How Many People Use Bitcoin in 2024?

Although Bitcoin is still an emerging, volatile asset, billions of dollars worth of BTC tokens are traded every day. The digital currency continues to increase its awareness on a global scale, but how many people use Bitcoin in 2024?

In this guide, we examine the numbers meticulously.

We use a variety of methods to assess how many people are actively using Bitcoin, including trading volumes, research studies, wallet addresses, daily transactions, and more.

How Many People Use Bitcoin in 2024?

There is no definitive answer to the question: How many people use Bitcoin? This is because of the pseudonymous nature of the blockchain. For instance, Bitcoin addresses tell us how much a specific wallet is holding.

But equally, it is not possible to know who owns the specific wallet. For example, some Bitcoin investors have multiple wallet addresses. Similarly, crypto exchanges generate a new Bitcoin address for every account that is opened.

Considering that the best crypto exchanges have millions of clients, this is a significant number of addresses.

The inability to put a specific figure on the number of Bitcoin owners is evident in a recent Chainalysis study. The study notes that since Bitcoin was launched in 2009, more than 460 million wallets have been created. Importantly, only 37% are “economically relevant”. Chainalysis states that the vast majority of Bitcoin wallet addresses belong to “named services”, which include crypto exchanges.

Another issue when assessing how many people use Bitcoin is that cryptocurrencies do not trade in centralized marketplaces. This is unlike equities, which trade on stock exchanges like the NYSE and NASDAQ. Stock exchanges operate in heavily regulated conditions, meaning that the number of individual shareholders is reported.

In contrast, Bitcoin trades on more than 200 crypto exchanges, as per CoinMarketCap data. Moreover, while some exchanges report the number of ‘registered’ users, this does not help us determine how many people actually use Bitcoin.

Additional clarity on the number of Bitcoin holders can be found in some other recent studies. For example, a Crypto.com study found that more than 219 million individual Bitcoin holders were recorded in late 2022. This was up from 183 million a year prior.

