AI

AI

AI

AI

AI

AI

CoreWeave Inc. is holding talks about a new funding round that could value it at $16 billion, Bloomberg reported today.

That sum is more than double what the company was worth in December and would represent an eightfold increase over its April valuation. Bloomberg’s sources didn’t specify how much capital CoreWeave could raise or from whom. But they did reveal that the company plans to offer both new and existing shares, which means investors will have an opportunity to sell their stakes.

Roseland, New Jersey-based CoreWeave launched in 2017 as a cryptocurrency mine operator. It used Nvidia Corp. graphics processing units to mint Ethereum. A few years later, it shifted to renting those GPUs to developers building artificial intelligence models.

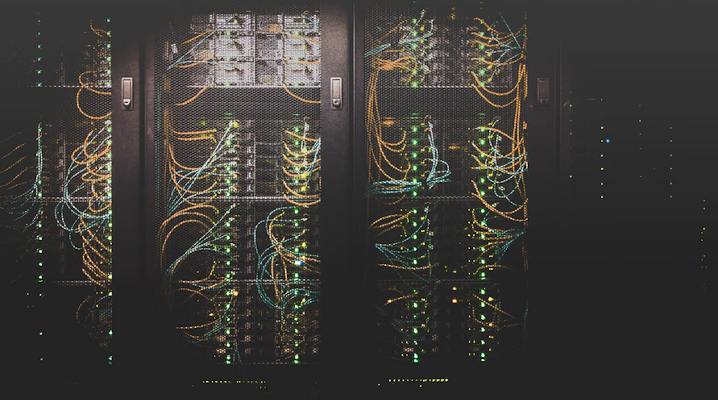

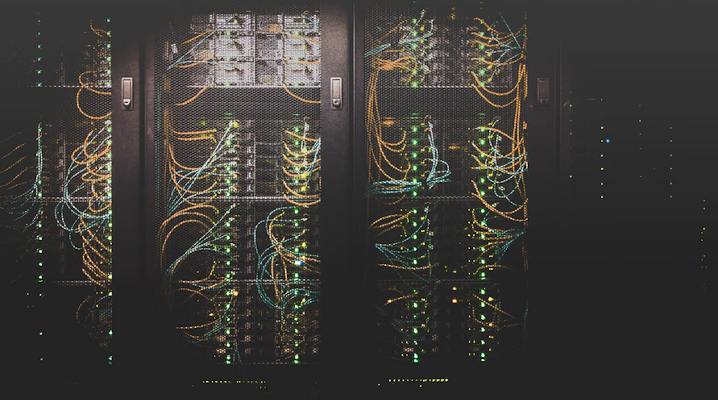

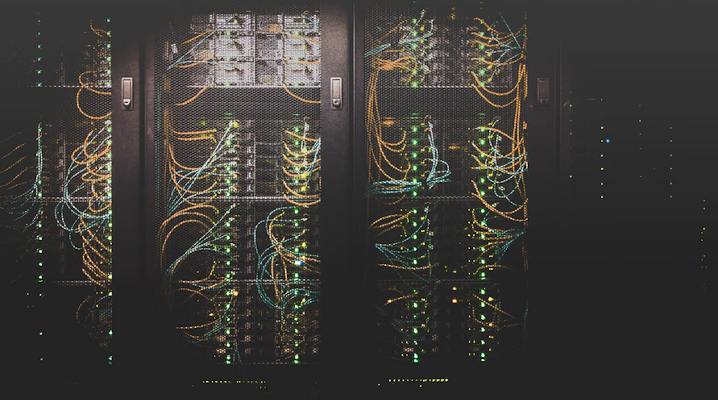

The company operates a cloud platform optimized specifically for AI workloads. According to the company, customers can choose from about a dozen different Nvidia chips. The most powerful instance configuration on offer combines eight high-end H100 graphics cards, which reportedly cost up to $40,000 apiece, with a pair of Intel Corp. central processing units and 2 terabytes of RAM.

CoreWeave also provides access to other types of hardware besides GPU servers. It offers several instances that only include CPUs and are geared toward general-purpose workloads rather than AI models. Additionally, it provides bare-metal servers for applications that can’t be easily packaged into software containers.

Customers can store their workloads’ data in a storage service that includes a so-called triple replication feature. CoreWeave spreads copies of each customer record across multiple server racks, as well as several machines within those racks. This arrangement ensures that the data remains available if one of the servers goes offline.

Under the hood, the platform is powered by Kubernetes. It uses a network with a built-in load balancer to move data between customers’ GPU instances, as well as from those instances to services deployed on external infrastructure. The load balancer evenly distributes incoming traffic among a company’s GPU instances to optimize performance.

At the start of 2023, CoreWeave hosted its cloud platform in two data centers. The company raised $221 million in April of that year and went on to build a dozen additional cloud facilities. Last December, it sold another $642 million worth of share to an investor consortium that included Fidelity Management and JPMorgan Asset Management.

The additional funding could enable the company to further expand its data center network. All 14 of the cloud facilities it currently operates are in North America. Using a fresh capital infusion, CoreWeave could establish data centers in more regions to expand its addressable market.

The company would likely also use any new funding it raises to procure Nvidia’s latest Blackwell B200 graphics card. It’s estimated that the chip provides five times the performance of the H100, the most advanced Nvidia graphics card that CoreWeave currently offers. Its competitors in the AI infrastructure market, such as newly funded startup Together Computer Inc., are also likely to adopt the chip.

THANK YOU