FTSE 100 rises and pound edges back above $1.25 as US job growth beats expectations in January

Dollar gains on yen after BoJ's buying ops

US job growth beats expectations in January

European bourses edge higher on solid earnings

Hong Kong stocks fall for fourth session

Sterling hovers above $1.25

Trump to order review of Dodd-Frank

Market Report: Beazley hits record high on results beat

Lloyd’s of London insurer Beazley surged to a record high after its full-year profits smashed expectations.

The mid-cap company reported full-year pre-tax profits of $293m, up 3pc on a like-for-like basis and 13pc ahead of consensus forecasts. The beat was driven by a combination of stronger underwriting performance and higher investment returns The group also declared a special dividend of 10p - comfortably ahead of consensus forecast of 7.4p. Management also pointed to “significant” growth opportunities in the US and other markets outside London amid a challenging environment for insurers.

Although there was no mention of M&A in today’s statement, Eamonn Flanagan, of Shore Capital, said: “The underwriting delivery, the capital discipline together with the significant diversification benefits its specialty book would offer a potential predator should not be overlooked.”

In its wakes, shares leapt 26.3p, or 6.4pc, to 435p. Its stellar results also lifted its peers higher. Prudential climbed 48p to £16.01, Admiral advanced 42p to £18.35 and Hiscox rose 38p to £10.68.

On the wider market, the FTSE 100 ended the final trading session of the week in positive territory, buoyed by pound weakness and a rally in banking stocks. The blue chip index closed 47.55 points, or 0.67pc, higher at 7,188.30.

Banking stocks rallied on expectations of simpler bank regulations. Reports US President Donald Trump is preparing to repeal the Dodd-Frank Act, which was signed into law by Barack Obama in 2010 after the financial crisis nearly toppled the banking system, lifted the sector. Barclays soared 7.5p to 228.9p, Royal Bank of Scotland jumped 6p to 228.5p, Lloyds closed up 1p at 65.9p and HSBC advanced 8.3p to 685.2p.

Separately, UBS hiked HSBC’s price target to 680p from 580p to reflect the better near-term macro outlook in the UK and higher assumed revenues.

Elsewhere, a broker upgrade from Investec helped British broadcaster ITV inch up 4p to 205.5p, while private hospital group Mediclinic edged 23.5p higher to 788.5p after Macquarie raised its rating to “outperform”.

On the other side, miners became the biggest laggards. Metals prices faltered after China raised interest rates stoking fears that an erosion of cheap liquidity could stunt economic growth. Glencore dropped 15.5p to 309.5p, Rio Tinto surrendered 124.5p to £33.91, Anglo American slipped 45.5p to £13.32, Antofagasta lost 27.5p to 813p and BHP Billiton closed down 35.5p at £13.98.

Retailer Dixons Carphone also came under pressure, skidding 8.9p to 304.6p, after its chief executive Sebastian James offloaded 302,000 shares at a price of 315p a piece.

Elsewhere, mid-cap engineer Halma enjoyed its best day in 15 months, bouncing 37p higher to 963p, on the back of rating upgrade. Barclays lifted its rating to “overweight” from “equal weight” as it admires the company’s “consistent, long-term record”.

Finally, e-learning group Learning Technologies agreed to buy NetDimensions in a cash deal that values the management software group at around £54m. The cash offer of 100p per share for the entire issued share capital is more than double NetDimensions’ share price when it received the initial takeover approach in October. NetDimensions surged 24.2pc to 97.5p, while Learning Technologies slipped 3.8p, or 8.4pc, to 41p.

With that, it's time to close. Thanks for following our markets coverage this week.

Dow back above 20k

It's also worth noting the rally in banking stocks has propelled the Dow Jones back across the 20,000 mark.

The sharp rise was powered by bets that Trump would usher in an era of simpler regulations.

"I like the rollback of Dodd-Frank," said Robert Pavlik, chief market strategist at Boston Private Wealth in New York. "It's a net-net win for the overall financial market because these rules and regulations have meant a big increase in costs for major banks and brokerage firms."

It is currently trading up 0.8pc at 20,042.80.

Quotes from Reuters

European bourses end the week in positive territory as banking stocks rally

European bourses ended the week in positive territory, buoyed by a rally in banking stocks on expectations of simpler regulations.

At the closing bell:

FTSE 100: +0.67pc

DAX: +0.3pc

CAC 40: +0.83pc

IBEX: +0.69pc

Chris Beauchamp, of IG, said: "The week is ending on a positive note in London, as the FTSE 100 moves 50 points higher and markets around the globe focus on the positives in yet another good US jobs report. Not only did the headline number beat expectations, but it also showed healthy growth in most private sectors. This has helped to alleviate the disappointment caused by the weaker payroll number; this is still the missing link in the US recovery, but for now it seems investors are happy to concentrate on the jobs beat, even if it leaves the broader economic landscape and the outlook for the next rate hike broadly unchanged."

Repealing too much of Dodd Frank puts entire system at risk of a repeat of 2008

Financial firms were clear cut leaders on the open of the Dow Jones this afternoon, as expected.

Visa, Goldman Sachs and JP Morgan were among the top risers on expectations of simpler bank regulations.