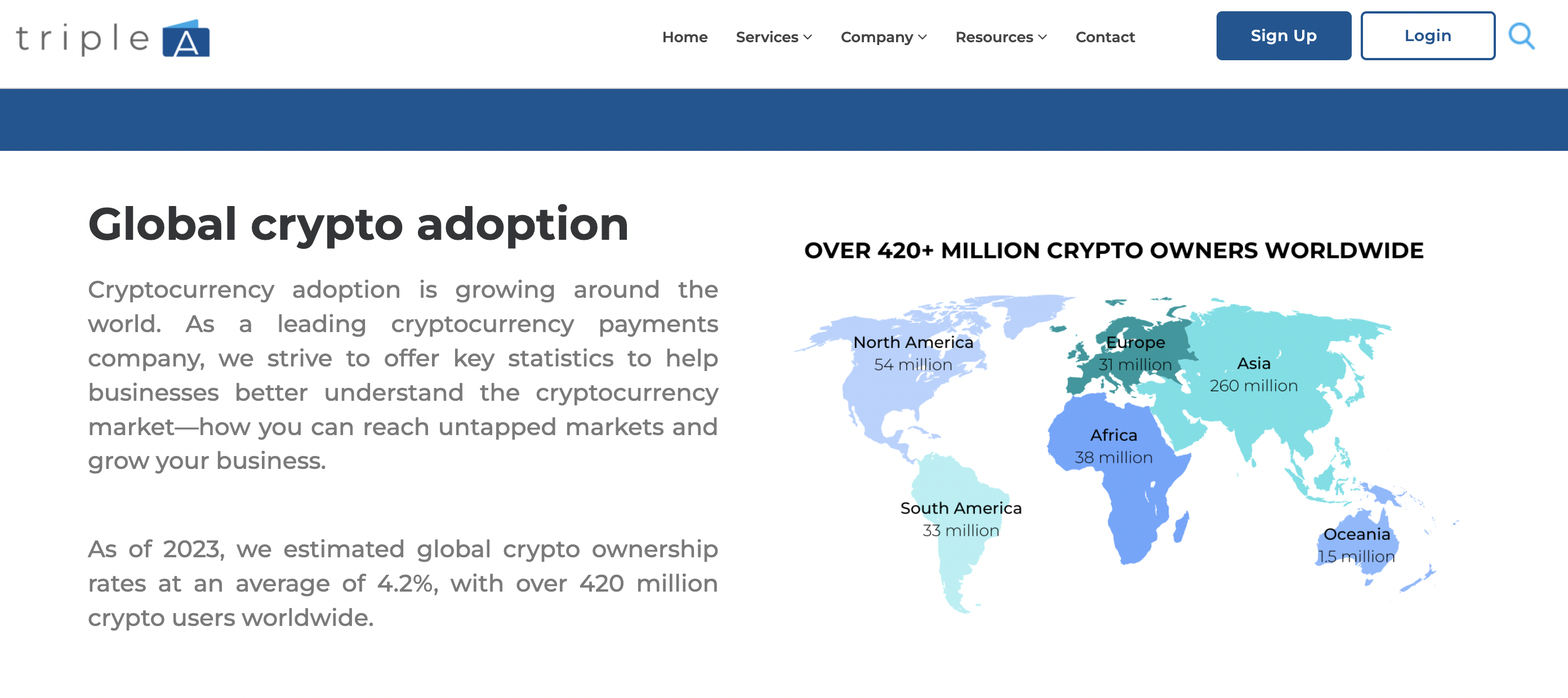

A Triple-A study found that there are 420 million cryptocurrency owners worldwide, but it doesn’t specifically break it down by Bitcoin holders.

Then there’s a study by Coinbase (conducted by Morning Consult) that focused on the American market. The study found that 67 million US residents own at least one cryptocurrency. But again, the Coinbase study doesn’t mention how many cryptocurrency owners hold Bitcoin.

A more reliable method could be to look at the number of people actively involved in the Bitcoin ecosystem. For example, BitInfoCharts data suggests that there were over 888,000 active Bitcoin wallets in the prior 24 hours. This data refers to Bitcoin wallets that involve at least one transaction to or from a unique address.

We also looked at other methods when determining how many people use Bitcoin. For example, the number of daily Bitcoin transactions. We also examined trends related to the Bitcoin market capitalization, trading volumes, and other price-related data. This is in addition to the number of people actively trading on exchanges.

But ultimately, it is beyond the realms of possibility to know exactly how many people use Bitcoin.

How Many Bitcoin Owners Are There? Methods and Calculations

We will now take a deep dive into the many methods that can be used to answer the question: How many people actually use Bitcoin?

Bitcoin Wallet Activity

All transactions on the Bitcoin network are transparent. This is because the Bitcoin blockchain records all wallet movements on its public ledger. While this doesn’t tell us who is behind the specific wallet address, we can still extract a lot of useful data.

For example, we mentioned above that 460 million wallet addresses have been created so far. However, many of these addresses are either inactive or controlled by crypto exchanges. A more reliable indicator is to look at the number of Bitcoin wallets with an active balance.

- As per BitInfoCharts data, there are more than 40 million wallet addresses holding between $1-$100 worth of Bitcoin.

- While more than 17 million addresses hold between $100-$1,000 worth.

- More than 7.3 million Bitcoin addresses are valued between $1,000-$10,000.

On the one hand, it is feasible that some Bitcoin owners have more than one wallet address. However, the above figures do not include a significant proportion of the market; Bitcoin brokers that do not provide investors with a wallet address.

For example, consider the process of investing in Bitcoin with Robinhood, Webull, or eToro. These platforms allow investors to buy Bitcoin without needing to have a wallet. Instead, the Bitcoin is held in the broker’s custodial wallet.

As such, the number of Bitcoin holders could be much higher than the amount of active wallet addresses in circulation.

Additionally, we mentioned above that over 888,000 active Bitcoin wallets were recorded in the prior 24 hours. The vast majority of Bitcoin owners do not actively move funds. On the contrary, most will buy Bitcoin and then hold their tokens long-term.

As such, the number of active addresses is likely just a small fraction of actual Bitcoin owners.

Research Studies

Research studies offer another approach when exploring the question: How many people use Bitcoin? Each study will have its own methodology, so estimates can vary widely. That being said, we did find some validity in studies commissioned by Crypto.com and Triple-A.

As we covered earlier, the Triple-A study found that there are 420 million people owning cryptocurrencies globally. The Crypto.com study yielded a slightly higher figure, at 425 million. Nonetheless, Crypto.com states that of this figure, 219 million, or 51%, specifically own Bitcoin. This is just above the current Bitcoin dominance ratio of 49.2%.

