It’s been a difficult year for investors. Recession doomsayers abound, inflation has proven sticky in the land down under, and high interest rates have applied extra layers of pressure to an economy attempting to walk a tightrope.

The tech sector has been on a strong upward trajectory this year despite all of that, up 12.6% in the March quarter.

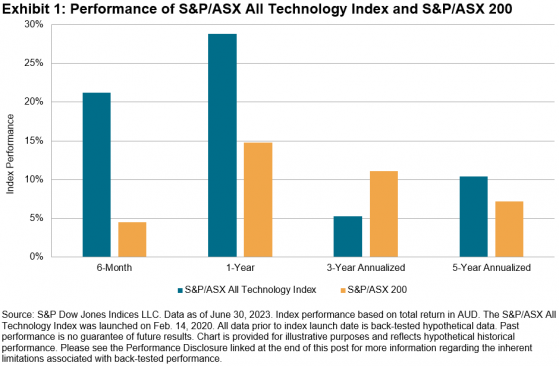

While the S&P ASX All Technology (XTX) index has taken some damage in the last few months, shedding 3.05% in the last 30 days alone, it’s still up 7.2% for the last six months and an impressive 22.2% for the year to date.

It’s also consistently outperformed the broader ASX200 index over most comparable time periods.

Overall, the market capitalisation for the full XTX index sits at about $195 billion, averaging about $425 million in daily traded value.

(Source: ASX)

Small caps making moves this quarter

ArchTIS

ArchTIS Ltd made strong financial progress with its data-centric software solutions this quarter, enjoying a 140% surge in revenue compared to the Prior Comparative Period (PCP).

The uptick was driven by a 60% increase in licensing revenue and an impressive 239% rise in services revenue. Customer cash receipts also reached a record $4.8 million.

In a determined push towards fiscal prudence, archTIS reported a reduction in net quarterly cash usage to $200,000, alongside a 40% cut in operating expenses, the result of cost management and a strategic approach to achieving a cash flow positive position.

The company’s big win for the quarter was the successful launch of their product, Kojensi, into the UK market, which was unveiled in partnership with Fujitsu at the UK Defence and Security Equipment International conference.

The move opens up new partner channels during significant shifts in global defence alliances, particularly AUKUS.

AR9 received several awards this quarter, including the 2023 Australian Cyber Business of the Year, the 2023 Policy Management Solution of the Year, and the most inclusive information security company on the Australian Securities Exchange (ASX) for having women represented at every level of the company’s leadership team.

RemSense

RemSense Technologies Ltd (ASX:REM) delivered several key project and strategic wins this quarter, chief among them being the deployment of its virtualplant technology for Chevron (NYSE:CVX), capturing intricate details of the Gorgon LNG Train 3 and Jansz-Io MEG regeneration inlet.

A similar success was mirrored with Woodside's Ngujima-Yin FPSO vessel.

In collaboration with Programmed and Qteq, RemSense conducted virtualplant trials for utility facilities, including in Southeast Queensland for flood monitoring applications.

The quarter also saw RemSense expanding its drone service capabilities, undertaking high-resolution data capture for canola crop germination, traffic monitoring for Western Australia’s Main Roads, bushfire mitigation strategies, development of a drone magnetometer suspension system, and water sampling for BHP (ASX:BHP).

Further, RemSense advanced virtualplant integration with IBM (NYSE:IBM) Maximo and enhanced its Asset Audit AI technology for interoperability with Enterprise Asset Management systems like SAP.

The company’s technology roadmap has been updated to include features such as data security, maintenance planning, and asset defect detection.

On the financial front, RemSense is actively seeking capital raising opportunities and considering restructuring to support short-term funding and future growth, alongside securing a research and development rebate advance of A$198,080 from Radium Capital.

SensOre

Sensore Ltd lifted its quarterly invoicing to $1.4 million, a 71% increase from the company’s September 2022 numbers of A$760,000, underpinned by strong sales and grants.

The company made several strides in software and service delivery, including completing phases two and three of the Barton Gold Central Gawler Project and forming contracts with major international Oil and Gas firms for its Cauchy geophysics services.

S3N was actively exploring this quarter, with the Abbott’s North AI target revealing lithium grades as high as 1.25%.

SensOre is engaging in strategic talks to unlock value from its early-stage lithium assets, although its Total Contract Value (TCV) noted a 25% decline to $2.35 million due to the completion of several substantial contracts.

CEO Richard Taylor highlighted the promising outcomes from the lithium targeting partnership with Deutsche Rohstoff, emphasising the discovery of a new lithium-rich pegmatite system by SensOre's technology.

Taylor noted the seasonal nature of revenue streams and confirmed cost reduction measures to enhance year-round cash availability. The cash balance stood at about $1 million as of September 30, 2023.

Synertec Corporation

Synertec Corporation Ltd (ASX:SOP) achieved about a 10% uptick in revenue compared to the PCP, with figures falling somewhere betweeb $4.2 million to $4.6 million.

The increase in revenue comes from the company's shift from fixed-price contracts in engineering, coupled with ongoing cost control and productivity improvements, resulting in strong gross margins.

Operationally, the company's Powerhouse units have demonstrated superior performance against traditional diesel, gas and hybrid systems.

Following the close of the quarter, Santos indicated intentions to acquire an additional two Powerhouse systems for delivery in FY24.

The Engineering Division's continued contract wins contribute to an expanding work backlog, offering a strong outlook for sustained growth and technological advancement.

The company's commitment to high standards is underscored by its achievement of ISO27001 Information Security Management System certification.

Moreover, the company formed a new exclusive partnership with Siemens to supply control systems for the water industry.

The group's financial health is solid, with a net cash position of around $7 million as of September 30, inclusive of close to $2 million invested in inventory for future Powerhouse assemblies.

Spenda

Spenda Ltd (ASX:SPX) achieved a 37% increase in payments volume quarter-on-quarter, reaching $61.8 million in Q1 FY24 from $44.9 million in Q4 FY23.

Higher transaction volumes from the Carpet Court network were the core drivers following a successful integration with Spenda’s payment system.

The company now has a five-year contract with Carpet Court, offering a sizable growth opportunity as Spenda will now implement its payment infrastructure across Carpet Court's 205 franchise stores.

Post-quarter developments in October 2023 included commercial contracts with Capricorn and AgriChain.

The AgriChain collaboration marks Spenda’s first foray into the agriculture sector, initially focusing on grain growers with the potential to broaden into other markets.

The company reported a peak loan book value of $15 million during the quarter, with an additional $1 million drawn and a slight rise in average portfolio yield to 21.2%.

Cash receipts from customers in Q1 FY24 amounted to $749,000, which, despite being a record in the previous quarter due to a significant one-off implementation fee, still represents a steady inflow from software, payments, and lending services.

As of September 30, Spenda maintains a robust cash balance of $6.9 million.