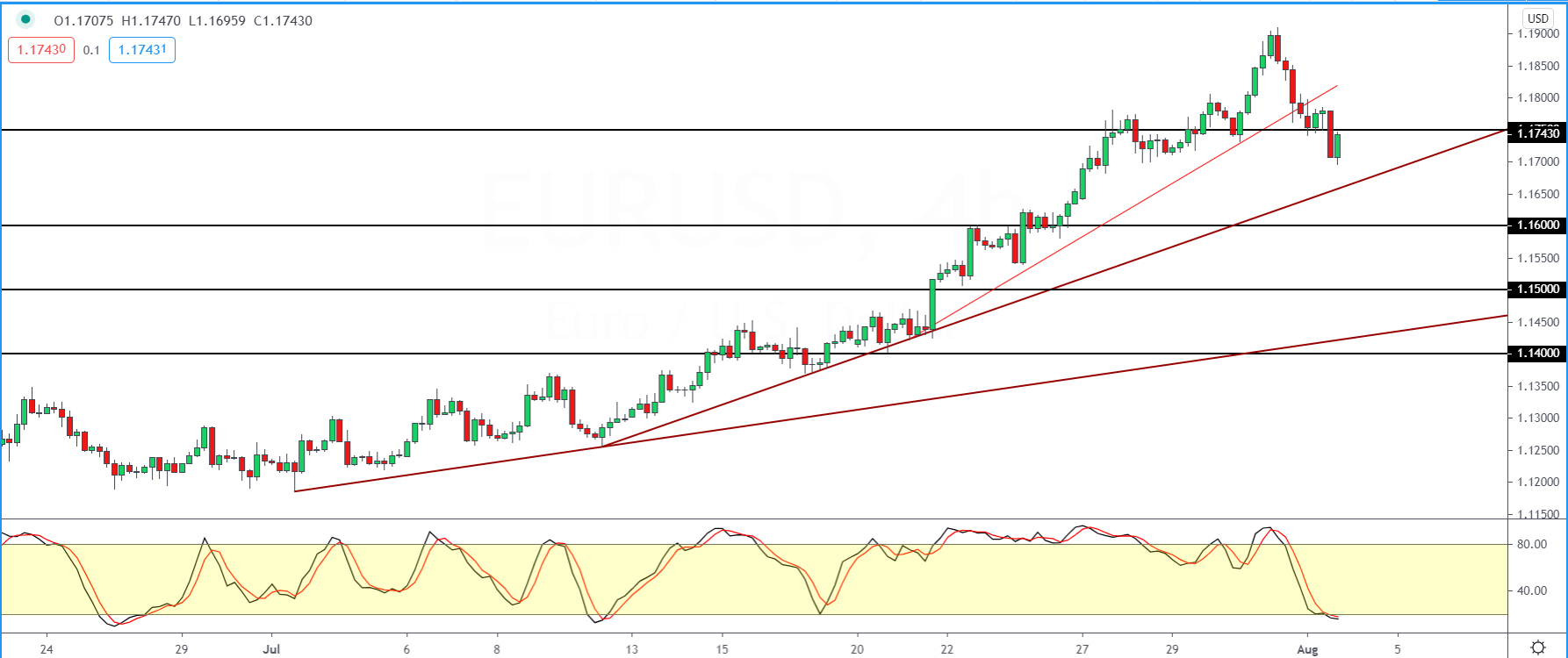

Euro Pulls Back From Two Year Highs

The euro currency broke the support level near 1.1750 on Monday. This came after last Friday saw price action testing this area.

The strong close below this level could see possible declines further. But for the moment, there is scope for price to retest this level.

If resistance forms near 1.1750 then we expect to see a continuation lower. The next main trend line is, however, likely to act as support in the near term.

But we see a possible decline to 1.1600 level of support which is the next key target for EURUSD.

For the moment, the Stochastics is well oversold, which could signal a possible bounce to the upside.

Sterling Loses The 1.3100 Handle

The pound sterling is trading weaker on Monday. This comes just after on Friday last, GBPUSD rose above the 1.3122 level.

A strong bearish candlestick on an intraday basis saw prices pulling back lower. However, we see a reversal taking place, just above the major trend line.

