As China’s economy powers up, what’s the growth outlook for 2021?

- China has succeeded in containing the spread of Covid-19 and is at the forefront in the race for a vaccine, which will boost its economy. However, the scrapping of some stimulus measures will add downward pressure

This year will go down in history as one of the most challenging for the global economy since World War II. A major public health crisis, triggered by a deadly virus, quickly turned into an economic disaster as governments around the world took drastic measures to restrict social mobility and shut down large portions of the economy.

Looking ahead, the 2021 macro outlook is likely to feature a further normalisation of economic policies and easing of pandemic-related measures. Some of these developments – firmer control of the coronavirus and restoring organic growth engines – will add to the growth forecast, while policies that lead to reduced stimulus measures will adversely affect it.

02:26

Demand for free food rises in US as nation’s Covid-19 pandemic crisis deepens

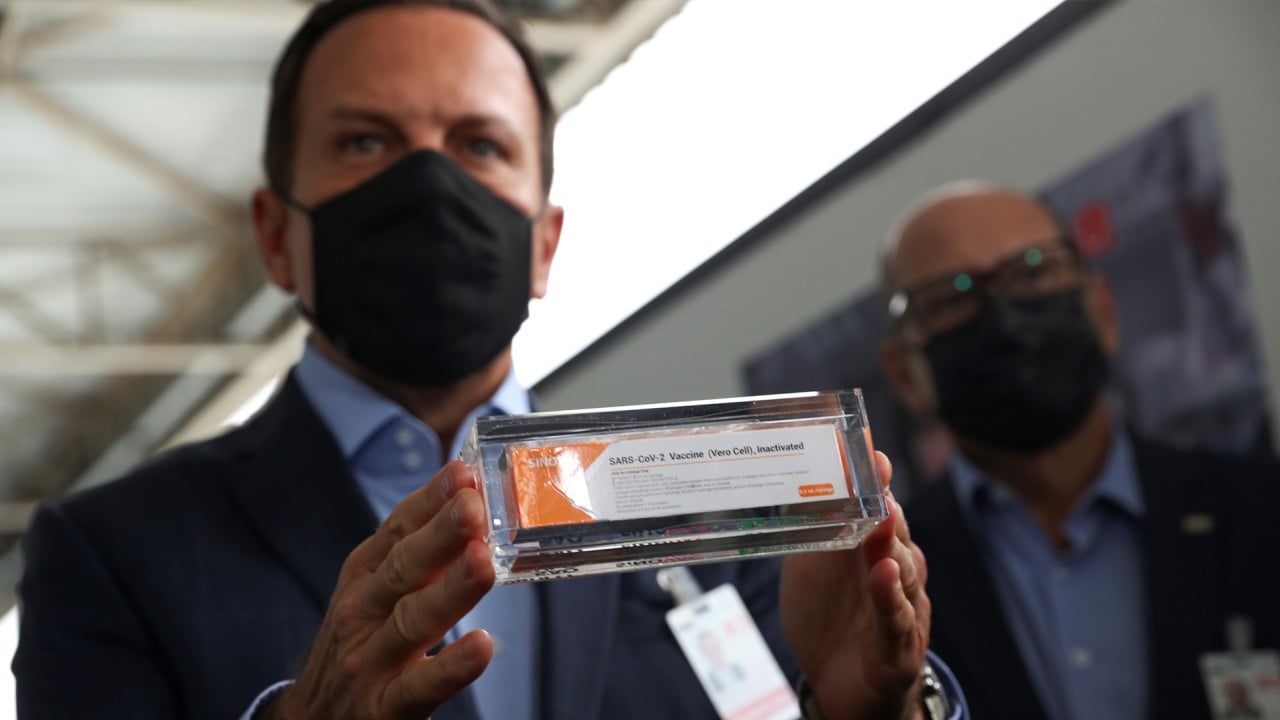

In addition, China is at the forefront in developing a Covid-19 vaccine. It has at least three treatments in phase three clinical trials, and one is generally expected to be made available by the end of this year, before a mass roll-out in 2021. A safe and effective vaccine will help further boost public confidence and accelerate social and economic normalisation.

While the pandemic was responsible for the unprecedented economic contraction at the start of 2020, the subsequent rebound would not have been possible without Beijing’s forceful intervention. Powerful monetary and fiscal stimulus measures were deployed to keep businesses afloat and employees on the payroll at the height of the Covid-19 crisis.

01:36

First doses of China’s CoronaVac Covid-19 vaccine land in Brazil

With the price of money now neutral, the quantity of money – credit and money supply – is expected to follow suit. This should lead to a gradual convergence of credit and nominal gross domestic product growth in 2021, and a stabilisation in the aggregate debt ratio as a result.

While the PBOC appears to be in no hurry to tighten policy due to muted inflation, targeted risk control for some sectors, such as property, could be stepped up against growing financial imbalances.

China unlikely to ease up on stimulus even as economic recovery gathers pace

The withdrawal of stimulus will probably be more gradual and data-dependent than monetary policy, to ensure that some supportive measures remain in place to buffer the economy against lingering headwinds.

In level terms, GDP should be moderately below the pre-Covid-19 trend at the end of 2021, reflecting reduced official support. This gap is likely to close in 2022 when growth returns to the trend rate of 5.5 per cent without the distortion.

Aidan Yao is senior emerging Asia economist at AXA Investment Managers