We also mentioned a study commissioned by Coinbase and conducted by Morning Consult. This study focused on the US market and found that 67 million Americans currently own cryptocurrencies. However, the study doesn’t state how many people specifically hold Bitcoin.

Trading-Related Data

We also found a lot of useful data from the Bitcoin trading markets based on how many Bitcoins there are. While this doesn’t specifically tell us how many people use Bitcoin, it gives us a broad overview of industry trends.

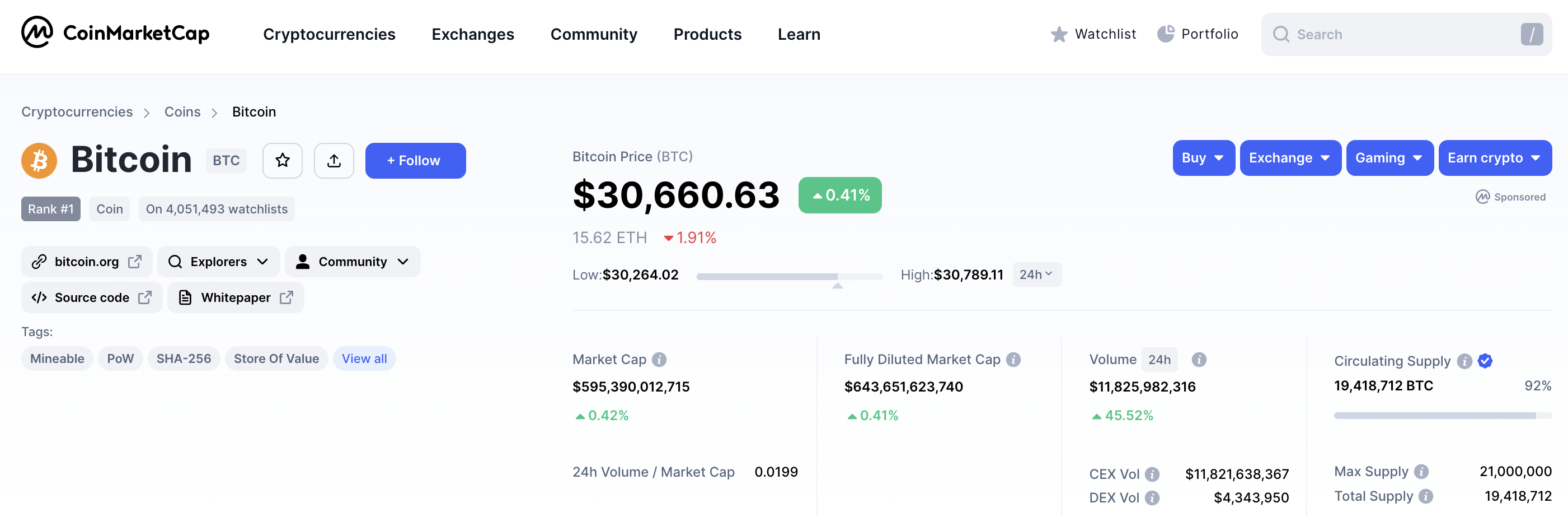

For example, over the prior 24 hours, nearly $12 billion worth of Bitcoin was traded, as per CoinMarketCap data. This is an increase of 45% from the previous day. However, we also found that daily trading volumes are extremely volatile.

For example, on June 30th, 2023, more than $26 billion worth of Bitcoin was traded. But the day prior, this was down to just $13 billion.

