A bevy of proposals on the ballot next month would bring tax relief to Atlanta and Fulton County residents, but could also exacerbate financial inequities and punch holes in city and school district budgets.

If approved by voters on Nov. 6, the measures would create new tax breaks to make up for sharp increases in property values after Fulton County, for years, failed to properly assess the worth of residents' homes.

But the proposals could also raise taxes for some; reduce city and schools’ revenues; and lead to unequal tax burdens, penalizing renters or newer owners while benefiting people who stay in their homes longer, according to experts.

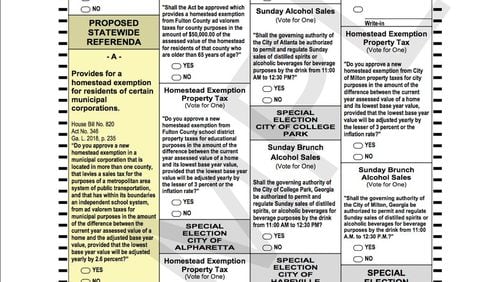

Statewide, residents will vote on a measure to limit property value increases in Atlanta. Voters in five other Fulton cities and the Fulton and Atlanta school districts will weigh in on other tax-relief proposals.

All told, there are eight proposals that could affect property values or taxes for the owners of about 175,000 owner-occupied homes with homestead exemptions in Atlanta, Alpharetta, Johns Creek, Milton, Mountain Park and Roswell as well as residents in the two school districts. While similar, there are some differences.

Residents across Georgia will see an Atlanta-specific proposal on their ballots, though the word “Atlanta” never appears. The city is “a municipal corporation that is located in more than one county, that levies a sales tax for the purposes of a metropolitan area system of public transportation, and that has within its boundaries an independent school system.”

If that measure is approved, taxable values couldn’t go up more than 2.6 percent each year for owner-occupied homes. And residents won’t have to start with 2018 values, which for many people represented a sharp increase from past years. They can use the lowest assessed value from 2016, 2017 or 2018, plus 4.23 percent to account for inflation, to set their new base rate.

Rep. Beth Beskin, R-Atlanta, who proposed the bill, said it is important to provide predictability and stability to homeowners she said are at risk of being taxed out of their homes.

“Sometimes Atlanta needs some help,” Beskin said. “We’ve got to stop making it less and less affordable for people to own homes.”

But Dan Immergluck, a professor of urban studies and real estate at Georgia State University, said the proposal is “extremely inequitable.”

“It’s basically a huge tax cut for folks whose values went up a lot,” he said. “It’s going to benefit people in bigger houses in appreciating places.”

The Atlanta measure would worsen the city’s rental crisis and displace people, Immergluck said. Because only owner-occupied homes would have their taxable value increases limited, apartments or rental homes would bear the full brunt of any value increases and could pay more as tax rates rose.

Immergluck also said the measure could deter people from moving within the metro area, because they would have to start over with a new, higher base every time they purchased a home or substantially renovated their home. Additionally, neighbors in similar homes could pay vastly different property taxes, depending on when they moved in.

“There are much fairer ways to deliver tax relief to low-income homeowners,” Immergluck said.

School tax relief

Another proposal in Atlanta would provide school tax relief for some homeowners but would require owners of lower-value homes to begin paying them.

Residents within the Atlanta school district now are exempt from paying school taxes on the first $30,000 of their home’s assessed value, which is 40 percent of the fair market value.

So a homeowner with a $75,000 home, which is assessed at $30,000, pays no school taxes.

If the ballot question passes, homeowners would pay school taxes on the first $10,000 of assessed value. That would pull in an estimated 16,000 to 18,000 homeowners who previously were not paying school taxes. A resident with a home value of $75,000 would begin paying about $207 in taxes (under the current tax rate).

"We want to make sure that we are all contributing," Sen. Jen Jordan, D-Atlanta, who sponsored the APS tax legislation, said in March.

