Ryanair and easyJet eye work with rivals

Simply sign up to the European companies myFT Digest -- delivered directly to your inbox.

European passengers flying long-haul to the US or further afield could soon find themselves travelling part of the way on a low-cost airline should Michael O’Leary, Ryanair’s chief executive, get his way.

Europe’s biggest budget airline by revenue has signalled a major shift in strategy by targeting tie-ups with flag carriers under which it would provide them with passengers for their long-haul flights. EasyJet is considering a similar move.

This could see Ryanair and easyJet partner with British Airways or Lufthansa, with passengers initially flying on the budget airlines’ short-haul passenger jets and then transferring on to the flag carriers’ long-range aircraft. Through a single transaction with one airline, someone wishing to go from Lyon to New York might in the future fly from the French city to London’s Heathrow airport with easyJet, and then switch smoothly to BA to travel to the US.

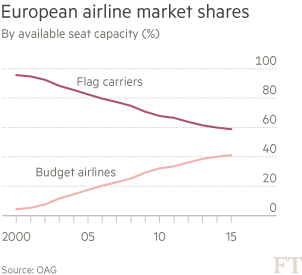

It would be a remarkable turn of events — for the past two decades, Ryanair, easyJet and other budget airlines have engaged in cut-throat competition with flag carriers on European short-haul routes. The likes of BA, Air France and Lufthansa have ceded as much as 40 per cent of the European short-haul market to low-cost carriers offering cheap fares.

Furthermore, the willingness of easyJet and Ryanair to countenance partnerships with flag carriers represents a big change for the budget airlines, which have traditionally shunned the idea of providing so-called feeder traffic to other carriers due to the costs and complexity.

But as Ryanair and easyJet search for further growth in an increasingly mature European market, many industry insiders believe that budget airlines will become feeders for flag carriers’ long-haul routes.

“They all say ‘No we would never have Ryanair feed us’ but in the end they will, simply because we can deliver feed into them at €45 a seat, whereas currently they do it themselves at €150 a seat and are losing money hand over fist,” says Mr O’Leary. Ryanair’s average fare was €56 in the six months to September 30.

The advantage for flag carriers would partly be that, by taking feeder traffic from low-cost airlines, they could more easily fill their long-haul aircraft, and therefore ensure some marginal routes are profitable. Just as importantly, the arrangements would enable the likes of Air France to axe some of their lossmaking short-haul routes, where they struggle to compete with easyJet and Ryanair because of higher operating costs.

In recent years, easyJet and Ryanair have increased the pressure on flag carriers by wooing business passengers with flights to key European hubs such as Charles de Gaulle in Paris and Rome’s Fiumicino. EasyJet has even expressed an interest in flying to Heathrow.

Chris Tarry of Aviation Industry Research and Advisory says low-cost airlines realise that offering feeder traffic to flag carriers is an opportunity for them. “As their own networks get more extensive then the opportunity for them to take passengers to and from another airline’s network increases as well,” he adds.

However, several obstacles stand in the way of budget airlines acting as feeders to European flag carriers.

The biggest hurdle to date has been agreeing which company — the budget airline or the flag carrier — would be liable if flights were delayed and connections missed.

Mr O’Leary is adamant Ryanair would not be responsible for any missed connections or baggage — an issue that has already led to the ending of negotiations between the company and Aer Lingus and Virgin Atlantic. Ryanair is still in discussions with Portugal’s TAP and Norwegian Air Shuttle, which offers cheap transatlantic flights.

Under Ryanair’s feeder proposals, customers would be able to buy their tickets for the two flights — one with the budget airline, the second with the flag carrier — in one transaction from the company operating the long-haul flight. This company would be responsible for looking after their bags and taking responsibility for missed connections.

Analysts say there are other matters that could hinder discussions between budget airlines and flag carriers. For example, John Strickland, analyst at JLS Consulting, says the proposed sharing of revenue between the two sides would be a critical part of negotiations.

Another issue that would need to be resolved is improving services at airports, to ensure that passengers transferring from a short-haul to a long-haul flight would not have to go through immigration again, and that baggage was moved between aircraft remotely.

Will Horton, analyst at Centre for Aviation, agrees. “Lufthansa and others are clearly seeking a solution to lower their costs — but is the price point that works for them also favourable to low-cost carriers?,” he asks. “Is it worthwhile to take on complexity, cost and potentially some loss of agility?”

Carolyn McCall, easyJet’s chief executive, admits no one has yet been able to show how low-cost airlines can provide feeder traffic to flag carriers “simply and easily and make money at the end of it”.

Moreover, some analysts believe that feeder partnerships are not crucial for either Ryanair or easyJet’s growth.

Oliver Sleath, analyst at Barclays, says that in the European short haul market, 85 per cent of passengers are flying point-to-point — people starting and ending their journeys within the EU — while just 15 per cent are travellers connecting to long-haul aircraft.

“Low-cost carriers have taken about 35-40 per cent of the overall market so they could double in size doing just what they do in the point to point market without needing to worry about entering the feeder market,” he adds.

Deals between budget airlines and flag carriers such as Lufthansa and Air France are unlikely to happen in the short term because both are engaged in highly sensitive union negotiations over current cost-cutting initiatives.

But some industry insiders believe agreements could be made with smaller airlines. Mr O’Leary says flagship carriers need to “stop messing around and trying to be low-fares airlines” when they can just work with Ryanair or easyJet. “It just becomes the logical thing for them to do,” he adds.

Comments