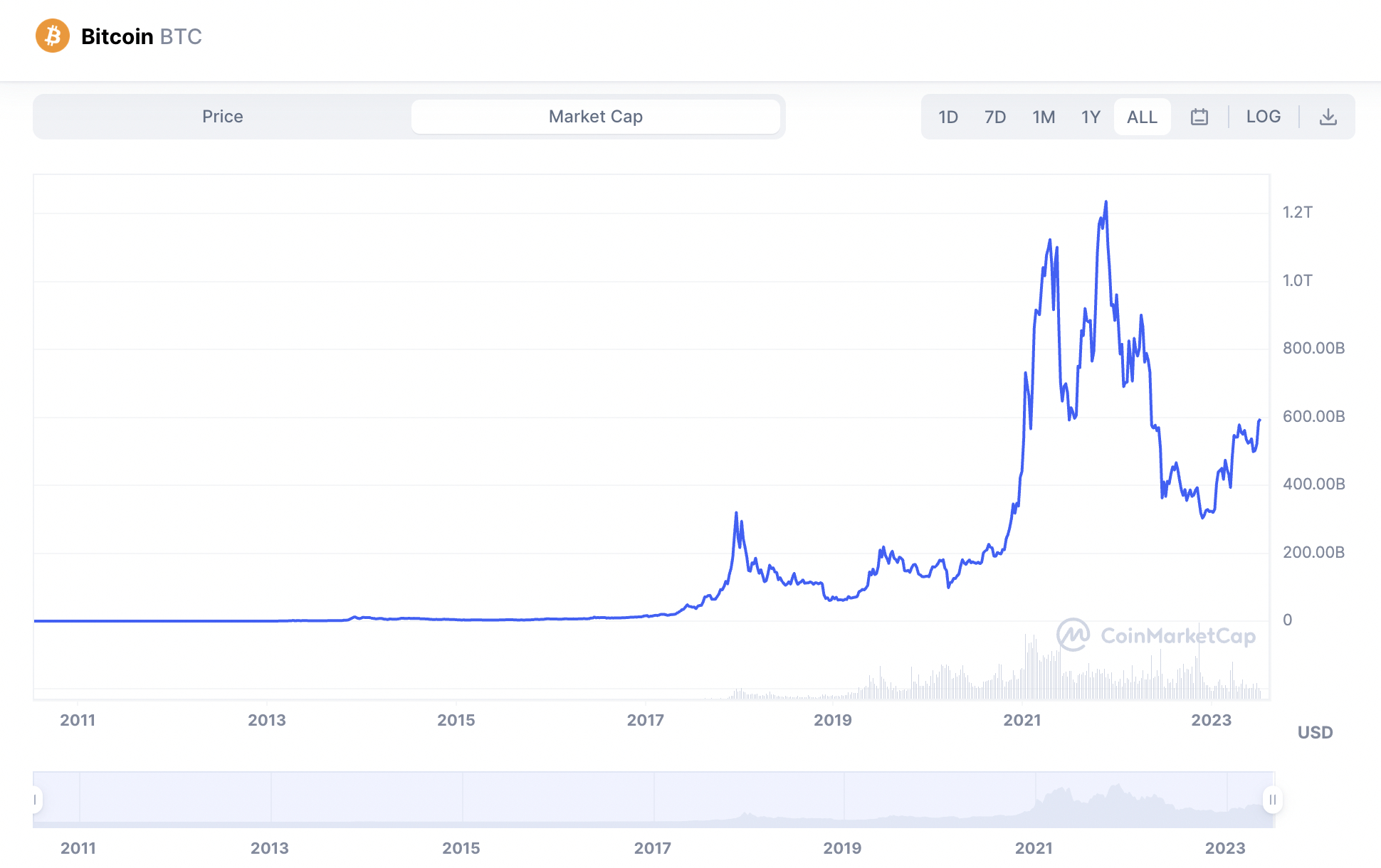

The market capitalization of Bitcoin also yields some interesting results.

For example, Bitcoin was valued at $368 billion 12 months ago. Today, Bitcoin has a market capitalization of $595 billion. That’s an increase of 61%, showing that more people are entering the Bitcoin market than they were a year previous.

That said, the market capitalization of Bitcoin was over $1.2 trillion at its peak in late 2021. This means that sentiment on Bitcoin is still weak when compared to the previous market cycle.

Key Stats Showing How Many People Use Bitcoin

The table below highlights our key findings on how many people use Bitcoin in 2023:

| Statistic | Our Findings | Notes | Source |

| No. Bitcoin Wallets | 460 million | Based on the total number of Bitcoin wallets created | https://blog.chainalysis.com/reports/bitcoin-addresses/ |

| No. Bitcoin Wallets With an Active Balance | 67 million | Based on the number of wallets with at least $1 worth of Bitcoin | https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html |

| Bitcoin Transactions in the Prior 24 Hours | 321,532 | N/A | https://bitinfocharts.com/comparison/bitcoin-transactions.html#3y |

| Active Bitcoin Wallets in the Prior 24 Hours | 888,603 | Performing at least one unique transaction | https://bitinfocharts.com/comparison/bitcoin-activeaddresses.html#3y |

