A new report by Equifax Canada indicates insolvencies are rising in the country amid mounting financial stress on Canadian businesses.

And the Canada Emergency Business Account (CEBA) loan repayment has added to that financial burden.

“Canadian businesses are facing a perfect storm of economic pressures,” said Jeff Brown, Head of Commercial Solutions for Equifax Canada. “The end of the initial grace period for CEBA loans, combined with high input costs, labour expenses, a slowdown in consumer spending and high interest rates, is creating a challenging environment.

“These factors are contributing to a growing trend of business failures. The sharp rise in insolvencies, representing a 30.3 per cent surge since 2019, underscores the financial pressures faced by businesses. There is a need to manage debt and adapt to changing market conditions through strategic financial planning and proactive measures.”

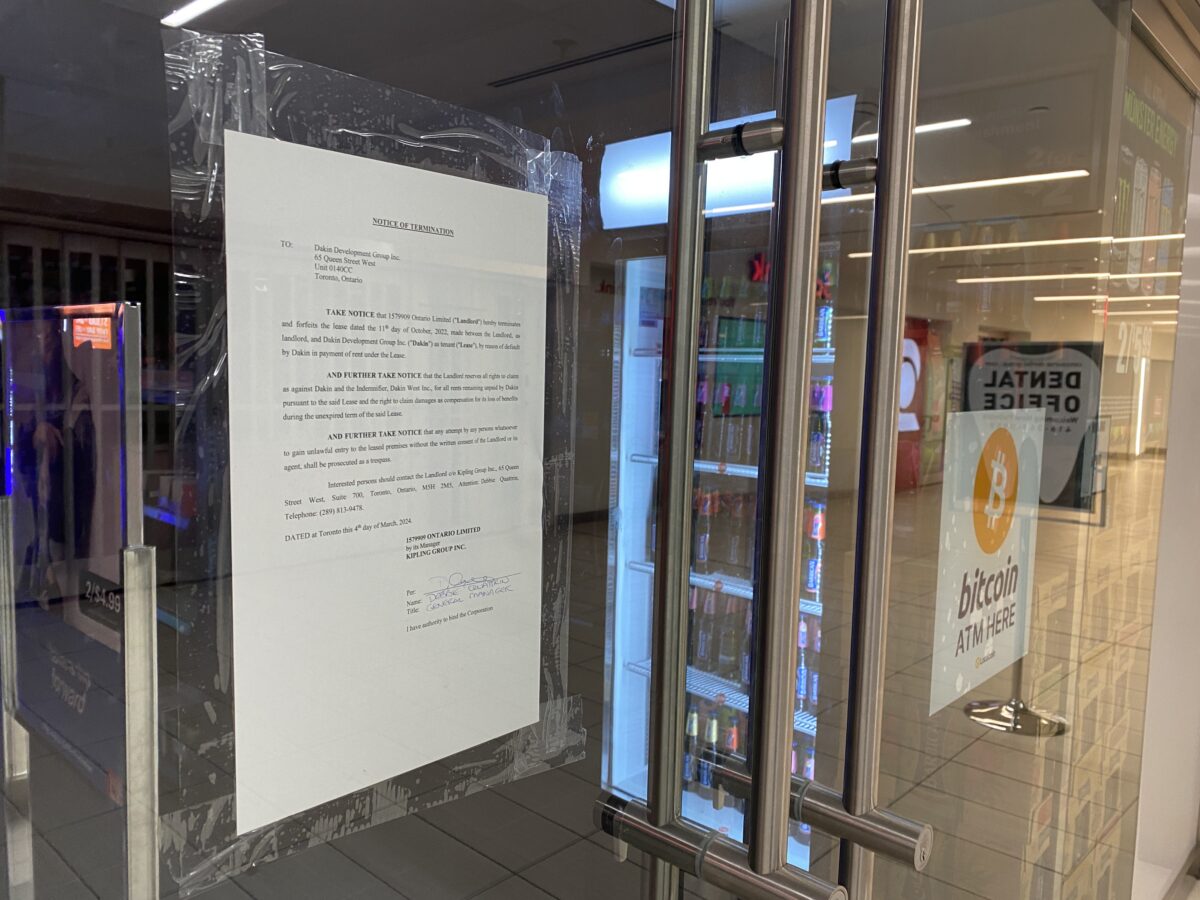

With the deadline for CEBA loan repayments now passed, many businesses find themselves navigating the financial strain of monthly payments accompanied by a higher interest rate — a stark contrast to the initial terms of interest-free and no monthly payments. On January 19, 2024, CEBA loans converted to a three-year term loan with five per cent interest payable per year.