Jasper Lawler, of London Capital Group, said: "Since Dodd Frank was introduced, banks have devoted a lot more capital towards compliance and have had to decrease leverage, both of which are a direct hit to profitability. If Dodd Frank is watered down, that’s a direct boost to the bottom line for banks.

"The changes to Dodd Frank are likely to be small to begin with but Trump is shifting the direction of travel from more regulation to less regulation. That’s a good thing for the financial sector, and less red tape is good for corporate America as a whole. Trump turning his attention to deregulation could be just the boost Wall Street needs to send the Dow back above the 20,000 mark."

Here we go... @realDonaldTrump brands #DoddFrank bank regulations "a disaster" and promises to do "big number" on them pic.twitter.com/nHGHK9WQBY

— Stephen Morris (@sjhmorris) January 30, 2017

He adds that too much regulation favours the large institutions who can afford the extra compliance costs.

"Unwinding some of Dodd Frank is a good thing because it will enable smaller community banks to compete, offering competition to consumers. Repealing too much of Dodd Frank puts the entire system at risk of a repeat of 2008. The red line is the Volker rule; if the big banks can engage in proprietary trading, then depositors will be put at much greater risk."

US factory orders increase by more than expected

US factory orders increased by more than expected in December and shipments surged, data from the US Commerce Department showed today.

Factory goods orders increased 1.3pc, after a revised 2.3pc decline in November. Expectations pointed to factory orders rising 1pc in December.

Solid #ISM report .. new orders and employment both well in expansion. #bullmarket

— Marco Mazzocco, CFA (@MarcoMNYC) February 3, 2017

Meanwhile, total shipments of manufactured goods increased 2.2pc, the largest increase since December 2010, after rising 0.3pc in November.

The department also said orders for non-defense capital goods excluding aircraft - seen as a measure of business confidence and spending plans - rose 0.7pc in December instead of the 0.8pcincrease reported last month.

#UnitedStates Factory Orders ex Transportation at 2.1% https://t.co/tw2ACzAtVvpic.twitter.com/qEDR8HTzmy

— Trading Economics (@tEconomics) February 3, 2017

US service sector growth reaches 14-month high in January

US service sector growth hit a 14-month high in January, buoyed by another robust increase in incoming new work.

Greater willingness to spend among clients and signs of an upturn in domestic economic conditions also contributed to stronger business optimism across the service sector.

The seasonally adjusted final Markit US Services Business Activity Index rebounded to 55.6 in January, up from December’s three-month low of 53.9. Moreover, the latest reading was comfortably above the average for Q4 2016 (54.4) and signalled the fastest rate of business activity growth since November 2015.

#US Composite #PMI rises to 55.8 in Jan'17 (54.1 - Dec'16). Strongest rise in private sector output since Nov'15. https://t.co/gq8UuWWfmYpic.twitter.com/0LJ2fRGOMB

— Markit Economics (@MarkitEconomics) February 3, 2017

Commenting on the economic data release, Chris Williamson, Chief Business Economist at IHS Markit said: “With January seeing the largest inflow of new business for 18 months, there’s good reason to believe that firms will be even busier in coming months.

“Even more encouraging is the ongoing impressive rate of job creation, with the January PMI numbers comparable to around 200,000 jobs being added.

“A waning of price pressures takes some heat off the Fed, though the sustained strong output and jobs growth signalled by the surveys will fuel speculation that the next rate hike will be sooner rather than later, with June looking most likely.”

Investor group takes aim at Thomas Cook chief executive's bonus

An influential shareholders group has issued a warning over Thomas Cook's payouts to executives.

The Institutional Voting Information Service wrote to investors over concerns about chief executive Peter Fankhauser's bonus.

It also hit out at proposed changes to the company's long-term incentive plan that would allow the chief executive to be given a higher pay packet, Bloomberg reported.

The tour operator paid Mr Fankhauser a total of £1.2m last year, after it was cut from £4.3m. The company has already scaled back plans to award him more money this year, after concerns were raised by shareholders and the share price dipped. He will now be paid 1.65 times his salary.

Thomas Cook said: “The Remuneration Committee actively engages with shareholders and advisory groups on remuneration and any proposed changes throughout the year, ensuring that it takes their comments and feedback on board.”

Report by Isabelle Fraser (Read the full story here)

Wall Street opens higher after US jobs report

US stocks jumped at the opening bell following a better-than-expected non-farm payrolls report.

Meanwhile, reports Donald Trump is planning to repeal Dodd-Frank has driven bank stocks higher on Wall Street.

At the opening bell:

Dow Jones: +0.58pc

S&P 500: +0.43pc

Nasdsaq: +0.26pc

Watch what Donald Trump has to say

He hasn't tweeted about the US jobs report yet, but Kathleen Brooks, of City Index, reckons we should watch out for Trump's comments on the data.

According to Brooks, there are two things to watch this afternoon:

Donald Trump's Twitter account

US non-manufacturing ISM report

She says: "Will the President want to take credit for the 227k jobs created? Or will he lament the rise in the unemployment and the underemployment rate? It is worth noting, that Trump’s team want to scrap the unemployment rate and make the underemployment rate the key gauge for the health of the US labour market.

