- Bitcoin price continues its late New York session rally in the early Asian session, posting a 1.17% gain.

- While the short-term outlook might seem bullish, a few signs suggest a looming bearish outlook.

- BTC could trigger a steep correction around the halving event and resume the uptrend thereafter.

Bitcoin’s (BTC) directional bias has been unclear lately after its dip below $70,000. This development has split the community into bulls - expecting a resumption of the uptrend, and bears - looking for signs of a reversal.

Also read: Two theories why GBTC sticks to high fees despite bleeding billions

Bitcoin price action reveals telltale signs of correction

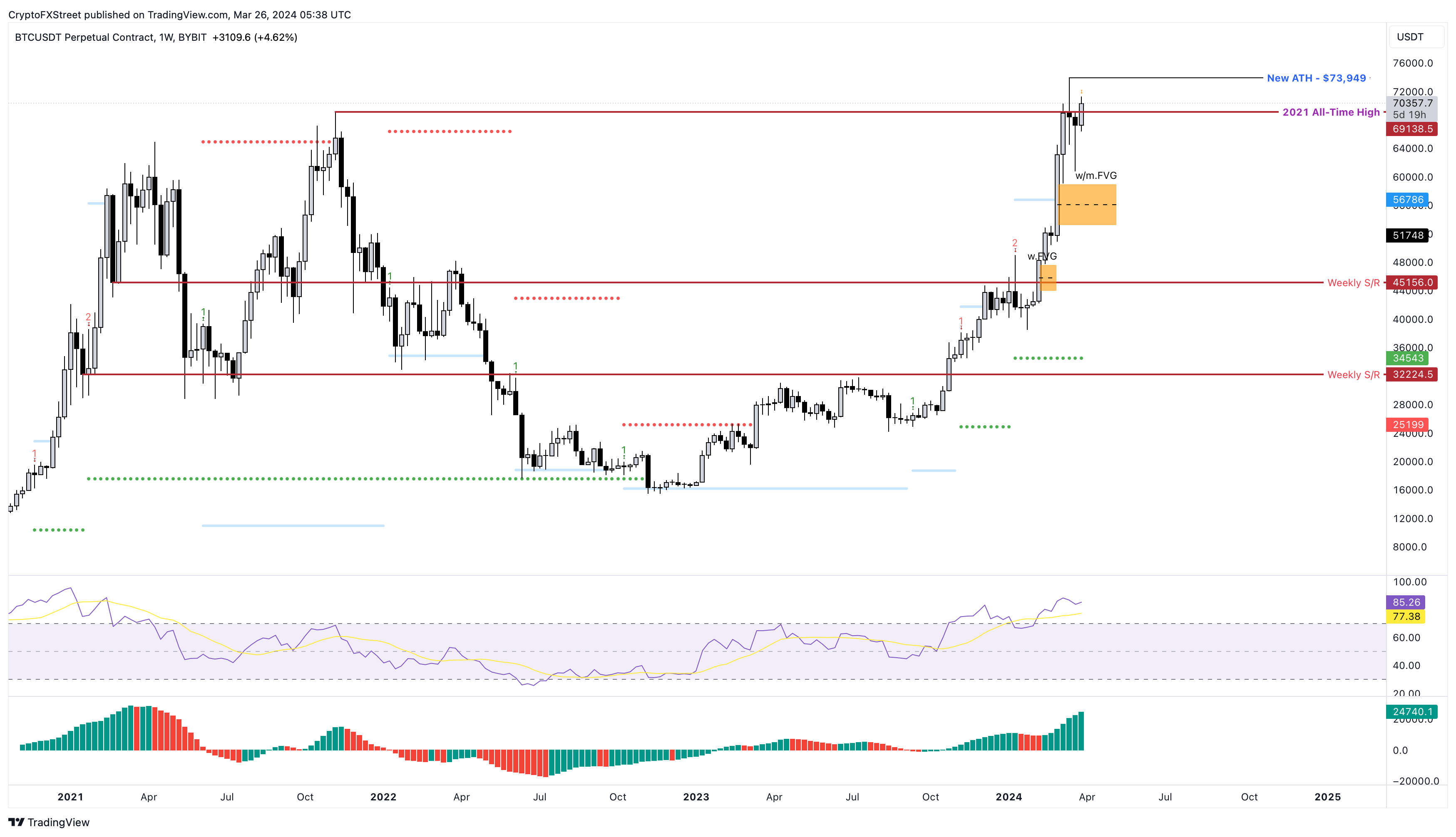

Bitcoin price set up a bearish swing failure pattern (SFP) in the second week of March, signaling a waning bullish momentum. While this sell signal resulted in an 11% correction the following week, BTC’s recovery rally does not seem to have the oomph required to sustain.

