9 Stocks Louis Moore Bacon Continues to Buy

- By Tiziano Frateschi

Moore Capital Management was founded by Louis Moore Bacon (Trades, Portfolio) In 1989. In both the second and third quarters, he invested in the following stocks:

Warning! GuruFocus has detected 4 Warning Sign with HZO. Click here to check it out.

The intrinsic value of GDS

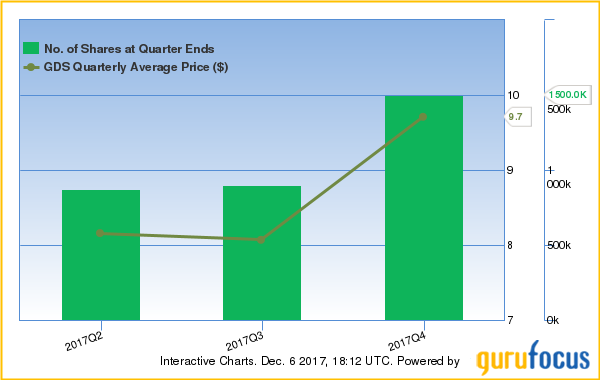

GDS Holdings Ltd. (GDS)

In the second quarter, the guru increased his stake by 2.98% and added another 66.41% in the third quarter. He holds 1.54% of the company"s outstanding shares. The Chinese data center operator has a market cap of $1.99 billion and an enterprise value of $2.72 billion.

Jim Simons (Trades, Portfolio) is another notable guru shareholder of the company with 0.01% of outstanding shares.

Time Warner Inc. (TWX)

The investor increased his position by 70% in the second quarter and by 17.65% in the third quarter. The guru holds 0.03% of outstanding shares. The entertainment company has a market cap of $71.09 billion and an enterprise value of $91.52 billion.

The company"s largest shareholder among the gurus is Dodge & Cox with 3.04% of outstanding shares, followed by Steven Cohen (Trades, Portfolio) with 0.63%, Pioneer Investments (Trades, Portfolio) with 0.44% and Daniel Loeb (Trades, Portfolio) with 0.35%.

China Life Insurance Co. Ltd. (LFC)

Bacon increased his position by 109.52% in the second quarter and added another 27.27% in the third quarter. The guru holds 0.02% of the Chinese life insurance provider"s outstanding shares. It has a market cap of $119.9 billion and an enterprise value of $117.03 billion.

Vulcan Materials Co. (VMC)

In the second quarter, Bacon boosted his holding by 285.99% and added another 9.04% in the third quarter. The guru holds 0.18% of the company"s outstanding shares. The construction aggregates producer has a market cap of $16.03 billion and an enterprise value of $18.15 billion.

The company"s largest guru shareholder is Loeb with 1.78% of outstanding shares, followed by the T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.98%, Cohen with 0.79% and Lee Ainslie (Trades, Portfolio) with 0.54%.

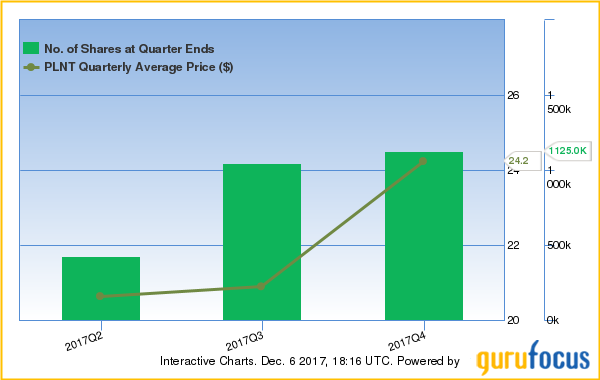

Planet Fitness Inc. (PLNT)

The guru increased his stake by 147.06% in the second quarter and added another 7.14% in the third quarter. He holds 1.14% of outstanding shares. The gym and fitness center operator has a market cap of $3.12 billion and an enterprise value of $3.71 billion.

W ith 2.74% of outstanding shares, Mariko Gordon (Trades, Portfolio) is the company"s largest guru shareholder, followed by Pioneer Investments (Trades, Portfolio) with 0.46%.

T-Mobile US Inc. (TMUS)

Bacon boosted his position by 175% in the second quarter and increased it by 129.09% in the third quarter. The guru holds 0.08% of the company"s outstanding shares. It has a market cap of $50.67 billion and an enterprise value of $78.23 billion.

