- Gold price nurses losses after impressive US NFP-inspired sell-off.

- US dollar eases in tandem with the Treasury yields amid a better mood.

- XAU/USD looks south towards $1,750, as 75 bps Sept Fed rate hike bets rise.

Gold price is licking its wound below the $1,800 mark, awaiting a fresh catalyst for the next leg lower. Risk-on flows have returned at the start of the week, fuelling a broad-based US dollar retreat while the Treasury yields also ease. Investors assess the implications of a super-sized Fed rate next months, the odds for which now stand at 70% after a big upside surprise in the US Nonfarm Payrolls for July. The jobs blowout raised the stakes for the July US inflation report due on Wednesday. The US Consumer Price Index (CPI) could likely see a slight pullback in headline growth but the core figure is seen accelerating. The debate of peak inflation remains in play heading into the key event risk of the week. The non-yielding bullion is expected to remain highly reactive to the US employment and inflation data after the Fed said that it remains data-dependent while deciding on its policy outlook.

Also read: Gold Price Forecast: XAU/USD could challenge $1,750, with big Fed rate hike bets back in play

Gold Price: Key levels to watch

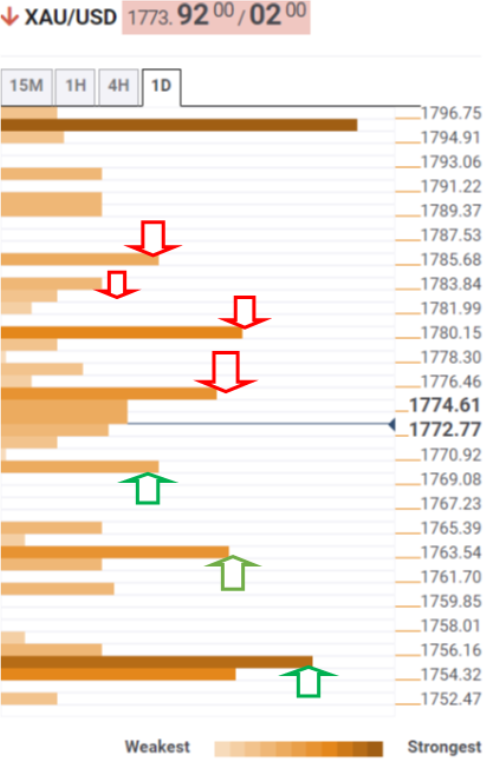

The Technical Confluence Detector shows that the gold price needs to slice through a bunch of healthy support levels around the $1,772-$1,771 area to resume the post-NFP sell-off.

That demand zone is the convergence of the SMA5 one-day, Fibonacci 23.6% one-day and the previous low four-hour.

The Fibonacci 61.8% one-week at $1,769 will be next on sellers’ radars. However, bears need acceptance below the confluence of the Fibonacci 61.8% one-month and pivot point one-day S1 at $1,763 to negate the recent bullish momentum.

Further south, the intersection of the previous week’s low and the pivot point one-week S1 at $1,754 will guard the downside.

On the upside, the immediate resistance appears at $1,775, above which the Fibonacci 38.2% one-week at %1,780 will be challenged.

The next resistance levels are located at $1,784 and $1,786, which are the Fibonacci 61.8% one-day and Fibonacci 23.6% one-week respectively.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD tumbles out of recent range, tests below 1.0770 as markets flee into safe havens

EUR/USD slid below the 1.0670 level on Tuesday after an unexpected uptick in US wages growth reignited fears of sticky inflation, chopping down rate cut expectations and sending investors into safe haven bids.

Gold pullbacks on rising US yields, buoyant US Dollar as inflation heats up

Gold prices drop below the $2,300 threshold on Tuesday as data from the United States show that employment costs are rising, thus putting upward pressure on inflation. XAU/USD trades at $2,296 amid rising US Treasury bond yields and a stronger US Dollar.

Ethereum slumps again as long liquidations exceed those of Bitcoin

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

No tap dancing around inflation concerns

Tuesday saw U.S. stocks closing considerably lower as investors grappled with economic indicators indicating increasing labour costs and a decline in consumer confidence, all coming ahead of a crucial Fed policy meeting aimed at determining the trajectory of interest rates.