5 Guru Stocks Trading Below Peter Lynch Value

- By Tiziano Frateschi

According to the GuruFocus All-in-One Screener, a Premium feature, as of April 12, the following companies are trading below their Peter Lynch fair values with wide margins of safety and have had positive performances over the past 12 months.

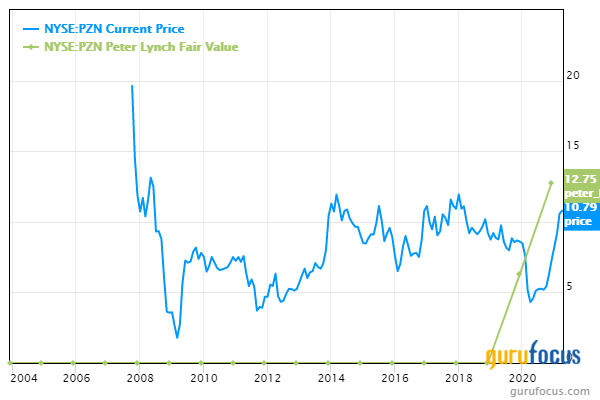

Pzena Investment Management

Pzena Investment Management Inc. (NYSE:PZN) was trading around $10.79 per share as of April 12. The Peter Lynch fair value is $12.75, which suggests the stock is undervalued with a 15% margin of safety. Over the past 12 months, the stock has climbed 139.87%.

The investment management company has a market cap of $783.25 million and an enterprise value of $807.47 million.

The price-earnings ratio is 21.14. The share price is 10.16% below its 52-week high and 180.99% above its 52-week low.

The largest guru shareholder of the company is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 1.35% of outstanding shares, followed by David Nierenberg (Trades, Portfolio) with 0.16% and Mario Gabelli (Trades, Portfolio) with 0.11%.

Pampa Energia

Pampa Energia SA (NYSE:PAM) was trading around $14.42 per share as of Monday. The Peter Lynch fair value is $27.53, which suggests it is undervalued with a 48% margin of safety. The stock has registered a 52-week increase of 38.39%.

The company, which operates in the utilities - regulated industry, has a market cap of $819.06 million and an enterprise value of $2.16 billion.

The stock is trading with a price-earnings ratio of 1.05, which is higher than 68% of companies in the industry. The share price is 5.44% below its 52-week high and 57.77% above its 52-week low.

Howard Marks (Trades, Portfolio) is the company's largest guru shareholder with 1.46% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.09%.

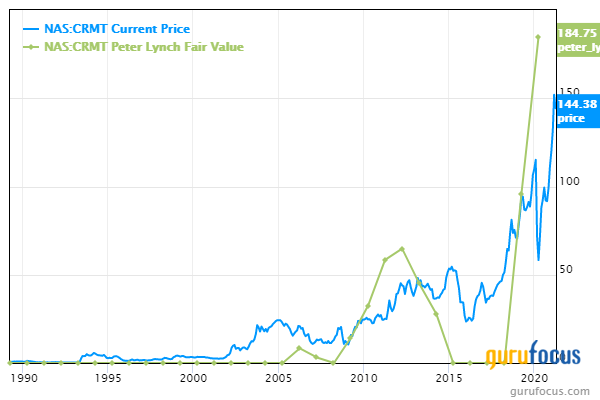

America's Car-Mart

America's Car-Mart Inc. (NASDAQ:CRMT) was trading around $144.38 per share. The Peter Lynch fair value gives the stock a price of $252, which suggests it is undervalued with an 43% margin of safety. Over the past 12 months, the stock has climbed 124%.

The automotive retail company has a market cap of $954.77 million and an enterprise value of $1.23 billion.

The stock is trading with a price-earnings ratio of 14.32, which is higher than 74% of companies in the vehicles and parts industry and is currently 12.50% below its 52-week high and 191.85% above its 52-week low.

The company's largest guru shareholder is Chuck Royce (Trades, Portfolio) with 5.15% of outstanding shares, followed by Paul Tudor Jones (Trades, Portfolio) with 0.06%.

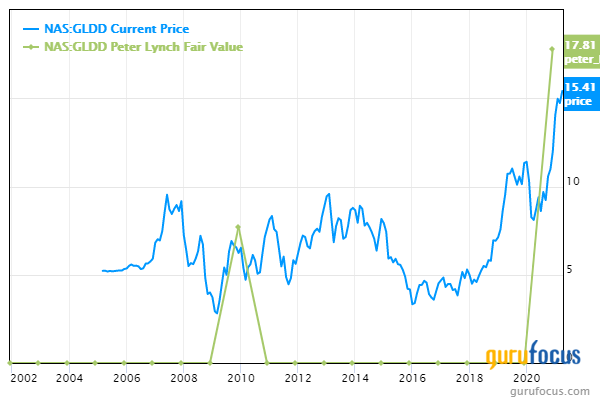

Great Lakes Dredge & Dock

Great Lakes Dredge & Dock Corp. (NASDAQ:GLDD) was trading around $15.41 per share as of Monday. The Peter Lynch fair value is $17.81, which suggests the company is undervalued with a 13% margin of safety. Over the past 52 weeks, the stock has increased 76.11%.

The U.S. company, which provides dredging services, has a market cap of $1.01 billion and an enterprise value of $1.18 billion.

The stock is trading with a price-earnings ratio of 15.26, which is higher than 51% of companies in the construction industry. The price is currently 4.40% below its 52-week high and 107.68% above its 52-week low.

Simons' firm is the company's largest guru shareholder with 3.58% of outstanding shares, followed by Royce with 2.03% and Hotchkis & Wiley with 0.67%.

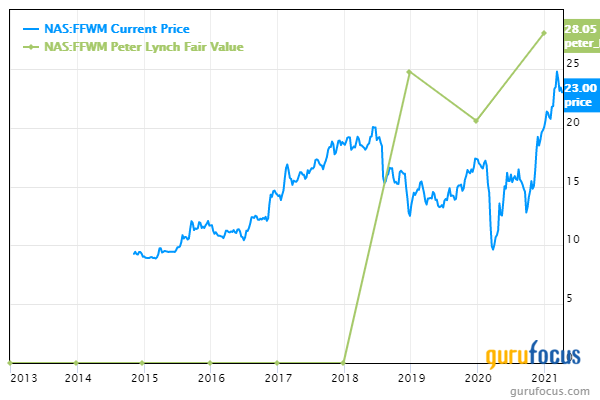

First Foundation

First Foundation Inc. (NASDAQ:FFWM) was trading around $23 per share as of Monday. The Peter Lynch fair value gives the stock a price of $28.5, which suggests it is undervalued with an 18% margin of safety. Over the past 12 months, the stock has climbed 102.26%.

The company, which provides personalized financial services, has a market cap of $1.03 billion and an enterprise value of $666.70 million.

The stock is trading with a price-earnings ratio of 12.23, which is higher than 56% of companies in the banks industry. The share price is currently 10.12% below its 52-week high and 102.26% above its 52-week low.

Royce is the company's largest guru shareholder with 0.53% of outstanding shares, followed by Jeremy Grantham (Trades, Portfolio) with 0.10%.

Disclosure: I do not own any stocks mentioned in this article.

Read more here:

5 Financial Companies Boosting Book Value

5 Guru Stocks Predicted to Boost Earnings

5 Stocks Paying High Dividend Yields

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.