| Bitcoin Trading Volume in the Prior 24 Hours | $11.9 billion | N/A | https://coinmarketcap.com/currencies/bitcoin/ |

| Bitcoin Market Capitalization | $595 billion | N/A | https://coinmarketcap.com/currencies/bitcoin/ |

| Global Bitcoin Owners | 219 million | As of December 2022 | https://crypto.com/company-news/global-cryptocurrency-owners-grow-to-425-million-through-2022 |

| Americans Owning Crypto | 67 million | Does not specify the number of Bitcoin owners specifically | https://assets.ctfassets.net/c5bd0wqjc7v0/WvuOkBwNXZsqhd6EWtkEL/7f94f8b6fbb222f3faf4d0346e473012/Morning_Consult_Cryptocurrency_Perception_Study_Feb2023_Memo__1_.pdf |

| Americans That Have ‘Heard’ of Crypto | 88% | Does not specifically mention Bitcoin but rather crypto | https://www.pewresearch.org/short-reads/2023/04/10/majority-of-americans-arent-confident-in-the-safety-and-reliability-of-cryptocurrency/ |

The Number of People Using Bitcoin on a Daily Basis

We will now look at how many people use Bitcoin on a daily basis. A good starting point is to look at the number of Bitcoin transactions.

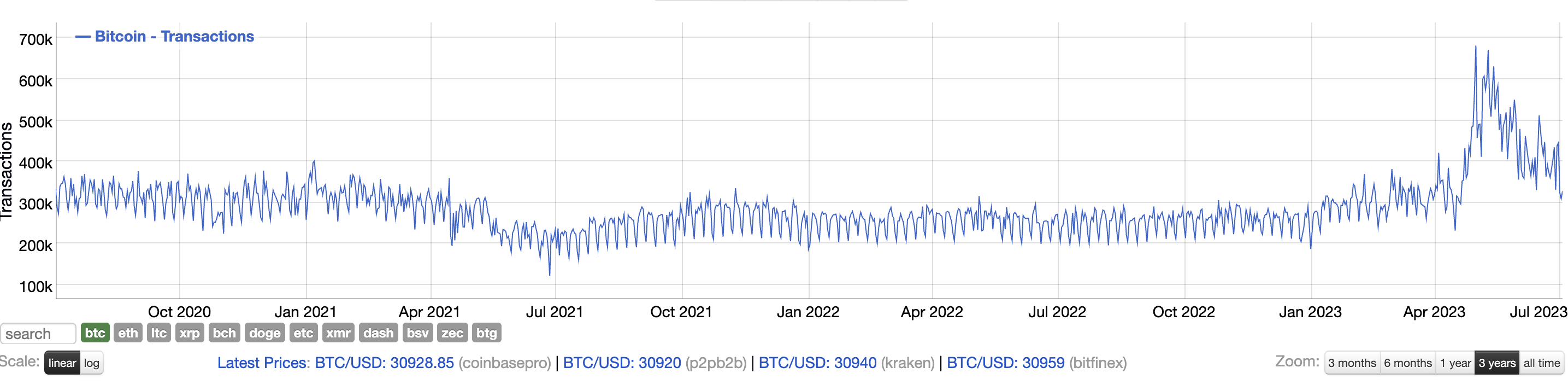

As noted earlier, 321,532 Bitcoin transactions took place in the prior 24 hours, as per BitInfoCharts. This is much lower than the 630,099 transactions that were conducted on May 1st, 2023. Interestingly, this is the highest number of daily Bitcoin transactions over the prior three years. This shows that daily transactions do not correlate to pricing trends.

For example, Bitcoin’s all-time high of over $68,000 was hit on November 10th, 2021. On the same day, the number of Bitcoin transactions was just shy of 301,000. This means that over the prior 24 hours, more transactions were conducted. This is the case even though Bitcoin is trading 55% below its former all-time high.

The reason for this remains unclear. For example, it could indicate that more people are using Bitcoin to perform everyday transfers. It could also mean that a greater number of people are entering the market, albeit, at smaller amounts.

Wondering how many people use BTC for purchases? According to PYMNTS and BitPay research, over a 30-day period, 16.1 million Americans used Bitcoin to make purchases online.

How Many Bitcoin Wallets Are There?

