-

On Friday, leading crypto options exchange Deribit will settle bitcoin and ether options contracts worth $9.5 billion and $5.7 billion, respectively.

-

Deribit’s Luuk Strijers told CoinDesk that many options are set to expire in-the-money (ITM), which could inject upward pressure or volatility into the market.

-

Dealer hedging could also breed volatility around $70,000, FRNT’s David Brickell said.

The impending quarterly expiry of Bitcoin (BTC) and Ether {{ETH} options contracts worth several billion dollars could breed bullish price volatility, according to observers.

On Friday at 08:00 UTC, Deribit, the world’s leading cryptocurrency options exchange, will settle quarterly contracts worth $15.2 billion. Bitcoin options account for $9.5 billion or 62% of the total notional open interest due for settlement, while ether options comprise the rest.

The $15 billion expiry is one of the largest in the exchange’s history, Deribit data show. The expiry will wipe out 40% and 43% of Bitcoin and Ether’s total notional open interest across maturities.

Notional open interest refers to the dollar value of the number of active contracts at a given time. On Deribit, one options contract represents one BTC and one ETH. The exchange accounts for over 85% of the global crypto options market. A call option is a type of financial contract that gives the buyer the right, but not the obligation, to purchase an underlying asset at a preset price at a later date. A put gives the right to sell.

Luuk Strijers, chief commercial officer at Deribit, said large amounts of options are set to expire in-the-money (ITM), which could inject upward pressure or volatility into the market.

A call option expiring ITM has a strike price lower than the underlying asset’s going market rate. On expiry, the ITM call gives the purchaser the right to buy 1 BTC at the strike price (which is lower than the spot market rate), generating a profit. A put option expiring ITM has a strike price higher than the underlying asset’s going market rate.

At the going market rate of around $70,000, bitcoin options worth $3.9 billion are set to expire in the money. That’s 41% of the total quarterly open interest of $9.5 billion due for settlement. Similarly, 15% of ETH’s total quarterly open interest of $5.7 billion is on track to expire in the money, as data from Deribit shows.

“These levels are higher than usual, which can also be seen in the low max pain levels. The reason is, of course, the recent price rally. Higher levels of ITM expiries might lead to potential upward pressure or volatility in the underlying,” Strijers told CoinDesk.

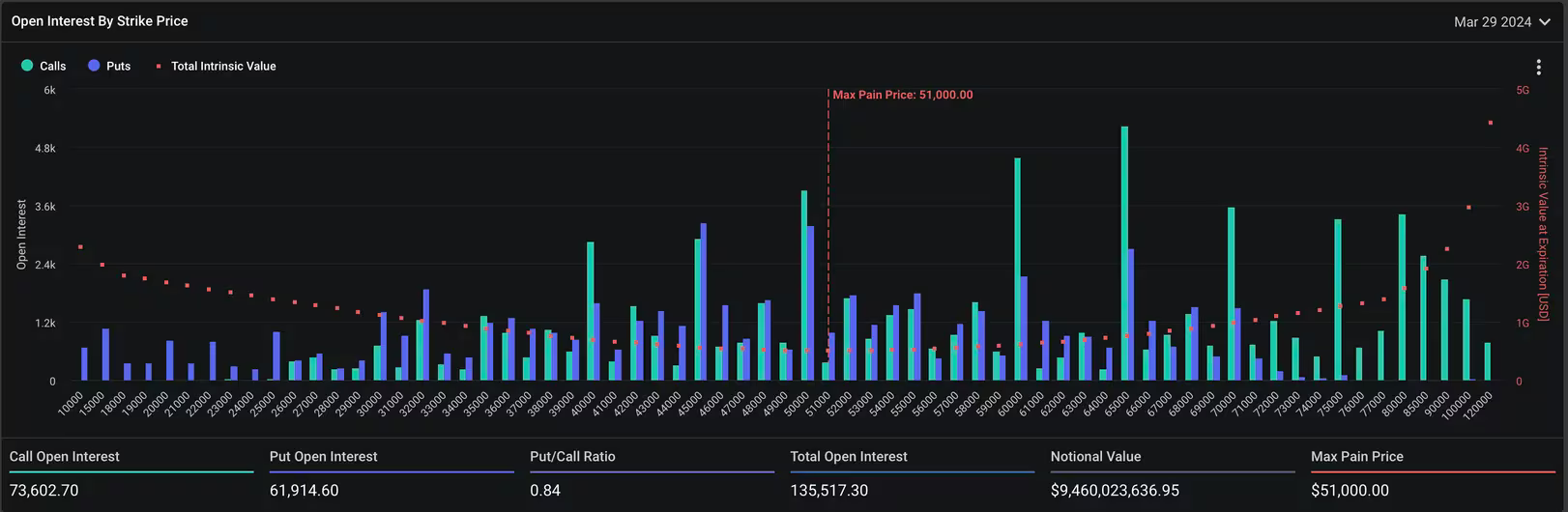

Bitcoin options: open interest by strike price (March 29 expiry). (Deribit) (Deribit)