"Thus, it will be worth watching Trump’s twitter account for any potential reaction to the increase in both of these rates and the disappointing wage data. In fairness, it puts pressure on Trump to disclose his economic plans in more detail, which is something the market desperately wants to hear.

"The second thing to watch is the US non-manufacturing ISM report for January, which is released at 1500 GMT today. This is a key gauge of US economic health, and the market expects a solid reading of 57.0. Any disappointment could set the dollar back even further. Overall, the market reaction to the labour market report has been one of mild disappointment so far."

US construction firms and retailers ramp up hiring but wages soft in January

Digging deeper into the Labor Department's job report, here are the key points:

Nonfarm payrolls increased by 227,000 jobs in January, the largest gain in four months and better than forecasts of 175,000;

Unemployment rate rose one-tenth of a percentage point to 4.8pc;

Wages increased modestly, suggesting that there was still some slack in the labor market;

Revisions to November and December showed the economy created 39,000 fewer jobs than previously reported;

Average hourly earnings increased only three cents or 0.1pc last month. December's wage gain was revised down to 0.2pc from the previously reported 0.4pc increase;

If sluggish wage growth persists it would suggest only a gradual pace of rate rises by the Fed (Fed left rates unchanged this week);

The labor force participation rate, or the share of working-age Americans who are employed or at least looking for a job, was at 62.9pc in January - its highest level since September;

All sectors of the economy added jobs in January. (Manufacturing payrolls increased by 5,000 jobs, construction employment jumped 36,000, retail payrolls surged 45,900);

Government employment fell for a fourth straight month in January.

US jobs growth 'still somewhat solid'

Commenting on the US jobs beat, Naeem Aslam, of Think Markets, said: "The US NFP data has confirmed that the lavish party in the employment sector is still somewhat solid, especially if you look at the headline number. You can say that it was a super solid number because it was well ahead of expectations. This week we had a number disappointing news with respect to what traders were expecting, for instance, the Bank of England’s event."

However, he flags that it isn't all good news because when you peel away the layers, the figures show that the downside surprise is in the wage report.

"We still need to see more readings before we can see that there is a trend because this number is full with noise.

There is no doubt that the hourly wage growth has gathered the most momentum recently and fuelled this concern among traders that the Fed is behind the curve, while inflation is picking up steam. Clearly, today’s number has put cold water on that."

The U.S. added the most jobs in 4 months in January, while wage growth slowed more than projected https://t.co/g45m9fJbVypic.twitter.com/MzHjiy4mHv

— Bloomberg (@business) February 3, 2017

Kully Samra, Charles Schwab U.K. Managing Director, said:“Today’s jobs numbers coupled with most other economic data points this week demonstrate the ongoing resilience and strength of the US economy.

The figures also corroborate the findings of the Atlanta Fed Wage Growth Tracker, which has generally continued on an upward trend over the last quarter. This is a further indicator of both momentum in the wider domestic economy and that a tighter job market is boosting job security and overall pay.

“Weekly jobless claims remain near a multi-decade low and appear healthy enough to keep the low unemployment rate intact. A strong job market, inflection points in the wider economic data and corporate earnings, alongside increased consumer and business confidence, should be a cause for optimism amongst investors in US equities.”

Pound reverses initial fall on jobs report

Let's take a look at how the markets reacted to the US jobs report:

US now trading higher against the yen and euro after briefly turning negative

Sterling reverses initial fall on jobs report, jumps back above $1.25

FTSE 100 extends gains, now up 0.55pc

Europe's Stoxx 600 extends gains, now up 0.6pc

Analysts react to US jobs report: 'Overall a weak report'

NFP takeaway - ostensibly solid report, but suggests "slack" in labor market = less pressure on Fed to raise rates in Mar/June $DXY$SPX

— Matt Weller CFA, CMT (@MWellerFX) February 3, 2017

Numbers solid but softer hourly earnings and Trump administration weak USD talk has got to be a concern for USD bulls right now. #nfps

— Joel Kruger (@JoelKruger) February 3, 2017

Initial knee jerk reaction to headline quickly reversed, overall a weak report, neg revisions, poor wage data & uptick in unemployment #NFP

— Anthony Cheung (@AWMCheung) February 3, 2017

US job growth beats expectations in January

US jobs growth smashed expectations this month as construction companies and retailers ramped up hiring.

Here are the key findings from the US Labor Department:

Nonfarm payrolls increase 227,000 in January (largest gain in four months and above forecasts of an increase of 175,000)

Unemployment rate rises to 4.8 percent from 4.7 percent

Average hourly earnings edge up 0.1pc

Markets like it. Beat on headline, miss on wages, miss on unemployment rate.

— Joe Weisenthal (@TheStalwart) February 3, 2017

US stock index futures point to positive open as investors eye US jobs report

US Stock index futures climbed this afternoon as investors eyed the US jobs report due out at 1.30pm.

The Labor Department report is expected to show that hiring in the private and public sectors in January increased to 175,000 from 156,000 in the previous month.

Meanwhile, banking stocks are also set to bounce on Wall Street on reports that Donald Trump is preparing to scale back the Dodd-Frank act.