The Chainalysis study we referenced earlier states that over 460 million Bitcoin addresses have been created. In reality, this information doesn’t get us any closer to answering the question: How many people use Bitcoin for transactions?

After all, anyone can create a Bitcoin wallet at any time. One investor might decide to create multiple Bitcoin addresses to separate their balances. While another might have Bitcoin wallet addresses at multiple trading platforms.

- For example, consider that in late 2022, Binance claimed to have over 128 million users.

- If each user has one Bitcoin wallet, that’s over 128 million addresses.

- That said, crypto exchanges can repurpose Bitcoin addresses if the user is inactive.

- This means that a dormant address can be given to another user.

Another issue is that the vast majority of wallet addresses do not hold any Bitcoin. As such, a more reliable method is to look at addresses that have a balance.

BitInfoCharts provides some useful data in this regard.

For example, we can likely disregard the 3,530,911 wallets that have a balance of under 0.00001 BTC. Based on current BTC/USD prices, this values the wallet at $0.31 or under.

Moreover, there are 9,346,143 wallets that have a balance of between 0.00001 BTC and 0.0001 BTC. This translates to between $0.31-$3.10.

- BitInfoCharts also gives wallet figures in monetary terms.

- For example, there are over 27 million wallets with at least $100 worth of Bitcoin.

- While over 10 million wallets have at least $1,000.

- The figure is significantly higher for wallets containing between $1 and $100, at over 40 million addresses.

Another important metric is the number of dormant Bitcoin wallets. After all, it was reported by the New York Times that an estimated 20% of Bitcoins in circulation are no longer accessible.

This refers to investors being locked out of their wallets. This can happen if the investor forgets the password to their wallet and no longer has their private keys. Bitcoins can also be unrecoverable if tokens are sent to an incorrect address.

According to BitInfoCharts data, there are almost 18 million Bitcoin addresses that have not sent or received tokens within the prior nine years. Some of these dormant addresses have significant balances.

For instance, the largest dormant wallet has over nearly 80,000 BTC tokens. This is valued at almost $2.5 billion. The next largest dormant wallet has almost 54,000 BTC tokens, valued at over $1.6 billion.

Is Bitcoin Popular in 2023?

Of the 26,000+ cryptocurrencies listed on CoinMarketCap, Bitcoin is by far the most popular.

For instance, consider that the total market capitalization of all cryptocurrencies is currently $1.2 trillion. Bitcoin alone is valued at $595 billion. This means that Bitcoin dominates nearly 50% of the broader market.

Moreover, over $37 billion worth of cryptocurrencies were traded in the prior 24 hours. Of this figure, nearly $12 billion worth of Bitcoin was traded.

But how popular is Bitcoin right now compared to previous years?

First and foremost, the Crypto.com study we referenced earlier mentioned that in January 2022, there were 183 million Bitcoin holders. And that by the end of the same year, this number had increased to 219 million.

This means that even when Bitcoin was embroiled in a continuous downward trend, it increased its number of holders by 36 million people. This shows that people are still buying Bitcoin even in the midst of a bear market.

That being said, this isn’t being reflected in its market capitalization. As we mentioned earlier, Bitcoin was valued at $1.2 trillion at the peak of the 2021 bear market. Today, the market capitalization is 50% lower.

This could indicate that while more people are buying Bitcoin, this is in small amounts. As such, it is hoped that the bull market will once again attract institutional investors.

Large-scale investors might also be pulling funds out of Bitcoin while interest rates are high. This is because riskier assets like Bitcoin become less attractive. In contrast, safer assets like US Treasuries become more attractive.

Nonetheless, over the course of time, there is no denying that Bitcoin is increasingly becoming more popular.

For example, CoinMarketCap data shows that in January 2011, Bitcoin had a market capitalization of just $25 million. Based on its peak of $1.2 trillion, that’s an increase of over 48,000 times. In other words, that’s $48,000 in late 2021 for every $1 invested in early 2011.

Wondering how many people use Bitcoin to buy stuff? There is no definitive answer to this question, considering transactions do not reveal the name of the sender or receiver. Nonetheless, an increasing number of merchants are beginning to accept Bitcoin as payment.

How Many People Use Binance?

Like all crypto exchanges, Binance operates in a loosely regulated market. This means that Binance self-reports the number of people that use its platform to trade.