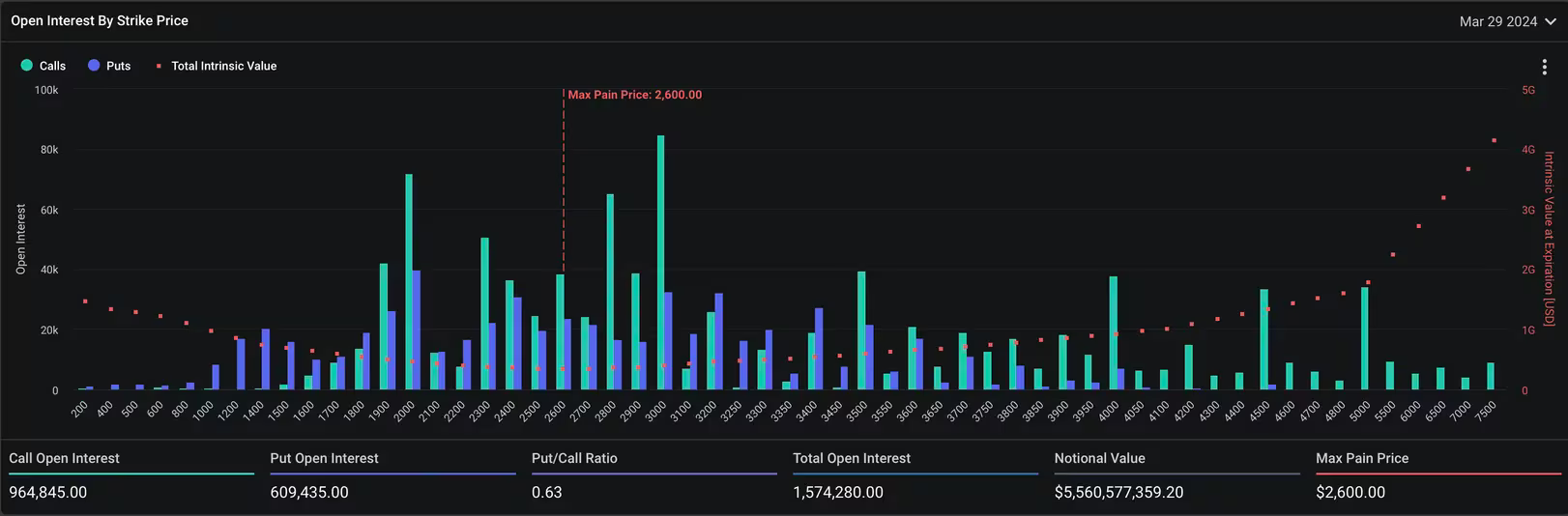

The maximum pain points for BTC and ETH's quarterly expiry are $50,000 and $2,600, respectively. The max pain is when option buyers stand to lose the most money. The theory is that option sellers (writers), usually institutions or traders with ample capital supply, look to pin prices near the maximum pain point to inflict maximum loss on option buyers.

During the last bull market, bitcoin and ether consistently corrected lower in the direction of their respective max pain points only to resume the rally after the expiry.

Similar dynamics could be at play, according to Strijers.

“The market could see upward pressure as the expiry removes the lower max pain magnet,” Strijers explained.

ETH options: open interest by strike price. (March 29 expiry). (Deribit) (Deribit)

Dealer hedging

David Brickell, head of international distribution at Toronto-based crypto platform FRNT Financial, said hedging activities of dealers or market makers could boost volatility.

“The big impact, however, is [from] the gamma positioning of dealers into the event. Dealers are short some $50 million of gamma, with the majority focused at around the $70,000 strike. As we near the expiry, that gamma position gets larger and the forced hedging will exacerbate volatility around $70,000, providing for some whippy, choppy moves either side of the said level,” Brickell told CoinDesk.

Gamma measures the movement of Delta, which gauges the option’s sensitivity to changes in the underlying asset’s price. In other words, gamma shows the amount of delta-hedging market makers need to do to keep their net exposure neutral as prices move. Market makers must maintain a market-neutral exposure while creating liquidity in order books and profiting from the bid-ask spread.

When market makers are short gamma or holding short options positions, they buy high and sell low to hedge their books, potentially amplifying the price.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

TRON gains 10% in 2024, supply of stablecoins reaches over $50 billion in Q1

TRON, a blockchain-based digital platform, has seen positive growth in the first quarter of 2024, as seen in a Messari report. TRON noted gains across several metrics like market capitalization, revenue and total value locked.

XRP hovers near $0.50 as Ripple CTO addresses concerns related to stablecoin launch

XRP is hovering near $0.53 on Friday, spending nearly all week below $0.55. Ripple CTO David Schwartz addressed concerns on stablecoin and XRP utility on Thursday.

Terraform Labs set to restrict access for users in the US after recent ruling in SEC lawsuit

Blockchain company Terraform Labs said Thursday that it will restrict access to some of its products and services for US-based users as it expects to receive a court order soon in light of its legal battle against the US Securities and Exchange Commission (SEC).

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.