We've also had some more guesses ahead of the US jobs report:

The US #NFP are due for releases in 30 mins with 175K expected. However be wary of the bumper ADP that could point to a strong reading.

— James Hughes (@James_HughesUK) February 3, 2017

I think US hiring picked up again in January 225K plus a 20K upward revision to December #NFPGuesses

— Colin Cieszynski (@CCieszynski_CMC) February 3, 2017

Why does Donald Trump want to repeal the Dodd-Frank rules on banks and finance?

My colleague Ben Martin explains why Donald Trump wants to repeal the Dodd-Frank act:

After a flurry of executive orders taking action on a range of campaign pledges - including building a wall with Mexico and enacting a travel ban on seven Muslim-majority countries - President Donald Trump has finally turned his attention to the banks.

Meeting with biggest business leaders this morning. Good jobs are coming back to U.S., health care and tax bills are being crafted NOW!

— Donald J. Trump (@realDonaldTrump) February 3, 2017

Mr Trump is today expected to announce a review of the Dodd-Frank Wall Street Reform and Consumer Protection Act, sweeping aside legislation that was designed to overhaul the financial industry in the wake of the last crisis. It would mark yet another move by Mr Trump to tear down centrepiece legislation pushed through by his predecessor, President Obama.

What is Dodd-Frank?

Named after Barney Frank, the former chairman of the US House of Representatives Financial Services Committee, and Chris Dodd, the former chairman of Senate Banking Committee, the legislation was signed into law by Mr Obama in 2010.

It spans some 2,300 pages and incorporates a host of measures aimed at making the banking industry safer following the collapse of Lehman Brothers and the financial crisis, which was at its height when Mr Obama took office in 2009.

If Dodd-Frank made banks safer, why is it being reviewed?

Scrapping legislation that stifles businesses was a central plank of Mr Trump’s election campaign, playing to his image as a successful tycoon who made billions in the private sector. Last November, he described Dodd-Frank as “a sprawling and complex piece of legislation that has unleashed hundreds of new rules and several new bureaucratic agencies”.

Mr Trump, who has also previously argued that Dodd-Frank “made it impossible for bankers to function”, pledged to “dismantle” the law and replace it with “new policies to encourage economic growth and job creation”. Last week, while signing an executive order aimed at reducing regulations, he described Dodd-Frank as a “disaster”. Republicans have long been opposed to the law.

And the guessing game begins...

Non-farm payroll guesses are in:

210k

4.7%

2.8%#NFPguesses— Joe Weisenthal (@TheStalwart) February 3, 2017

Jobs report predictions. 194K jobs added. #NFPguesses 8:36 a.m. Time of first self-congratulatory @POTUS or @realdonaldtrump tweet.

— Paul R. La Monica (@LaMonicaBuzz) February 3, 2017

+119k #NFPguesses

— GarthC (@HindsightFX) February 3, 2017

But not everyone was in the mood for guessing...

#NFPguesses A number that initially sees markets go crackers before settling as if nothing happened

— Mike van Dulken (@Accendo_Mike) February 3, 2017

Pinned tweet is once again relevant https://t.co/k2h0H26Ym1

— World First (@World_First) February 3, 2017

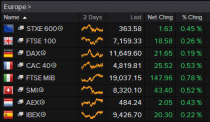

Half-time update: European bourses rise on solid earnings

Solid corporate results and a rally in financial stocks on reports Donald Trump will repeal Dodd-Frank has lifted European bourses.

Britain's FTSE 100 has risen 0.52pc, the German DAX has added 0.25pc, the CAC in Paris has climbed 0.82pc and the Spanish IBEX has made gains of 0.47pc.

Connor Campbell, of SpreadEx, said: "After a slow start that was a lot in play this Friday, and that’s before this afternoon’s non-farm jobs report from the US.

"The FTSE was caught between two of its most important sectors this morning. The hefty mining stocks were all rouged up thanks to the Chinese central bank raising its short-term interest rates; the banking sector, on the other hand, was flush was positivity following reports that Donald Trump is seeking to repeal the Dodd-Frank Law."

Investors eye US jobs report

We've got the US jobs report coming up at 1.30pm today. Let's take a look at what analysts have to say ahead of the data release:

Connor Campbell, of SpreadEx, says wage growth is expected to dip in January from 0.4pc to 0.3pc, while the unemployment rate is forecast to hold steady at 4.7pc.

"As for the headline non-farm figure, forecasts suggest a solid 170k reading. However, with the ADP non-farm number surging unexpectedly mid-week, a big surprise could well be in order."

Big day for US markets with #NFP numbers and @realDonaldTrump to roll back Dodd-Frank - US financials could jump.

— Neil Wilson (@neilwilson_etx) February 3, 2017

Meanwhile, Mike van Dulken, of Accendo Markets, says US is expected to have created 175K jobs in January, bouncing back from the disappointment of December where only 156K jobs were created against consensus of 178K.

"However, after Wednesday’s ADP Employment data smashed consensus (246K vs 180K est.), might we be in for another upside surprise? The headline Unemployment Rate is expected steady at 4.7pc. However, Average Hourly Earnings may prove the most important figure, closely watched by the Fed for signs of inflationary pressures that could push it to hike again."

