Today’s publishers are no longer just producers of newspapers and magazines. Faced with dwindling circulation and subscriptions and combined with insufficient revenues from online advertising, many publishers have added other strings to their bows – from membership clubs to global events – in order to survive.

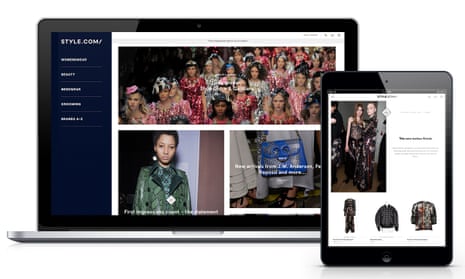

One area many are investing in is e-commerce. Several years in the making, Condé Nast has just launched Style.com, an e-commerce business that’s arguably one of its most significant ventures. Glossy-looking and featuring high-end designer products such as a Chloe zip-front leather jumpsuit and a Paul Smith bomber jacket, Condé Nast has reportedly pumped £75m into the e-tail business and hired fashion heavyweight such as former Browns buying director Yasmin Sewell as fashion director and Galeries Lafayette former head of internet and e-commerce Franck Zayan as president.

Fashion fans can shop across the site while those browsing Condé Nast properties such as Vogue.co.uk and GQ.co.uk will be directed to products they’ve just read about.

“Style.com brings added value by connecting the content with the product offer and providing other suggestions of products and brands when they read pieces on Vogue.co.uk or GQ.co.uk,” says Zayan. He views it as an “incredible” new stream of revenue.

Unlike many retailers, Condé Nast isn’t holding any stock though – the fulfilment is handled by the individual brands – but they do, of course, take a cut of the transaction.

Launching in a competitive luxury market

But in a world where consumers might look for inspiration across magazines then buy via established retailers such as Net-a-Porter and Selfridges, how easy is it going to be to break into this already competitive market? “As we are going to target the same customers but in a space that is expanding, I’m convinced that we will find our place more easily than any new player could,” says Zayan. “Condé Nast already has a massive audience, so our customers are already readers of one or more of our on- and offline publications. They go there for inspiration before they purchase products. What we are doing is bringing all of that together in what I think is a really amazing offer.”

Admittedly, the launch of Style.com didn’t get off to the best of starts. A Sunday Times Style magazine article reported that the launch of the Style.com had been delayed and highlighted the lack of top designers on the site. Zayan bats away this criticism. “The reality is that we are adding brands every single day, so if you come back tomorrow you’ll see even more of both established and upcoming brands. All of that is a process that is built in a long-term perspective and vision.” At the time of writing, the site stocked 170 brands but Condé Nast said it had signed up 350 brands which will drop in the coming weeks.

Style.com isn’t the first foray into ecommerce for a publisher, though many don’t pump so much investment into it as Condé Nast has. Many publishers operate third-party stores on their sites and take a cut. Others have a different strategy. Take women’s title Marie Claire, which has partnered with Ocado to launch Fabled by Marie Claire, a physical store located in central London and an e-tail offer selling over 12,000 beauty and wellness products from brands such as Chanel, Clinique and Yves Saint Laurent.

Giving readers what they want

Justine Southall, managing director fashion & beauty at Marie Claire’s parent company Time Inc UK, says the magazine and Fabled operate separately, with the store having a dedicated editor and team creating bespoke content. However, Southall says they do collaborate. “The uniqueness of this business model is that the access to content, shared opportunities, market knowledge and intelligence, is much more seamless, and yes the two teams do work closely together.” For instance, if a product written about in the magazine is available in Fabled by Marie Claire then they may tag it as such.

With these etail ventures, publishers must balance the need for building profits whilst also retaining the trust of their valued readers. For instance, will readers be more than a little skeptical when they discover that a product that’s been raved about in a magazine is one they’re also pushing through its e-commerce site?

Zayan admits they need to be careful. “We will lose the advantage that we have, which is the influence and authority of those brands and we do not want to do that, it would be shooting ourselves in the foot.”

“We will always maintain a mix of retailers because it is important for variety and choice and of course our integrity,” says Southall.

Not all publishers’ etail ventures have worked out as planned. In 2014, publisher Mondadori Group launched Graziashop.com as a marketplace with more than 20,000 designers. However, just over a year after launch several senior members including managing director Richard Hatfied exited the business. In July, the site switched from being a marketplace “to a more sustainable affiliate model”, according to Zeno Pellizzari, general manager of Mondadori International Business. They also licensed the brand to a third party. Pellizzari notes that they’ve learnt some lessons along the way. “[The fashion e-tail market] is highly competitive and requires significant investments to be able to scale.”

So why are publishers throwing serious bucks at e-tail? It comes at a time when newspapers and magazines are grappling to sustain themselves while simultaneously, the publishing business model is changing. “The rise of digital, mobile and social media have had two consequences,” says Douglas McCabe, an analyst with Enders. “On the one hand they have disrupted the funnel as a whole, diluting the role of magazines; and on the other hand they have created opportunities for many organisations – including magazines – to occupy many different parts of the shopping funnel, from discovery through to transaction.” He also points to the way retailers try to inspire customers through their magazines – take Net-a-Porter with Porter magazine.

“So everyone is converging in the middle,” says McCabe. “Inevitably, all companies underrate the complexity of each other’s business models. Retail is a complex, low-margin business which publishers will find it challenging to thrive in.”

So will Style.com survive? Keely Stocker, editor of fashion trade magazine Drapers, says the launch of the store has been “slightly underwhelming”. She adds: “It launched with less brands than expected although there are still some good names on there.”

McCabe says the result looks high-end, well-curated and cleanly designed. “But competition from e-commerce specialists will remain brutally focused and the digital publishing and e-commerce landscape changes at an extraordinary pace, so the publisher should expect a tough marketplace for the foreseeable future.”

For Condé Nast, it’s an investment that they’ll hope will be in vogue for a very long time.

To get weekly news analysis, job alerts and event notifications direct to your inbox, sign up free for Media & Tech Network membership.

All Guardian Media & Tech Network content is editorially independent except for pieces labelled “Brought to you by” – find out more here.

Comments (…)

Sign in or create your Guardian account to join the discussion