But others would save money. The measure would increase the exemption from $30,000 to $50,000 in assessed value. So a homeowner with a home valued at $150,000 would see their school taxes decrease by about $415.

The measure would expire after three years.

If approved, APS would lose an estimated $20 million to $25 million in potential tax revenue each of the three years. That rough estimate is based on the number of owner-occupied homes. However, APS would expect to see its revenue from property taxes go up, even if the proposal passes, because the district anticipates the total value of the tax digest to rise.

Residents who live within the Fulton County Schools district and in Alpharetta, Johns Creek, Milton, Mountain Park and Roswell will vote on proposals similar to the city of Atlanta’s.

In each area, taxable property value increases for owner-occupied homes would be capped at 3 percent a year or the federal inflation rate. Fulton County and Sandy Springs already have similar measures.

Like in Atlanta, the base year would be the lowest of 2016, 2017 or 2018. Because Fulton County failed to keep up with rising property values for years, then froze most 2017 residential values at 2016 levels, many 2018 property values are substantially higher. Since Fulton is waiting for final approval of both its 2017 and 2018 tax digests, the actual values aren’t known.

Some homeowners who were properly appraised during the years when Fulton fell behind worry that because many of the ballot measures lower homeowners' base values, they will be stuck with a greater share of the tax burden for decades to come than neighbors who were under-appraised and can use lower values as their base years.

In 2019, the base value for any of the five cities and the Fulton County Schools would be adjusted by the same 4.23 percent inflation rate as in Atlanta.

Immergluck said the impact of those measures would be similar to Atlanta, though areas with fewer rental properties won’t be as hard-hit by the inequity issue.

Ginny Helms, who lives in Roswell, wants property tax relief. But she doesn’t think this is the way to get it. She wants similar houses to be valued equally, and said there’s nothing that would stop governments from raising tax rates to bring in more money even if values are kept low.

“I don’t think it’s a particularly great idea,” Helms said. “I still want it to be fair.”

Dean Heinz, on the other hand, said he’s not concerned about potential issues. Heinz’ property value rose 67 percent this year, and the Johns Creek resident wants some relief.

“I think it’s great,” Heinz said. “You bet I’m going to vote for it.”

The Fulton school board has supported the tax-cap proposal, which would help homeowners, but restrict revenue.

The district expects to receive about $9.4 million less in property tax money next year if the measure is approved. That will contribute to a projected $33 million budget gap, which includes an expected reduction in state funds plus lower collections because of an earlier tax-rate reduction.

The district’s general fund budget this year is about $1.05 billion. The school system would have to balance its budget next year by using fund balance, cutting costs or raising the tax rate, said Chief Financial Officer Robert Morales.

City budgets

The impact on cities’ budgets will vary by their tax base. In a city like Mountain Park, which has little commercial property or rental units, the change would not shift the tax burden. Lourdes Hildoer, an accountant with the city, said if the measure passes and the city needs more money, it is likely officials will increase the tax rate.

That won’t work for all cities, though. Some, like Milton, are limited in how much they can increase their tax rates, said Shannon Ferguson, the city’s spokesperson.

Mike Bodker, the Johns Creek mayor, said residential property taxes are the city’s largest source of revenue. He said he thinks the measure to provide a cap is a good one, but residents should know that if taxes go down, it’s likely services will be cut, too.

“I would hope they understand they can’t have it both ways,” he said.

Tom Harris, Alpharetta’s finance director, said that city’s council supports the proposal. He estimated it would cost Alpharetta $1.4 million, but said the city assumed the measure would pass, and didn’t plan on the money in the budget. He said because Alpharetta has a large commercial base, the city has the opportunity to lean on businesses if it needs money.

In Roswell, finance director Ryan Luckett said the proposal could have a $3 million to $3.5 million budget impact, though new construction could help offset that.

“That’s a substantial chunk of money,” Luckett said. “It will probably make a difference in any new initiative being able to be implemented.”

RELATED