The i publisher Johnston Press reports slowdown in steep sales decline

Shares in Johnston Press climbed 4.8pc to 16.5p in mid-morning trade despite reporting a 14pc fall in revenues for the year on a like-for-like basis. Our chief business correspondent Christopher Williams reports:

Johnston Press, the publisher of the i newspaper and more than 200 regional titles, said a precipitous fall in sales slowed in the fourth quarter to leave revenues down 14pc for the year on a like-for-like basis.

Excluding the £24m acquisition of the i in April, fourth-quarter sales were down 11pc, compared with 16pc in the third quarter.

Including the i, Johnston Press's only national newspaper, the third quarter was down 5pc and the final three months of the year up 1pc. The full year was down 6pc.

The company said classified advertising for property, cars and jobs was hit particularly badly, as the long-term structural shift to Google and specialist online marketplaces such as Auto Trader continued.

Excluding classifieds, like-for-like digital and print advertising was down 7pc for the year. The decline slowed at the end of the year. Including the i, the shortfall on the prior year was 3pc.

Metals head for first weekly fall in six weeks

Metals prices are under pressure after China raised interest rates, spooking markets with fears that an erosion of cheap liquidity could stunt economic growth.

In its wake, copper tumbled. The basic resources index is now on track for its worst week since mid-December.

The slide in metals prices have caused mining stocks to falter. Glencore tumbled 3.3pc, Antofagasta lost 2.9pc, BHP Billiton shed 2.7pc, Rio Tinto slumped 2.7pc and Anglo American fell 2.7pc.

Michael Hewson, of CMC Markets, attributed the slip back in the sector to the disappointing Chinese manufacturing survey as well as slight tightening of money market rates by Chinese authorities.

"It’s not immediately clear what prompted this action, though there is speculation about rising concerns about a property bubble, and this slight rise could well be an attempt to warn that tighter policy is on the way."

Trump boosts the banks

Banking stocks are among the best performers this morning on the back of reports US President will repeal the Dodd-Frank act.

Barclays rose 2.5pc, RBS advanced 1.9pc, and Lloyds climbed 1.3pc.

Chris Beauchamp, of IG, said: "UK bank stocks are higher across the board this morning, after the magic words ‘Dodd-Frank’ and ‘repeal’ flashed across screens last night; leaving aside the political implications, the news could provide a tonic for the sector, especially as the previous narrative, that of higher US rates, starts to lose its power to inspire."

Britain set for economic battle between strong growth and soaring prices

Here's our full report on the UK services PMI by our economics correspondent Tim Wallace:

Economic growth got off to a strong start in 2017 with expansion in every sector, indicating that the economy's steady performance since the Brexit referendum will continue unabated for now.

There are more signs of rising inflation, however, according to the latest surveys from IHS Markit, which threatens to squeeze business profits and household finances.

Firms in Britain’s dominant services sector benefitted from rising demand for the sixth consecutive month, encouraging them to hire more workers again.

The purchasing managers’ index (PMI) came in at 54.5 in January, a slowdown from 56.2 in December, but still above the 50-level that indicates expansion.

Npower price hike signals more inflation worries for UK plc

Neil Wilson, of ETX Capital, says the move by Npower to raise prices by almost 10pc is only adding to fears that inflation will crimp consumer spending throughout this year.

"We have to assume that some of the other Big Six energy providers will follow when they review in April. It’s a sign that higher input prices – seen across UK industry – are starting to bite. Someone has to pay for it and that burden is going to fall on the British consumer. Food and clothing retailers are next line."

Npower putting up energy bills by 10% - just days after it admitted it uses pricey deals to subsidise the chase for new business

— steve hawkes (@steve_hawkes) February 3, 2017

Wilson adds that today’s PMI data for the services industry also affirms the view that inflation is going to continue to rise. Input price pressures were at their highest since 2011.

"Savings are being depleted, while unsecured debt is rising fast. Credit card debt recently hit a record high and indebtedness is rising at a rate not seen since before the financial crisis. It’s hard to see the consumer spending splurge post-Brexit being maintained indefinitely unless wages can keep pace. Productivity would need to improve a lot faster than it has hitherto."

The former chief executive of Npower there, calling its 9.8% price rise "shocking"... pic.twitter.com/1Fy13APvzV

— Emily Gosden (@emilygosden) February 3, 2017

Npower to hike gas and electricity prices by almost 10pc

British energy supplier Npower will hike its duel-fuel annual energy bills by an average of 9.8pc from March 16. Jillian Ambrose reports:

Npower will hike the standard cost of gas and electricity by almost 10pc from next month, adding £109 to the dual fuel bill of 1.4 million energy customers.

The big six supplier blamed rising cost pressures for the hike, which was branded "shocking" by the company's former chief executive Paul Massara.

Npower blamed climbing wholesale energy prices and the rise in the cost of delivering Government policies, such as roll-out of smart meters and renewable energy support, for the move.

So much for Ofgem saying no rise necessary https://t.co/aH4NfHhDhO

— paul massara (@paulmassara) February 3, 2017

Npower’s domestic market boss Simon Stacey said: “This is a hugely difficult decision, and we’ve delayed the date this takes effect until after the coldest months of the year.”