- For example, Binance last reported in late 2022 that it had 128 million ‘users’.

- However, Binance doesn’t provide any more information on this figure.

- For instance, this could simply relate to the number of people that have opened an account with Binance since it was launched in 2017.

- The number of ‘active’ traders could be just a small fraction of this number.

CoinMarketCap presents data on the number of weekly visitors for each listed exchange. It states that over the prior week, 11,196,476 people have visited Binance. These figures are extracted from SimilarWeb, a third-party data analytics website.

That said, daily trading volumes speak for themselves. Over the prior 24 hours, more than $9.1 billion was traded on Binance. In comparison, $1 billion was traded on Coinbase. On Kraken and KuCoin, this was $559 million and $525 million, respectively.

How Many People Will Use Bitcoin in the Future

The best way to evaluate the number of people that might use Bitcoin in the future is to look at historical data. For this metric, the number of daily Bitcoin transactions provides valuable insights.

- As per BitInfoCharts data, there were between 1-10 daily transactions in the 12 months after Bitcoin launched in January 2009.

- Fast forwarding to early 2012, this had increased rapidly to over 6,000 daily transactions.

- In January 2014, the average number of transactions had increased 10-fold to over 60,000.

- At the turn of 2017, more than 300,000 daily transactions were being posted to the Bitcoin network.

- The largest number of daily transactions took place on May 1st, 2023. On this day, 630,099 transactions were executed.

The above figures show a clear trend – more people are using Bitcoin as each year passes. Moreover, the numbers continue to grow even though Bitcoin has been in a bear market since late 2021.

This is good news for long-term Bitcoin investors and a key reason why it’s one of the best cryptocurrencies to buy.

That said, some investors are also keeping an eye on the best altcoins. After all, while Bitcoin continues to increase in value over time, so do other cryptocurrencies. Ethereum – which is one of the best utility tokens, was priced at just $2.79 in early 2016. By November 2021, Ethereum was trading at nearly $5,000. This represents growth of over 179,000%.

Do Celebrity Endorsements Impact Bitcoin?

The ethics of celebrities promoting cryptocurrencies and NFTs continues to be a hot topic of debate.

For example, a Bloomberg article gives a breakdown of some of the most infamous celebrity endorsements that have resulted in significant investor losses. This includes Reese Witherspoon, French Montana, Nick Carter, Paul Pierce, and Mark Cuban.

The SEC has since charged various celebrities for their crypto promotions, as reported by the Washington Post. This includes Jake Paul and Lindsay Lohan, who were charged for promoting cryptocurrencies without disclosing they were paid by the respective project.

However, these cases refer to so-called ‘shitcoins’ and NFTs, created for the sole purpose of generating hype and FOMO (fear of missing out). The objective is for the founders of these projects to get rich from investor losses.

In contrast, Bitcoin is a decentralized asset that is not controlled by any single person or entity.

That said, this isn’t to say that celebrities cannot influence public opinion on Bitcoin.

- For example, the BBC reported that on February 8th, 2021, Elon Musk announced that Tesla would begin accepting Bitcoin as payment.

- This was in addition to Tesla buying $1.5 billion worth of Bitcoin.

- The news caused Bitcoin to increase by 17%.

Crucially, Bitcoin is still an emerging asset class. So when the world’s largest carmaker announces it will accept it as payment, it has a positive impact on Bitcoin sentiment.

However, three months later, Elon Musk reversed his decision. Musk stated Bitcoin’s high energy consumption did not align with Tesla’s EV vision.

As reported by CNBC, the price of Bitcoin dropped 5% within minutes of the announcement being made. On the date of Musk’s announcement, Bitcoin dropped to daily lows of $49,000. Six months later, Bitcoin hit an all-time high of over $68,000.

What Can Influence the Number of Bitcoin Owners?

According to some analysts, there are various factors that can influence the number of people using and buying Bitcoin.

This includes:

- Institutional Interest: When large financial institutions show interest in Bitcoin, this can have a major impact on broader adoption. After all, if Wall Street funds have exposure to Bitcoin, this gives it legitimacy as an investment product.

- Regulation: Many people are wary about investing in Bitcoin because of its unregulated status. If the US and other major economies regulate Bitcoin in the same way as traditional securities, this could attract a new demographic of buyers.

