFs is probably underserved, and none of the large ETF insurers are currently in this space, leaving the door wide open for other issuers.

Plenty Of Room For Growth

Our research concludes that there is much more room to grow for Chinese-based ETFs, despite the dominance of a few issuers.

First, while there are many Chinese ETFs listed in the U.S. already, most of them are based on market-cap-weighted indexes. If the U.S. ETF growth trend is any indication for what is to come for the Chinese ETFs, we are likely to see the need for smart-beta ETFs that track indexes with weighting schemes other than market capitalization.

Second, there is only a handful of dedicated fixed-income Chinese ETFs, an area that will likely see growth as investors seek higher yield.

Third, there are very few ETFs in the U.S. that track A-shares, local Chinese companies listed on the Chinese stock exchanges. Many of these firms represent the new economy, the fastest-growing part of the Chinese economy. U.S.-based investors are missing out hugely in this area.

No Issuer Commanding The Space

Lastly, our research also suggests there is no apparent authority among the issuers that have already established a full range of Chinese ETFs products. This creates opportunities for those issuers that might be able to compete with the giants using their investment strength in both depth and scope.

In a follow-up series, I will examine these issues from the perspectives of China-listed Chinese security ETFs.

At the time of writing, the author held a position in FXI.

Recommended Stories

Yahoo Finance

Yahoo Finance