But the hike is likely to be seen as a slap in the face to the energy regulator, which warned companies only a fortnight ago to keep a lid on prices.

Pound still 16pc lower since Brexit vote

With the pound extended its losses this morning, Jamie McGeever, of Reuters, points out that the local currency is still down 16pc against the dollar since the Brexit vote.

That sterling recovery:

-still 16% vs $ since Brexit

-still 40% vs $ since crisis

-still anchored near 40+ yr low on trade-weighted basis pic.twitter.com/lhL7tjHNdH— Jamie McGeever (@ReutersJamie) February 3, 2017

Analysts react to UK services PMI data: Uncertainty remains

Here's a look at what the experts had to say about UK services PMI slowing for the first time in four months:

Dean Turner, UK Economist, UBS Wealth Management, said: “The most notable aspect of the Services PMI was the ongoing strength of the input prices index, which rose again and is now above 60 level for the fourth consecutive month. Higher input prices will, in time, shift into selling prices otherwise firms will see their profits shrink. In line with the Manufacturing and Construction PMI, this points to inflation continuing its recent surge in the months ahead."

Shorter Services PMI: Brexit starting to matter

— World First (@World_First) February 3, 2017

Turner adds that headline activity, although falling back slightly, suggests the economy is continuing to expand at "a healthy pace". However, he questions its sustainability.

"Can the UK economy keep pace as inflation erodes the spending power of the consumer? We don’t share the Bank of England’s optimism that households will continue to whittle away their savings to support spending. Our conviction strengthened today with the softer outlook for employment highlighted in this survey.”

UK service sector growth slows more than expected in January. PMI posts biggest fall since July, second biggest in a year.

— Jamie McGeever (@ReutersJamie) February 3, 2017

Meanwhile, Chris Sood-Nicholls, managing director and head of global services at Lloyds Bank Commercial Banking, said:

“There are some helpful economic ingredients that are keeping the PMI in positive territory. Healthy levels of employment and low interest rates mean consumers continue to spend. Business confidence has also been buoyed by a stronger than expected economic performance in 2016, and is likely to be further boosted by yesterday’s improved growth forecast from the Bank of England."

However, he says "some uncertainty remains", adding that the bank is seeing a cautious approach towards making major investment decisions across the services sector.

Pound skids below $1.25 after UK services PMI data

The pound fell by as much as 0.6pc to $1.2481 against the dollar after data showed that UK services PMI fell for the first time in four months.

It also turned negative against the euro, trading down 0.1pc at 85.97p per euro.

Meanwhile, the FTSE 100 has extended its gains, rising 0.49pc to 7,175.92.

UK services sector: Main area of concern is higher costs

Commenting on the UK services PMI, Chris Williamson, Chief Business Economist at IHS Markit, which compiles the survey said that even though service sector growth eased after a strong end to the year, January's data still points to a "buoyant" start to 2017 for the UK economy.

"The PMI surveys are collectively signalling that GDP will increase by a robust 0.5pc in the first quarter, if current growth is sustained in coming months. Encouragingly, optimism about the coming year has risen to its highest in one-and-a-half years, improving across the board in all sectors to suggest that January’s slowdown may only be temporary."

Williamson says the main area of concern is the extent to which companies’ costs are rising across the economy, with the rate of inflation accelerating to a pace not seen since before the global financial crisis.

“There is evidence that higher costs are deterring some companies from taking on extra staff, with the January surveys finding employment to have increased at the slowest rate since August. Only construction companies stepped up their hiring at the start of 2017.

“Higher costs are feeding through to increased selling prices, which will inevitably put upward pressure on consumer prices. While the robust start to the year adds some justification to the Bank of England’s improved outlook for 2017, the degree to which costs are rising threatens to test the tolerance of some policymakers in terms of their willingness to ‘look through’ what’s likely to be a marked upturn in inflation in 2017."

UK #PMI data signal slowdown in January but still consistent with +0.5% GDP. New future business activity index at 1½ year high pic.twitter.com/PvGET5SoCx

— Chris Williamson (@WilliamsonChris) February 3, 2017

UK services PMI falls for first time in four months

Growth in Britain's services sector slowed for the first time in four months in January, as businesses battled the sharpest rise in costs in more than five years, the latest PMI survey found.

Highlights from UK services PMI pic.twitter.com/p7lA6O22Jr

— World First (@World_First) February 3, 2017

The Markit/CIPS services purchasing managers' index (PMI) dropped to a three-month low of 54.5 last month from December's 15-month high of 56.2.

UK service sector growth eases at start of 2017 and much like other UK readings this week input price inflation highest since March 2011

— Anthony Cheung (@AWMCheung) February 3, 2017

More to follow...

Reaction: Eurozone PMIs point to accelerating GDP growth

Julien Lafargue, European Equities Strategist with JP Morgan Private Bank, comments on the final composite PMI reading for the eurozone:

"Although Germany has decelerated somewhat in the recent months, today’s PMIs are clearly pointing to accelerating GDP growth in the Eurozone in 2017. In addition, the rate of job creation - the fastest since February 2008 – indicates that this momentum could be sustained in the coming months.