“Over the shoulders of a lot of small businesses right now is the CEBA loans and the repayment of them. It was comforting to see a lot of small businesses stepped up and repaid that loan,” he said. But many of them had to take on another loan to pay for that loan.

“But really what’s happening behind the scenes is almost the equivalent of a small business taking on a net new car loan for a car they don’t get to drive so it’s just something that’s just adding onto their shoulders of how they operate moving forward and really when we think about this we always say the adage you’ve got to spend money to make money but you have less access to capital because you’re already paying something else off. There’s less of the ability for them to spend money to grow their businesses and support their businesses moving forward.”

Some key findings from Equifax Canada’s Market Pulse Quarterly Business Credit Trends Report:

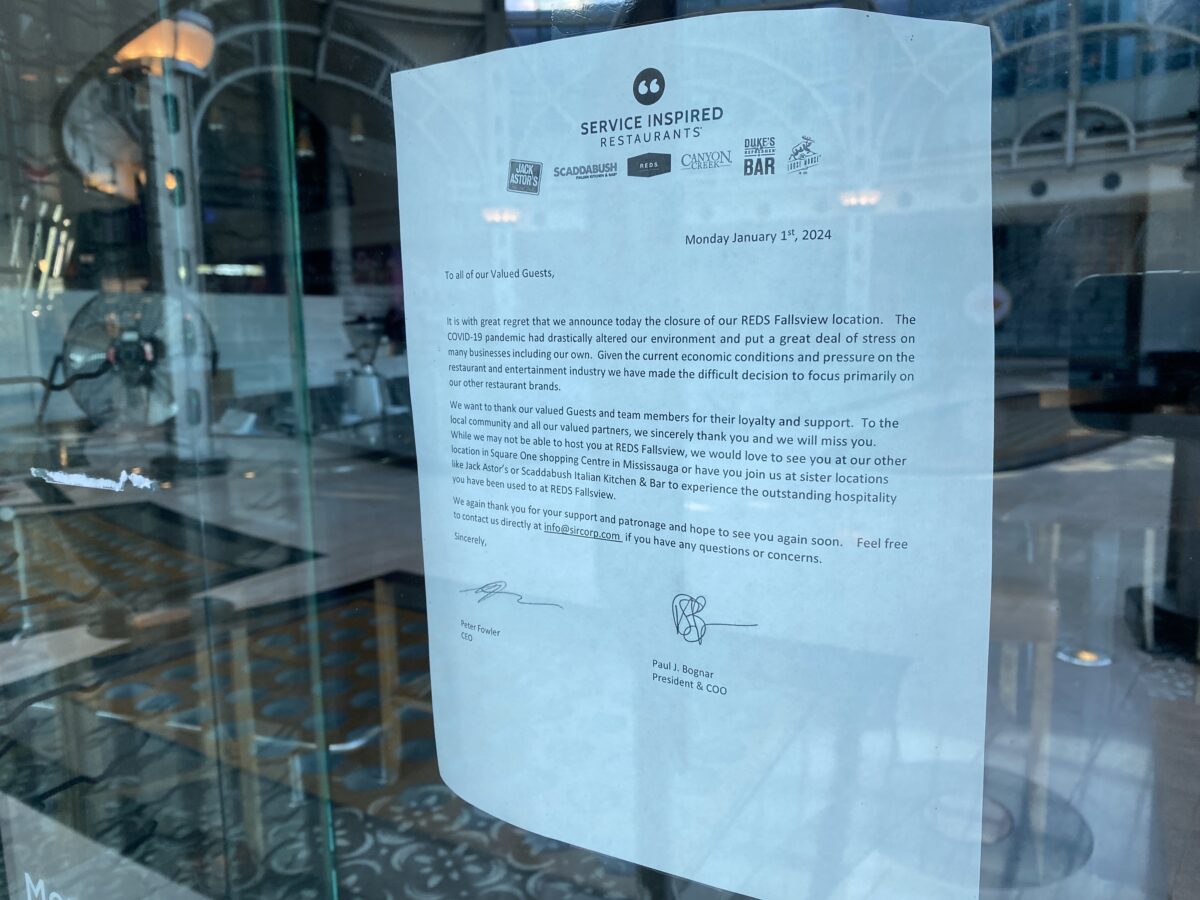

- Many Canadian businesses are facing an uphill battle, as evidenced by a 41.4 per cent surge in business insolvencies in 2023 when compared to 2022;

- A 14.3 per cent uptick in the number of businesses that missed a payment on a credit product (Q4 2023 vs. Q4 2022);

- Delinquencies across business credit accounts continued to rise, with industrial and financial trades experiencing increases in account-level delinquencies. In Q4 2023, industrial trades experienced an 8.8 per cent increase in 30+ day account-level delinquencies, reaching 11.2 per cent. Financial trades saw a 3.1 per cent increase to 3.3 per cent;

- Installment loan delinquencies reported a significant surge, with early-stage delinquencies up by 12.5 per cent and late-stage delinquencies up by 16.3 per cent year-over-year, suggesting that businesses are struggling with monthly loan payments. Revolving credit (cards and line of credit) delinquencies of 30+ days grew by 1.3 per cent year over year, reaching 3.2 per cent in Q4 2023. Real estate, rental, leasing, and retail trades also witnessed substantial increases in missed payments;

- The provinces with the highest financial trade delinquency rates are Alberta (3%), Ontario (2.9%) and Quebec (2.6%), with Quebec also having experienced the largest uptick year over year from 2.4 per cent to 2.6 per cent in severe (90+ days) delinquency rate; and