We could expect prices to pullback to this trend line in the near term. As long as prices are steady above the rising trend line, GBPUSD will be retesting the 1.3122 level once again.

If price action fails to breakout above this level, then we might get to see a possible correction lower.

The next main support area is around the 1.2813 level.

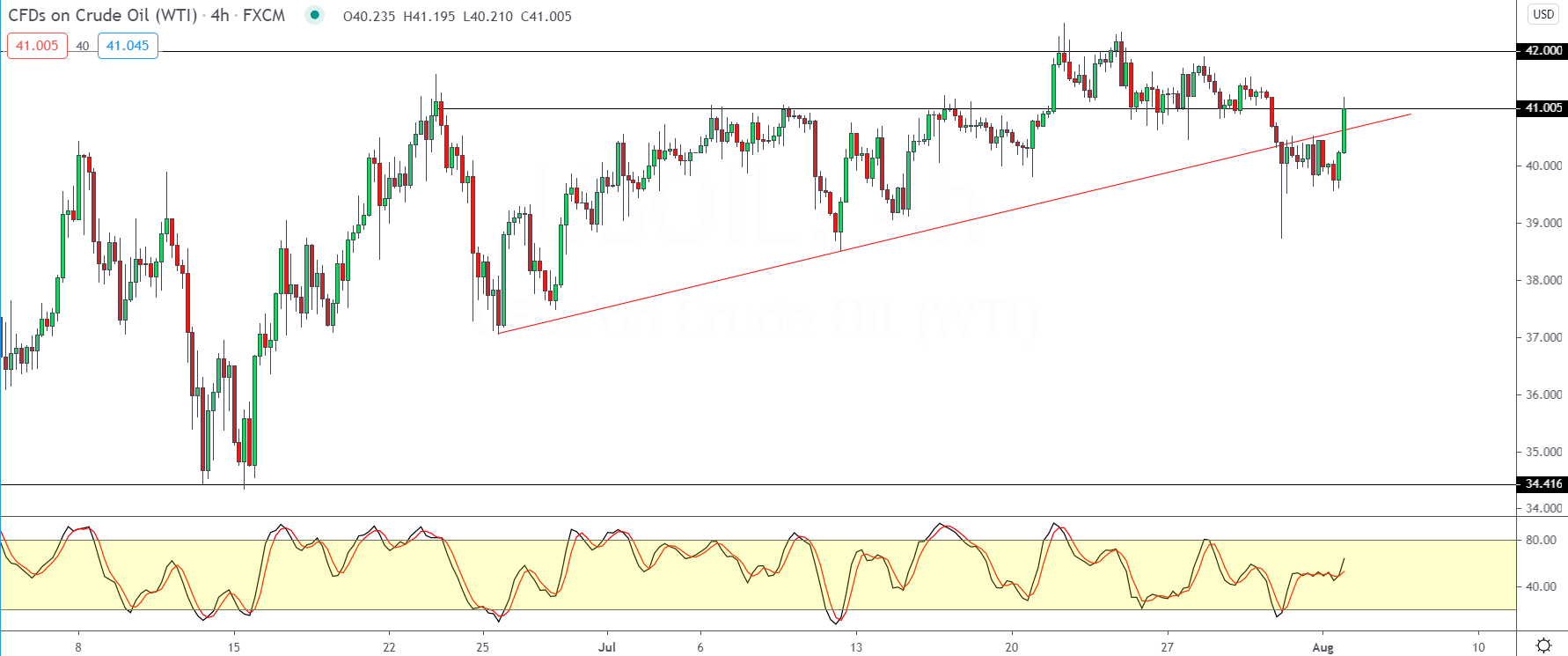

WTI Crude Oil Drops Below 40 And Rebounds

Oil prices are trading somewhat volatile over the past two sessions. The commodity is up over 1.25% on an intraday basis.

The gains come as WTI crude oil is testing the 41.00 level once again. Given that this price level held up as floor, a retest back to this region could see resistance forming.

If oil prices fail to breakout above 41.00 then we might get to see a move lower.

For now, the key swing point near 39.75 will be critical. If oil prices slip below this level then we could see a move toward the 37.50 – 38.00 level eventually.