The largest shareholder among the gurus is John Paulson (Trades, Portfolio) with 0.63% of outstanding shares, followed by Steve Mandel (Trades, Portfolio) with 0.55%, Loeb with 0.46%, Ainslie with 0.2% and Mario Gabelli (Trades, Portfolio) with 0.06%.

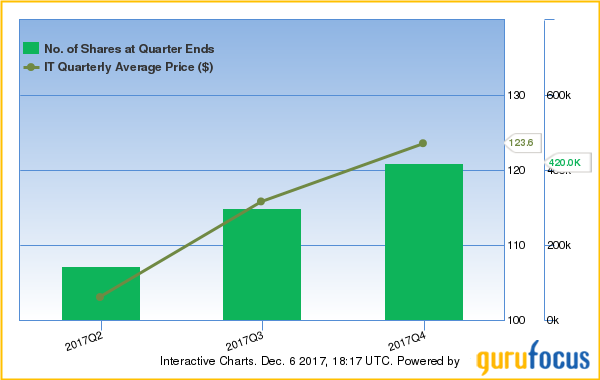

Gartner Inc. (IT)

The guru boosted his holding by 106.09% in the second quarter and by 40% in the third quarter. Bacon holds 0.46% of the information technology research and advisory company"s outstanding shares. It has a market cap of $10.87 billion and an enterprise value of $13.59 billion.

Ron Baron (Trades, Portfolio) is the company"s largest guru shareholder with 7.79% of outstanding shares, followed by Columbia Wanger (Trades, Portfolio) with 0.48%, Chuck Royce (Trades, Portfolio) with 0.28% and Simons with 0.24%.

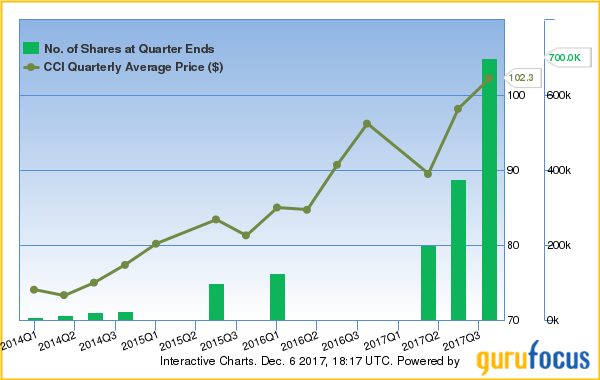

Crown Castle International Corp. (CCI)

In the second quarter, Bacon added 87.50% to his holding and added another 86.67% in the third quarter. The guru holds 0.17% of outstanding shares. The telecom services company has a market cap of $45.73 billion and an enterprise value of $54.21 billion.

With 1.31% of outstanding shares, Bill Gates (Trades, Portfolio) is the company"s largest guru shareholder, followed by Simons with 1.21%, Spiros Segalas (Trades, Portfolio) with 0.83% and Pioneer Investments (Trades, Portfolio) with 0.26%.

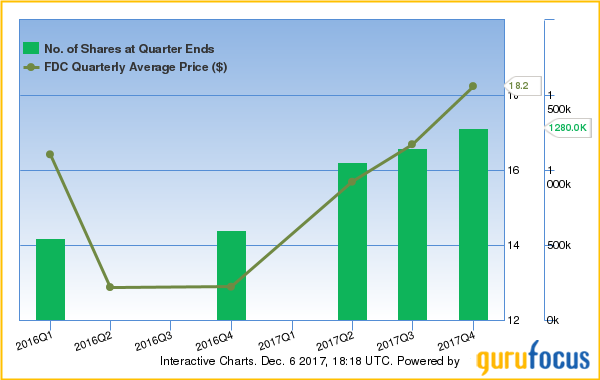

First Data Corp. (FDC)

Bacon added 9.21% to his holding in the second quarter and another 11.30% in the third quarter. He holds 0.14% of the company"s outstanding shares. The e-commerce solutions company has a market cap of $15.04 billion and an enterprise value of $36.06 billion.

Larry Robbins (Trades, Portfolio) is the company"s largest shareholder among the gurus with 1.84% of outstanding shares, followed by Leon Cooperman (Trades, Portfolio) with 0.98%, Cohen with 0.6% and Simons with 0.13%.

Disclosure: I do not own any stocks mentioned in this article.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Sign with HZO. Click here to check it out.

The intrinsic value of GDS