"Going forward, it will be important to keep an eye on cost pressures which continue to intensify. The companies’ ability to pass these higher costs onto consumers will be critical to support margins and the earnings recovery we anticipate."

Eurozone Job Creation At 9-Year High As Business Confidence Strengthens – Markit https://t.co/uzpCi5qSV3pic.twitter.com/c2coY94EqA

— Livesquawk (@Livesquawk) February 3, 2017

Eurozone job creation at nine-year high as business confidence strengthens

The eurozone economy made a strong start to 2017, with output growth maintained at December’s five-and-a-half year high and job creation accelerating to a near-nine year record.

The final Markit Eurozone PMI Composite Output Index posted 54.4 in January, unchanged from December.

Markit #Eurozone#PMI Composite Output Index unchanged at 54.4 in Jan'17. Job creation fastest since Feb'08. https://t.co/8l5aV5qnPWpic.twitter.com/fRPujteWVD

— Markit Economics (@MarkitEconomics) February 3, 2017

The services PMI reading in the eurozone came in at 53.7 in January, again unchanged from December.

Chris Williamson, Chief Business Economist at IHS Markit said: “The final PMI indicated marginally stronger business activity growth than the earlier flash estimate, and suggests the eurozone economy is growing at the fastest rate since mid-2011.

“The latest reading is comparable to GDP rising at a quarterly rate of 0.4pc, indicating that the economy is starting 2017 on a solid footing. Meanwhile, faster growth of new business and an upturn in confidence about the year ahead to the highest since the region’s debt crisis bodes well for the robust pace of growth to be sustained in coming months."

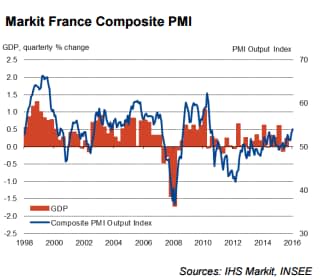

French services activity at five-and-a-half-year high

Service sector activity in France rose for the seventh successive month in January. Moreover, the pace of growth accelerated from December to a 19-month high. The amount of new business placed with French service providers also increased markedly, which in turn led to a further accumulation of unfinished work.

At the same time, staffing numbers increased following a stagnation in the previous month. Meanwhile, output prices continued to fall despite a further rise in average cost burdens. Firms maintained an optimistic outlook with regard to their prospects for output growth over the coming year.

The seasonally adjusted headline Markit France Business Activity Index posted 54.1 in January. Up from 52.9 in December, the latest index reading pointed to the sharpest rate of growth since June 2015.

The final seasonally adjusted Markit France Composite Output Index – which covers the combined manufacturing and service sectors – rose to 54.1 in January from 53.1 in December, and signalled the strongest rate of growth in over five-and-a-half years.

Weaker services slow German private sector growth

Germany's services firms stayed in relatively good shape in January though activity slowed slightly for the second month running as cost pressures increased, data from Markit showed this morning.

Markit's flash composite Purchasing Managers' Index (PMI), which tracks the private manufacturing and services sectors that account for more than two-thirds of Europe's biggest economy edged down to 54.8 from 55.2 in December . That's its lowest level in four months.

Business activity growth in #German service sector eases to 4-month low. #PMI at 53.4 in Jan, down from 54.3 in Dec. https://t.co/atlYVT0LTS

— Markit Economics (@MarkitEconomics) February 3, 2017

Philip Leake, Economist at IHS Markit said: “January saw a further slowdown in growth of Germany’s service sector. Both output and new orders rose more slowly than in December, although each expansion remained historically strong. What’s more, they were sufficient to motivate firms to hire staff at an increased rate.

“With purchase prices and salaries both rising at the start of 2017, cost pressures intensified to the most marked in nearly five years. Panellists reported a broad-based rise in costs, with price hikes seen in commodities such as oil and services including IT. The rate of charge inflation was comparatively muted – consumers are therefore likely to face greater selling prices in coming months as firms look to protect margins."

Reaction to Dodd-Frank roll-back

Naeem Aslam, of Think Markets, thinks Trump's move to repeal Dodd-Frank could provide fresh ammunition for US markets, after they lost momentum following the travel ban.

#US markets have lost steam since #Trump took the office but repealing of #doddfrank after review could provide fresh ammunition

— Naeem Aslam (@NaeemAslam23) February 3, 2017

Donald #Trump is to reverse parts of the post-crisis #banking law #doddfrank, reports @WSJ. That will unnerve many who don't trust banks

— Rob Young (@robyounguk) February 3, 2017

Lawyers likely loving Trump admin review/rollback of #doddfrank - yet further years of work guaranteed #suegrabittrunne

— Jeremy Grant (@TradingJeremy) February 3, 2017

There are many who wld welcome roll back of #doddfrank but will pendulum swing too far the opposite way?

— Jeremy Grant (@TradingJeremy) February 3, 2017

Trump to order review of Dodd-Frank

President Donald Trump will sign an executive order today to review the 2010 Dodd-Frank financial regulatory framework put into effect in response to the financial crisis, according to a report from The Wall Street Journal.

