With the Bitcoin halving event just a month away, the cryptocurrency market is witnessing a flurry of activity that could shape its trajectory for months to come.

Key industry figures have begun sounding alarms over recent trends that signal a possible shift in the market dynamics.

Why the Bitcoin Halving in 1 Month is a Big Deal

The Bitcoin halving is a significant event coded into the Bitcoin protocol that occurs approximately every four years or after every 210,000 blocks are mined. During this event, the reward for mining new blocks is halved, meaning that Bitcoin miners receive 50% less BTC for verifying transactions and adding them to the blockchain.

When Bitcoin was first created by Satoshi Nakamoto in 2009, the block reward was 50 BTC. The first halving in 2012 reduced the reward to 25 BTC, the second halving in 2016 brought it down to 12.5 BTC, and the most recent halving in 2020 decreased the reward to 6.25 BTC.

Likewise, the 2024 Bitcoin halving is anticipated to follow the same fundamental principles as previous halvings, with the mining reward halved to 3.125 BTC per block.

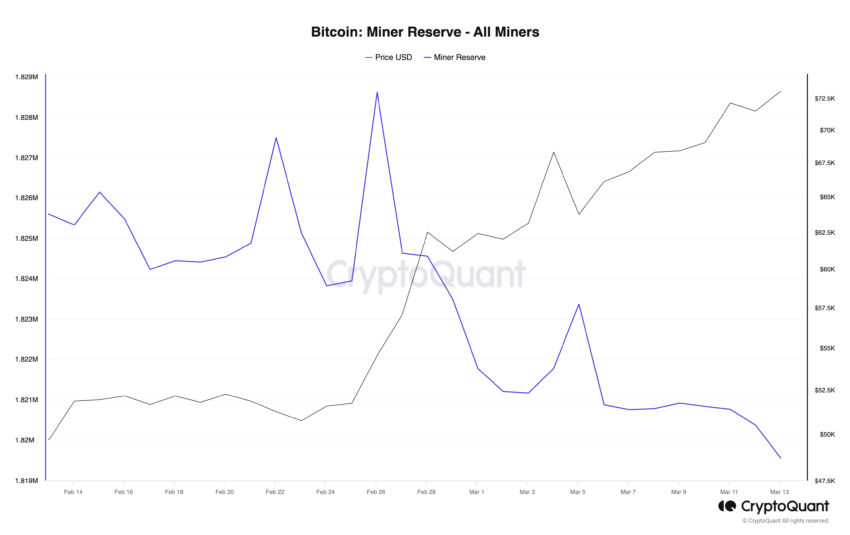

As the forthcoming Bitcoin halving, anticipated to occur between April 17 and April 20, draws near, Ki Young Ju, CEO of CryptoQuant, has voiced concerns regarding a noticeable uptick in selling activity among Bitcoin miners. Indeed, Ju said that miners have offloaded approximately 6,145 BTC, valued at around $384 million, in the past month alone.

This surge in selling activity raises questions about the immediate future of Bitcoin’s price stability.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