Bitcoin’s sell signal on the weekly was noted in a previous publication after it set up a bearish SFP. Our previous article also forecasted the recovery from this crash and how ETF flows could be influencing the price and how this short-term correction could be followed by a bounce that pushes BTC to sweep the current all-time high (ATH) of $73,949 or set up a new one at $75,000.

So far, the pioneer crypto is bouncing right on cue, and this move’s strength will be tested near the ATH, which will decide if the run-up is a dead cat bounce or a continuation of the uptrend.

Here are two reasons that support a dead cat bounce:

- Pre-halving ATH: As noted in our article, Bitcoin price setting up an ATH before the halving is a one-of-a-kind event. Glassnode’s report suggests that this development, backed by the buying pressure after ETF approval, could lead to a sell-off. The report suggests that halving could turn out to be an immediate sell-the-new event and that the declining ETF flows could be a factor.

Read more: Inflows from Bitcoin ETFs may weaken halving effect, says Glassnode amid price correction - Declining CME OI: This outlook does not give ETF flows the weighting as seen in the above point. Instead, it focuses mostly on the Chicago Mercantile Exchange’s (CME) Open Interest (OI) for Bitcoin futures. This metric has declined nearly 6% from 170.44k BTC on March 20 to 160.36k BTC on March 25.

The uptrend in Bitcoin price so far was not mainly due to Bitcoin spot ETF flows but rather the traditional finance BTC buyers via CME futures. If the ETF flows start to decline, falling in line with the bearish BTC CME futures OI, it could trigger a correction in Bitcoin price as well.

The bearish theories noted above hint at a potential correction in Bitcoin price and that the ongoing recovery rally could be a deception, aka a dead cat bounce. Let’s examine the on-chain metrics to determine if that is possible.

BTC on-chain metrics flash pessimistic outlook

The key BTC on-chain metrics suggest a bearish outlook. The active addresses, social dominance, and transaction volume are all sliding lower despite the bullish start of the week, indicating a waning bullish momentum. This non-conformity indicates a bearish divergence, suggesting a potential correction that falls in line with the dead cat bounce scenario noted above.

BTC active addresses, social dominance, and transaction volume

How low can BTC go?

Assuming the ongoing rally leads to a correction, here are two key support or accumulation zones where investors can consider re-entering the markets.

- The weekly imbalance, extending from $59,111 to $53,120.

- The $45,156 weekly support level, which also harbors the imbalance, stretching from $47,712 to $43,890.

BTC/USDT 1-week chart

While the declining CME BTC futures OI might be concerning, if it improves, Bitcoin price could continue its ascent above $70,000. In a highly bullish outlook, BTC could eye a retest of a new ATH at $75,000, but if the pioneer crypto forms a base around this level, chances of continuing the uptrend are high. This development will invalidate the short-term correction thesis for Bitcoin and forecast an extension of the bull run to the next psychological level of $80,000.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

TRON gains 10% in 2024, supply of stablecoins reaches over $50 billion in Q1

TRON, a blockchain-based digital platform, has seen positive growth in the first quarter of 2024, as seen in a Messari report. TRON noted gains across several metrics like market capitalization, revenue and total value locked.

XRP hovers near $0.50 as Ripple CTO addresses concerns related to stablecoin launch

XRP is hovering near $0.53 on Friday, spending nearly all week below $0.55. Ripple CTO David Schwartz addressed concerns on stablecoin and XRP utility on Thursday.

Terraform Labs set to restrict access for users in the US after recent ruling in SEC lawsuit

Blockchain company Terraform Labs said Thursday that it will restrict access to some of its products and services for US-based users as it expects to receive a court order soon in light of its legal battle against the US Securities and Exchange Commission (SEC).

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

%20[10.50.28,%2026%20Mar,%202024]-638470317209976936.png)