With individual income tax collection surging, state general revenue tax collection in February increased $42.4 million over the same month a year ago to $501.5 million.

General revenue last month exceeded the forecast by $8.6 million, state Department of Finance and Administration officials reported Tuesday in their monthly revenue report.

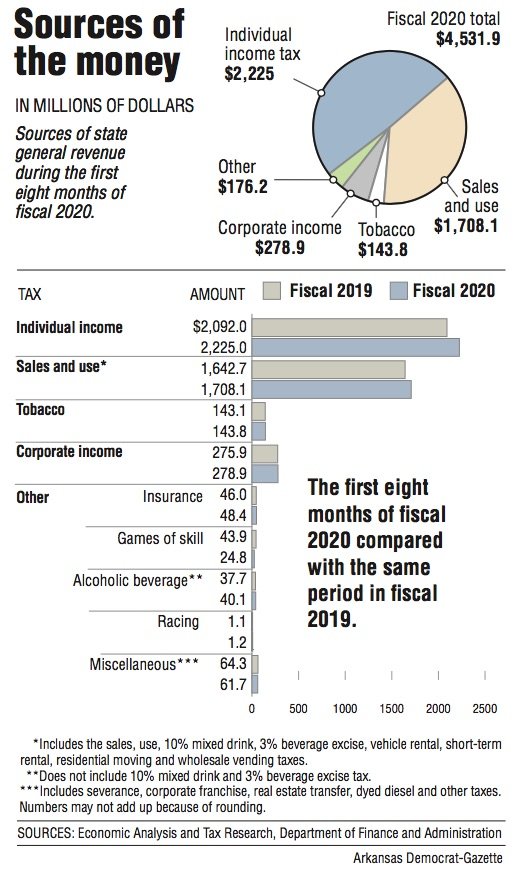

While individual income tax collection exceeded the forecast for February, sales and use tax collection fell short of prediction. They are the state's two largest sources of general revenue.

February's collection exceeded the previous record for the month, $459.1 million in 2019, said Whitney McLaughlin, a tax analyst for the finance department.

Gov. Asa Hutchinson said Tuesday last month's general revenue "continues the trend of meeting projections and slowly building the surplus.

"This is encouraging considering some of the headwinds we are facing globally and nationally in regard to [covid-19,]" the Republican governor said in a statement, referring to the spread of the coronavirus. "As a state we must continue to budget conservatively even though our economy remains strong."

Tax refunds and some special government expenditures come off the top of total general revenue collection, leaving an amount state agencies can spend.

The net in February increased by $21.7 million, or 6.7%, over last year to $343.1 million and exceeded the forecast by $3.5 million, or 1%.

February is the eighth month of fiscal 2020, which started July 1.

So far in 2020, general revenue increased $185.3 million, or 4.3%, over 2019 to $4.5 billion and outdistanced the forecast $89.2 million, or 2%.

The 4.3% increase in total revenue over the year is "a healthy number and in line with what we have seen in recent months," said John Shelnutt, the state's chief economic forecaster.

During the first eight months of fiscal 2020, net general revenue increased $171.4 million, or 4.6%, over 2019 to $3.9 billion. That's exceeded the forecast by $97.7 million, or 2.6%.

BUDGET FUNDING

The general revenue budget for 2020 totals $5.75 billion, a $124.1 million increase of over last year's budget, with most of the increase targeted for human services and education programs.

FEBRUARY DETAILS

According to the finance department, February's general revenue included:

• A $34.9 million, or 14.8%, increase in individual income tax collection over the same month a year ago to $271.6 million exceeding the forecast by $9.3 million. Last month's surge in this category was driven by one more Friday payday compared with a year ago, Shelnutt said. The largest category of individual income tax collection is withholdings.

Withholdings increased last month $32.7 million, or 14.8%, over a year ago to $253.8 million, exceeding forecast by $7.4 million.

• A $7.6 million, or 4.1 %, increase in sales and use tax collection over a year ago to $193.1 million that fell $3.6 million short of forecast.

This category lagged in the forecast largely because of collection lagging from business-related sectors, such as wholesale, construction and rental leasing, "whereas the consumer side was up nicely with better than 5% growth in retail and restaurants and motor vehicles up more than 12%, so quite a disparity there between those two groups," Shelnutt said.

Sale tax collection last month from motor vehicles increased $2.9 million over a year ago to $25.7 million, Shelnutt said.

Collection from online sales in February totaled about $4 million, which was double the projection, said Scott Hardin, a spokesman for the finance department.

• A $500,000, or 5.9%, increase in corporate income tax collection from a year ago to $8.1 million, exceeding forecast by $600,000.

CASINOS, HIGHWAYS

Casino gambling general tax revenue in February dropped by $2.6 million, or 48.3%, from a year ago to $2.8 million, but exceeded the forecast by about $300,000.

The drop is because of Oaklawn Racing Casino Resort in Hot Springs and Southland Casino Racing in West Memphis paying a lower state tax rate under Amendment 100 to the Arkansas Constitution, approved by voters in November 2018.

State officials expect to take in $31.2 million in 2020 -- down from $69.7 million in 2019. But they've also said they project casino tax revenue to grow to $55.9 million in 2021 and steadily increase to $81.8 million by 2028.

During the first eight months of 2020, casino gambling general tax revenue totaled $24.8 million, a drop of $19.1 million, or 43.5%, over 2019. But that's exceeded the forecast by $3 million.

NW News on 03/06/2020