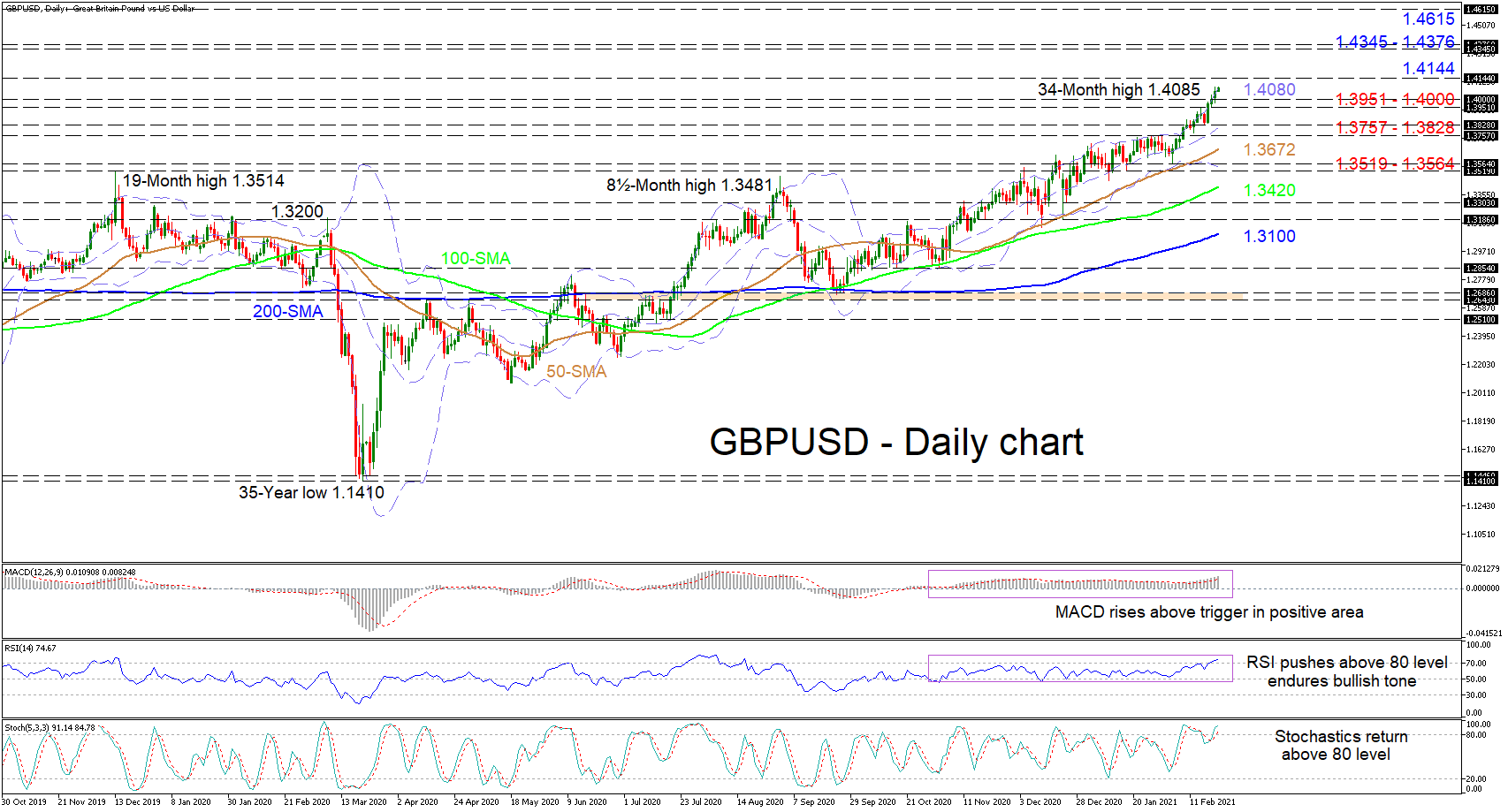

GBPUSD is trailing the upper Bollinger band hiking to a new 34-month high of 1.4085. The pair is exhibiting a sturdy positive tone, something also reflected in the short-term oscillators. The price is steadily progressing above the climbing simple moving averages (SMAs), which are conveying a predominant bullish demeanour.

The MACD, in the positive zone, is rising above its red trigger line, while the RSI is preserving its push into the overbought territory. Furthermore, the stochastic oscillator is persisting above the 80 mark with the %K line reflecting a slight stalling in the upwards drive, however, the %K line has yet to confirm any clear deterioration in the price.

If the upwards trajectory continues, initial constraints could commence at the 1.4144 barrier. Overrunning this obstacle, the price could then propel to challenge a key resistance band of 1.4345-1.4376. If buyers manage to prolong the rally, overstepping this critical border too, the bulls may then target the 1.4615 boundary, identified in June 2016.

Otherwise, if sellers resurface, early support could develop from the 1.4000 hurdle until the 1.3951 inside swing high. Should a pullback evolve strong downside limitations may quickly appear from the zone of 1.3757-1.3828, which also contains the mid-Bollinger band. If an even deeper retracement matures, the pair may then test the 50-day SMA at 1.3672, while a dive past it, could be dismissed by the 1.3519-1.3564 boundary, which is reinforced by the lower Bollinger band.

Summarizing, GBPUSD’s five-month climb appears durable above the SMAs and the 1.3757-1.3828 support region.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.