- Reported outstanding balances from financial trades continued to rise, reaching $31.8 billion in Q4 2023, and marking a 7.4 per cent annual increase driven primarily by a 15.3 per cent increase in credit card balance.

“We’re seeing the struggles all over the place right now,” said Brown. “There’s obligations with suppliers across the board. Delinquency rates are increasing. So 8.8 per cent with suppliers. Then we’re seeing it grow even more with financial institutions. The percentage of businesses that are 30 days plus overdue shot up 11.2 per cent this past quarter. It means even with the debt that they’ve taken on it looks like it’s becoming a bit more mounting for them to be able to pay even their basic obligations right now. So it’s very challenging.

“Obviously it’s going to vary by sector.”

Despite a slowdown in inflationary pressure, new credit growth remains subdued, with high interest rates and tighter lending criteria constraining lending activities, said Equifax. This is evidenced by a notable decline in new originations for both financial (-24.4%) and industrial trades (-15.3%) compared to the previous year. However, despite reduced lending activity, the demand for credit among businesses remains robust, as reflected in a 5.5 per cent increase in credit inquiries.

“The demand for new credit may point to signs of growth and expansion as Q4 2023 saw a 21.9 per cent rise in establishment of new businesses when compared to the same time period in 2022,” said Brown.

“We haven’t seen growth (in insolvencies) this large over the past 10 years . . . With this mounting debt and delinquencies increasing we’re not really seeing any signs of why those insolvency numbers shouldn’t continue to climb.”

![Miele Expanding Canadian Footprint with Retail Space at CF Sherway Gardens in Toronto [Interview]](https://retailinsider.b-cdn.net/wp-content/uploads/2024/04/IMG_2779-324x160.jpg)

![Home Société Group Expands Ontario Footprint with Opening of 1st Standalone MUST Stores in Toronto and Mississauga [Interview/Photos]](https://retailinsider.b-cdn.net/wp-content/uploads/2024/04/IMG_1210-324x160.jpg)