Americans aren’t lighting up like they used to, but tobacco companies aren’t burning out just yet.

North Carolina-based Reynolds American Inc., the nation’s second-biggest tobacco company, on Tuesday became the latest in the industry to report quarterly strong sales and profits, even as tobacco industry stocks have collectively outperformed the stock markets this year.

Second-quarter stock profits surged for RAI, the parent company for Reynolds American, with shares up 6.3 percent to $84.20 Tuesday and dividends increasing by 7.5 percent to $1.44 a share. Reynolds also tripled its net income to $1.93 billion, marking a 3.7 percent higher gain in domestic cigarette volume production compared to the rest of the industry.

Tobacco industry analysts are also expecting higher revenues for Altria, a Reynolds rival and the maker of top-selling U.S. brand Marlboro, which is scheduled to announce its second-quarter earnings on Wednesday.

While the S&P 500 has posted a gain of under 6 percent in the last 12 months, the Dow Jones tobacco stock index is up more than 16 percent.

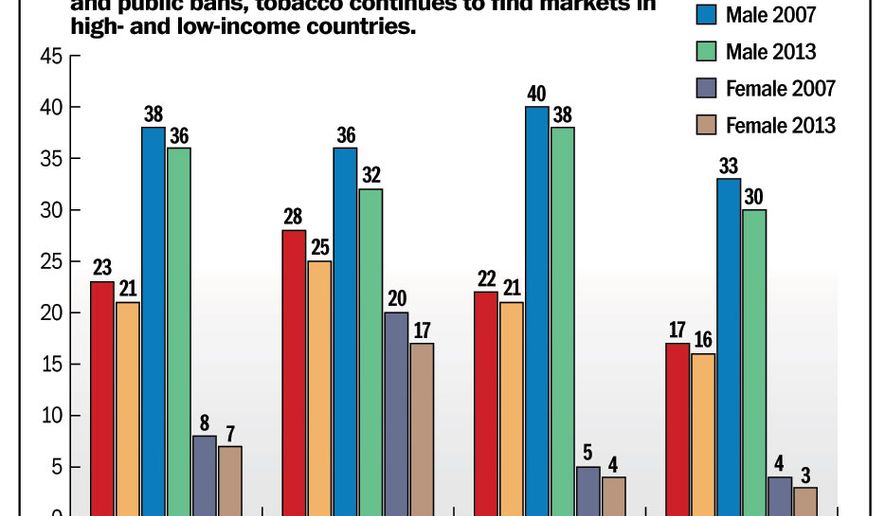

While tobacco companies like Reynolds are posting significant stock gains, their increasing success raises questions about how they are achieving those numbers in an environment where less and less people are smoking cigarettes. Smoking rates among U.S. adults have gradually declined since the 1970s, when an average of 40 percent of the population smoked cigarettes. In 2013 the smoking rate hit an all-time low of 17.8 percent among adults, according to a report by the Centers for Disease Control and Prevention (CDC).

The number of cigarette sales has also dwindled — 264 billion cigarettes were sold in the U.S. in 2014, 9 billion less than the previous year.

But tobacco companies have been able to revamp themselves to stay profitable, including through a sharp industry consolidation through mergers. Reynolds American Chief Executive Susan Cameron said just such a merger is one of the main reasons for her company’s success.

“The strength of our operating companies and their growth brands continued to benefit RAI’s earnings and operating margin through the first half, and the integration of the powerful Newport menthol brand into R.J. Reynolds Tobacco Company’s cigarette portfolio is going very smoothly,” Ms. Cameron said.

RAI, whose brands include Camel and Pall Mall cigarettes, completed a roughly $25 billion merger on June 12 with Lorillard, which makes the popular Newport brand. Ms. Cameron said the move “significantly strengthened” RAI’s reach in the market, which has struggled in the face of diminished demand and the advent of electronic cigarettes, vaporized nicotine-delivery devices that people use to mimic the act of smoking a traditional cigarette.

“These results reflected strong financial performance at all of our operating companies, and continued momentum behind their distinctive brands,” Ms. Cameron said in a conference call with analysts Tuesday, announcing at the same time a two-for-one stock split, the company’s third since 2004.

The big tobacco firms have been able to co-opt their electronic rivals while expanding into overseas markets.

E-cigarettes came into the market in 2004, although their health impacts were relatively unknown. As recently as last year, the Food and Drug Administration (FDA) admitted that more has to be done to learn about the growing phenomenon.

“E-cigarettes have not been fully studied, so consumers currently don’t know: the potential risks of e-cigarettes when used as intended, how much nicotine or other potentially harmful chemicals are being inhaled during use, or whether there are any benefits associated with using these products,” the agency said.

• Brennan Weiss can be reached at bweiss@washingtontimes.com.

Please read our comment policy before commenting.