- Interest Rates: When interest rates are high (like they currently are), investors are less inclined to hold risky assets like Bitcoin. In turn, government bonds become more attractive, considering the higher interest rates on offer.

- Large-Scale Hacks and Scams: Major hacks, scams, and large-scale bankruptcies can negatively impact the number of Bitcoin holders. For example, exchange collapses like FTX, which resulted in investors losing billions of dollars.

- Broader Trends: Broader market trends can also influence the number of people buying Bitcoin. For example, when Bitcoin is in a bull market, and prices are rising, this attracts more buyers. The opposite happens when Bitcoin enters a bear market, and prices are falling.

- Volatility: The high volatility of Bitcoin can make risk-averse investors reluctant to enter the market. If volatility levels become more stable, this could attract a new wave of investors.

Crucially, the above factors can influence Bitcoin in the shorter term. But over the course of time, the fundamentals of Bitcoin are strong.

As such, many Bitcoin enthusiasts will ignore the short-term noise.

Conclusion

Having used a variety of methods and studies, it is not possible to put a definitive figure on how many people use Bitcoin in 2023.

After all, Bitcoin operates in a semi-anonymous ecosystem, so estimations on actual holders vary considerably.

Nonetheless, Bitcoin was valued at just $25 million in 2011. Today, Bitcoin is worth nearly $600 billion.

- References

- https://coinmarketcap.com/currencies/bitcoin/

- https://blog.chainalysis.com/reports/bitcoin-addresses/

- https://www.nyse.com/index

- https://coinmarketcap.com/rankings/exchanges/

- https://crypto.com/company-news/global-cryptocurrency-owners-grow-to-425-million-through-2022

- https://assets.ctfassets.net/c5bd0wqjc7v0/WvuOkBwNXZsqhd6EWtkEL/7f94f8b6fbb222f3faf4d0346e473012/Morning_Consult_Cryptocurrency_Perception_Study_Feb2023_Memo__1_.pdf

- https://triple-a.io/crypto-ownership-data/

- https://bitinfocharts.com/bitcoin/

- https://www.pymnts.com/study/the-us-crypto-consumer-finance-digital-currencies-alternative-payments-shopping/

- https://bitinfocharts.com/comparison/bitcoin-transactions.html#1y

- https://coinmarketcap.com/charts/#dominance-percentage

- https://www.binance.com/en/blog/ecosystem/looking-back-at-binances-2022-endofyear-report-1820343945198453383

- https://www.tradingview.com/symbols/BTCUSD/

- https://bitinfocharts.com/top-100-dormant_7y-bitcoin-addresses.html

- https://www.nytimes.com/2021/01/13/business/tens-of-billions-worth-of-bitcoin-have-been-locked-by-people-who-forgot-their-key.html

- https://coinmarketcap.com/currencies/ethereum/

- https://www.washingtonpost.com/business/2023/03/23/lindsay-lohan-sec-charges-crypto-justin-sun/

- https://www.bbc.co.uk/news/business-55939972

- https://www.cnbc.com/2021/05/12/elon-musk-says-tesla-will-stop-accepting-bitcoin-for-car-purchases.html

- https://www.cnbc.com/2022/12/19/three-ways-the-ftx-disaster-will-reshape-crypto.html

FAQs

What is the point of Bitcoin?

Bitcoin allows people to transact and store wealth away from centralized institutions, central banks, and government control.

Which country has the most Bitcoin owners?

At over 46 million people, the US has the largest number of cryptocurrency holders.

Is Bitcoin the same as real money?

No, Bitcoin is not backed by a central bank or nation-state, allowing it to operate free of government control and manipulation.

How many people use Bitcoin to buy goods?

A study conducted by BitPay and PYMNTS showed that 16.1 million Americans used Bitcoin to make payments online within a 30-day period.

How many people in the world own Bitcoin?

As of late 2022, 219 million people owned Bitcoin – as reported by a Crypto.com study.

What can Bitcoin be used for?

While Bitcoin can be used as a medium of exchange and a store of value, many people buy it as an investment product.

How many people have a full Bitcoin?

As per BitInfoCharts data, 1,006,410 wallet addresses hold at least 1 full Bitcoin.

How many people use Bitcoin on Steam?

None – Steam no longer accepts Bitcoin or any other cryptocurrencies.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell

Eric Huffman

Eric Huffman