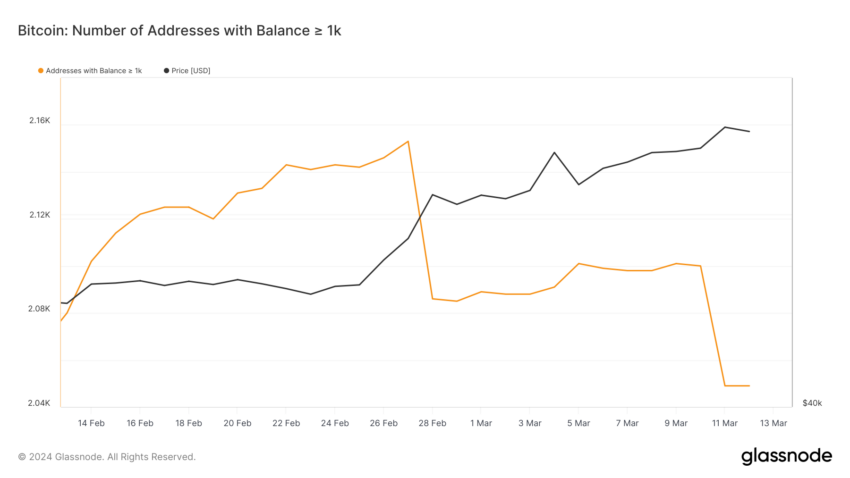

Adding to the complexity, on-chain analyst Ali Martinez has highlighted a worrying trend among Bitcoin whales. Martinez’s analysis reveals that holders of over 1,000 BTC are increasingly liquidating their holdings, with a 4.83% decrease in such addresses observed over the last two weeks.

This notable sell-off by large stakeholders adds to the selling pressure, potentially impacting Bitcoin’s price adversely. Indeed, Jan Happel, CEO of Glassnode, warned that “Nothing rallies in a straight line. Not even BTC.” Happel remarked. He anticipates a corrective Bitcoin price dip to between $59,000 and $58,000, cautioning investors that this is not indicative of a market peak but rather a necessary adjustment.

“No moves without a counter-move. And a counter-move seems to be near. We observe negative divergence as BTC has rallied into its highs in a 3-wave structure. Sentiment is hot at 89! It is time for a cooler,” Happel said.

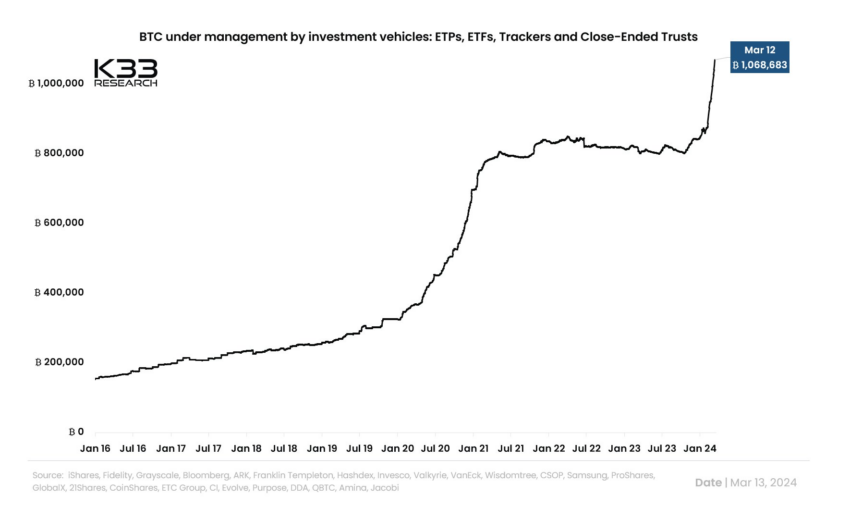

In light of the selling pressure, some analysts remain optimistic about Bitcoin’s potential post-halving. Technical analyst DaanCrypto noted the significant net inflow into Bitcoin ETFs, with over $1 billion recorded in a single day. Therefore, such accumulation levels could counterbalance the selling pressure, supporting a continued rally.

“The Bitcoin ETFs pulled in a net inflow of over $1 billion yesterday. For reference, after the halving, we will see $33 million in BTC mined per day. So this one day of inflows accounts for an entire month of Bitcoin mining supply post-upcoming halving,” DaanCrypto explained.

Echoing this sentiment, Rekt Capital draws on historical data to suggest that Bitcoin is far from reaching a market top. According to his analysis, Bitcoin could hit its next bull market peak between December 2024 and February 2025. This is based on its performance trends following previous all-time highs.

Read more: Bitcoin Price Prediction 2024 / 2025 / 2030

As the Bitcoin halving approaches, investors closely monitor these developments. While the short-term outlook may present challenges, the underlying sentiment among some experts suggests that Bitcoin’s long-term trajectory remains robust. The coming weeks will be crucial in determining whether Bitcoin can weather the current storm of the halving event.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.