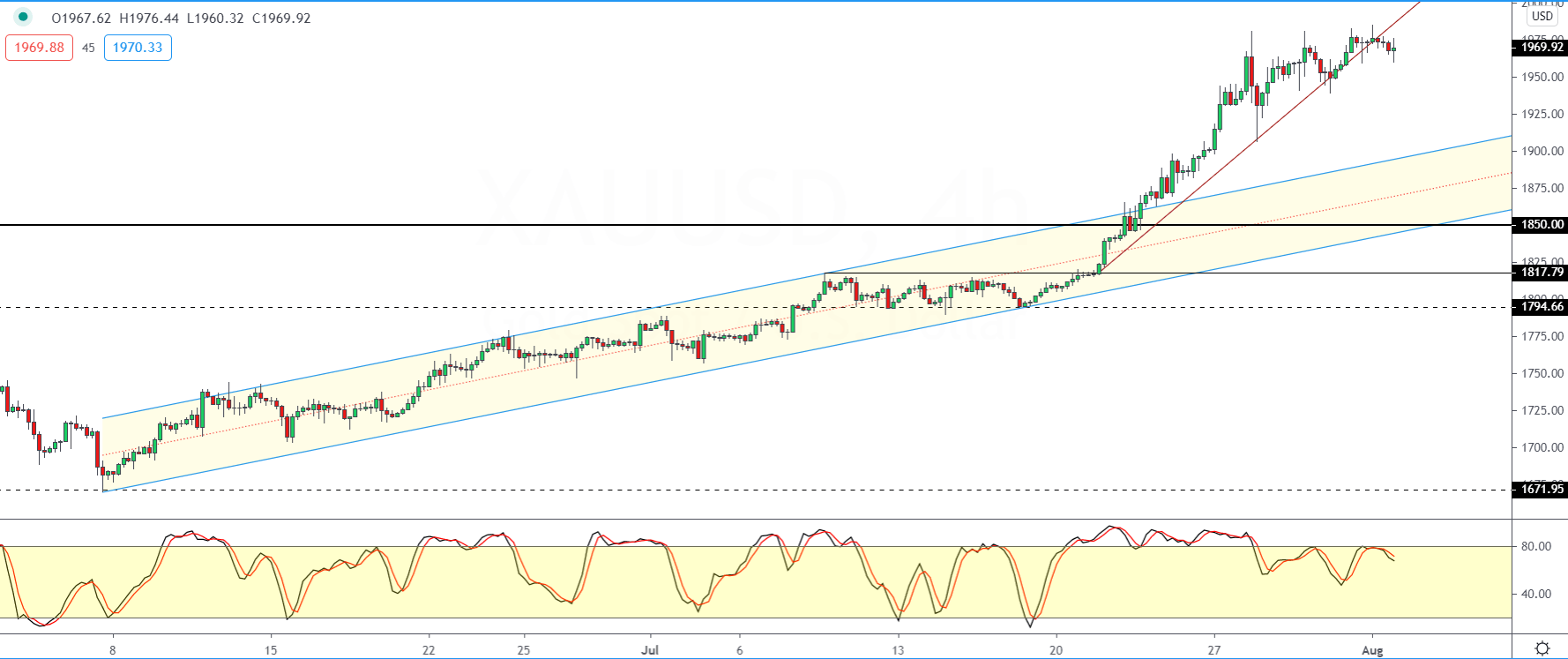

Gold Prices Pause After Setting Record Highs

The precious metal is trading on a softer note on Monday.

Robust economic data has sparked optimism in the Eurozone economy.

After rising to highs of 1984.86, price action is trading a few points lower.

While the trend line is breached, it is still too early to confirm if price will continue to push lower.

For now, a soft support area is near the 1950 handle. A break down below this level might, however, suggest a sharper correction to come.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD looks depressed ahead of FOMC

EUR/USD followed the sour mood prevailing in the broader risk complex and plummeted to multi-session lows in the vicinity of 1.0670 in response to the data-driven rebound in the US Dollar prior to the Fed’s interest rate decision.

Gold stable below $2,300 despite mounting fears

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

Bitcoin price tests $60K range as Coinbase advances toward instant, low-cost BTC transfers

BTC bulls need to hold here on the daily time frame, lest we see $52K range tested. Bitcoin (BTC) price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.

-637321222699885318.png)