Gary Cohn, White House National Economic Council Director and former Goldman Sachs Chief Operating Officer, told the WSJ: "Americans are going to have better choices and Americans are going to have better products because we're not going to burden the banks with literally hundreds of billions of dollars of regulatory costs every year."

Trump to Halt Obama Fiduciary Rule, Order Dodd-Frank Review. (Banks are the best performers since Trump election) https://t.co/HZ3qWHKUxRpic.twitter.com/LOKFghsrNe

— Holger Zschaepitz (@Schuldensuehner) February 3, 2017

Earlier this week, Trump promised to do “a big number” on the Dodd-Frank Act during a meeting with small business owners. He described Dodd-Frank as "a diaster", adding that "regulation has actually been horrible for big business".

The Dodd-Frank Act was signed into law by Barack Obama in 2010 after the financial crisis nearly toppled the banking system. It was put in place to prevent another financial crisis or, at least, protect consumers caught in the fray.

Trump set to dismantle Dodd-Frank framework: WSJ https://t.co/Ab6INdJOQU

— CNBC (@CNBC) February 3, 2017

European shares rise on robust corporate earnings

European bourses made a solid start to the final trading session of the week thanks to a raft of robust corporate earnings reports.

Here's a snapshot of the current state of play in Europe:

Mike van Dulken, of Accendo Markets, said: "Calls for a mildly positive open come after a mixed but muted finish on Wall Street mirrored by contrasting performances in Asia overnight. Investors are making their monthly pilgrimage to the side-lines ahead of a closely scrutinised US jobs report, one which may or may not provide the US Fed with more evidence about whether another US rate hike is warranted soon."

Hong Kong stocks fall for fourth session as China surprises with policy tightening

Hong Kong stocks suffered their fourth consecutive session of declines on Friday, as a robust post-Christmas rebound appears to be losing steam amid uncertainty over global growth and fresh signs of policy tightening in China.

Sentiment was also depressed by a slump in commodity prices on the mainland, which knocked shares of resources firms traded in Hong Kong.

The benchmark Hang Seng index fell 0.2pc, to 23,129.21, while the China Enterprises Index lost 0.1pc, to 9,683.23 points.

Good morning from Czech. Asia stocks mostly declining in vol session after China unexpectedly tightens policy to discourage spec investments pic.twitter.com/6lDiW5k2Am

— Holger Zschaepitz (@Schuldensuehner) February 3, 2017

For the week, Hang Seng dropped 1pc, while HSCE lost 0.7pc.

Linus Yip, strategist at First Shanghai Securities Ltd, said a series of controversial policies unveiled by U.S president Donald Trump raised fears of rising trade and political frictions, which is sapping investor confidence.

"There's a lot of unpredictability in the external environment, so investors are becoming risk-averse," Yip said, adding the market is under pressure to consolidate after rebounding strongly since late December.

"In addition, tighter liquidity conditions won't help equities, as the U.S. will keep raising rates, while China is also deleveraging."

Report from Reuters

Agenda: Investors eye UK services data and US jobs report

Good morning and welcome to our live markets coverage.

Yesterday, the pound came under pressure, sliding from a seven-week high above $1.27 to $1.2530 against the dollar after the Bank of England appeared to be in no rush to tighten monetary policy in its latest inflation report, disappointing bets that interest rates could be hiked by the end of the year.

Despite raising its growth forecasts - a move that had been widely expected - the BoE sent broad signals that it was comfortable with its record low interest rates, and it said it now expected inflation would be slightly lower in two years' time than it did in November.

Mark Carney: Stronger growth projections don’t mean the referendum is without consequence. #InflationReport#SuperThursdaypic.twitter.com/1qOnp7B5qz

— Bank of England (@bankofengland) February 2, 2017

Today attention shifts to services PMI figures. A raft of European data releases are expected to be released this morning, with UK figures due at 9.30am.

UK services PMI is expected to fall to 55.8 expected from 56.2.

The big event of the day is the US jobs data.

Michael Hewson, of CMC Markets, said expectations are high that today’s US employment report will blow the doors off in the same way as Wednesday’s 245k ADP number did.

"These expectations aren’t unrealistic given that over the last 12 months the ADP and official NFP numbers have only deviated by more than 30k on just two occasions, with an average change of 14k over the last 12 months.

"This would suggest that the 180k estimate being predicted is probably too low, with a figure in excess of 200k not being beyond the realms of possibility. Such a high number given an unemployment rate of 4.7pc, would suggest that there is probably still a fair degree of slack in the jobs market."

With strong ADP private payrolls (246,000 jobs) & good ISM Manufacturing, today's Non-Farm Payrolls EST +185k with unemployment rate of 4.7%

— David Buik (@truemagic68) February 3, 2017

Also on the agenda:

Full-year results: Beazley

Economics: Services PMI (UK), unemployment rate (US), non-farm employment change (US), average hourly earnings m/m (US), final services PMI (US), factory orders m/m (US), ISM non-manufacturing PMI (US), final services PMI (EU), retail sales m/m (EU)

Our European opening calls:$FTSE 7143 up 3

$DAX 11638 up 10

$CAC 4797 up 3$IBEX 9412 up 6$MIB 18925 up 36— IGSquawk (@IGSquawk) February 3, 2017

Yahoo Finance

Yahoo Finance